Arduous for Canadian traders to beat final yr, when the

S&P/TSX Composite Index

powered via to a 28 per cent achieve.

That amounted to the second strongest efficiency this century and beat the S&P 500 which ended the yr up 17 per cent.

In some way this managed to occur in opposition to a backdrop of commerce turmoil unleashed by U.S.

President Donald Trump

, fears the financial system would sink into recession and political turmoil of our personal.

“The important thing query for traders now’s whether or not inventory markets can ship constructive positive factors for a fourth yr,” mentioned investing agency

Edward Jones

of their market outlook out this week.

Strategists are optimistic, with each Edward Jones and

CIBC Capital Markets

predicting upside for fairness markets once more this yr.

“Fairness valuation in Canada is above its longer-term common however nowhere close to bubble territory,” wrote Christopher Harvey, CIBC’s head of fairness and portfolio technique.

“Importantly, tight investment-grade credit score spreads are a constructive signal for EPS development. When mixed with capex tailwinds from information centre buildout and authorities infrastructure priorities, we see double-digit EPS development supporting an above-average market a number of.”

CIBC is predicting the TSX will hit 35,200 in 2026, up 11 per cent from its shut on Dec. 31. Its goal vary for the S&P 500 goes as excessive as 7,790, up from 6,846 at year-end.

Valuations soared in 2025, however this yr “earnings development might be within the driver’s seat,” mentioned Edward Jones.

They too count on double-digit earnings development in all 11 sectors of Canadian and U.S. shares, with a 15 per cent development fee in Canada.

Enhancing financial situations will play a job. Edward Jones expects GDP development to rebound to about 2 per cent by yr finish as commerce tensions ease, employment rises and rates of interest keep supportive.

“After struggling via commerce disputes in 2025, the Canadian financial system is positioned for restoration as fiscal stimulus measures take impact,” mentioned the report.

Although the

Financial institution of Canada

is anticipated to carry its fee at 2.25 per cent, the

Federal Reserve

ought to proceed gradual cuts towards a 3 to three.5 per cent fee, which is able to help fairness markets, they predict.

Edward Jones’ base case is for markets to be supported by regular financial development, secure rates of interest and rising company income.

However at this stage within the cycle, diversification turns into much more essential, mentioned the strategists. It favours U.S. large-cap shares uncovered to AI and mid-cap shares weighted towards cyclical sectors. It additionally recommends going world into rising markets which may benefit from Fed fee cuts and small and mid-cap shares in developed markets abroad.

In Canadian equities, Edward Jones is obese in supplies, industrials and vitality sectors.

CIBC places financials on high with a 33.2 per cent weight. Its high picks for this sector are Financial institution of Montreal, Nice-West Lifeco Inc, Toronto Dominion Financial institution and Brookfield Asset Administration.

Supplies come subsequent with a weight on 17.7 per cent. Gold, silver and copper function prominently in high picks which embody Capstone Copper Corp., IAMGOLD Corp., Kinross Gold Corp., Franco-Nevada Corp., Pan American Silver Corp. and Nutrien Ltd.

Vitality’s high picks weighing in at 14.9 per cent are Suncor Vitality Inc., Kelt Exploration Ltd., Keyera Corp. and Williams Firms Inc.

Industrials at 10.6 per cent embody TFI Worldwide Inc., AtkinsRealis Group Inc and CAE Inc.

Shopify Inc, Constellation Software program Inc., and Docebo Inc. are the highest picks for data expertise which will get a weight of 9.8 per cent.

Enroll right here to get Posthaste delivered straight to your inbox.

