The is bottoming – test.

It moved to a super-strong mixture of long-term assist ranges – double test.

The USDX declined after Trump’s feedback identical to it had declined in early 2018 after Mnuchin’s feedback (which led to a significant backside) – triple test.

However does it imply that the USD Index is completed bottoming?

No.

It may merely commerce sideways for some time earlier than hovering. In reality, there’s a particular 3-4 12 months cycle within the USD Index that helps this situation.

Let’s take a more in-depth look.

For the reason that 2005 backside (sure), the USD Index has been forming main bottoms each 3-4 years:

– 2005

– 2008 (three years later)

– 2011 (three years later)

– 2014 (three years later)

– 2018 (4 years later)

– 2021 (three years later)

– (almost definitely) 2025 (it’s 4 years after the earlier backside)

Curiously, in all these instances (aside from the present one, because the jury continues to be out right here), it took some time for the cash to stream to the USD and for the bottoms to type.

In 2005, the bottoms had been 50 buying and selling days aside.

In 2008, the bottoms had been 86 buying and selling days aside.

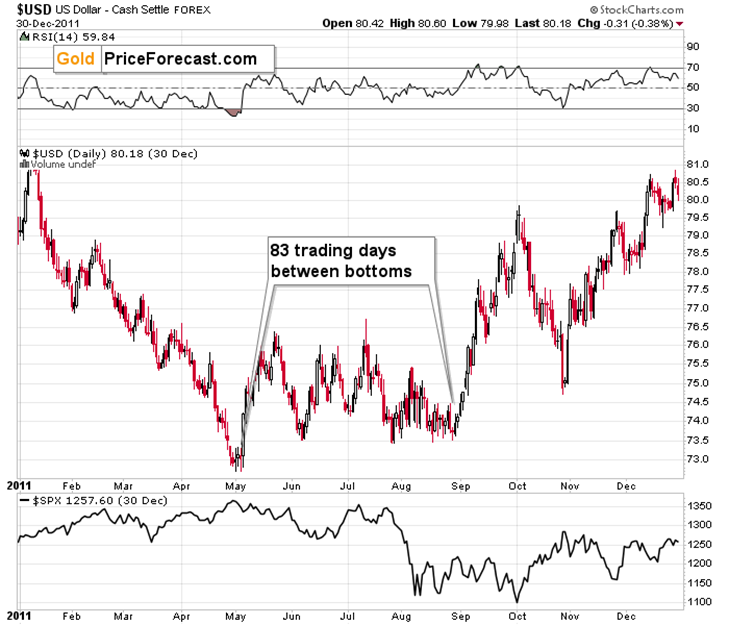

In 2011, the bottoms had been 83 buying and selling days aside.

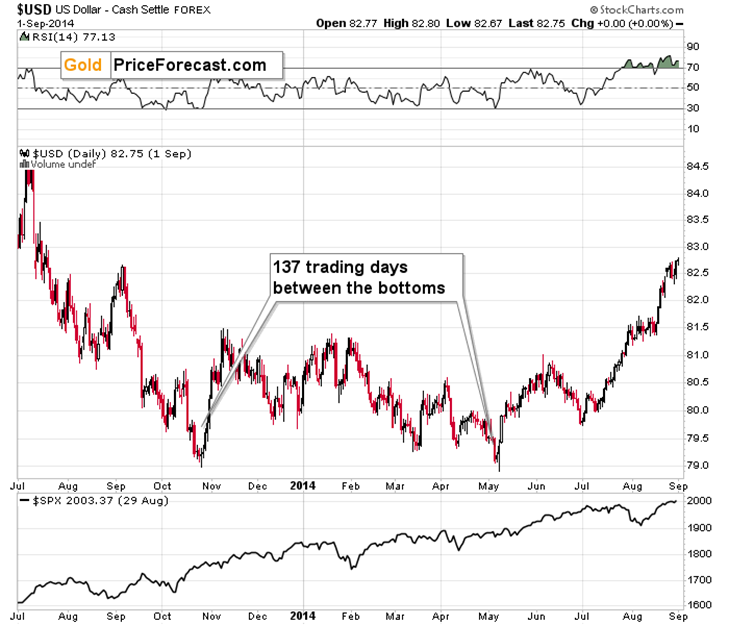

In 2014, the bottoms had been 137 buying and selling days aside.

