- Trump threatens EU tariffs, creates confusion about Mexico and Canada duties

- Greenback rebounds however gold slides once more

- Nvidia falls in after-hours buying and selling as earnings fail to set Wall Road alight

Trump Ups Tariff Rhetoric, EU Subsequent in Line

US President Donald Trump warned on Wednesday that tariffs on Canada and Mexico will go forward and that tariffs are additionally coming for the European Union. Nevertheless, there was confusion concerning the timing of the tariffs on Canada and Mexico, as Trump indicated they’re due to enter impact on April 2, however a White Home official later disputed this to say that the March 4 deadline nonetheless stands.

The suggestion that one other extension had been granted to Canada and Mexico briefly lifted the and in opposition to the . However it’s doable Trump was referring to the reciprocal tariffs, which additionally seem like set at 25% and are scheduled to be rolled out in April. It’s additionally not clear if the reciprocal duties will likely be utilized on prime of the 25% tariffs linked to frame safety and the fentanyl commerce.

The EU gained’t have the ability to escape Trump’s commerce conflict salvo both, because the President talked about 25% tariffs on European vehicles and different sectors. No additional specifics had been supplied however the EU was fast to reply, with a spokesperson saying that the bloc will “react firmly and instantly”.

Tariff Headlines Carry Greenback, Not So A lot Gold

The US greenback rebounded from close to two-month lows in opposition to a basket of currencies yesterday on the again of Trump’s newest tariff threats. It’s extending its features immediately, erasing among the latest losses following the renewed bets by buyers of extra aggressive easing by the Fed.

Treasury yields are additionally recovering, with the climbing to 4.30% from yesterday’s greater than two-month low of 4.245%. Protected-haven flows and expectations of further Fed fee cuts have been dragging yields decrease for the previous two weeks. In the meantime, the latest finances invoice handed by the Home, which didn’t go far sufficient in tackling the deficit, doesn’t seem to have nervous bond merchants a lot.

However what’s extra fascinating is that ’s rally slowed simply because the decline in US yields accelerated. On the one hand, there are rising considerations a couple of doable slowdown within the US financial system and expectations of decrease rates of interest needs to be optimistic for gold. However the treasured metallic is dealing with some technical resistance round $2,950/oz and this has given strategy to a small correction.

Euro and Pound Maintain Regular In Uneven Waters

The got here underneath slight strain from Trump’s remarks about EU tariffs however total stayed inside its latest buying and selling vary. It was final quoted at $1.0480. The was buying and selling considerably beneath yesterday’s two-month excessive of $1.2715, forward of UK Prime Minister Keir Starmer’s go to to Washington to satisfy with Trump.

Up to now, the UK will not be being individually focused by the Trump administration in his commerce conflict and whereas Ukraine would be the greater subject of debate, any indicators that Britain will likely be exempt from harsh tariffs might give the pound an extra edge over the euro.

Nvidia Underwhelms, however Aid Rally Nonetheless Attainable

Shares on Wall Road had been combined on Tuesday, and though futures are in optimistic territory immediately, there’s a danger they might reverse decrease amid some disappointment about Nvidia’s (NASDAQ:) earnings announcement, which got here after the market shut.

Nvidia beat each its earnings per share and income forecasts, in addition to the steerage for the present quarter, however not by a big margin. Nonetheless, all of the indicators are that AI demand is holding up and a few sort of a aid rally is feasible within the coming classes.

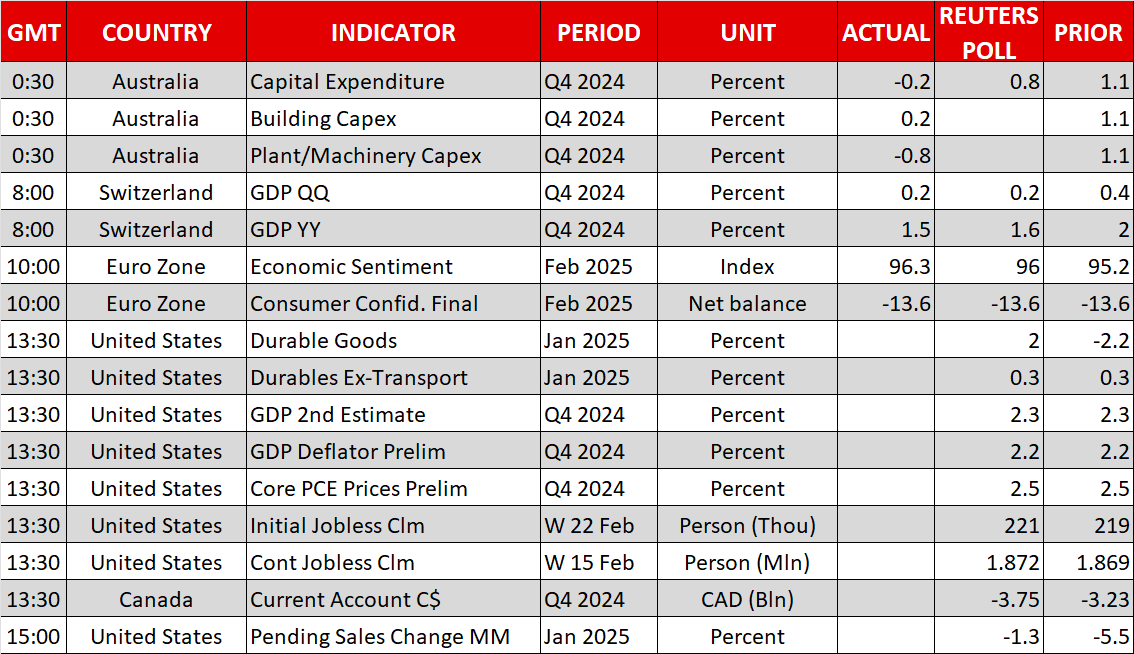

Later immediately, buyers will likely be watching US sturdy items orders and the weekly jobless claims, in addition to a number of Fed audio system together with Governor Bowman, whereas the main focus tomorrow will likely be on the all-important PCE inflation numbers.