- Center East ceasefire and Fed shenanigans weigh on the greenback

- ISM PMIs and Nonfarm payrolls to influence Fed charge lower bets

- Eurozone inflation and ECB discussion board to be carefully monitored by euro merchants

- China PMIs, Japan’s Tankan Survey and Swiss CPI additionally in focus

Israel-Iran Ceasefire and Fed Independence Dangers

The underperformed all its main friends this week, initially coming below strain after US President Donald Trump introduced a ceasefire between Israel and Iran. Though there have been some violations of the ceasefire just a few hours after the announcement, the accord was revered the final couple of days, permitting a risk-on market response. Equities on Wall Avenue rebounded strongly, collapsed as provide issues eased, and the US greenback, which acted because the secure haven of selection for this battle, pulled again.

What could have additionally weighed on the US greenback have been new assaults by President Trump on Fed Chair Powell about not decreasing , with a Wall Avenue Journal report noting that the President is contemplating asserting Powell’s successor by September or October. This has raised issues in regards to the credibility and independence of the Federal Reserve and prompted traders so as to add to their charge lower bets.

Based on Fed funds futures, market members at the moment are penciling in virtually 65bps value of charge cuts by the tip of the 12 months, which signifies that they agree with the 2 quarter-point reductions indicated by the Fed’s newest dot plot, however they’re additionally seeing a more-than-50% likelihood for a 3rd one. The primary discount is greater than totally priced in for September, whereas the likelihood of performing as quickly as in July has risen to 25%.

ISM PMIs and Nonfarm payrolls enter the highlight

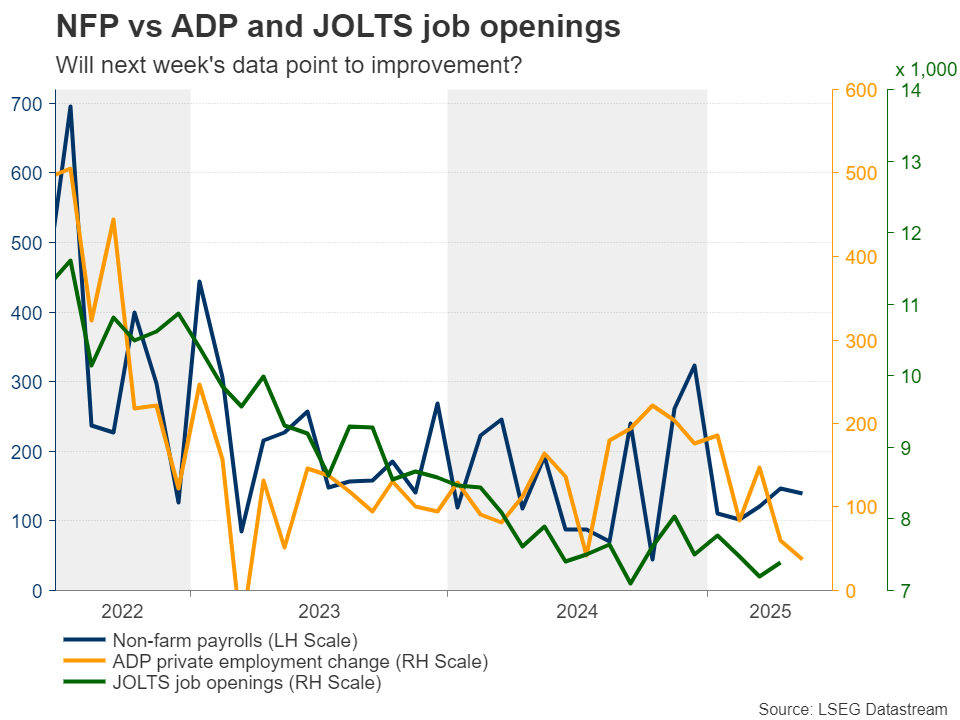

With all that in thoughts, as they attempt to higher assess how the Fed could navigate financial coverage, traders are prone to pay additional consideration to the ISM and PMIs for June, due out on Tuesday and Thursday, respectively, however the highlight is prone to fall on the for a similar month, scheduled to be launched on Thursday, as on Friday, the US shall be celebrating its Independence. The for Might will come out on Tuesday and the personal employment report for June on Wednesday.