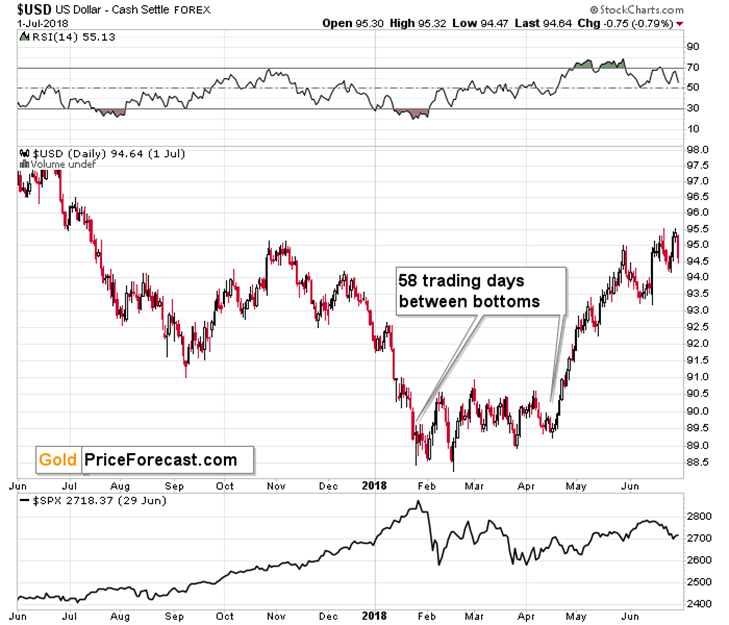

In 2018, the bottoms had been 58 buying and selling days aside.

Which means the 50-something buying and selling day bottoms are regular, and so are the 80-something buying and selling day bottoms. The 137 one or ones a lot shorter than 50 may very well be seen as an anomaly.

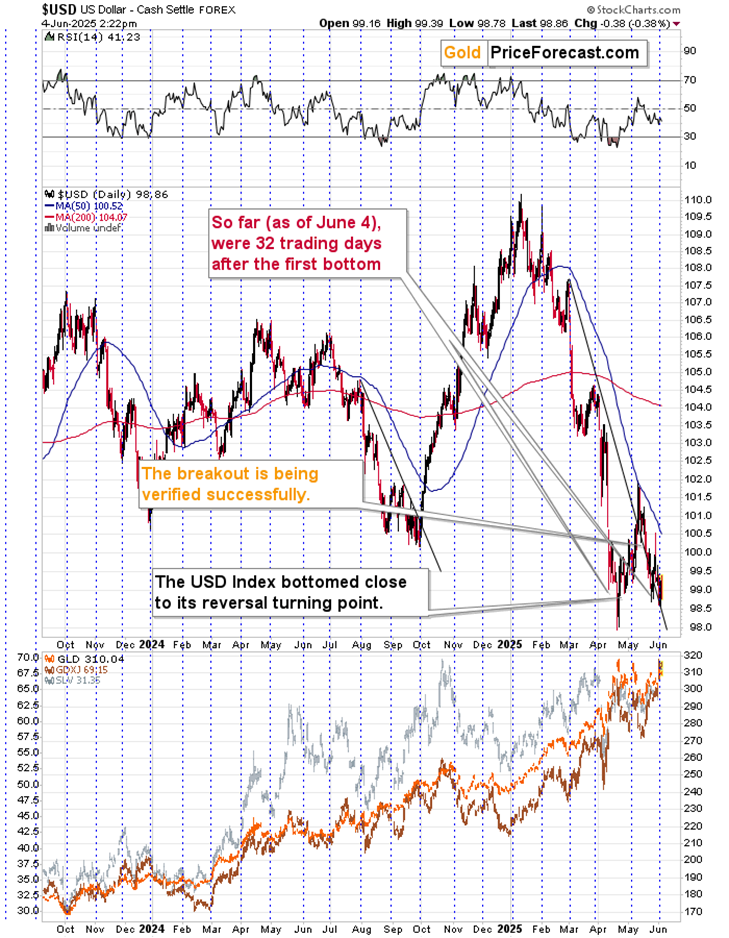

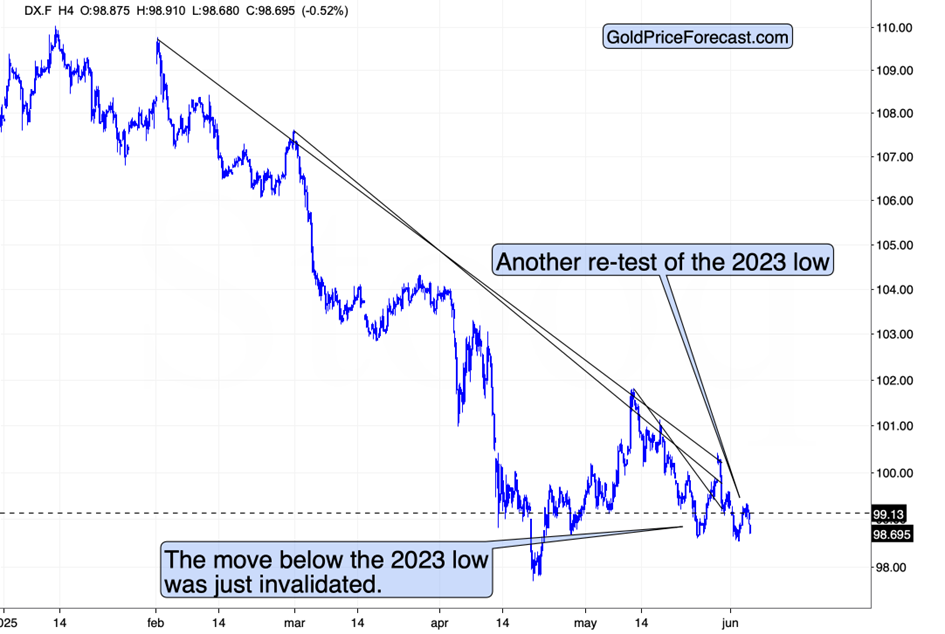

Proper now, we’re 32 days after the primary backside. This can be a a lot shorter interval than in all earlier instances. This, in flip, signifies that even when the USD Index is more likely to rally from the present ranges (and this very a lot IS the case – I view this as very seemingly), It would take one other 18-28 buying and selling days earlier than the second backside kinds – this could be in excellent tune with historic norms.