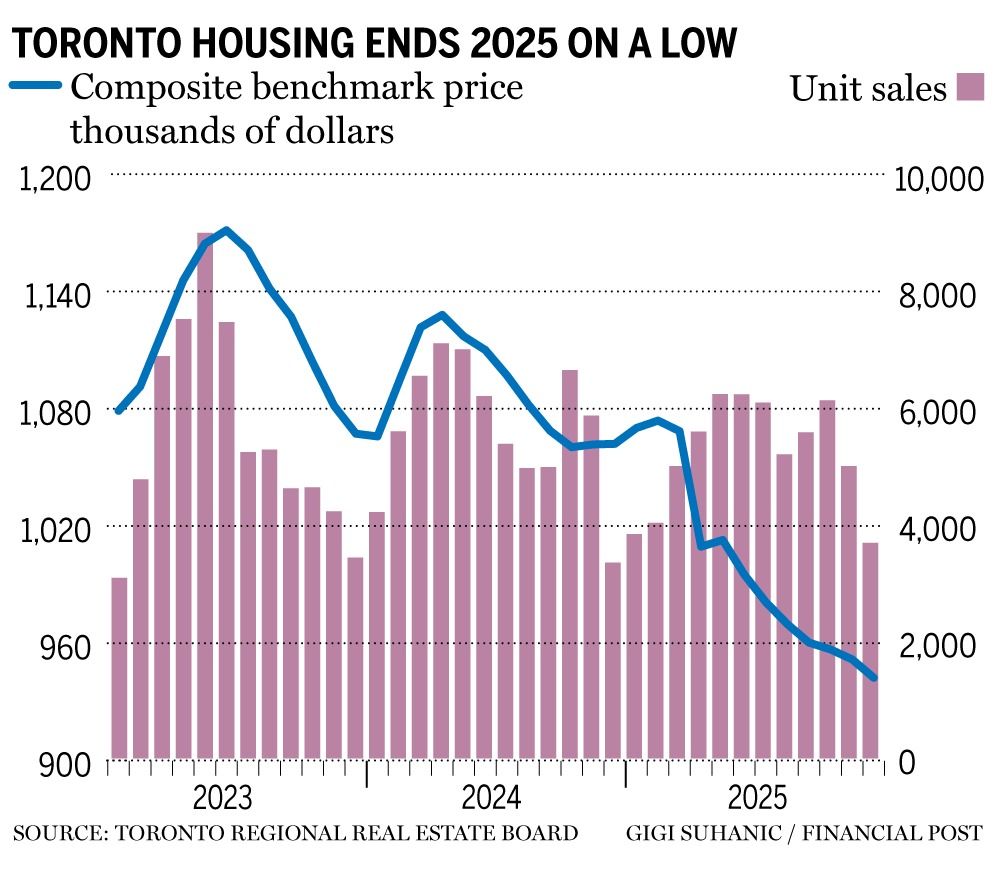

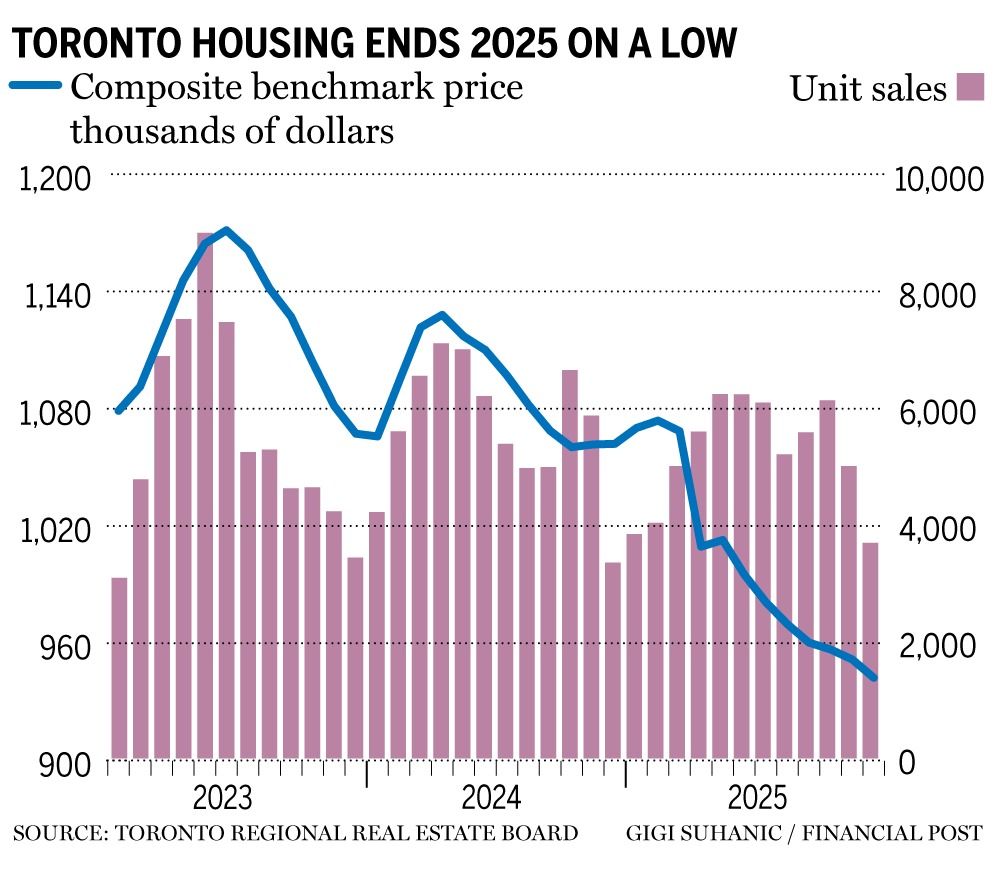

Toronto

dwelling gross sales

ended the yr very like they began — with a whimper.