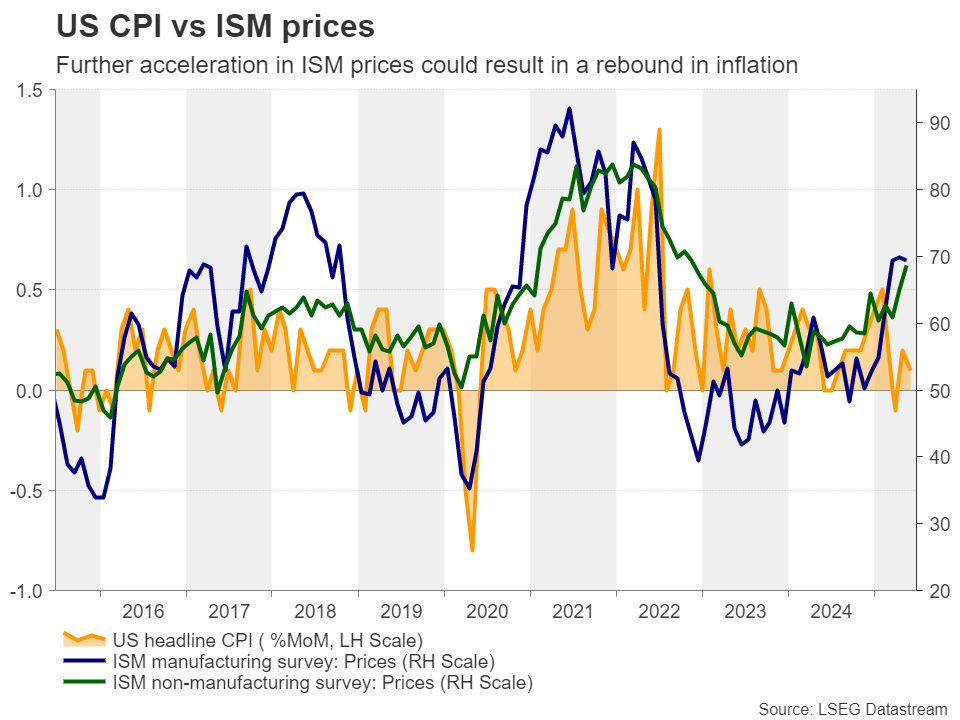

This week, the preliminary S&P International got here in larger than anticipated. Though the pulled again considerably to 52.8 from 53.0, it was decently larger than the 52.2 forecast. Worth pressures rose sharply in each the and sectors, with the previous sector reporting an particularly steep improve because of tariffs.

What’s extra, corporations elevated their employment at a charge not seen for simply over a 12 months, largely in response to larger workloads.

Ought to the ISM figures paint an analogous image, traders are prone to cut back their charge lower bets, particularly if non-farm payrolls proceed to point that the labor market is faring effectively. The US greenback is prone to rebound because the market turns into accustomed to the concept that the Fed may stay affected person earlier than resuming its rate-cut course of.

Nevertheless, with a few members already shifting to dovish and supporting a July lower, like Fed Governors Waller and Bowman, and the US President placing extra strain on Powell and his colleagues to decrease borrowing value, any restoration is prone to stay restricted and short-lived. At this level, it’s value mentioning that Waller is rumoured to be among the many candidates President Trump is contemplating for changing Powell, which provides to issues in regards to the Fed’s independence.

Will the Eurozone CPI Knowledge Corroborate ECB Price Minimize Bets?

Flying to Europe, with the greenback slipping and the market foreseeing just one quarter-point discount within the ECB’s arsenal earlier than this easing cycle ends, climbed to a nearly-four-year excessive.

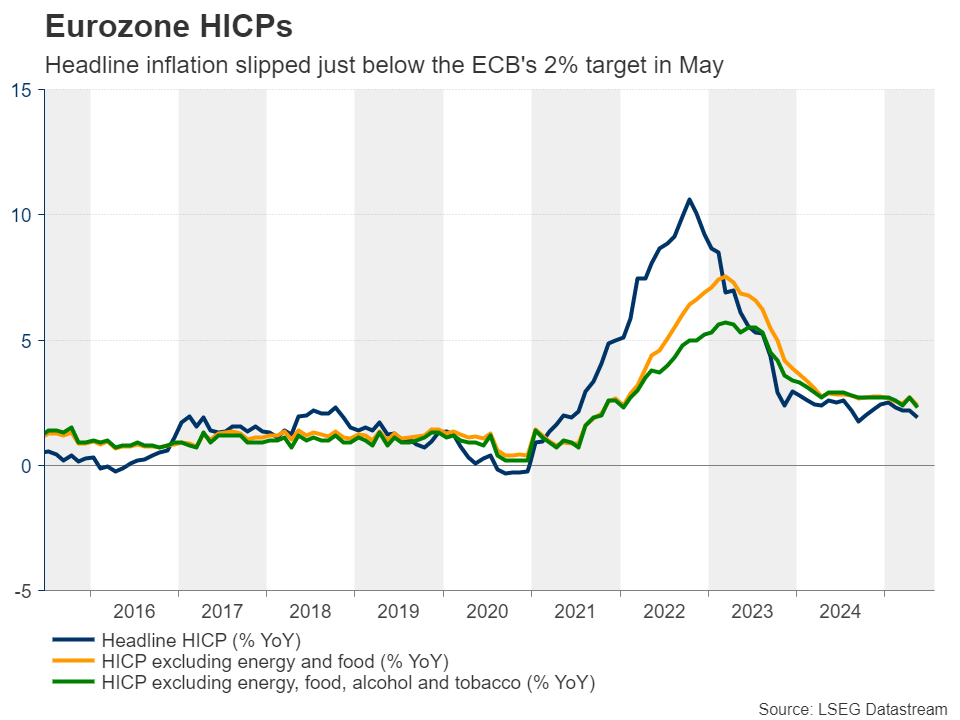

Subsequent week, euro merchants should assess the Eurozone’s preliminary information for June, due out on Tuesday. At its newest gathering, the ECB determined to decrease by 25bps, bringing the deposit charge to 2.0%, with President Lagarde noting on the press convention that the choice was not unanimous as one member didn’t assist the choice to chop rates of interest. She additionally mentioned that they’re in “good place” with the present charge path, with traders impterpreting the assertion as rising probability for a break in charge cuts. What’s extra, citing 4 sources with direct information of the dialogue, Reuters famous that there was broad settlement at that assembly about taking the sidelines in July.

