- Trump’s “Liberation Day” tariffs are right here—so why did markets flinch?

- With recession fears simmering and commerce tensions rising, buyers aren’t shopping for the optimism simply but.

- However may names like Century Aluminum quietly emerge as tariff-era winners?

- In search of extra actionable commerce concepts to navigate the present market volatility? Subscribe right here to unlock entry to ProPicks AI winners.

Yesterday afternoon, Donald Trump started his speech detailing U.S. tariff coverage, in what has been dubbed “Liberation Day.” The broad vary of tariffs offered have been described by the present president as “mushy reciprocal tariffs” and largely confirmed earlier bulletins made in current weeks.

Fairness markets traded decrease in after-hours buying and selling, with the dropping greater than 2%, indicating that buyers had hoped for a extra dovish tone from the convention. Foreign money markets, after a short spike in volatility, returned to baseline ranges. Particularly, the pair resumed its downward pattern, reflecting continued weakening of the U.S. greenback on account of rising recession fears. Buying and selling within the coming periods this week ought to assist form short-term sentiment throughout each forex and fairness markets.

A Turning Level or the Begin of a Lengthy Negotiation?

Donald Trump offered a transparent chart summarizing the tariffs imposed on numerous nations:Supply: Yahoo Finance

The US is now approaching its highest efficient tariff stage in 100 years—slightly below 30%. In accordance with the present administration, this transfer is a part of an effort to return the U.S. to the high-growth period of the late nineteenth and early twentieth centuries. Whether or not these measures will obtain that aim stays to be seen over the subsequent few quarters and can little question be the topic of detailed financial evaluation.

All indicators counsel this isn’t the ultimate chapter within the tariff warfare. As a substitute, present charges might function a baseline for future negotiations with particular person nations or buying and selling blocs. Within the coming weeks, markets will intently look ahead to overseas reactions, the chance of reciprocal tariffs, and the anticipated affect on company margins—particularly as comparable tariffs throughout Trump’s first time period notably strained U.S. firms’ backside strains, significantly within the case of tariffs on China.

Along with the numerous sectors prone to be negatively impacted, there are additionally industries that will profit from these sweeping modifications. Home steelmakers and aluminum producers, for instance, may even see elevated demand on account of lowered overseas competitors. The semiconductor trade can be present process a strategic shift, because the U.S. pushes for provide chain independence—attracting funding and manufacturing to the U.S. and allied nations. This might present a long-term increase to main gamers within the area.

Will Century Aluminum Firm Profit From the Tariff Conflict?

One firm that would profit considerably from the brand new tariffs is Century Aluminum Firm (NASDAQ:)—the most important U.S. producer of major aluminum. Final month, 25% tariffs on and aluminum have been enacted as a part of the preliminary effort to help home producers.

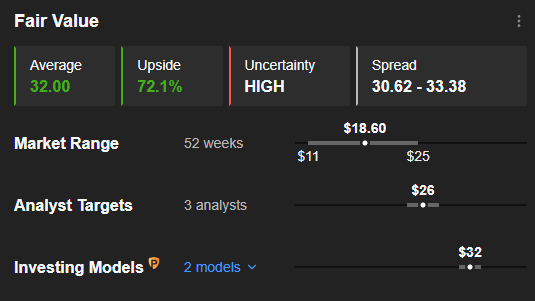

In accordance with InvestingPro’s honest worth evaluation, Century Aluminum has as a lot as 72.1% progress potential. Supply: InvestingPro

Supply: InvestingPro

Nevertheless, it might take till the Q2 2025 earnings outcomes to see the primary tangible affect of those new tariffs mirrored within the firm’s financials.

***

Be sure you try InvestingPro to remain in sync with the market pattern and what it means to your buying and selling. Whether or not you’re a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now and immediately unlock entry to a number of market-beating options, together with:

- ProPicks AI: AI-selected inventory winners with confirmed observe report.

- InvestingPro Truthful Worth: Immediately discover out if a inventory is underpriced or overvalued.

- Superior Inventory Screener: Seek for the most effective shares based mostly on tons of of chosen filters, and standards.

- High Concepts: See what shares billionaire buyers comparable to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclaimer: This text is written for informational functions solely. It’s not supposed to encourage the acquisition of property in any approach, nor does it represent a solicitation, provide, advice or suggestion to take a position. I want to remind you that each one property are evaluated from a number of views and are extremely dangerous, so any funding resolution and the related danger belongs to the investor. We additionally don’t present any funding advisory companies.