After the Financial institution of England’s unprecedented cut up vote this week, James Smith asks: why can’t central banks simply make their minds up on ? Rate of interest expectations are set for a unstable trip, he argues, beginning with Tuesday’s all-important US numbers. Right here’s all the things we’re on the lookout for subsequent week. Wasn’t summer season alleged to be quiet?

Why Central Banks Can’t Agree

What do the UK and US economies have in widespread proper now? Rather a lot, truly, when you consider it.

Each are more likely to see inflation briefly rise to round 4% this 12 months. Each have creaking jobs markets. Each have seen large revisions to the hiring numbers just lately. And each have seen their progress outlooks bitter amid mounting home coverage uncertainty.

Why, then, are their respective central banks set to do wildly various things with rates of interest this autumn? That’s the notion at the least. Traders are pricing greater than three US fee cuts by subsequent easter, the place barely one is priced within the UK.

Clearly, I’m simplifying issues a bit. The UK isn’t waging an enormous tariff warfare, neither is it putting in identified doves to its rate-setting committee.

Nonetheless, the stark variations between Federal Reserve and Financial institution of England expectations are onerous to reconcile. One is more likely to be flawed. And fairly presumably each.

However how have we ended up on this state of affairs? And why are there such unprecedented ranges of disagreement amongst policymakers on the way in which ahead? This week’s BoE determination yielded the primary ever tied vote, whereas July’s Fed assembly noticed two governors dissent for the primary time in over 30 years.

I see three explanations:

One, now greater than ever, it’s attainable to achieve wildly totally different interpretations from the financial knowledge. Within the UK, subsequent week’s payroll knowledge is more likely to verify that employment has fallen in eight out of the final 9 months. But, redundancies haven’t risen in any respect. And surveys recommend hiring is actually flat. The true image is way from clear.

Information high quality points don’t assist, an issue removed from distinctive to the UK. Response charges to key surveys have fallen since Covid, and that’s partly why we’re seeing large revisions, just like the shock downgrades to Might/June’s US payrolls. Isolating traits is getting more durable.

Secondly, there’s the availability facet of the financial system. It’s a woolly idea, admittedly. And it’s one thing policymakers didn’t have to fret about earlier than the pandemic, when economies (Europe, notably) weren’t precisely working at full capability.

Since then, although, economies have been working sizzling. Provide chain disruption and employee shortages have taken on better significance. However these items is difficult to measure, so it’s no shock there’s a spread of views on the market.

That mentioned, there’s a rising acceptance that US immigration coverage is placing limits on staffing availability. It’s why Chair Powell has mentioned he’s placing extra weight on knowledge just like the unemployment fee, which theoretically does a greater job of incorporating these provide constraints than payrolls.

Whether or not Powell nonetheless thinks that after July’s bombshell jobs numbers, time will inform. However unemployment has undoubtedly been extra secure. So in case you needed to make an argument in opposition to a September fee minimize – and there aren’t many proper now – that is definitely certainly one of them.

One other is inflation – the third supply of lively disagreement. Subsequent week’s US knowledge is more likely to be sizzling. James Knightley is anticipating core CPI to come back in at a punchy 0.4% month-on-month, which in annualised phrases is according to nearly 5% inflation. August’s knowledge might be related.

Now, there are superb causes to assume this tariff-driven spike received’t final, which James outlines under. I’d make related arguments in regards to the UK, which is finally why I nonetheless assume the BoE will minimize charges once more in November, even when that decision seems a shakier after this week’s assembly.

However the hawks on the Fed and BoE fear a few repeat of the notorious 2022 inflation spike. Officers within the UK have mentioned that inflation is statistically extra more likely to develop into entrenched when headline reaches its present 3.5-4% stage. The thought is that one thing adjustments within the psychology of households and companies that makes inflation extra more likely to stick.

I’m not satisfied, as I’ve defined earlier than. However extra importantly, I’m undecided the likes of the Fed or the BoE have the posh of time to have these debates proper now, given the omens rising from the roles market. What the UK and US – and lots of others, for that matter – have in widespread is the for much longer lags concerned with coverage adjustments hitting the actual financial system. Extra prevalent fixed-rate lending has seen to that. The danger of falling behind the curve is actual.

Which means when the Fed does minimize, it’ll in all probability accomplish that faster than many anticipate. We now assume the Fed will minimize charges in September, and an additional 4 occasions by early 2026. That’s a extra aggressive path than markets are pricing.

