Up to date on April twenty fourth, 2025 by Bob Ciura

Shares with low P/E ratios can provide enticing returns if their valuation multiples broaden.

And when a low P/E inventory additionally has a excessive dividend yield, buyers get ‘paid to attend’ for the valuation a number of to extend.

We outline a high-yield inventory as one with a present dividend yield of 5% or larger.

The free excessive dividend shares checklist spreadsheet under has our full checklist of particular person securities (shares, REITs, MLPs, and so forth.) with with 5%+ dividend yields.

You possibly can obtain a free copy by clicking on the hyperlink under:

On this analysis report, we talk about the prospects of 20 undervalued excessive dividend shares, that are at present buying and selling at P/E ratios underneath 10 and are providing dividend yields above 5.0%.

Worldwide shares have been excluded from this report.

Now we have ranked the shares by P/E ratio, from lowest to highest. For REITs, we use P/FFO instead of the P/E ratio. And for MLPs, we use P/DCF (which is distributable money flows).

These are comparable metrics much like earnings for widespread shares.

These 20 dividend shares haven’t been screened for dividend security. As an alternative, these are the 20 most undervalued shares within the Positive Evaluation Analysis Database with excessive dividend yields.

Desk of Contents

Maintain studying to see evaluation on these 20 undervalued excessive dividend shares.

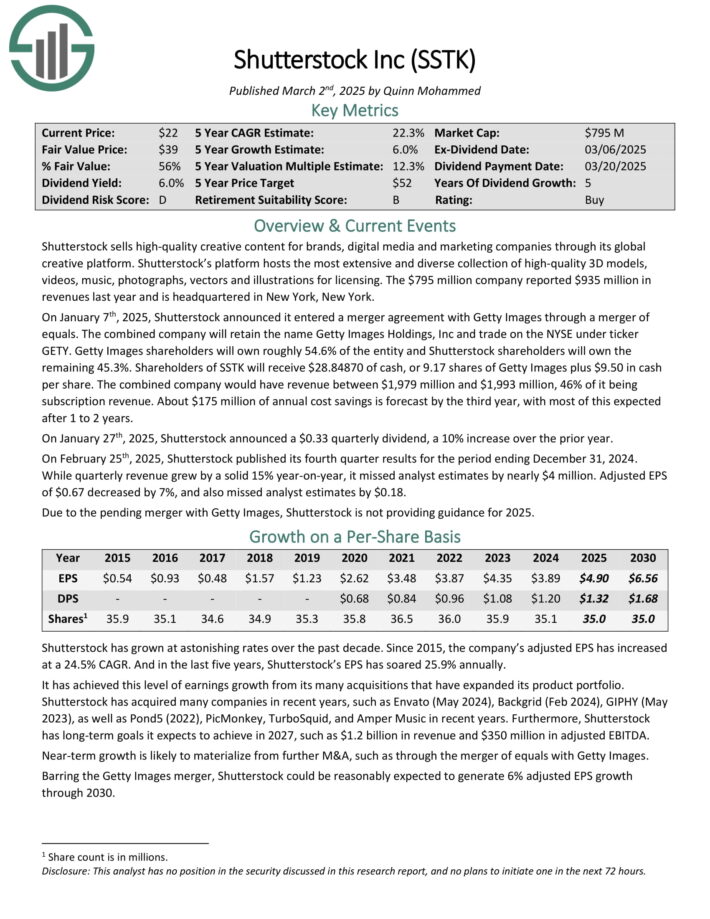

Undervalued Excessive Dividend Inventory #1: Shutterstock, Inc. (SSTK) – P/E ratio of three.3

Shutterstock sells high-quality artistic content material for manufacturers, digital media and advertising and marketing corporations via its world artistic platform.

Its platform hosts essentially the most in depth and numerous assortment of high-quality 3D fashions, movies, music, images, vectors and illustrations for licensing. The corporate reported $935 million in revenues final 12 months.

On January seventh, 2025, Shutterstock introduced it entered a merger settlement with Getty Photos via a merger of equals. The mixed firm will retain the identify Getty Photos Holdings, Inc and commerce on the NYSE underneath ticker GETY.

Getty Photos shareholders will personal roughly 54.6% of the entity and Shutterstock shareholders will personal the remaining 45.3%. Shareholders of SSTK will obtain $28.84870 of money, or 9.17 shares of Getty Photos plus $9.50 in money per share.

The mixed firm would have income between $1,979 million and $1,993 million, 46% of it being subscription income. About $175 million of annual price financial savings is forecast by the third 12 months, with most of this anticipated after 1 to 2 years.

On January twenty seventh, 2025, Shutterstock introduced a $0.33 quarterly dividend, a ten% enhance over the prior 12 months.

On February twenty fifth, 2025, Shutterstock printed its fourth quarter outcomes for the interval ending December 31, 2024. Whereas quarterly income grew by a stable 15% year-on-year, it missed analyst estimates by almost $4 million.

Adjusted EPS of $0.67 decreased by 7%, and in addition missed analyst estimates by $0.18.

Click on right here to obtain our most up-to-date Positive Evaluation report on SSTK (preview of web page 1 of three proven under):

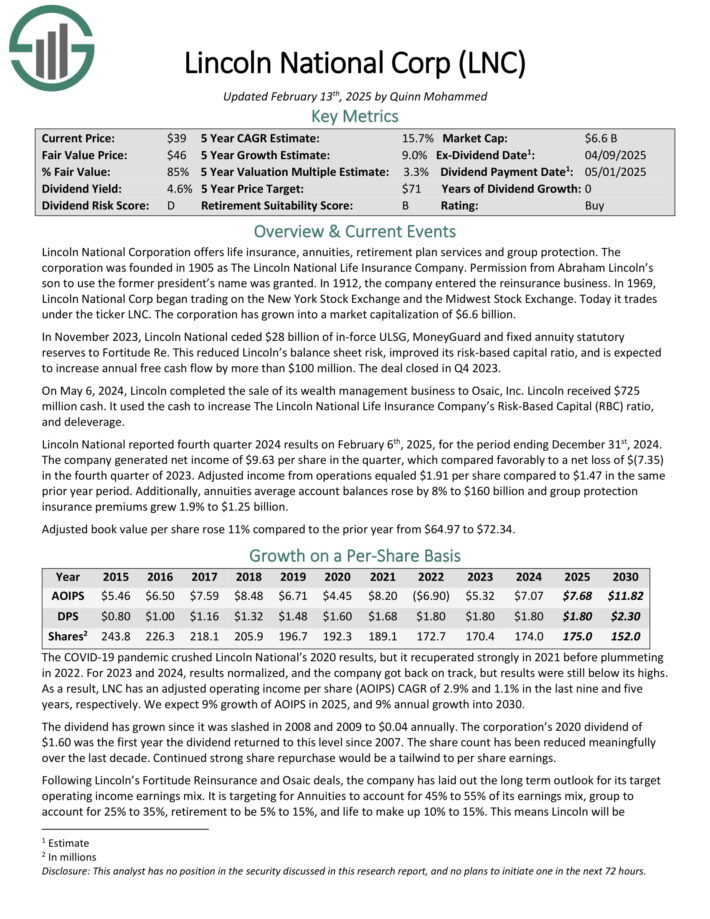

Undervalued Excessive Dividend Inventory #2: Lincoln Nationwide Corp. (LNC) – P/E ratio of 4.0

Lincoln Nationwide Company affords life insurance coverage, annuities, retirement plan providers and group safety. The company was based in 1905 as The Lincoln Nationwide Life Insurance coverage Firm.

