Up to date on Could twenty seventh, 2025 by Bob Ciura

Water is among the fundamental requirements of human life. Life as we all know it can’t exist with out water. For this easy motive, water will be the most respected commodity on Earth.

It is just pure for buyers to think about buying water shares. There are lots of completely different corporations that can provide buyers publicity to the water enterprise, akin to water utilities. Another corporations are engaged in water purification.

In all, we’ve got compiled a listing of practically 50 shares which can be within the enterprise of water. The checklist was derived from two of the highest water trade exchange-traded funds:

- Invesco Water Assets ETF (PHO)

- First Belief ISE Water Index Fund (FIW)

You possibly can obtain a spreadsheet with all 46 water shares (together with metrics that matter like price-to-earnings ratios and dividend yields) by clicking on the hyperlink under:

Along with the Excel spreadsheet above, this text covers our high 7 water shares at present, that we cowl within the Certain Evaluation Analysis Database.

This text will talk about the highest 7 water shares in accordance with their anticipated returns over the following 5 years, ranked so as of lowest to highest.

Desk of Contents

Water Inventory #7: Lindsay Company (LNN)

- 5-year anticipated annual returns: 8.8%

Lindsay Company supplies water administration and highway infrastructure companies in the USA and internationally. The enterprise’s irrigation phase supplies irrigation options for farmers and contributed 85% of gross sales in fiscal yr 2024, the infrastructure phase helps with highway and bridge repairs and contributed the opposite 15%.

On April third, 2025, Lindsay reported its Q2 2025 outcomes for the interval ending February twenty eighth, 2025. The enterprise noticed diluted earnings-per-share of $2.44 which improved from the $1.64 reported the identical quarter of final yr and dramatically exceeded expectations. Revenues surged 23% year-over-year to $187 million.

These outcomes, at first look, appear extraordinary. Nonetheless, they’re seemingly partially an artifact of the tariff state of affairs moderately than precise underlying power. To that time, Lindsay’s worldwide revenues skyrocketed 42% whereas U.S. gross sales dropped 7%.

Click on right here to obtain our most up-to-date Certain Evaluation report on LNN (preview of web page 1 of three proven under):

Water Inventory #6: Stantec Inc. (STN)

- 5-year anticipated annual returns: 9.5%

Stantec Inc. supplies skilled consulting companies within the discipline of infrastructure and services internationally. This consists of companies in engineering, structure, inside design, environmental sciences, challenge administration, and challenge economics.

The corporate additionally undertakes water provision, transportation, and public works akin to transportation planning and visitors engineering.

Lastly, it serves the city regeneration, infrastructure, schooling, and waste industries. Stantec generated $4.1 billion in revenues final yr and is predicated in Edmonton, Canada. All figures on this report have been transformed to U.S. {dollars}.

On Could 14th, 2025, Stantec reported its Q1 outcomes for the interval ending March thirty first, 2025. For the quarter, web revenues had been $1.12 billion, up 13.3% year-over-year resulting from 5.9% natural progress and three.2% acquisition-driven progress.

Adjusted web revenue elevated by 28.9% to about $95.6 million, with a 10-bps enchancment in challenge margins to 54.3%. On a per-share foundation, adjusted web revenue was $0.83, up 28.9% year-over-year.

Stantec’s contract backlog elevated to $5.71 billion, up 12.8% year-over-year.

Click on right here to obtain our most up-to-date Certain Evaluation report on STN (preview of web page 1 of three proven under):