The variety of properties offered in Canada’s largest metropolis fell 0.4 per cent in December from the month earlier than, whereas the benchmark value slipped 0.7 per cent to $962,000, seasonally adjusted information from the

Toronto Regional Actual Property Board (TRREB)

confirmed Wednesday.

The declines have been a part of a pattern seen all year long. Complete gross sales for 2025 have been down greater than 11 per cent, and benchmark costs fell greater than 6 per cent.

Final February TRREB forecast that gross sales would rise 12 per cent in 2025. As a substitute exercise was the bottom seen within the Higher Toronto Space since 2000.

Solely sellers have been out in pressure. Energetic listings rose by 10.5 per cent in the course of the yr, with new listings hitting their highest stage since 1980.

- Right this moment’s Knowledge: Canada worldwide merchandise commerce, United States wholesale commerce, shopper credit score, non-farm productiveness and commerce stability

- Earnings: Aritzia Inc., Tilray Manufacturers Inc.

- Canada has issues: Listed here are the tech startups value watching which might be attempting to deal with them

- Howard Levitt: 7 survival suggestions for employers in 2026

- The way to make 1,000,000 a yr enjoying disc golf

The Rich Barber writer David Chilton is again and this time he has up to date his best-selling private finance information for as we speak’s younger Canadians, greater than 30 years after he first printed it.

Gen Z and millennial Canadians face totally different monetary points than earlier generations, together with out-of-reach dwelling possession and earnings uncertainty, getting cash administration appear unimaginable for some.

In an interview for the Monetary Submit, Chilton talks about how youthful Canadians can get a deal with on their funds and set themselves up for profitable saving methods in 2026 and past, regardless of the monetary circumstances they could face.

Learn extra

Involved in vitality? The subscriber-only FP West: Vitality Insider e-newsletter brings you unique reporting and in-depth evaluation on one of many nation’s most essential sectors.

Enroll right here.

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Submit column

will help navigate the complicated sector, from the newest developments to financing alternatives you received’t need to miss. Plus examine his

mortgage fee web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Submit on YouTube

Go to the Monetary Submit’s

YouTube channel

for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

Right this moment’s Posthaste was written by Pamela Heaven with further reporting from Monetary Submit workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? Electronic mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information you might want to know — add financialpost.com to your bookmarks and join our newsletters right here

Arduous for Canadian traders to beat final yr, when the

S&P/TSX Composite Index

powered via to a 28 per cent achieve.

That amounted to the second strongest efficiency this century and beat the S&P 500 which ended the yr up 17 per cent.

In some way this managed to occur in opposition to a backdrop of commerce turmoil unleashed by U.S.

President Donald Trump

, fears the financial system would sink into recession and political turmoil of our personal.

“The important thing query for traders now’s whether or not inventory markets can ship constructive positive factors for a fourth yr,” mentioned investing agency

Edward Jones

of their market outlook out this week.

Strategists are optimistic, with each Edward Jones and

CIBC Capital Markets

predicting upside for fairness markets once more this yr.

“Fairness valuation in Canada is above its longer-term common however nowhere close to bubble territory,” wrote Christopher Harvey, CIBC’s head of fairness and portfolio technique.

“Importantly, tight investment-grade credit score spreads are a constructive signal for EPS development. When mixed with capex tailwinds from information centre buildout and authorities infrastructure priorities, we see double-digit EPS development supporting an above-average market a number of.”

CIBC is predicting the TSX will hit 35,200 in 2026, up 11 per cent from its shut on Dec. 31. Its goal vary for the S&P 500 goes as excessive as 7,790, up from 6,846 at year-end.

Valuations soared in 2025, however this yr “earnings development might be within the driver’s seat,” mentioned Edward Jones.

They too count on double-digit earnings development in all 11 sectors of Canadian and U.S. shares, with a 15 per cent development fee in Canada.