Lincoln Nationwide reported fourth quarter 2024 outcomes on February sixth, 2025, for the interval ending December thirty first, 2024.

The corporate generated internet earnings of $9.63 per share within the quarter, which in contrast favorably to a internet lack of $(7.35) within the fourth quarter of 2023. Adjusted earnings from operations equaled $1.91 per share in comparison with $1.47 in the identical prior 12 months interval.

Moreover, annuities common account balances rose by 8% to $160 billion and group safety insurance coverage premiums grew 1.9% to $1.25 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on LNC (preview of web page 1 of three proven under):

Undervalued Excessive Dividend Inventory #3: ARMOUR Residential REIT (ARR) – P/E ratio of 4.2

ARMOUR Residential invests in residential mortgage-backed securities that embrace U.S. Authorities-sponsored entities (GSE) equivalent to Fannie Mae and Freddie Mac.

It additionally consists of Ginnie Mae, the Authorities Nationwide Mortgage Administration’s issued or assured securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate dwelling loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, cash market devices, and non-GSE or authorities agency-backed securities are examples of different forms of investments.

Supply: Investor presentation

Within the fourth quarter of 2024, ARMOUR Residential REIT, Inc. reported a GAAP internet lack of $49.4 million, or $0.83 per widespread share. Regardless of this, the corporate achieved distributable earnings of $46.5 million, equating to $0.78 per widespread share, which fell in need of the anticipated $0.97. Web curiosity earnings for the quarter was $12.7 million.

Throughout this era, ARMOUR raised roughly $136.2 million via the issuance of about 7.2 million shares by way of an on the market providing program. The corporate maintained its month-to-month widespread inventory dividend at $0.24 per share, totaling $0.72 for the quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on ARMOUR Residential REIT Inc (ARR) (preview of web page 1 of three proven under):

Undervalued Excessive Dividend Inventory #4: APA Company (APA) – P/E ratio of 4.6

Peoples Monetary Companies (PFIS) is the holding firm of Peoples Safety Financial institution and Belief Firm, a neighborhood financial institution that was based in 1905 and is headquartered in Scranton, Pennsylvania.

It operates 44 branches in Pennsylvania and offers varied banking services to shoppers, municipalities and companies.

On July 1st, 2024, Peoples Monetary Companies accomplished its acquisition of FNCB Bancorp in an all-stock deal. As per the phrases of the deal, the shareholders of FNCB now personal ~29% of the mixed entity.

Due to the merger, the financial institution grew its complete belongings from $3.7 billion to $5.5 billion and thus it grew to become the fifth largest neighborhood financial institution in Pennsylvania.

In early February, Peoples Monetary Companies reported (2/6/24) monetary outcomes for the fourth quarter of fiscal 2024. Loans and deposits grew 40% and 28%, respectively, over the prior 12 months’s quarter, due to the acquisition of FNCB Bancorp.

Web curiosity margin expanded impressively, from 2.30% within the prior 12 months’s quarter to three.25% due to the a lot larger internet curiosity margin of the acquired financial institution.

Click on right here to obtain our most up-to-date Positive Evaluation report on PFIS (preview of web page 1 of three proven under):

Undervalued Excessive Dividend Inventory #4: NewtekOne Inc. (NEWT) – P/E ratio of 4.6

Newtek Enterprise Companies Corp. was a enterprise growth firm (BDC) specializing in offering monetary and enterprise providers to the small- and medium-sized enterprise market in the US.

What makes NewTek a novel firm is {that a} good portion of its earnings is derived from subsidiaries that present a wide selection of enterprise providers to its massive shopper base.

The corporate additionally will get a major quantity of its earnings from being an issuer of SBA (Small Enterprise Administration loans), which solely only a few BDCs are licensed to do. This isn’t your typical BDC that solely generates earnings from rate of interest spreads, but in addition from a a lot wider vary of small enterprise providers.

On February twenty sixth, 2025, Newtek launched its This fall and full-year outcomes for the interval ending December thirty first, 2024. For the quarter, Newtek reported internet earnings of $18.3 million, or diluted earnings per share (EPS) of $0.69, representing a 62.8% enhance over the prior 12 months. Web curiosity earnings elevated to $11.3 million, up 36.1% from This fall 2023.

Its complete belongings reached $2.1 billion, marking a 50% rise year-over-year, with loans held for funding rising 23% to $991.4 million.

Newtek’s internet curiosity margin was 2.80%, a slight enhance from the prior 12 months.

Moreover, the corporate’s Different Mortgage Program mortgage closings skyrocketed by 199% to $91.4 million. Newtek additionally achieved vital enhancements in return on tangible widespread fairness (ROTCE) and return on common belongings (ROAA), reaching 31.8% and 4.1%.

Click on right here to obtain our most up-to-date Positive Evaluation report on NEWT (preview of web page 1 of three proven under):

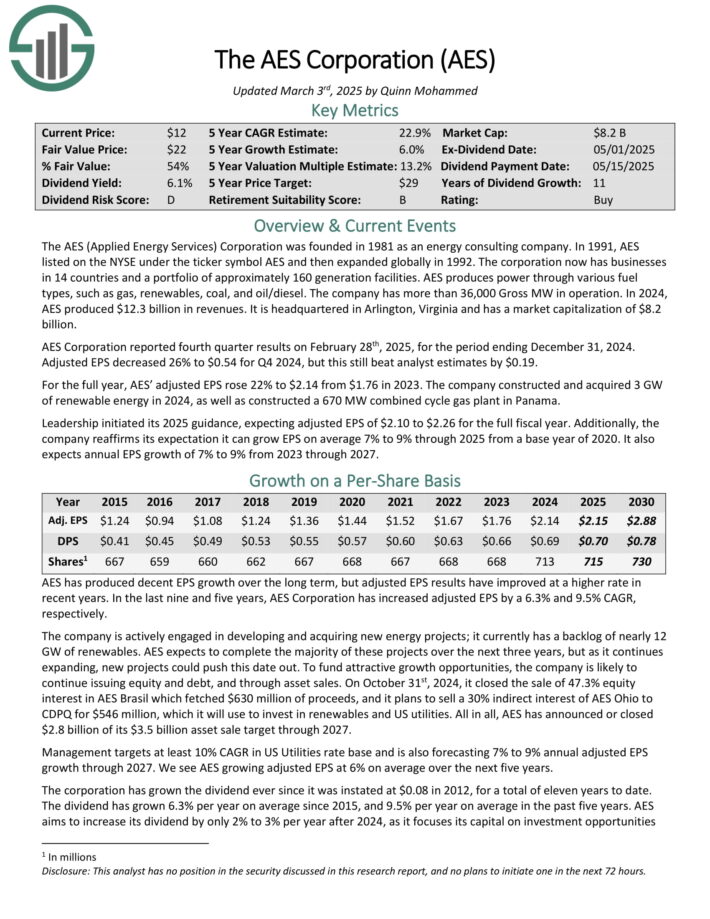

Undervalued Excessive Dividend Inventory #6: AES Corp. (AES) – P/E ratio of 4.7

The AES (Utilized Power Companies) Company was based in 1981 as an power consulting firm. It now has companies in 14 international locations and a portfolio of roughly 160 technology amenities.