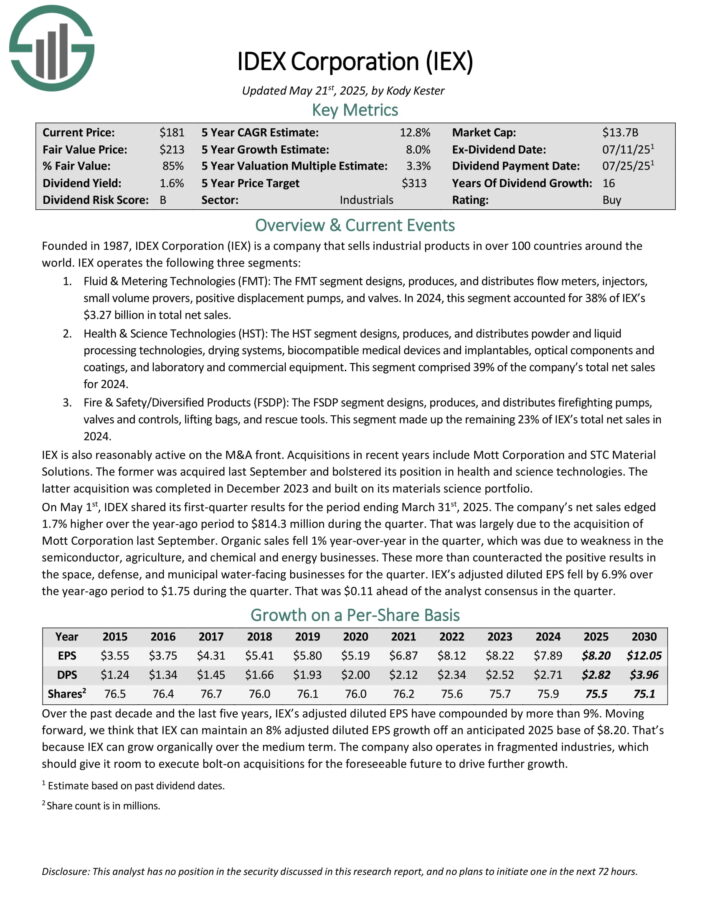

Water Inventory #5: IDEX Company (IEX)

- 5-year anticipated annual returns: 9.5%

IDEX Company (IEX) is an organization that sells industrial merchandise in over 100 nations across the world. IEX operates the next three segments. The Fluid & Metering Applied sciences (FMT) phase designs, produces, and distributes circulation meters, injectors, small quantity provers, constructive displacement pumps, and valves.

The Well being & Science Applied sciences phase designs, produces, and distributes powder and liquid processing applied sciences, drying programs, biocompatible medical gadgets and implantables, optical elements and coatings, and laboratory and industrial gear.

The Fireplace & Security/Diversified Merchandise phase designs, produces, and distributes firefighting pumps, valves and controls, lifting baggage, and rescue instruments.

On Could 1st, IDEX shared its first-quarter outcomes for the interval ending March thirty first, 2025. The corporate’s web gross sales edged 1.7% larger over the year-ago interval to $814.3 million throughout the quarter. That was largely because of the acquisition of Mott Company final September.

Natural gross sales fell 1% year-over-year within the quarter, which was resulting from weak point within the semiconductor, agriculture, and chemical and power companies.

Click on right here to obtain our most up-to-date Certain Evaluation report on IEX (preview of web page 1 of three proven under):

Water Inventory #4: Masco Company (MAS)

- 5-year anticipated annual returns: 11.5%

Masco Company is a world chief within the design, manufacture, and distribution of all kinds of house enchancment and constructing merchandise.

Its main manufacturers embody Behr paint, Hotspring spas, Kichler ornamental and out of doors lighting, and Delta taps, tub, and bathe fixtures. Masco additionally sells branded ornamental and purposeful {hardware} and waterproofing merchandise.

The corporate has two reportable segments, together with Plumbing Merchandise and Ornamental Architectural Merchandise. Masco’s prospects embody plumbing, heating, and {hardware} wholesalers in addition to {hardware} shops, house facilities, and on-line retailers.

On February eleventh, 2025, Masco raised its quarterly dividend 6.9% to $0.31.

On April twenty third, 2025, Masco reported first quarter earnings outcomes. Income of $1.8 billion declined 6% from the prior yr, which missed estimates by $30 million. Adjusted earnings-per-share of $0.87 in comparison with $0.93 within the prior yr, however this was $0.04 under expectations.

For the quarter, income for the Plumbing Merchandise phase fell 1% to $1.19 billion whereas Ornamental Architectural Merchandise declined 16% to $617 million. By areas, North America decreased 7% whereas worldwide was flat.