Enhancing financial situations will play a job. Edward Jones expects GDP development to rebound to about 2 per cent by yr finish as commerce tensions ease, employment rises and rates of interest keep supportive.

“After struggling via commerce disputes in 2025, the Canadian financial system is positioned for restoration as fiscal stimulus measures take impact,” mentioned the report.

Although the

Financial institution of Canada

is anticipated to carry its fee at 2.25 per cent, the

Federal Reserve

ought to proceed gradual cuts towards a 3 to three.5 per cent fee, which is able to help fairness markets, they predict.

Edward Jones’ base case is for markets to be supported by regular financial development, secure rates of interest and rising company income.

However at this stage within the cycle, diversification turns into much more essential, mentioned the strategists. It favours U.S. large-cap shares uncovered to AI and mid-cap shares weighted towards cyclical sectors. It additionally recommends going world into rising markets which may benefit from Fed fee cuts and small and mid-cap shares in developed markets abroad.

In Canadian equities, Edward Jones is obese in supplies, industrials and vitality sectors.

CIBC places financials on high with a 33.2 per cent weight. Its high picks for this sector are Financial institution of Montreal, Nice-West Lifeco Inc, Toronto Dominion Financial institution and Brookfield Asset Administration.

Supplies come subsequent with a weight on 17.7 per cent. Gold, silver and copper function prominently in high picks which embody Capstone Copper Corp., IAMGOLD Corp., Kinross Gold Corp., Franco-Nevada Corp., Pan American Silver Corp. and Nutrien Ltd.

Vitality’s high picks weighing in at 14.9 per cent are Suncor Vitality Inc., Kelt Exploration Ltd., Keyera Corp. and Williams Firms Inc.

Industrials at 10.6 per cent embody TFI Worldwide Inc., AtkinsRealis Group Inc and CAE Inc.

Shopify Inc, Constellation Software program Inc., and Docebo Inc. are the highest picks for data expertise which will get a weight of 9.8 per cent.

Enroll right here to get Posthaste delivered straight to your inbox.