AES produces energy via varied gasoline sorts, equivalent to gasoline, renewables, coal, and oil/diesel. The corporate has greater than 36,000 Gross MW in operation.

Supply: Investor Presentation

The corporate is actively engaged in growing and buying new power tasks.

It at present has a backlog of 12.7 GW of renewables. AES expects to finish the vast majority of these tasks via 2027.

AES Company reported fourth quarter outcomes on February twenty eighth, 2025, for the interval ending December 31, 2024. Adjusted EPS decreased 26% to $0.54 for This fall 2024, however this nonetheless beat analyst estimates by $0.19.

For the complete 12 months, AES’ adjusted EPS rose 22% to $2.14 from $1.76 in 2023. The corporate constructed and bought 3 GW of renewable power in 2024, in addition to constructed a 670 MW mixed cycle gasoline plant in Panama.

Management initiated its 2025 steerage, anticipating adjusted EPS of $2.10 to $2.26 for the complete fiscal 12 months.

Moreover, the corporate reaffirms its expectation it may possibly develop EPS on common 7% to 9% via 2025 from a base 12 months of 2020. It additionally expects annual EPS development of seven% to 9% from 2023 via 2027.

Click on right here to obtain our most up-to-date Positive Evaluation report on AES (preview of web page 1 of three proven under):

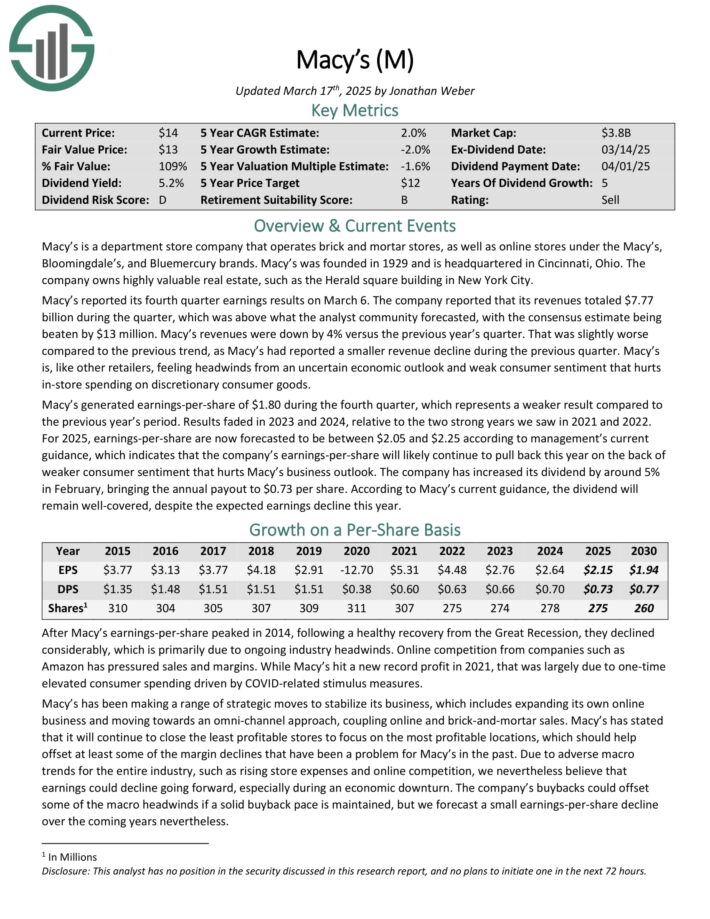

Undervalued Excessive Dividend Inventory #7: Macy’s Inc. (M) – P/E ratio of 5.0

Macy’s is a division retailer firm that operates brick and mortar shops, in addition to on-line shops underneath the Macy’s, Bloomingdale’s, and Bluemercury manufacturers.

Macy’s reported its fourth quarter earnings outcomes on March 6. The corporate reported that its revenues totaled $7.77 billion through the quarter, which was above what the analyst neighborhood forecasted, with the consensus estimate being crushed by $13 million. Macy’s revenues have been down by 4% versus the earlier 12 months’s quarter.

Macy’s generated earnings-per-share of $1.80 through the fourth quarter, which represents a weaker consequence in comparison with the earlier 12 months’s interval. Outcomes light in 2023 and 2024, relative to the 2 sturdy years we noticed in 2021 and 2022.

For 2025, earnings-per-share are actually forecasted to be between $2.05 and $2.25 in response to administration’s present steerage, which signifies that the corporate’s earnings-per-share will probably proceed to tug again this 12 months on the again of weaker shopper sentiment that hurts Macy’s enterprise outlook.

Click on right here to obtain our most up-to-date Positive Evaluation report on M (preview of web page 1 of three proven under):

Undervalued Excessive Dividend Inventory #8: AGNC Funding Company (AGNC) – P/E ratio of 5.4

American Capital Company Corp is a mortgage actual property funding belief that invests primarily in company mortgage–backed securities (or MBS) on a leveraged foundation.

The agency’s asset portfolio is comprised of residential mortgage move–via securities, collateralized mortgage obligations (or CMO), and non–company MBS. Many of those are assured by authorities–sponsored enterprises.

Supply: Investor Presentation

Within the fourth quarter of 2024, AGNC Funding Corp. reported a complete loss per widespread share of $0.99, a reversal from the excellent earnings of $0.93 per share recorded within the earlier quarter.

Regardless of this, the corporate achieved a constructive financial return of 13.2% for the complete 12 months, pushed by its constant month-to-month dividend totaling $1.44 per widespread share.

The corporate’s internet unfold and greenback roll earnings, excluding catch-up premium amortization, was $0.65 per widespread share for the quarter, down from $0.67 per share within the prior quarter.