USDX Pauses, However the Uptrend Stays Intact

A rally that begins later than that will even be in tune with the above however given the present geopolitical scenario (tariffs are basically optimistic for the USDX) and the inventory market turmoil may begin any day (which traditionally led to USD’s strengthening) it appears that evidently we received’t have to attend too lengthy for the USD Index’s rally. That’s why I’m leaning towards the analogies to narrower (if one may name a 2-month bottoming course of that) bottoms.

All which means the USD Index may simply maintain its super-bullish medium-term potential and nonetheless do nothing (buying and selling sideways) for the remainder of this month.

That’s what it’s doing at this time – shifting backwards and forwards once more. The volatility is excessive in intraday phrases, however low in in medium phrases of weeks.

The USD Index as soon as once more moved beneath its 2023 low, and identical to was the case beforehand, it’s more likely to invalidate this transfer decrease as effectively.

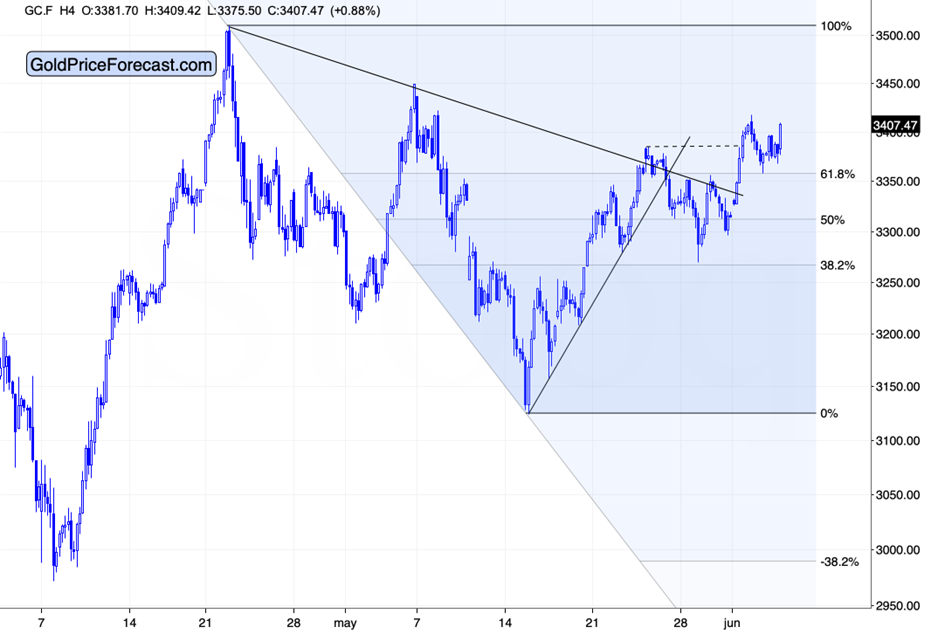

Because the USD Index moved decrease at this time, moved increased.

The breakout above the 61.8% Fibonacci retracement was efficiently verified yesterday, so we may see one other try and rally to $3,450 or maybe even $3,500.

Mining Shares Sign Bullish Continuation

And whereas this may occasionally not end in sturdy features in silver, gold shares may rally as soon as once more.

Getting again to the USD Index’s back-and-forth motion, it is perhaps tempting to view this as discouraging or boring, however I really view it as informative. It permits us to observe how gold and mining shares react to this motion. Are they magnifying the USD’s bearish indicators or the bullish ones? The present indication is bullish – the back-and-forth within the USDX triggers features within the miners, that are sturdy relative to gold.

Once we see indicators of weak point – and I’m staying alert – we’ll know that it’s time to take earnings from the mining shares that we now have lengthy positions in, however for now, it appears that evidently they will rally additional. Particularly, one firm that rallied has such a unprecedented technical setup that it’s tough to not get enthusiastic about it. Damaged above key resistance, verified the breakout, and it’s very sturdy in comparison with GDX (NYSE:) on a relative foundation. It may rally even when the USDX does the identical. And whereas it rallied proper after we entered lengthy positions in it, it seems prefer it may soar by one other 25% (unleveraged!) earlier than hitting our profit-take degree – and whereas I can’t make any guarantees, this might occur as early as this month.

Additionally, one other firm that’s almost definitely about to verify its long-term breakout at this time, enormously enhancing its technical image, and certain leading to a robust rally (larger than in GDX or VanEck Junior Gold Miners ETF (NYSE:)).