Skip to content material

The complexion of the September 16-17 FOMC assembly adjustments with two developments.

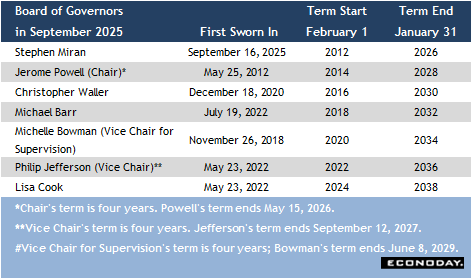

First is the unusually swift affirmation of Stephen Miran as a Fed governor and his swearing in that happened earlier than the assembly started on Tuesday. Miran is appointed to finish the time period ending January 31, 2026 that was vacated early by Adriana Kugler. It may be inferred that his time on the board will deliberately be quick since his affirmation didn’t embody a reappointment to the brand new time period when the present one expires. This leaves President Trump with the choice nominating another person to the time period starting February 1, 2026 and working by means of January 31, 2040. Miran joins two different Trump appointees on the Board – Governor Christopher Waller and Vice Chair for Supervision Michelle Bowman.

Governor Lisa Prepare dinner has gained her enchantment to stay on the board except and till the efforts of the Trump administration to unseat her are efficient. Up to now authorized grounds for her removing are skinny and unlikely to prevail.

Fed Chair Jerome Powell faces even higher challenges to his management in sustaining the professionalism and independence of the central financial institution. Regardless of the statements in his affirmation listening to concerning the significance of an impartial Fed, Miran is retaining his ties with the Trump administration. This doesn’t presage the disinterred stance of a financial policymaker sworn to attempt to obtain the twin mandate of value stability and most employment. Nonetheless, that is conjecture and his actions will decide his legacy on the Fed.

In any case, the FOMC could have a full complement of 12 voters to set financial coverage on the finish of the 2 days of deliberations.

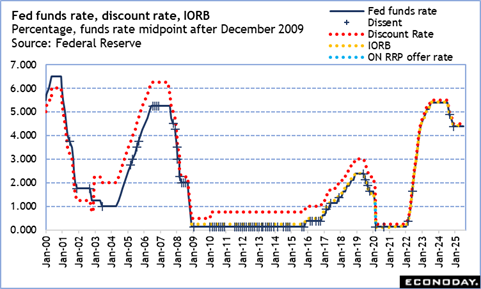

Ought to the vast majority of the FOMC voters favor a 25-basis level fee reduce at this assembly as is extensively anticipated, this raises a definite chance of one other dissent within the vote. On the prior assembly Waller and Bowman dissented in favor of a 25-basis level reduce towards the bulk for no change within the fed funds goal fee vary of 4.25-4.50 %. It might be no shock if Waller, Bowman, and/or Miran want a 50-basis level reduce at this assembly. It isn’t out of the realm of chance that one, two, or all three would favor a 75-basis level reduce.

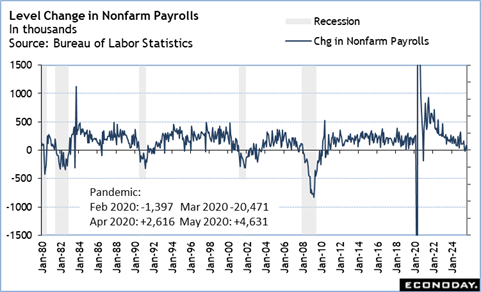

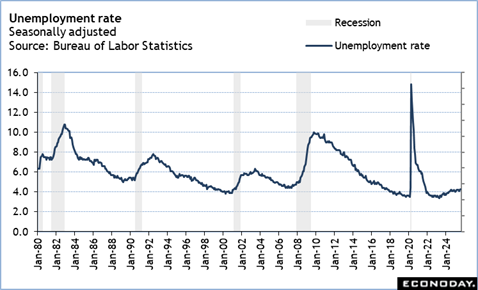

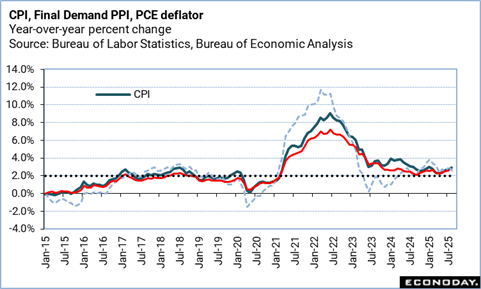

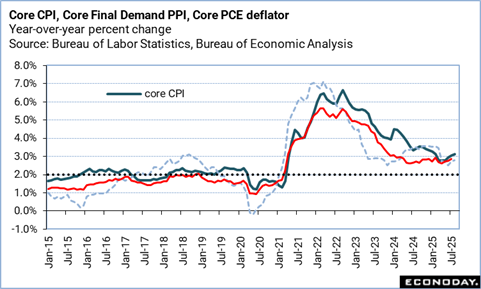

Ought to the FOMC majority decide a 50-basis level fee reduce is suitable, the chance of dissenting votes is far much less, particularly if the quarterly replace to the abstract of financial projections (SEP) alerts an acceleration within the timeline for fee cuts. The SEP forecasts for the US financial system are prone to present a downgrade in development, larger unemployment, and fewer progress in disinflation towards the Fed’s 2 % inflation goal. The SEP may nicely mirror anticipation of cuts on the October 28-29 and December 9-10 conferences, and extra into 2026.

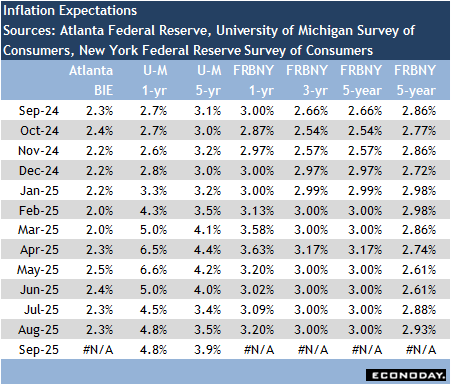

The up to date SEP can be launched at 14:00 ET on Wednesday together with the FOMC assertion and implementation word. The assertion can be a cautious one because the presently delicate stability between reaching most employment and value stability is beginning to tip the main target extra towards the weakening labor market whilst inflation stays elevated and inflation expectations are reluctant to return down. Vital to the FOMC choice is how a lot emphasis can be positioned on the drop in hiring whilst unemployment has barely risen versus the current uptick in inflation – principally associated to tariffs and presumably of quick period – and persistently larger inflation expectations for the long run.

In his press briefing at 14:30 ET on Wednesday, Powell will probably obtain many questions that he can’t or won’t reply relating to the influence of political interference on the central financial institution and the relationships between his colleagues on the FOMC. He’ll, as ever, insist that the FOMC makes its selections solely on the premise of the out there info, that no choice is made earlier than the assembly, and that financial coverage shouldn’t be on a preset course. Nonetheless, he can be pressed on the FOMC consensus concerning the choice and what it means for the long run path of rates of interest.

Share This Story, Select Your Platform!

Web page load hyperlink