AGNC’s tangible internet e-book worth per widespread share stood at $9.08 as of December 31, 2024, reflecting a lower from $9.84 on the finish of the third quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on AGNC Funding Corp (AGNC) (preview of web page 1 of three proven under):

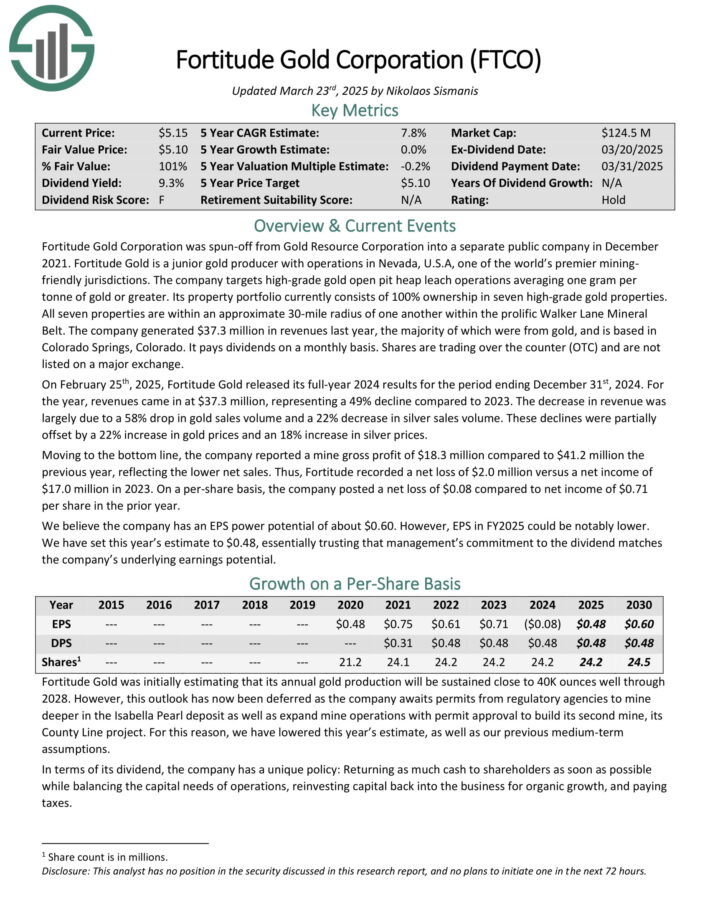

Undervalued Excessive Dividend Inventory #9: Fortitude Gold Corp. (FTCO) – P/E ratio of 5.4

Fortitude Gold is a junior gold producer with operations in Nevada, U.S.A, one of many world’s premier mining pleasant jurisdictions. The corporate targets high-grade gold open pit heap leach operations averaging one gram per tonne of gold or larger.

Its property portfolio at present consists of 100% possession in six high-grade gold properties. All six properties are inside an approximate 30-mile radius of each other throughout the prolific Walker Lane Mineral Belt.

Supply: Investor Presentation

On February twenty fifth, 2025, Fortitude Gold launched its full-year 2024 outcomes for the interval ending December thirty first, 2024. For the 12 months, revenues got here in at $37.3 million, representing a 49% decline in comparison with 2023.

The lower in income was largely resulting from a 58% drop in gold gross sales quantity and a 22% lower in silver gross sales quantity. These declines have been partially offset by a 22% enhance in gold costs and an 18% enhance in silver costs.

Shifting to the underside line, the corporate reported a mine gross revenue of $18.3 million in comparison with $41.2 million the earlier 12 months, reflecting the decrease internet gross sales.

Fortitude recorded a internet lack of $2.0 million versus a internet earnings of $17.0 million in 2023. On a per-share foundation, the corporate posted a internet lack of $0.08 in comparison with internet earnings of $0.71 per share within the prior 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on FTCO (preview of web page 1 of three proven under):

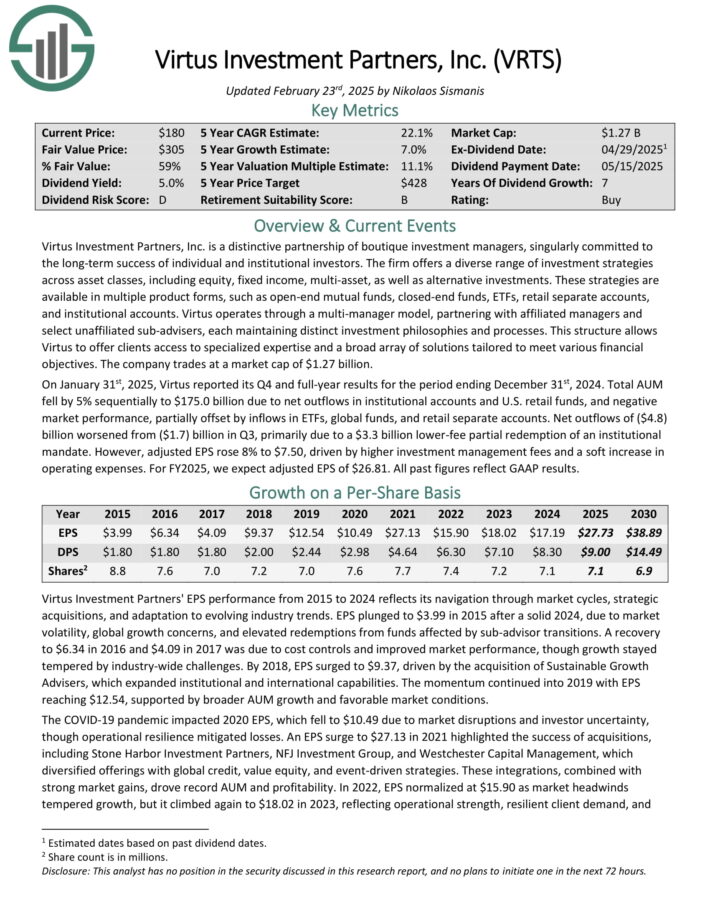

Undervalued Excessive Dividend Inventory #10: Virtus Funding Companions (VRTS) – P/E ratio of 5.5

Virtus Funding Companions, Inc. is a particular partnership of boutique funding managers, singularly dedicated to the long-term success of particular person and institutional buyers.

The agency affords a various vary of funding methods throughout asset lessons, together with fairness, fastened earnings, multi-asset, in addition to different investments.

These methods can be found in a number of product varieties, equivalent to open-end mutual funds, closed-end funds, ETFs, retail separate accounts, and institutional accounts.

Virtus operates via a multi-manager mannequin, partnering with affiliated managers and choose unaffiliated sub-advisers, every sustaining distinct funding philosophies and processes.

This construction permits Virtus to supply purchasers entry to specialised experience and a broad array of options tailor-made to fulfill varied monetary goals.

On January thirty first, 2025, Virtus reported its This fall and full-year outcomes for the interval ending December thirty first, 2024. Complete AUM fell by 5% sequentially to $175.0 billion resulting from internet outflows in institutional accounts and U.S. retail funds, and unfavorable market efficiency, partially offset by inflows in ETFs, world funds, and retail separate accounts.

Web outflows of ($4.8) billion worsened from ($1.7) billion in Q3, primarily resulting from a $3.3 billion lower-fee partial redemption of an institutional mandate.

Nevertheless, adjusted EPS rose 8% to $7.50, pushed by larger funding administration charges and a gentle enhance in working bills. For FY2025, we anticipate adjusted EPS of $26.81.

