Rate of interest may sink as little as 1.5%, say economists

Article content material

Article content material

Article content material

With Canadians on tenterhooks over Donald Trump‘s looming tariff struggle, now may not appear to be the perfect time to take an opportunity on a variable-rate mortgage.

Then once more, perhaps it’s, says one economist.

“With borrowing prices extra more likely to fall than rise — and by rather a lot in a attainable commerce struggle — a floating price mortgage may repay,” stated Sal Guatieri, senior economist with BMO Capital Markets, in a latest report.

Commercial 2

Article content material

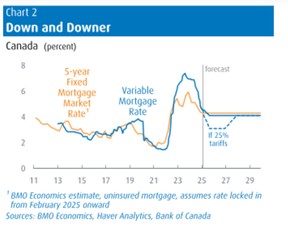

The Financial institution of Canada has reduce its rate of interest from 5 per cent to three per cent, and with the prospect of extra cuts forward, variable-rate mortgages are gaining in reputation.

About 1.2 million mortgages will renew this yr, most of them at the next price, stated actual property firm Royal LePage in a report out this morning.

Nearly 30 per cent of these householders stated they’d select a variable price on renewal, up from 24 per cent now on a floating price. Sixty-six per cent stated they’d renew on a fixed-rate mortgage, down from 75 per cent now locked in, the Royal LePage survey discovered.

“For householders seeking to scale back their month-to-month funds or pay down their principal sooner, variable-rate mortgages have change into an more and more engaging possibility in mild of immediately’s declining price surroundings and the probability of additional cuts this yr,” stated Royal LePage chief govt Phil Soper.

If the Financial institution of Canada cuts 25 foundation factors in April and once more in July to 2.5 per cent as BMO expects a “floating price may repay handsomely,” stated Guatieri.

BMO estimates a borrower placing 10 per cent down on a $500,000 house over 25 years may save a median of 40 bps a yr on a variable price over a hard and fast. That might work out to financial savings of over $100 a month or greater than $6,000 over 5 years.

Article content material

Commercial 3

Article content material

If “a commerce struggle torpedoes the financial system,” the Financial institution of Canada may slash charges as little as 1.5 per cent, growing the financial savings for debtors on a floating price, stated Guatieri.

If that price caught for a full yr, variable-rate debtors would save one other 29 bps in 5 years, or an additional $74 a month, he stated.

Nonetheless, any forecast today is beset by uncertainty. The Financial institution of Montreal and the markets agree that the financial institution is more likely to reduce one other 50 bps, however there may be at all times the possibility it stands pat, Guatieri stated. Or if a commerce struggle is averted and the financial system improves, the central financial institution might even elevate charges.

“On this case, a hard and fast price would clearly be the higher alternative,” he stated.

There’s an alternative choice. Taking out a fixed-rate mortgage of lower than 5 years would give debtors the chance to refinance at a probably a lot decrease price in a couple of years’ time, he stated.

Based mostly on BMO’s rate of interest forecast, a fixed-rate mortgage might be renewed at a decrease variable price in three years, saving a median of 20 bps a yr over 5 years, in comparison with the present five-year price.

Any break Canadians can get on their mortgages will doubtless be welcome.

Commercial 4

Article content material

Of those that anticipate their month-to-month mortgage cost to rise upon renewal this yr, 81 per cent say the rise will put monetary pressure on their family, stated Royal LePage.

Enroll right here to get Posthaste delivered straight to your inbox.

The American buck is the world’s most traded foreign money, however it’s additionally the world’s most counterfeited, in line with calculations by FX brokers BestBrokers.com.

BestBrokers estimates that 904,700 faux U.S. notes have been detected in 2023 — or 17 counterfeit payments for each million authentic. That’s nothing in contrast with the counterfeiting that went on through the American Civil Battle. In 1865, a 3rd to half of all U.S. foreign money was estimated to be counterfeit, stated BestBrokers.

Canada falls seventh on the rating of most counterfeited currencies, with 6 faux notes for each million real.

The title for probably the most counterfeit-proof banknote goes to the Swiss 100-franc observe launched on Sept. 12, 2019. The invoice has 20 safety features that makes it almost unimaginable to faux, says BestBrokers. These embrace safety thread, raised printing, watermark, micro-perforations, infrared properties and UV-visible parts.

Commercial 5

Article content material

- At the moment’s Knowledge: Canada industrial merchandise and uncooked supplies value indices

- Earnings: Cameco Corp., TransAlta Corp, Hydro One Ltd., Teck Assets Ltd., Cenovus Vitality Inc., Loblaw Cos Ltd., Eldorado Gold Corp., Centerra Gold Inc., Walmart Inc.

Nervous about your investments throughout Trump’s tariff discuss? First off, don’t panic, says investing professional Peter Hodson. Shares globally have survived dozens of commerce wars prior to now. Learn his recommendation on how you can deal with the uncertainty and 5 attainable causes the USA would put tariffs in place. Learn extra

Calling Canadian households with youthful youngsters or teenagers: Whether or not it’s budgeting, spending, investing, paying off debt, or simply paying the payments, does your loved ones have any monetary resolutions for the approaching yr? Tell us at [email protected].

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s Monetary Put up column may also help navigate the advanced sector, from the newest tendencies to financing alternatives you received’t need to miss. Plus test his mortgage price web page for Canada’s lowest nationwide mortgage charges, up to date each day.

Commercial 6

Article content material

Monetary Put up on YouTube

Go to the Monetary Put up’s YouTube channel for interviews with Canada’s main specialists in enterprise, economics, housing, the power sector and extra.

At the moment’s Posthaste was written by Pamela Heaven, with extra reporting from Monetary Put up workers, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this text? E mail us at [email protected].

Beneficial from Editorial

-

Why Trump’s tariffs may hit Canada tougher this time

-

5 explanation why Canada wouldn’t be higher off because the 51st state

Bookmark our web site and assist our journalism: Don’t miss the enterprise information it is advisable know — add financialpost.com to your bookmarks and join our newsletters right here

Article content material