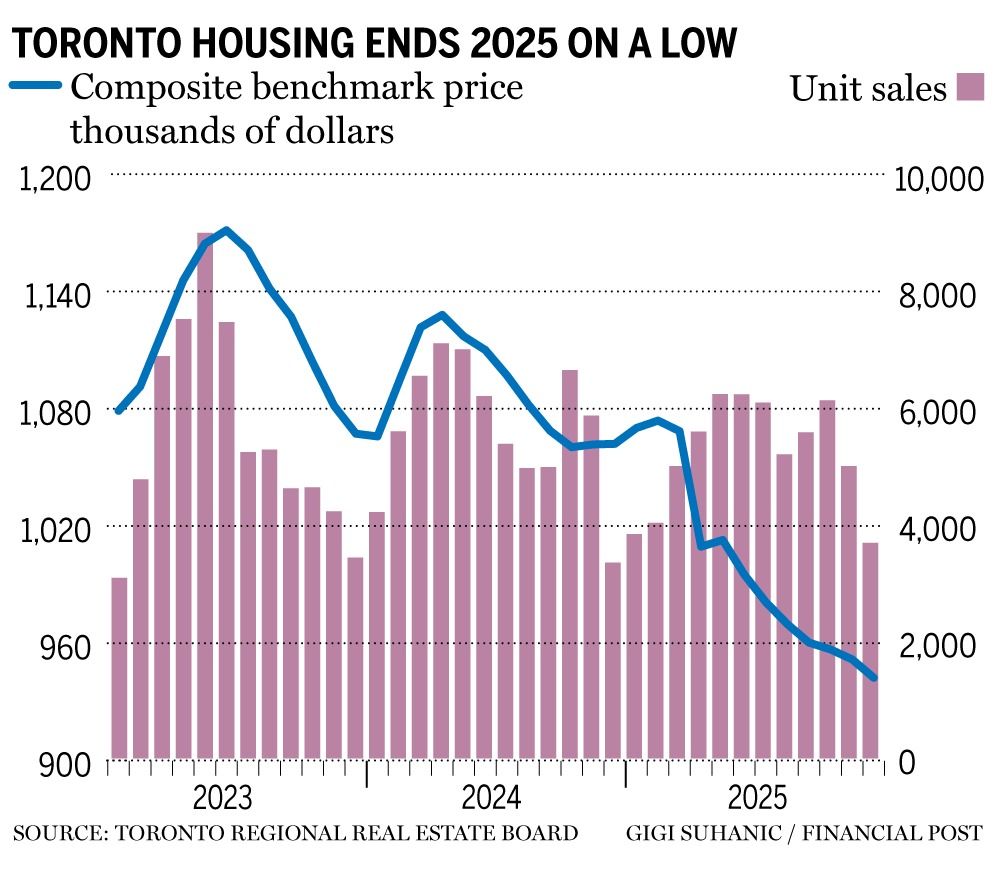

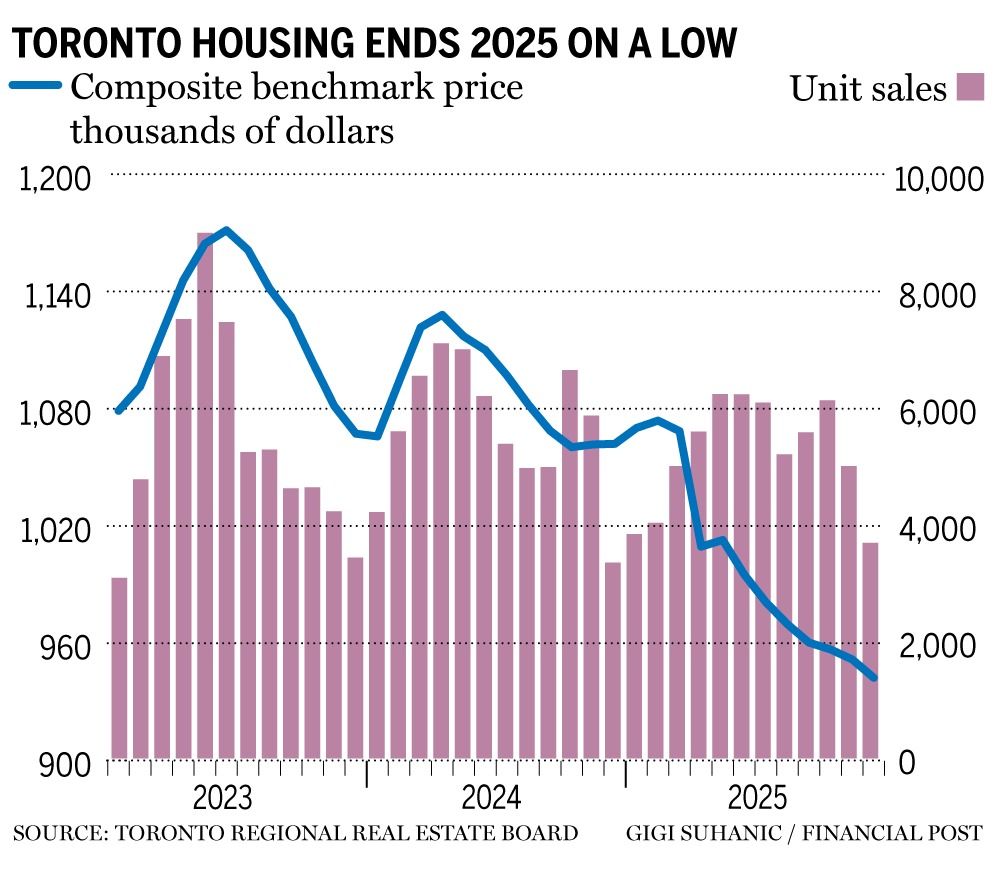

Toronto

dwelling gross sales

ended the yr very like they began — with a whimper.

The variety of properties offered in Canada’s largest metropolis fell 0.4 per cent in December from the month earlier than, whereas the benchmark value slipped 0.7 per cent to $962,000, seasonally adjusted information from the

Toronto Regional Actual Property Board (TRREB)

confirmed Wednesday.

The declines have been a part of a pattern seen all year long. Complete gross sales for 2025 have been down greater than 11 per cent, and benchmark costs fell greater than 6 per cent.

Final February TRREB forecast that gross sales would rise 12 per cent in 2025. As a substitute exercise was the bottom seen within the Higher Toronto Space since 2000.

Solely sellers have been out in pressure. Energetic listings rose by 10.5 per cent in the course of the yr, with new listings hitting their highest stage since 1980.

- Right this moment’s Knowledge: Canada worldwide merchandise commerce, United States wholesale commerce, shopper credit score, non-farm productiveness and commerce stability

- Earnings: Aritzia Inc., Tilray Manufacturers Inc.