Nonetheless, my conclusion from all the things I’ve mentioned right here – knowledge uncertainty, adjustments to the Fed board, the inflation curler coaster – is that we’re in for a extra unstable interval of central financial institution expectations.

Each knowledge level is taking up better significance. There are two extra inflation prints and yet another jobs report earlier than September’s Fed assembly, and each might be a critical check of that market’s conviction in imminent fee cuts – even when that’s in all probability the route of journey.

Need to know extra about that knowledge and all the things else to do with the Federal Reserve? Our webinar this coming Tuesday comes sizzling on the heels of these US inflation figures.

Chart of the Week: US Tariff Ranges After Current ’Commerce Offers’

Supply: The White Home, ING

THINK Forward in Developed Markets

United States

Inflation (Tues): We noticed some early proof of the tariff impression within the June report, with core items costs excluding autos rising 0.6percentMoM, the most important month-to-month improve since February 2022. We anticipate to see a equally sized index rise this time, with autos more likely to additionally contribute to a sooner fee of inflation.

Car costs surprisingly fell final in June regardless of the publicity to main tariff will increase, whereas will increase in automotive public sale costs additionally add upside threat for the July studying. Consequently, we’re forecasting a 0.4percentMoM improve in , above the 0.3% consensus forecast.

We don’t assume the Fed ought to fear a few repeat of 2021/22 when a supply-side shock led to inflation hitting 9%. Companies dominate the inflation basket by weighting, and right here the state of affairs may be very totally different to 2021/22. Keep in mind that tripled over that interval, home costs and housing rents surged, whereas the roles market was purple sizzling with determined hiring practices leading to file worker turnover as wages soared.

This all helped to amplify and lengthen the post-Covid supply-shock-related improve in items costs. Immediately, these are all disinflationary influences, with cooling housing rents particularly set to assist offset the impact of tariffs over the approaching quarters.

/College of Michigan (Fri): First rate auto gross sales volumes ought to carry the headline gross sales figures, however weak shopper confidence figures as a result of anxiousness over tariff-induced worth hikes, worries in regards to the state of the roles market and volatility in family wealth imply exercise will probably sluggish via the second half of the 12 months.

United Kingdom

Jobs report (Tues): The BoE was remarkably relaxed in regards to the jobs market in its August determination, regardless of payroll employment having fallen progressively for a number of months now. Can we see one other dramatic drop in these hiring numbers this month? It’s attainable, although. Keep in mind, these generally tend of being revised up later.

(Thur): Like all over the place else, the numbers have been skewed by a surge in exports in Q1 as corporations sought to get forward of US tariffs. Q2 has unsurprisingly been weaker, however on common, exercise nonetheless probably rose via the spring.

THINK Forward in Central and Japanese Europe

Poland

Flash 2Q25 GDP (Wed): Regardless of a decline in development output and continued weak spot in industrial manufacturing progress, preliminary knowledge recommend that GDP progress accelerated within the second quarter. Annual GDP progress is estimated at 3.5% YoY, up from 3.2% YoY in 1Q25. A notable driver was retail gross sales of products, which surged to almost 6% YoY, in comparison with simply 1.4% YoY within the earlier quarter, pointing to stronger momentum in non-public consumption.

June Present Account (Wed): We estimate a €1.1bn deficit within the June present account, which widened the 12-month cumulative exterior imbalance barely to -1.1% of GDP, from -1.0% in Might. Nonetheless, the annual commerce deficit remained broadly secure at 1.6% of GDP. Our forecasts present exports in euro phrases rose 0.8% YoY, whereas imports elevated 3.2% YoY.

Regardless of the widening imbalance, the present account place stays manageable and isn’t anticipated to threaten macroeconomic stability or the outlook for the PLN.

July CPI (Thu): Ultimate figures ought to verify that headline inflation remained above 3% YoY in July, with core inflation nonetheless elevated. Though CPI dropped considerably from 4.1% YoY in June to three.1% YoY, we imagine this decline is just not sufficient to justify a 50bps fee minimize as beforehand anticipated. As an alternative, we now anticipate a extra gradual easing path, beginning with a 25bps minimize in September, adopted by related strikes in October and November, bringing the NBP’s most important coverage fee to 4.25% by year-end.