Click on right here to obtain our most up-to-date Certain Evaluation report on MAS (preview of web page 1 of three proven under):

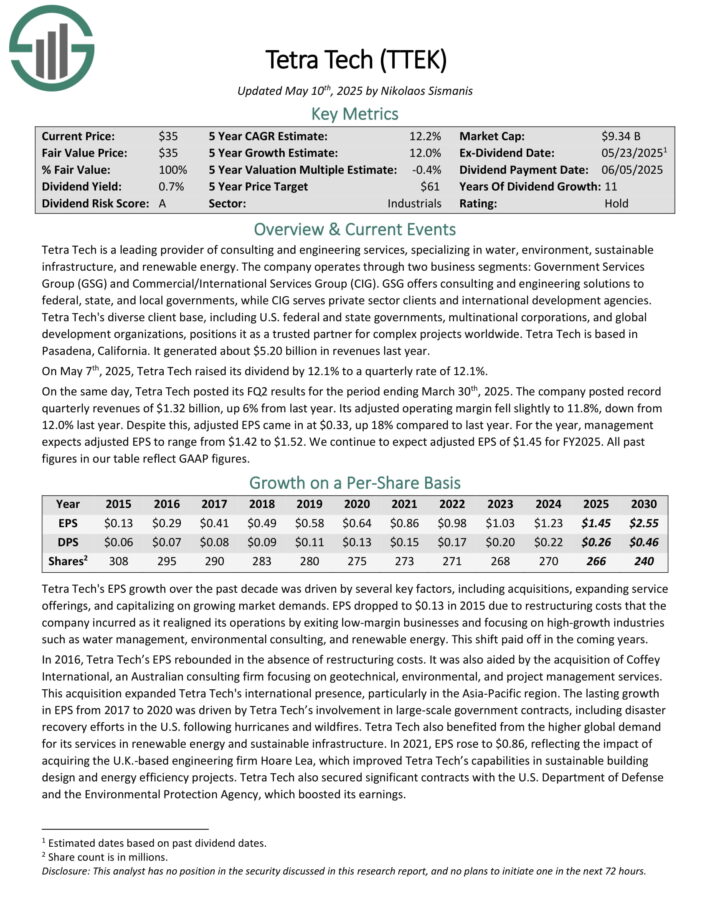

Water Inventory #3: Tetra Tech (TTEK)

- 5-year anticipated annual returns: 12.4%

Tetra Tech is a number one supplier of consulting and engineering companies, specializing in water, atmosphere, sustainable infrastructure, and renewable power.

The corporate operates by two enterprise segments: Authorities Companies Group (GSG) and Business/Worldwide Companies Group (CIG). GSG gives consulting and engineering options to federal, state, and native governments, whereas CIG serves personal sector shoppers and worldwide improvement companies.

On Could seventh, 2025, Tetra Tech raised its dividend by 12.1% to a quarterly price of 12.1%. On the identical day, Tetra Tech posted its FQ2 outcomes for the interval ending March thirtieth, 2025.

The corporate posted report quarterly revenues of $1.32 billion, up 6% from final yr. Its adjusted working margin fell barely to 11.8%, down from 12.0% final yr. Regardless of this, adjusted EPS got here in at $0.33, up 18% in comparison with final yr. For the yr, administration expects adjusted EPS to vary from $1.42 to $1.52.

Click on right here to obtain our most up-to-date Certain Evaluation report on TTEK (preview of web page 1 of three proven under):

