Uncertainty might wreak structural injury to financial system that will not be simple to reverse

Article content material

Article content material

Article content material

The commerce uncertainty sparked by Donald Trump’s tariff threats might wreak structural injury to Canada’s financial system that gained’t be simple to reverse, warns Royal Financial institution of Canada.

Statistics Canada’s survey on enterprise intentions Wednesday confirmed a slight rebound in deliberate capital expenditures, however not almost sufficient to reverse the hunch funding has been in for the previous 20 years, stated RBC senior economist Claire Fan, in a report yesterday.

Commercial 2

Article content material

What’s worse is the survey, taken September to January, largely misses the escalation in commerce tensions which have occurred since Trump took energy.

Since then the outlook has turn into “decidedly cloudier,” Fan stated. “Funding plans have seemingly already been dialled again, notably in trade-exposed sectors like manufacturing.”

Executives at two of Canada’s Massive Six banks stated this week that purchasers are taking a extra cautious method to capital spending with the specter of crippling tariffs hanging over the financial system.

“Individuals are holding their powder dry and ready to see what’s going to occur,” Phil Thomas, Financial institution of Nova Scotia’s chief danger officer, stated on a name with analysts Tuesday. “In consequence, whether or not it’s on the retail facet, the company facet or the business facet, you form of see a little bit of stasis proper now. It’s inflicting individuals to kind of pause and take into consideration what they’re going to do.”

Even earlier than this newest wave of challenges, enterprise funding was nothing to jot down house about.

Wednesday’s survey confirmed non-public companies deliberate to spend 5.5 per cent extra on funding in 2025, with a lot of the rise coming from goods-producing sectors, notably manufacturing.

Article content material

Commercial 3

Article content material

A lot of this progress, nonetheless, was the results of increased costs, stated Fan. “Actual” funding that excludes worth adjustments was down 2.3 per cent from a yr in the past and a couple of.2 decrease than in 2019, earlier than the pandemic.

Actual funding has additionally lagged the fast progress in inhabitants and workforce so, on a per-worker foundation, it has been contracting.

A scarcity of cash isn’t the issue. RBC says non-financial companies, as an entire, “are sitting on a stockpile of money.” By its rely companies have been holding $992 billion in money and deposits as of the fourth quarter of 2024, or 32 per cent of Canada’s gross home product, in comparison with 26 per cent of GDP in 2019.

The uncertainty Trump’s tariff talks has unleashed since then isn’t going to steer companies to let go of these liquid belongings anytime quickly, stated Fan.

“Identical to households who have a tendency to avoid wasting extra throughout the onset of financial downturns for contingency causes, rising uncertainty concerning the future Canadian commerce backdrop additionally will increase the chance that companies hold holding on to their liquid asset as a substitute of leveraging it to drive productivity-enhancing developments,” she wrote.

Commercial 4

Article content material

Slumping productiveness has been an ongoing downside in Canada, a lot so {that a} yr in the past the Financial institution of Canada declared a productiveness “emergency.”

“General, one other spherical of weak funding spending dangers extending Canada’s a long time lengthy productiveness crunch, turning commerce threats within the near-term into structural injury within the financial system that may’t be simply reversed,” warned Fan.

At present’s commerce turmoil threatens to not solely curb funding selections and GDP progress now, but additionally have “far-reaching damaging affect on the financial system additional down the highway,” she stated.

“The structural underperformance in productiveness progress, attributable to persistent under-investment principally means there can be a pace restrict on how briskly the Canadian financial system can progress in the long term, past the subsequent 4 years,” she stated.

Enroll right here to get Posthaste delivered straight to your inbox.

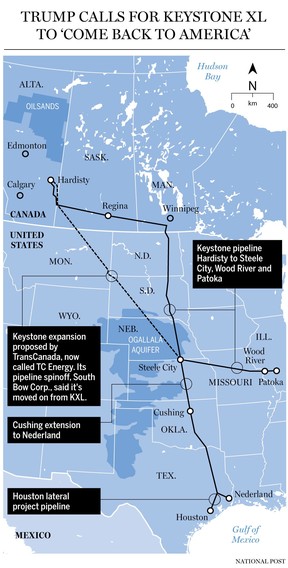

The great, outdated Keystone XL pipeline is again within the information, after U.S. President Donald Trump advised the world he needs it constructed “NOW!” The doomed cross-border undertaking that value the Canadian oilpatch billions when it was cancelled in 2021 by the previous administration continues to be the topic of an ongoing $1.3-billion lawsuit by the Alberta authorities.

Commercial 5

Article content material

South Bow Corp., TC Vitality Corp.’s pipeline spinoff, says it’s moved on, however a former Alberta premier had an attention-grabbing concept — use Keystone and Trump’s thirst for oil as a bargaining chip.

“We want leverage to cope with Trump. He’s indicating one space the place we’ve unused leverage and we should always take ‘sure’ for a solution,” stated Jason Kenney. Learn extra from the Monetary Put up’s Meghan Potkins.

- At present’s Information: Canada present account steadiness, United States gross home product, sturdy items orders, pending house gross sales

- Earnings: Canadian Imperial Financial institution of Commerce, Royal Financial institution of Canada, Toronto-Dominion Financial institution, Quebecor Inc., Pembina Pipeline Corp.

Speaking about cash could be powerful for {couples} of any age, however it’s particularly troublesome for youthful generations, in keeping with surveys. Learn on for why these conversations are essential and the way finest to open traces of communication.

Commercial 6

Article content material

Calling Canadian households with youthful youngsters or teenagers: Whether or not it’s budgeting, spending, investing, paying off debt, or simply paying the payments, does your loved ones have any monetary resolutions for the approaching yr? Tell us at wealth@postmedia.com.

McLister on mortgages

Wish to be taught extra about mortgages? Mortgage strategist Robert McLister’s Monetary Put up column may also help navigate the advanced sector, from the most recent tendencies to financing alternatives you gained’t wish to miss. Plus examine his mortgage price web page for Canada’s lowest nationwide mortgage charges, up to date every day.

Monetary Put up on YouTube

Go to the Monetary Put up’s YouTube channel for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

At present’s Posthaste was written by Pamela Heaven, with extra reporting from Monetary Put up employees, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this article? E mail us at posthaste@postmedia.com.

Really helpful from Editorial

Bookmark our web site and help our journalism: Don’t miss the enterprise information it’s worthwhile to know — add financialpost.com to your bookmarks and join our newsletters right here

Article content material