Click on right here to obtain our most up-to-date Positive Evaluation report on VRTS (preview of web page 1 of three proven under):

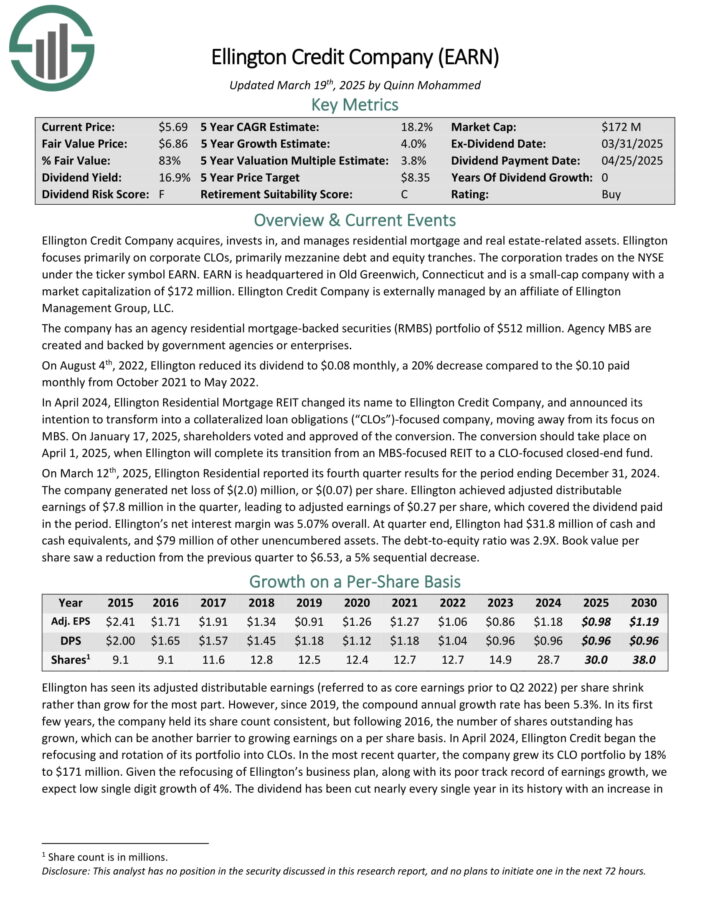

Undervalued Excessive Dividend Inventory #11: Ellington Credit score Co. (EARN) – P/E ratio of 5.6

Ellington Credit score Co. acquires, invests in, and manages residential mortgage and actual property associated belongings. Ellington focuses totally on residential mortgage-backed securities, particularly these backed by a U.S. Authorities company or U.S. authorities–sponsored enterprise.

Company MBS are created and backed by authorities businesses or enterprises, whereas non-agency MBS are not assured by the federal government.

On March twelfth, 2025, Ellington Residential reported its fourth quarter outcomes for the interval ending December 31, 2024. The corporate generated a internet lack of $(2.0) million, or $(0.07) per share.

Ellington achieved adjusted distributable earnings of $7.8 million within the quarter, resulting in adjusted earnings of $0.27 per share, which lined the dividend paid within the interval.

Ellington’s internet curiosity margin was 5.07% total. At quarter finish, Ellington had $31.8 million of money and money equivalents, and $79 million of different unencumbered belongings.

Click on right here to obtain our most up-to-date Positive Evaluation report on EARN (preview of web page 1 of three proven under):

Undervalued Excessive Dividend Inventory #12: Western Union Firm (WU) – P/E ratio of 5.6

The Western Union Firm is the world chief within the enterprise of home and worldwide cash transfers. The corporate has a community of roughly 550,000 brokers globally and operates in additional than 200 international locations.

About 90% of brokers are exterior of the US. Western Union operates two enterprise segments, Shopper-to-Shopper (C2C) and Different (invoice funds within the US and Argentina).

Western Union reported combined This fall 2024 outcomes on February 4th, 2025. Income elevated 1% and diluted GAAP earnings per share elevated to $1.14 within the quarter, in comparison with $0.35 within the prior 12 months on larger income and a $0.75 tax profit on reorganizing the worldwide operations.

Income rose, regardless of challenges in Iraq on larger Banded Digital transactions and Shopper Companies volumes.

CMT income fell 4% year-over-year even with 3% larger transaction volumes. Branded Digital Cash Switch CMT revenues elevated 7% as transactions rose 13%. Digital income is now 25% of complete CMT income and 32% of transactions.

Shopper Companies income rose 56% on new merchandise and enlargement of retail overseas change choices. The agency launched a media community enterprise, expanded retail overseas change, and grew retail cash orders.

Click on right here to obtain our most up-to-date Positive Evaluation report on WU (preview of web page 1 of three proven under):

Undervalued Excessive Dividend Inventory #13: Power Switch LP (ET) – P/E ratio of 6.4

Power Switch owns and operates one of many largest and most diversified portfolios of power belongings in the US.

Operations embrace pure gasoline transportation and storage together with crude oil, pure gasoline liquids, refined product transportation, and storage totaling 83,000 miles of pipelines.

Power Switch operates with a primarily fee-based mannequin, which considerably mitigates the sensitivity of the MLP to commodity costs.

In mid-February, Power Switch reported (2/11/25) monetary outcomes for the fourth quarter of fiscal 2024. The MLP continued to develop its volumes in all of the segments. Consequently, adjusted EBITDA grew 8% over the prior 12 months’s quarter.

Power Switch maintained a wholesome distribution protection ratio of 1.8 and raised the quarterly distribution by 0.8%, on high of the distribution hikes in every of the twelve earlier quarters.

Due to sturdy development within the demand for its networks, Power Switch supplied constructive steerage for 2025, anticipating adjusted EBITDA $16.1 to $16.5 billion. This steerage implies 5% development on the mid-point.

Click on right here to obtain our most up-to-date Positive Evaluation report on ET (preview of web page 1 of three proven under):