- Canada has issues: Listed here are the tech startups value watching which might be attempting to deal with them

- Howard Levitt: 7 survival suggestions for employers in 2026

- The way to make 1,000,000 a yr enjoying disc golf

The Rich Barber writer David Chilton is again and this time he has up to date his best-selling private finance information for as we speak’s younger Canadians, greater than 30 years after he first printed it.

Gen Z and millennial Canadians face totally different monetary points than earlier generations, together with out-of-reach dwelling possession and earnings uncertainty, getting cash administration appear unimaginable for some.

In an interview for the Monetary Submit, Chilton talks about how youthful Canadians can get a deal with on their funds and set themselves up for profitable saving methods in 2026 and past, regardless of the monetary circumstances they could face.

Learn extra

Involved in vitality? The subscriber-only FP West: Vitality Insider e-newsletter brings you unique reporting and in-depth evaluation on one of many nation’s most essential sectors.

Enroll right here.

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Submit column

will help navigate the complicated sector, from the newest developments to financing alternatives you received’t need to miss. Plus examine his

mortgage fee web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Submit on YouTube

Go to the Monetary Submit’s

YouTube channel

for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

Right this moment’s Posthaste was written by Pamela Heaven with further reporting from Monetary Submit workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? Electronic mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information you might want to know — add financialpost.com to your bookmarks and join our newsletters right here

Arduous for Canadian traders to beat final yr, when the

S&P/TSX Composite Index

powered via to a 28 per cent achieve.

That amounted to the second strongest efficiency this century and beat the S&P 500 which ended the yr up 17 per cent.

In some way this managed to occur in opposition to a backdrop of commerce turmoil unleashed by U.S.

President Donald Trump

, fears the financial system would sink into recession and political turmoil of our personal.

“The important thing query for traders now’s whether or not inventory markets can ship constructive positive factors for a fourth yr,” mentioned investing agency

Edward Jones

of their market outlook out this week.

Strategists are optimistic, with each Edward Jones and

CIBC Capital Markets

predicting upside for fairness markets once more this yr.

“Fairness valuation in Canada is above its longer-term common however nowhere close to bubble territory,” wrote Christopher Harvey, CIBC’s head of fairness and portfolio technique.

“Importantly, tight investment-grade credit score spreads are a constructive signal for EPS development. When mixed with capex tailwinds from information centre buildout and authorities infrastructure priorities, we see double-digit EPS development supporting an above-average market a number of.”

CIBC is predicting the TSX will hit 35,200 in 2026, up 11 per cent from its shut on Dec. 31. Its goal vary for the S&P 500 goes as excessive as 7,790, up from 6,846 at year-end.

Valuations soared in 2025, however this yr “earnings development might be within the driver’s seat,” mentioned Edward Jones.

They too count on double-digit earnings development in all 11 sectors of Canadian and U.S. shares, with a 15 per cent development fee in Canada.

Enhancing financial situations will play a job. Edward Jones expects GDP development to rebound to about 2 per cent by yr finish as commerce tensions ease, employment rises and rates of interest keep supportive.

“After struggling via commerce disputes in 2025, the Canadian financial system is positioned for restoration as fiscal stimulus measures take impact,” mentioned the report.

Although the

Financial institution of Canada

is anticipated to carry its fee at 2.25 per cent, the

Federal Reserve

ought to proceed gradual cuts towards a 3 to three.5 per cent fee, which is able to help fairness markets, they predict.

Edward Jones’ base case is for markets to be supported by regular financial development, secure rates of interest and rising company income.

However at this stage within the cycle, diversification turns into much more essential, mentioned the strategists. It favours U.S. large-cap shares uncovered to AI and mid-cap shares weighted towards cyclical sectors. It additionally recommends going world into rising markets which may benefit from Fed fee cuts and small and mid-cap shares in developed markets abroad.

In Canadian equities, Edward Jones is obese in supplies, industrials and vitality sectors.

CIBC places financials on high with a 33.2 per cent weight. Its high picks for this sector are Financial institution of Montreal, Nice-West Lifeco Inc, Toronto Dominion Financial institution and Brookfield Asset Administration.

Supplies come subsequent with a weight on 17.7 per cent. Gold, silver and copper function prominently in high picks which embody Capstone Copper Corp., IAMGOLD Corp., Kinross Gold Corp., Franco-Nevada Corp., Pan American Silver Corp. and Nutrien Ltd.