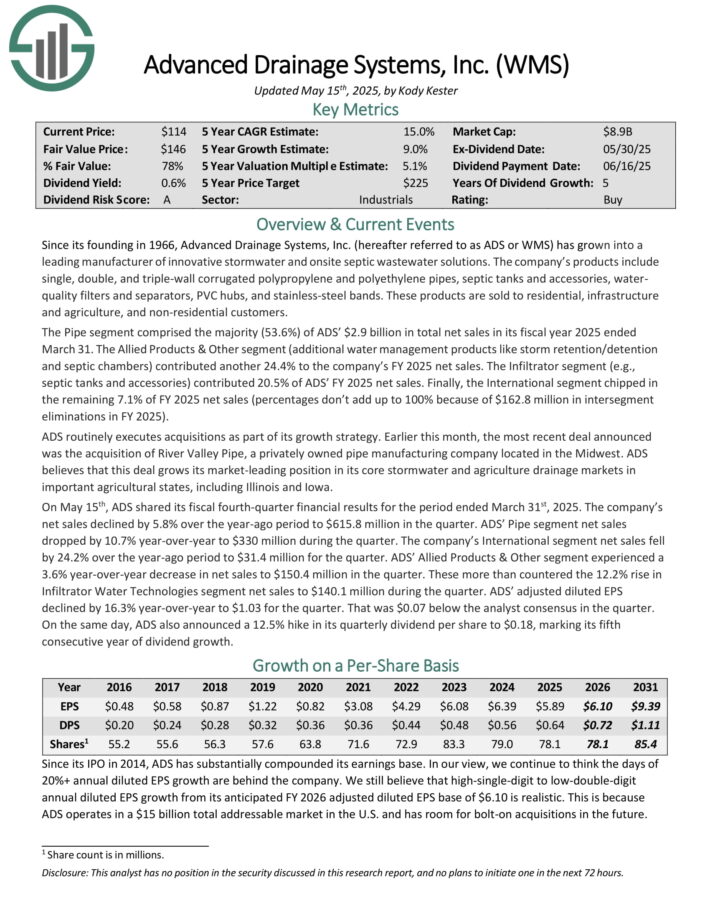

Water Inventory #2: Superior Drainage Techniques (WMS)

- 5-year anticipated annual returns: 15.8%

Superior Drainage Techniques is a number one producer of modern stormwater and onsite septic wastewater options. The corporate’s merchandise embody single, double, and triple-wall corrugated polypropylene and polyethylene pipes, septic tanks and equipment, waterquality filters and separators, PVC hubs, and stainless-steel bands.

Earlier this month, the latest deal introduced was the acquisition of River Valley Pipe, a privately owned pipe manufacturing firm positioned within the Midwest.

On Could fifteenth, ADS shared its fiscal fourth-quarter monetary outcomes for the interval ended March thirty first, 2025. The corporate’s web gross sales declined by 5.8% over the year-ago interval to $615.8 million within the quarter. ADS’ Pipe phase web gross sales dropped by 10.7% year-over-year to $330 million throughout the quarter.

The Worldwide phase web gross sales fell by 24.2% over the year-ago interval to $31.4 million for the quarter. ADS’ Allied Merchandise & Different phase skilled a 3.6% year-over-year lower in web gross sales to $150.4 million within the quarter.

These greater than countered the 12.2% rise in Infiltrator Water Applied sciences phase web gross sales to $140.1 million throughout the quarter. ADS’ adjusted diluted EPS declined by 16.3% year-over-year to $1.03 for the quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on WMS (preview of web page 1 of three proven under):

Water Inventory #1: SJW Group (SJW)

- 5-year anticipated annual returns: 18.6%

H2O America, previously SJW Group, is a water utility firm that produces, purchases, shops, purifies and distributes water to shoppers and companies within the Silicon Valley space of California, the realm north of San Antonio, Texas, Connecticut, and Maine.

It has a small actual property division that owns and develops properties for residential and warehouse prospects in California and Tennessee. The corporate generates about $800 million in annual revenues.

On April twenty eighth, 2025, the corporate reported first quarter outcomes. For the quarter, income improved 18.2% to $176.6 million, which beat estimates by $16.1 million. Earnings-per-share of $0.50 in contrast favorably to earnings-per-share of $0.36 within the prior yr and was $0.14 greater than anticipated.

For the quarter, larger water charges total added $17.2 million to outcomes and better buyer utilization added $1.0 million. Working manufacturing bills totaled $131.7 million, which was an 8% improve from the prior yr. A lot of the improve in bills was as soon as once more associated to larger water manufacturing prices.

Click on right here to obtain our most up-to-date Certain Evaluation report on HTO (preview of web page 1 of three proven under):

Ultimate Ideas

Water could possibly be one of many largest investing themes over the following a number of a long time. An rising international inhabitants is simply going to trigger demand for water to rise sooner or later.

And, given the truth that water is a necessity of human life, demand for water ought to maintain up extraordinarily nicely, even throughout the worst recessions.

Subsequently, younger buyers with an extended time horizon akin to Millennials ought to think about water shares. These components make water shares interesting for risk-averse buyers in search of stability from their inventory investments.

Not all of the water shares on this checklist obtain purchase suggestions presently, as some look like overvalued at present. However all of the water shares on this checklist pay dividends and are more likely to improve their dividends for a few years sooner or later.

Further Assets

At Certain Dividend, we frequently advocate for investing in corporations with a excessive chance of accelerating their dividends each yr.

If that technique appeals to you, it could be helpful to flick through the next databases of dividend progress shares:

The foremost home inventory market indices are one other strong useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].