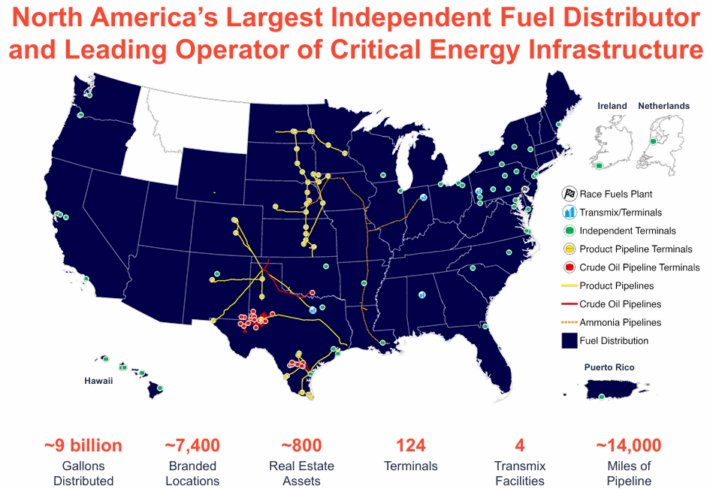

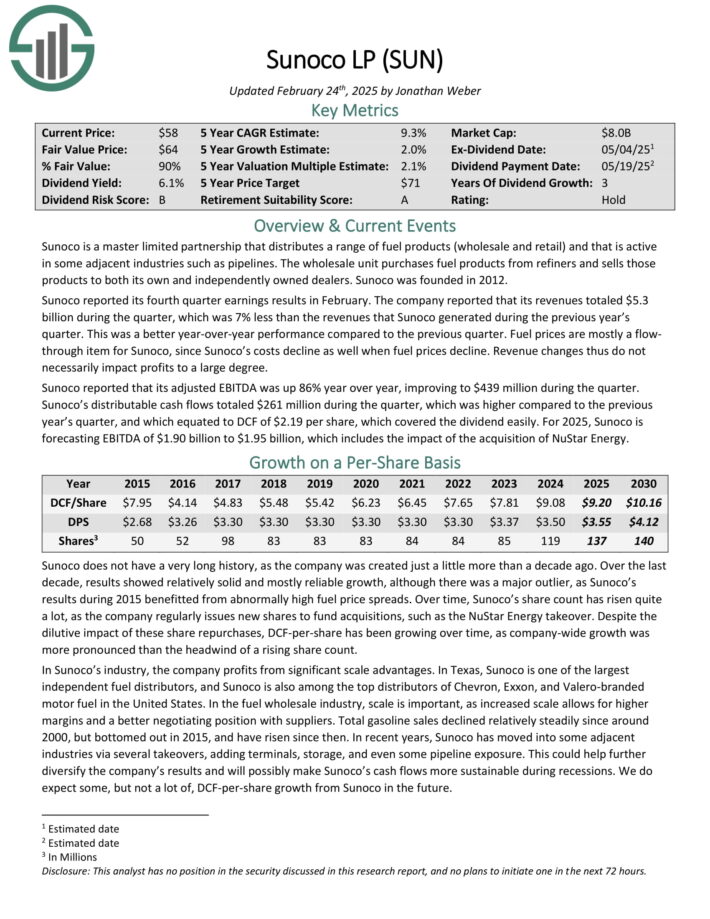

Undervalued Excessive Dividend Inventory #14: Sunoco LP (SUN) – P/E ratio of 6.4

Sunoco is a grasp restricted partnership that distributes a variety of gasoline merchandise (wholesale and retail) and that’s energetic in some adjoining industries equivalent to pipelines.

The wholesale unit purchases gasoline merchandise from refiners and sells these merchandise to each its personal and independently owned sellers.

Supply: Investor Presentation

Sunoco reported its fourth quarter earnings ends in February. The corporate reported that its revenues totaled $5.3 billion through the quarter, which was 7% lower than the revenues that Sunoco generated through the earlier 12 months’s quarter.

Gas costs are principally a move via merchandise for Sunoco, since Sunoco’s prices decline as effectively when gasoline costs decline. Income modifications thus don’t essentially impression earnings to a big diploma.

Sunoco reported that its adjusted EBITDA was up 86% 12 months over 12 months, bettering to $439 million through the quarter. Distributable money flows totaled $261 million through the quarter, which was larger in comparison with the earlier 12 months’s quarter, and which equated to DCF of $2.19 per share.

Click on right here to obtain our most up-to-date Positive Evaluation report on SUN (preview of web page 1 of three proven under):

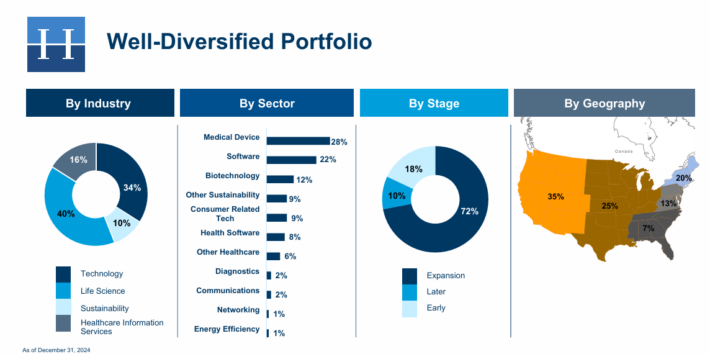

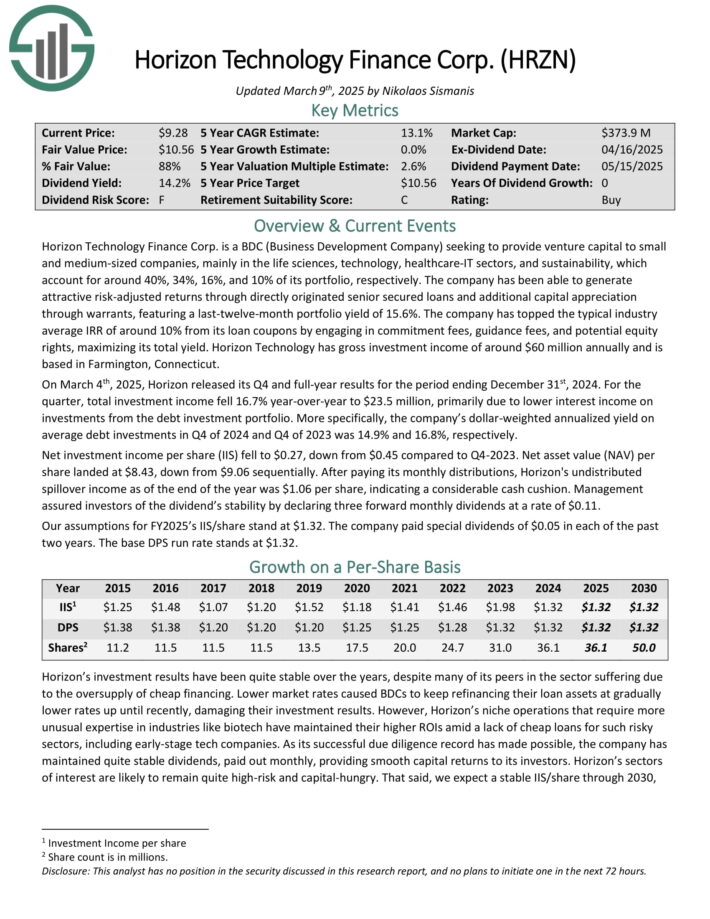

Undervalued Excessive Dividend Inventory #15: Horizon Expertise Finance (HRZN) – P/E ratio of 6.4

Horizon Expertise Finance Corp. is a BDC that gives enterprise capital to small and medium–sized corporations within the know-how, life sciences, and healthcare–IT sectors.

The corporate has generated enticing danger–adjusted returns via straight originated senior secured loans and extra capital appreciation via warrants.

Supply: Investor Presentation

On March 4th, 2025, Horizon launched its This fall and full-year outcomes for the interval ending December thirty first, 2024. For the quarter, complete funding earnings fell 16.7% year-over-year to $23.5 million, primarily resulting from decrease curiosity earnings on investments from the debt funding portfolio.

Extra particularly, the corporate’s dollar-weighted annualized yield on common debt investments in This fall of 2024 and This fall of 2023 was 14.9% and 16.8%, respectively.

Web funding earnings per share (IIS) fell to $0.27, down from $0.45 in comparison with This fall-2023. Web asset worth (NAV) per share landed at $8.43, down from $9.06 sequentially.

