In its newest 13F submitting final week, Warren Buffett’s Berkshire Hathaway (NYSE:) disclosed that it’s promoting extra shares than it’s shopping for.

Whereas the pattern has raised a purple flag for worth traders on the market, BRK’s newest quarterly outcomes, set for launch this Saturday, may nonetheless present additional perception into the legendary investor’s outlook for the inventory market this 12 months.

Analysts count on earnings per share (EPS) of $4.19, a 6.9% enhance from final 12 months, whereas income is projected to say no 3.2% year-over-year to $90.38 billion.

Supply: InvestingPro

The numbers may considerably influence Berkshire Hathaway’s share value in the event that they miss expectations. However different components could have a broader market affect, too.

Tens of millions of traders intently observe Warren Buffett’s market strikes, trusting his decades-long observe file of foresight. His new investments usually drive inventory rallies, whereas his exits can set off declines.

Final Friday’s 13F submitting revealed that Buffett added just one new inventory in This fall 2024: Constellation Manufacturers (NYSE:). He elevated holdings in Domino’s Pizza (NYSE:) and Occidental Petroleum (NYSE:) whereas trimming positions in Financial institution of America (NYSE:) and Citigroup (NYSE:).

Yesterday, the behemoth funding agency additionally revealed that it had offered one other 750,000 shares of DaVita (NYSE:), chopping its possession within the kidney dialysis service supplier by roughly 2%.

Warren Buffett’s Money Reserves Seemingly Grew In This fall

Whereas Buffett has stored some shares, he has offered greater than he has purchased, possible rising Berkshire’s money reserves in This fall 2024.

A key determine to look at within the upcoming earnings is Berkshire’s money holdings. In the event that they hold rising, it might imply Buffett is struggling to seek out good funding alternatives.

The report may additionally reveal current portfolio adjustments and provide Buffett’s view on the economic system and inventory market.

Best Strategy to Observe Buffett’s Portfolio

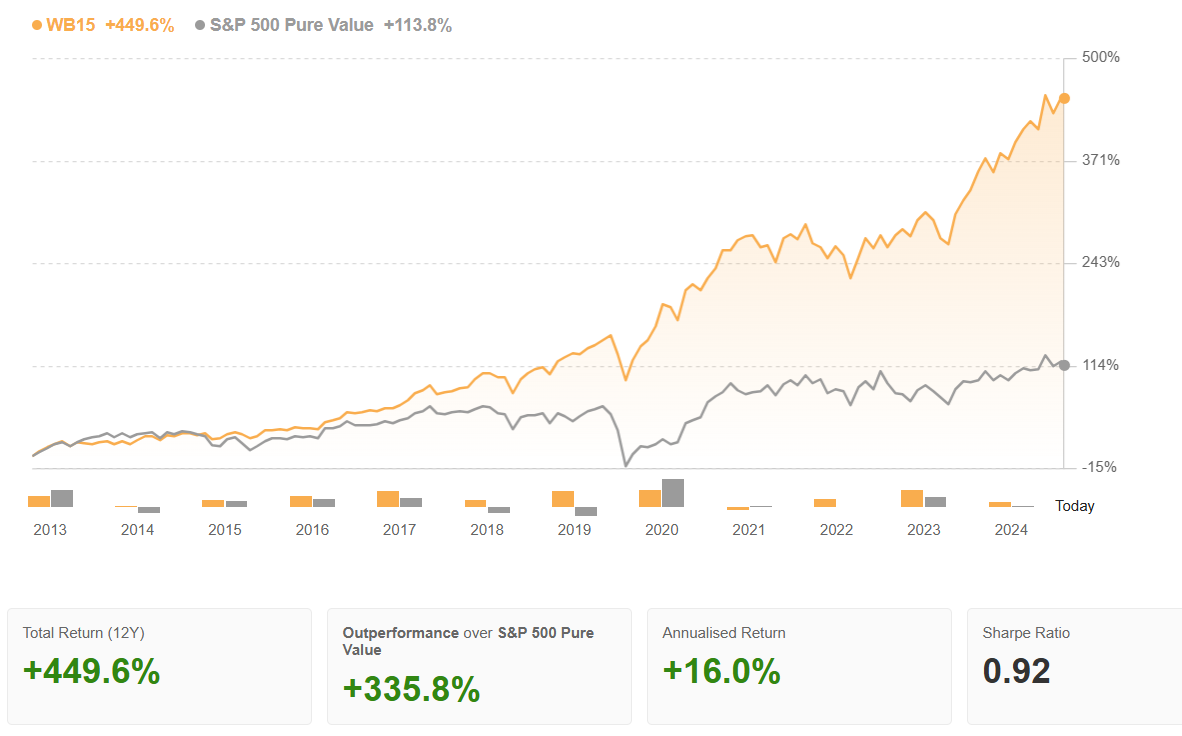

Traders trying to observe Warren Buffett’s technique can flip to the AI-powered Better of Buffett technique.

Every quarter, on the primary buying and selling day of the month that follows 13F filings, ProPicks AI selects the highest 15 shares from Buffett’s portfolio for the months forward.

The outcomes communicate for themselves:

Supply: InvestingPro

Since Warren Buffett’s final 13F submitting was final Friday, the technique will probably be re-evaluated in early March. InvestingPro subscribers will obtain a transparent checklist of shares to purchase and promote.

The “Better of Buffett” technique is one in all over 30 thematic and regional methods, all up to date month-to-month.

Click on right here to subscribe to InvestingPro and entry AI-powered ProPicks methods—rise up to 45% off primarily based in your subscription.

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, counsel or advice to take a position as such it isn’t meant to incentivize the acquisition of belongings in any manner. I want to remind you that any kind of asset, is evaluated from a number of views and is very dangerous and subsequently, any funding determination and the related threat stays with the investor.