Skip to content material

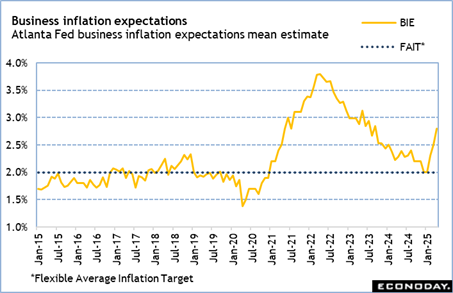

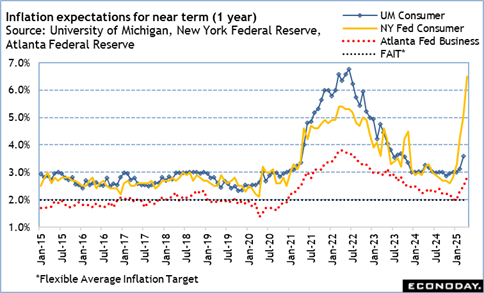

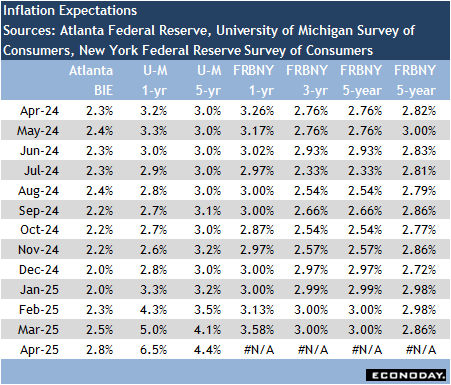

Inflation expectations proceed to rise in April as companies and shoppers navigate the uneven waters of the Trump administration’s tariff coverage. The reversals of coverage in all probability imply that among the anticipation of upper costs will ebb within the close to future, though it’s unclear whether or not the unease about elevated prices will dissipate shortly.

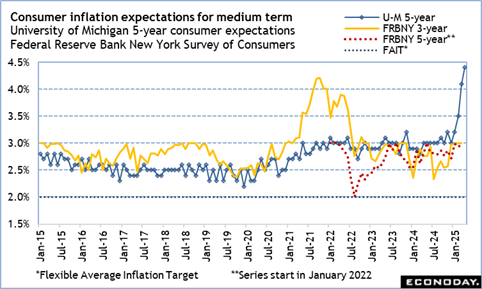

Fed policymakers are keenly conscious of the risks of permitting inflation expectations to lose their anchor and sow doubt concerning the Fed’s skill to take care of worth stability. Whereas the current uncomfortable readings for inflation expectations are probably a consequence of quickly elevated uncertainties, the FOMC can’t afford to disregard them.

Inflation expectations within the brief time period (1 yr) will be fairly risky and will be downplayed as vital. Alternatively, expectations for the medium time period that the FOMC offers extra weight are additionally sharply larger in the previous few months. That is the place the Fed can see its credibility for preventing inflation eroded. Fed policymakers should take this into consideration in setting coverage. It’s yet another argument for being affected person and leaving the fed funds goal fee vary unchanged at its current 4.25-4.50 p.c.

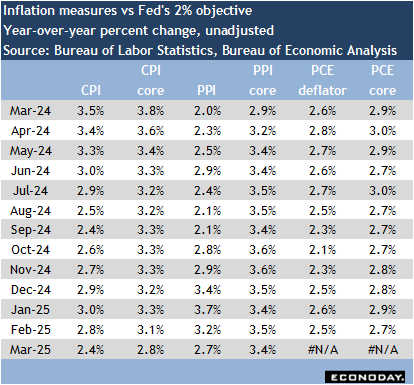

On the subsequent FOMC assembly on Could 6-7, the committee should take care of knowledge that factors to a cooling – however nonetheless wholesome – labor market, disinflation bringing the inflation measures tantalizingly near the two p.c inflation goal, and inflation expectations suggesting the buying habits of shoppers and companies expects larger costs and are shopping for now relatively than later.

That state of affairs might change within the subsequent week or two relying on the advance estimate of first quarter GDP at 8:30 ET on Wednesday, April 30, the PCE deflator within the report on private revenue and spending for March at 10:00 ET on Wednesday, April 30, and the month-to-month employment report at 8:30 ET on Friday, Could 2. The following main reviews on inflation and inflation expectations won’t be launched till after the FOMC assembly.

Share This Story, Select Your Platform!

Web page load hyperlink