Skip to content material

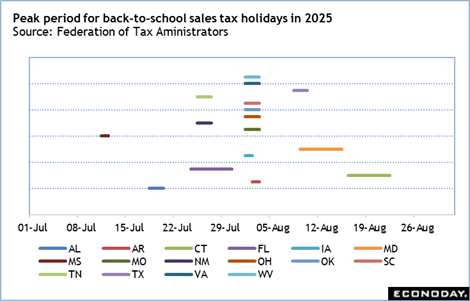

Within the July and August interval, a number of states maintain gross sales tax holidays on back-to-school objects like clothes, workplace provides, and private electronics. Though state governments aren’t keen on shedding tax revenues, companies wish to take the chance to spice up gross sales whereas shoppers can maximize their {dollars}. Though the tax holidays are largely supposed for households with youngsters in class, households and residential places of work additionally reap the benefits of the prospect to maximise their shopping for energy.

The majority of the gross sales tax holidays fall late in July and the primary weekend of August. These ought to help retail spending at a time when shoppers are exercising warning of their shopping for. There will not be proof of a lift to shopper spending within the July and August experiences on retail and meals companies gross sales (Friday, August 15 at 8:30 ET and Tuesday, September 16 at 8:30 ET, respectively). Nonetheless, if the tax vacation is tempting to shoppers, it may save private consumption expenditures in third quarter GDP from wanting weak, though that received’t be recognized till the advance estimate is launched at 8:30 ET on Thursday, October 30.

Share This Story, Select Your Platform!

Web page load hyperlink