Vitality’s high picks weighing in at 14.9 per cent are Suncor Vitality Inc., Kelt Exploration Ltd., Keyera Corp. and Williams Firms Inc.

Industrials at 10.6 per cent embody TFI Worldwide Inc., AtkinsRealis Group Inc and CAE Inc.

Shopify Inc, Constellation Software program Inc., and Docebo Inc. are the highest picks for data expertise which will get a weight of 9.8 per cent.

Enroll right here to get Posthaste delivered straight to your inbox.

Toronto

dwelling gross sales

ended the yr very like they began — with a whimper.

The variety of properties offered in Canada’s largest metropolis fell 0.4 per cent in December from the month earlier than, whereas the benchmark value slipped 0.7 per cent to $962,000, seasonally adjusted information from the

Toronto Regional Actual Property Board (TRREB)

confirmed Wednesday.

The declines have been a part of a pattern seen all year long. Complete gross sales for 2025 have been down greater than 11 per cent, and benchmark costs fell greater than 6 per cent.

Final February TRREB forecast that gross sales would rise 12 per cent in 2025. As a substitute exercise was the bottom seen within the Higher Toronto Space since 2000.

Solely sellers have been out in pressure. Energetic listings rose by 10.5 per cent in the course of the yr, with new listings hitting their highest stage since 1980.

- Right this moment’s Knowledge: Canada worldwide merchandise commerce, United States wholesale commerce, shopper credit score, non-farm productiveness and commerce stability

- Earnings: Aritzia Inc., Tilray Manufacturers Inc.

- Canada has issues: Listed here are the tech startups value watching which might be attempting to deal with them

- Howard Levitt: 7 survival suggestions for employers in 2026

- The way to make 1,000,000 a yr enjoying disc golf

The Rich Barber writer David Chilton is again and this time he has up to date his best-selling private finance information for as we speak’s younger Canadians, greater than 30 years after he first printed it.

Gen Z and millennial Canadians face totally different monetary points than earlier generations, together with out-of-reach dwelling possession and earnings uncertainty, getting cash administration appear unimaginable for some.

In an interview for the Monetary Submit, Chilton talks about how youthful Canadians can get a deal with on their funds and set themselves up for profitable saving methods in 2026 and past, regardless of the monetary circumstances they could face.

Learn extra

Involved in vitality? The subscriber-only FP West: Vitality Insider e-newsletter brings you unique reporting and in-depth evaluation on one of many nation’s most essential sectors.

Enroll right here.

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Submit column

will help navigate the complicated sector, from the newest developments to financing alternatives you received’t need to miss. Plus examine his

mortgage fee web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Submit on YouTube

Go to the Monetary Submit’s

YouTube channel

for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

Right this moment’s Posthaste was written by Pamela Heaven with further reporting from Monetary Submit workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? Electronic mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information you might want to know — add financialpost.com to your bookmarks and join our newsletters right here

Arduous for Canadian traders to beat final yr, when the

S&P/TSX Composite Index

powered via to a 28 per cent achieve.

That amounted to the second strongest efficiency this century and beat the S&P 500 which ended the yr up 17 per cent.

In some way this managed to occur in opposition to a backdrop of commerce turmoil unleashed by U.S.

President Donald Trump

, fears the financial system would sink into recession and political turmoil of our personal.

“The important thing query for traders now’s whether or not inventory markets can ship constructive positive factors for a fourth yr,” mentioned investing agency

Edward Jones

of their market outlook out this week.

Strategists are optimistic, with each Edward Jones and

CIBC Capital Markets

predicting upside for fairness markets once more this yr.

“Fairness valuation in Canada is above its longer-term common however nowhere close to bubble territory,” wrote Christopher Harvey, CIBC’s head of fairness and portfolio technique.

“Importantly, tight investment-grade credit score spreads are a constructive signal for EPS development. When mixed with capex tailwinds from information centre buildout and authorities infrastructure priorities, we see double-digit EPS development supporting an above-average market a number of.”

CIBC is predicting the TSX will hit 35,200 in 2026, up 11 per cent from its shut on Dec. 31. Its goal vary for the S&P 500 goes as excessive as 7,790, up from 6,846 at year-end.

Valuations soared in 2025, however this yr “earnings development might be within the driver’s seat,” mentioned Edward Jones.

They too count on double-digit earnings development in all 11 sectors of Canadian and U.S. shares, with a 15 per cent development fee in Canada.