Click on right here to obtain our most up-to-date Positive Evaluation report on HRZN (preview of web page 1 of three proven under):

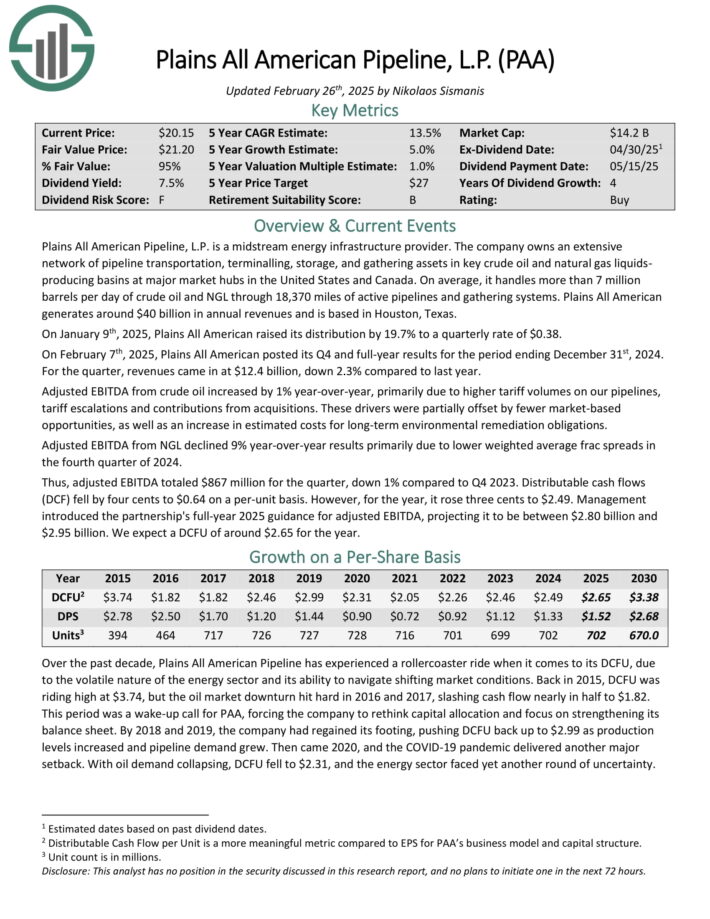

Undervalued Excessive Dividend Inventory #16: Plains All American LP (PAA) – P/E ratio of 6.7

Plains All American Pipeline, L.P. is a midstream power infrastructure supplier. The corporate owns an intensive community of pipeline transportation, terminaling, storage, and gathering belongings in key crude oil and pure gasoline liquids-producing basins at main market hubs in the US and Canada.

Supply: Investor Presentation

On February seventh, 2025, Plains All American posted its This fall and full-year outcomes for the interval ending December thirty first, 2024.

For the quarter, revenues got here in at $12.4 billion, down 2.3% in comparison with final 12 months. Adjusted EBITDA from crude oil elevated by 1% year-over-year, primarily resulting from larger tariff volumes on its pipelines, tariff escalations and contributions from acquisitions.

Adjusted EBITDA from NGL declined 9% year-over-year outcomes primarily resulting from decrease weighted common frac spreads within the fourth quarter of 2024.

Click on right here to obtain our most up-to-date Positive Evaluation report on PAA (preview of web page 1 of three proven under):

Undervalued Excessive Dividend Inventory #17: Revolutionary Industrial Properties (IIPR) – P/E ratio of 6.7

Revolutionary Industrial Properties, Inc. is a single-use “specialty REIT” that completely focuses on proudly owning properties used for the cultivation and manufacturing of hashish.

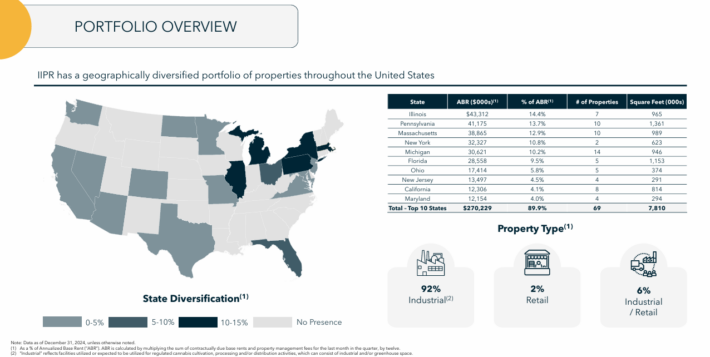

As of the top of 2024, IIPR had 109 properties, with a weighted common lease size of 13.7 years. Roughly 92% of IIPR’s properties are industrial, with retail comprising 2% and blended properties the remaining 6%.

Supply: Investor Presentation

On February nineteenth, 2025, IIPR launched its This fall and full-year outcomes for the interval ending December thirty first, 2024. For the quarter, revenues and normalized AFFO/share have been $76.7 million and $2.22, down 3% and a couple of.6% year-over-year, respectively.

The decline in revenues was resulting from misplaced lease and costs from properties repossessed or offered since 2023, lease amendments that adjusted and deferred lease on sure properties, and (iii) partial lease funds from some tenants, together with reclassified sales-type leases beginning January 2024.

These elements have been offset by $3.9 million from a disposition-contingent lease termination price, income from new acquisitions, and contractual lease escalations.

Click on right here to obtain our most up-to-date Positive Evaluation report on IIPR (preview of web page 1 of three proven under):

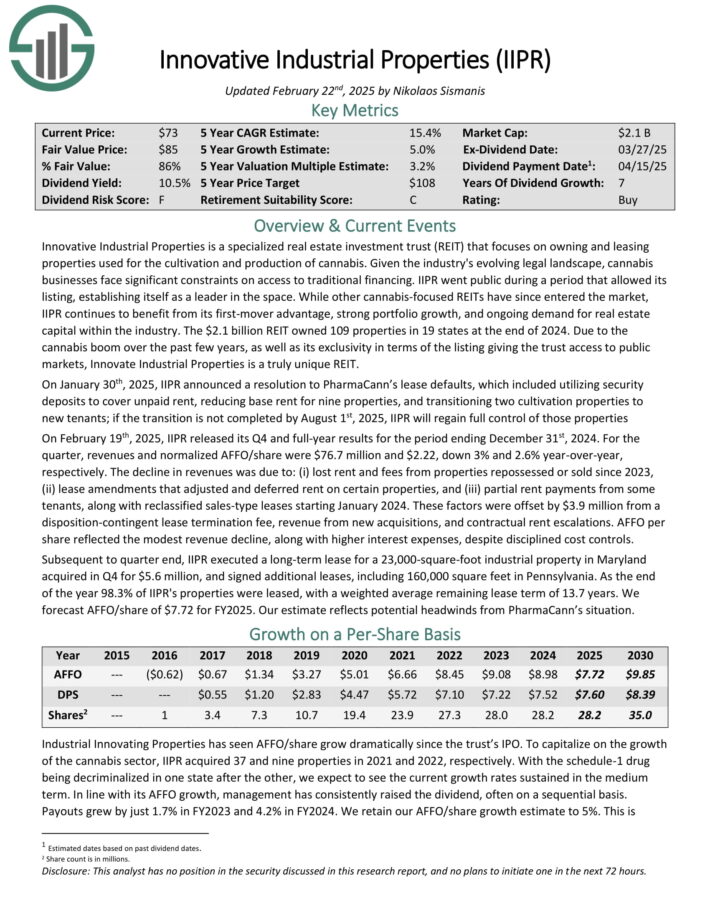

Undervalued Excessive Dividend Inventory #18: Midland States Bancorp (MSBI) – P/E ratio of 6.7

Midland States Bancorp (MSBI) is the holding firm of Midland States Financial institution, a neighborhood financial institution that was based in 1881 and is headquartered in Effingham, Illinois.

