- Political developments forged a shadow over the euro.

- Greenback in a very good temper, notably towards the euro.

- Gold and bitcoin in retreat; seasonality favours gold.

US Information Calendar within the Highlight this Week

With US market members returning rejuvenated from the lengthy weekend, an essential week commences, basically marking the beginning of a interval as much as December 19, when the final central financial institution conferences for 2024 can be held. The US economic system will primarily be within the highlight this week, as a result of busy information calendar and the plethora of audio system on the wires.

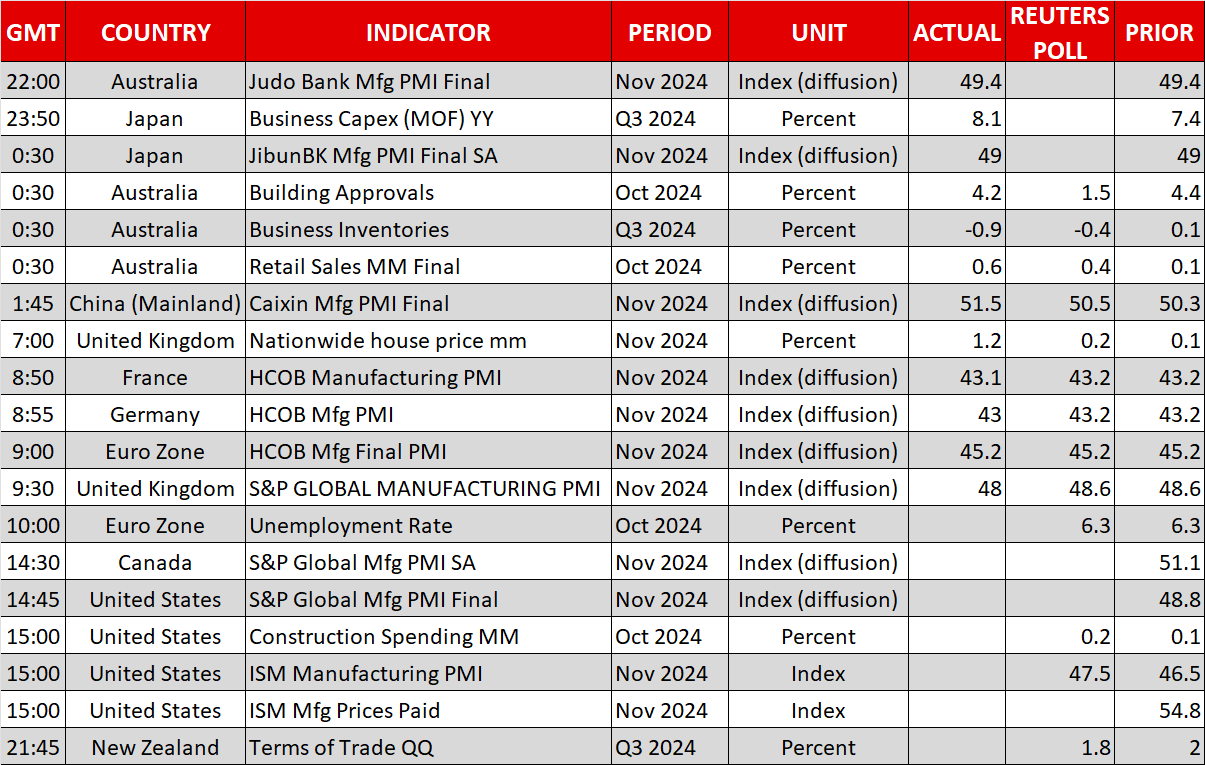

The US and manufacturing surveys will kick off this week’s schedule, and regardless of the general constructive sentiment for the US economic system, each indicators have been on a downward pattern previously few months. The market is in search of an honest correction within the ISM manufacturing survey, though it is going to probably stay firmly under its 50 threshold. The main target may even be on the subindices, notably on the employment one, as a gauge for Friday’s nonfarm payrolls determine.

Fed members Waller and Williams, who maintain reasonable views on financial coverage, are scheduled to talk at this time.

Buyers ought to put together for unscheduled appearances from FOMC members as the standard blackout interval forward of the December 18 Fed gathering begins this weekend.

Euro’s Troubles Multiply

The has had a dreadful month, underperforming towards virtually each main forex and recording the weakest month towards the since Could 2023. Weak financial information, political shenanigans and Trump’s victory have contributed to this efficiency, with the scenario remaining vital. Monday’s closing launch of the S&P International manufacturing PMI for November is unlikely to vary the present financial momentum and the present ECB minimize expectations.

Whereas Trump is getting ready for January 20, when he’ll formally start his second tenure on the Whereas Home, the eurozone is dealing with critical political points. The German pre-election marketing campaign has unofficially began, regardless of the arrogance vote being held on December 16, with Chancellor Scholz looking for a second time period. Different events are progressively starting to announce their election manifestos, with the far-right AfD occasion advocating for a withdrawal from each the EU and the euro system.

The scenario is equally vital in France, the place the 2024 finances is being debated. PM Barnier has introduced a combination of spending cuts and tax will increase, just like the UK finances, aiming to carry France’s funds again below management once more. The large distinction with the UK is that Barnier’s administration lacks a majority within the parliament and therefore depends on opposition votes for approval.

With the opposition events, particularly Le Pen’s Nationwide Rally, being brazenly vital of Barnier’s finances, a confidence vote, and probably the appointment of one other prime minister, might be across the nook. The results of these political shenanigans is that the French 10-year yield briefly rose above its Greek one final week, and the closed November with a unfavourable return, underperforming each the 40 and indices.

Gold and Lose Floor

Each and are within the pink on Monday. The king of cryptos has as soon as once more did not stage a transfer in the direction of the $100k degree, prompting the present selloff, whereas gold is hovering across the $2,620 space on the time of writing. In distinction to crypto’s extraordinary efficiency in November, gold recorded its weakest month since September 2023.

Nonetheless, gold patrons shouldn’t despair as seasonality factors to a markedly higher efficiency for gold over the last month of the 12 months.