Enhancing financial situations will play a job. Edward Jones expects GDP development to rebound to about 2 per cent by yr finish as commerce tensions ease, employment rises and rates of interest keep supportive.

“After struggling via commerce disputes in 2025, the Canadian financial system is positioned for restoration as fiscal stimulus measures take impact,” mentioned the report.

Although the

Financial institution of Canada

is anticipated to carry its fee at 2.25 per cent, the

Federal Reserve

ought to proceed gradual cuts towards a 3 to three.5 per cent fee, which is able to help fairness markets, they predict.

Edward Jones’ base case is for markets to be supported by regular financial development, secure rates of interest and rising company income.

However at this stage within the cycle, diversification turns into much more essential, mentioned the strategists. It favours U.S. large-cap shares uncovered to AI and mid-cap shares weighted towards cyclical sectors. It additionally recommends going world into rising markets which may benefit from Fed fee cuts and small and mid-cap shares in developed markets abroad.

In Canadian equities, Edward Jones is obese in supplies, industrials and vitality sectors.

CIBC places financials on high with a 33.2 per cent weight. Its high picks for this sector are Financial institution of Montreal, Nice-West Lifeco Inc, Toronto Dominion Financial institution and Brookfield Asset Administration.

Supplies come subsequent with a weight on 17.7 per cent. Gold, silver and copper function prominently in high picks which embody Capstone Copper Corp., IAMGOLD Corp., Kinross Gold Corp., Franco-Nevada Corp., Pan American Silver Corp. and Nutrien Ltd.

Vitality’s high picks weighing in at 14.9 per cent are Suncor Vitality Inc., Kelt Exploration Ltd., Keyera Corp. and Williams Firms Inc.

Industrials at 10.6 per cent embody TFI Worldwide Inc., AtkinsRealis Group Inc and CAE Inc.

Shopify Inc, Constellation Software program Inc., and Docebo Inc. are the highest picks for data expertise which will get a weight of 9.8 per cent.

Enroll right here to get Posthaste delivered straight to your inbox.

Toronto

dwelling gross sales

ended the yr very like they began — with a whimper.

The variety of properties offered in Canada’s largest metropolis fell 0.4 per cent in December from the month earlier than, whereas the benchmark value slipped 0.7 per cent to $962,000, seasonally adjusted information from the

Toronto Regional Actual Property Board (TRREB)

confirmed Wednesday.

The declines have been a part of a pattern seen all year long. Complete gross sales for 2025 have been down greater than 11 per cent, and benchmark costs fell greater than 6 per cent.

Final February TRREB forecast that gross sales would rise 12 per cent in 2025. As a substitute exercise was the bottom seen within the Higher Toronto Space since 2000.

Solely sellers have been out in pressure. Energetic listings rose by 10.5 per cent in the course of the yr, with new listings hitting their highest stage since 1980.

- Right this moment’s Knowledge: Canada worldwide merchandise commerce, United States wholesale commerce, shopper credit score, non-farm productiveness and commerce stability

- Earnings: Aritzia Inc., Tilray Manufacturers Inc.

- Canada has issues: Listed here are the tech startups value watching which might be attempting to deal with them

- Howard Levitt: 7 survival suggestions for employers in 2026

- The way to make 1,000,000 a yr enjoying disc golf

The Rich Barber writer David Chilton is again and this time he has up to date his best-selling private finance information for as we speak’s younger Canadians, greater than 30 years after he first printed it.

Gen Z and millennial Canadians face totally different monetary points than earlier generations, together with out-of-reach dwelling possession and earnings uncertainty, getting cash administration appear unimaginable for some.

In an interview for the Monetary Submit, Chilton talks about how youthful Canadians can get a deal with on their funds and set themselves up for profitable saving methods in 2026 and past, regardless of the monetary circumstances they could face.

Learn extra

Involved in vitality? The subscriber-only FP West: Vitality Insider e-newsletter brings you unique reporting and in-depth evaluation on one of many nation’s most essential sectors.

Enroll right here.

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Submit column

will help navigate the complicated sector, from the newest developments to financing alternatives you received’t need to miss. Plus examine his

mortgage fee web page

for Canada’s lowest nationwide mortgage charges, up to date day by day.

Monetary Submit on YouTube

Go to the Monetary Submit’s

YouTube channel

for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

Right this moment’s Posthaste was written by Pamela Heaven with further reporting from Monetary Submit workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? Electronic mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information you might want to know — add financialpost.com to your bookmarks and join our newsletters right here