It operates 53 branches in Illinois and Missouri and offers a variety of banking services to people, companies, municipalities and different entities. Midland States Bancorp has complete belongings of $7.5 billion.

In late January, Midland States Bancorp reported (1/23/25) outcomes for the fourth quarter of fiscal 2024. Its internet curiosity margin broaden sequentially from 3.10% to three.19% and its internet curiosity earnings grew 2%.

Nevertheless, the financial institution incurred huge charge-offs on loans ($103 million) and provisions for mortgage losses ($93.5 million).

Consequently, it switched from earnings-per-share of $0.74 to an extreme loss per share of -$2.52, lacking the analysts’ consensus by $3.19.

Midland States Bancorp has acquired seven smaller banks since 2009. Consequently, it grew its asset base by 12% per 12 months on common over the past 9 years.

It had additionally grown its earnings-per-share by 6.9% per 12 months on common throughout 2015-2023 however it incurred a loss in 2024 resulting from huge mortgage charge-offs and excessive deposit prices, which resulted from excessive rates of interest.

Click on right here to obtain our most up-to-date Positive Evaluation report on MSBI (preview of web page 1 of three proven under):

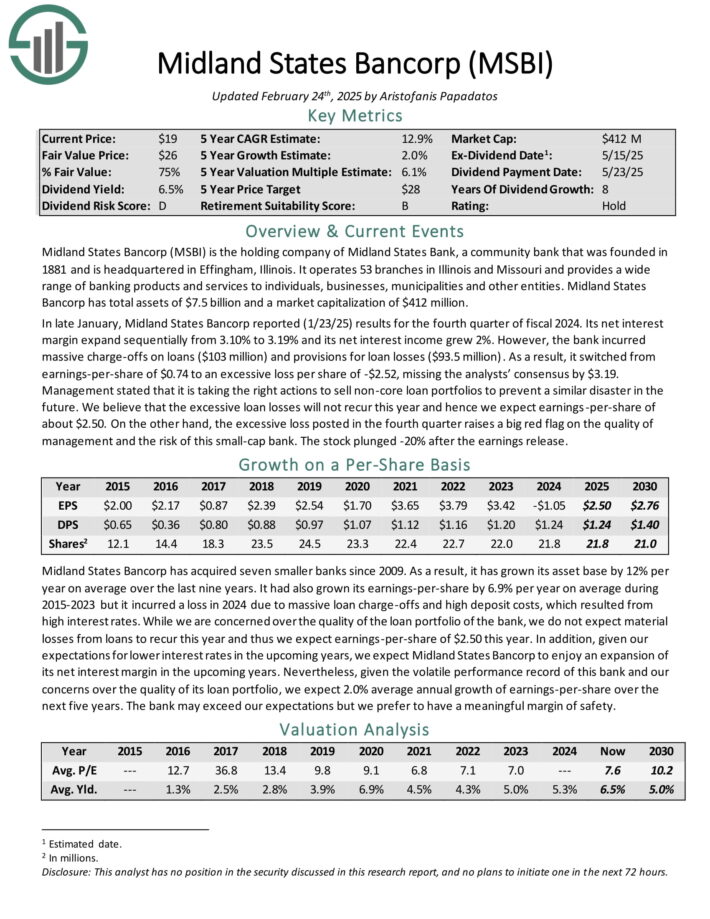

Undervalued Excessive Dividend Inventory #19: Prospect Capital (PSEC) – P/E ratio of 6.7

Prospect Capital Company is a Enterprise Improvement Firm, or BDC, that gives non-public debt and personal fairness to center–market corporations within the U.S.

The corporate focuses on direct lending to proprietor–operated corporations, in addition to sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional fairness investments.

Prospect posted second quarter earnings on February tenth, 2025, and outcomes have been considerably weak. Web funding earnings per-share acme to twenty cents, whereas complete funding earnings fell from $211 million to $185 million year-over-year.

NII per-share fell from 21 cents in Q1, and 24 cents from the year-ago interval. Complete curiosity earnings was $169 million for the quarter, down from $185 million within the prior quarter, and $195 million a 12 months in the past. It additionally missed estimates by about $2 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on PSEC (preview of web page 1 of three proven under):

Undervalued Excessive Dividend Inventory #20: Delek Logistics Companions LP (DLK) – P/E ratio of 6.8

Delek Logistics Companions, LP is a publicly traded grasp restricted partnership (MLP) headquartered in Brentwood, Tennessee.

Established in 2012 by Delek US Holdings, Inc. (NYSE: DK), Delek Logistics owns and operates a community of midstream power infrastructure belongings.

These belongings embrace roughly 850 miles of crude oil and refined product transportation pipelines and a 700-mile crude oil gathering system, primarily situated within the southeastern United States and west Texas.

The corporate’s operations are integral to Delek US’s refining actions, significantly supporting refineries in Tyler, Texas, and El Dorado, Arkansas.

Delek Logistics offers providers equivalent to gathering, transporting, and storing crude oil, in addition to advertising and marketing, distributing, and storing refined merchandise for each Delek US and third-party prospects.

On February 25, 2025, Delek Logistics Companions (DKL) reported its monetary outcomes for the fourth quarter of 2024. The corporate achieved an adjusted EBITDA of roughly $107.2 million, a rise from $100.9 million in the identical interval of the earlier 12 months.

Distributable money move was $69.5 million, with a protection ratio of roughly 1.2 instances. The Gathering and Processing phase noticed an adjusted EBITDA of $66 million, up from $53.3 million in This fall 2023, primarily resulting from larger throughput from Permian Basin belongings and contributions from the H2O Midstream acquisition.

Click on right here to obtain our most up-to-date Positive Evaluation report on DKL (preview of web page 1 of three proven under):

Closing Ideas

All of the above shares are buying and selling at remarkably low cost valuation ranges resulting from some enterprise headwinds. A few of them have been harm by excessive inflation or the newest financial slowdown whereas others are going through their very own particular points.

Furthermore, all of the above shares are providing dividend yields above 5%. Consequently, they make it a lot simpler for buyers to attend patiently for the enterprise headwinds to subside.

If you’re serious about discovering high-quality dividend development shares and/or different high-yield securities and earnings securities, the next Positive Dividend assets shall be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.