Romania

July CPI (Tue): Following June’s higher-than-expected print, we anticipate to study that inflation picked as much as 6.4% in July, principally as a result of vitality costs, that are set to rise after the tip of the electrical energy subsidy scheme. On the financial exercise entrance, we foresee an nearly stagnating GDP progress (2nd quarter, flash launch), according to the comparatively muted exercise seen thus far in high-frequency indicators.

Czech Republic

July CPI (Mon): July’s preliminary estimate of headline inflation is more likely to be confirmed by the Statistical Workplace, whereas the breakdown will present potent core inflation. In the meantime, softer meals worth dynamics mitigated the general inflation determine. The present account deficit is anticipated to have widened in June.

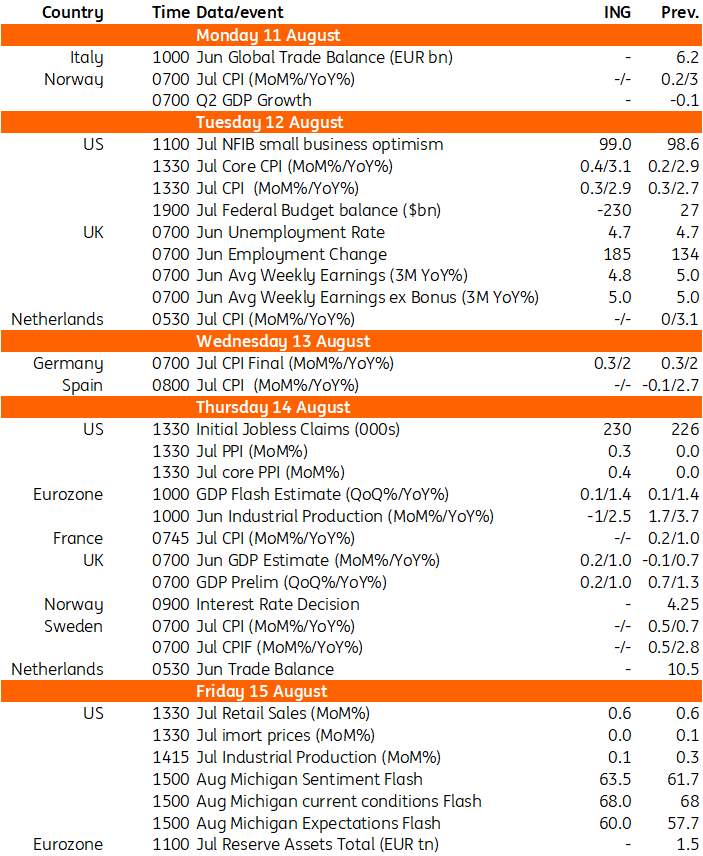

Key Occasions In Developed Markets Subsequent Week

Supply: Refinitiv, ING

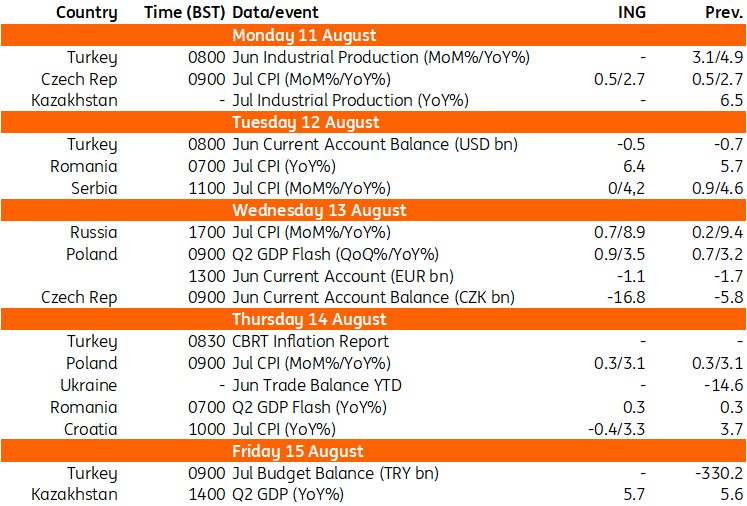

Key Occasions in EMEA Subsequent Week

Supply: Refinitiv, ING

Disclaimer: This publication has been ready by ING solely for info functions regardless of a selected person’s means, monetary state of affairs or funding aims. The data doesn’t represent funding advice, and neither is it funding, authorized or tax recommendation or a proposal or solicitation to buy or promote any monetary instrument. Learn extra

Authentic Put up