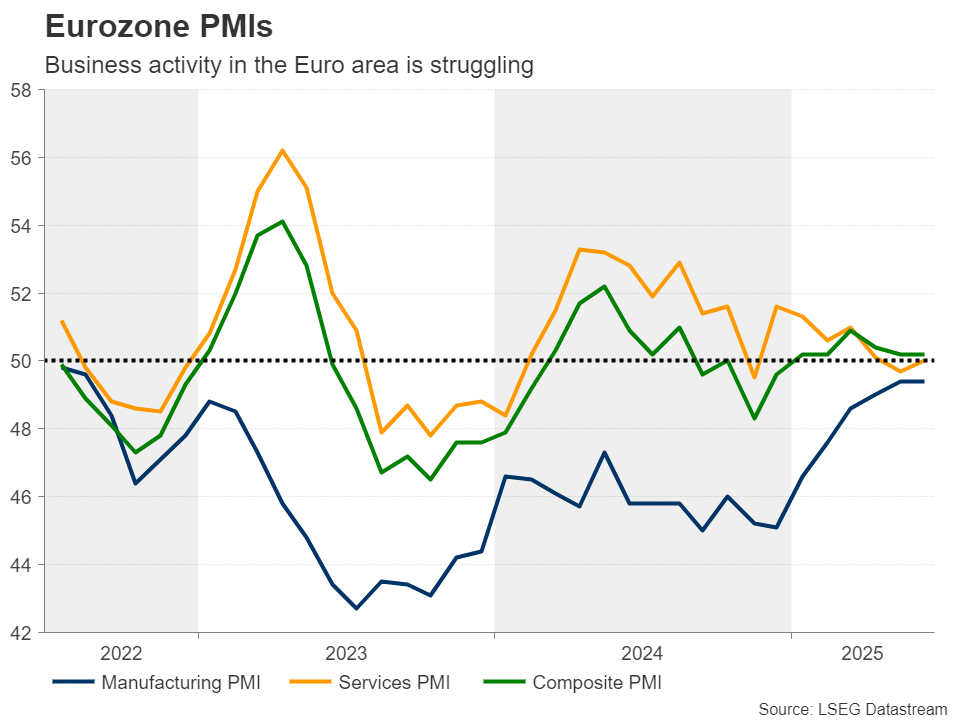

Since then, information revealed larger than anticipated development for Q1, whereas for April accelerated to 2.3% y/y from 1.9%, as an alternative of slowing to 1.4% because the forecast prompt. This corroborates the concept that the ECB could possibly be a bit affected person for now. Nevertheless, the tumble in and the weaker-than anticipated for June hold the door huge open for no less than another charge lower, even when it’s not delivered in July.

With President Lagarde noting once more just a few days in the past that, on the present rate of interest ranges, they may navigate unsure circumstances, and that they’ll observe a data-dependent strategy, traders are unlikely to change considerably their view, even when inflation accelerates considerably. In any case, the Euro space’s slipped to 1.9% y/y in Might, a tick beneath the ECB’s goal of two%.

As an alternative of anticipating the following charge lower to be delivered in December, merchants may push that timing into the start of 2026, one thing that might assist the euro considerably. The preliminary of the Eurozone’s financial powerhouse, Germany, shall be launched on Monday, whereas the ECB discussion board on central banking begins the identical day in Sintra, Portugal. ECB President Lagarde and different policymakers will maintain speeches, whereas among the many friends to take part in a coverage panel is Fed Chair Jerome Powell.

China PMIs, Japan’s Tankan Survey and Swiss Deflation

Elsewhere, China’s official and PMIs for June, in addition to Japan’s Tankan survey for Q1 are because of be launched in the course of the Asian periods on Tuesday and Wednesday, respectively. Though the deadline of the 90-day tariff-delay Trump imposed to achieve offers with the US’s fundamental buying and selling companions is quick approaching, China has a tentative accord that extends into mid-August, which permits time for a extra concrete settlement.

The PMIs will reveal how the Chinese language economic system has been performing throughout this grace interval and upbeat numbers may effectively profit the currencies of and , which have shut buying and selling ties with the world’s second largest economic system. As for the Tankan survey, with traders assigning a 50-50 likelihood of a BoJ charge hike on the finish of this 12 months or the beginning of the following, the end result may tilt the dimensions accordingly.

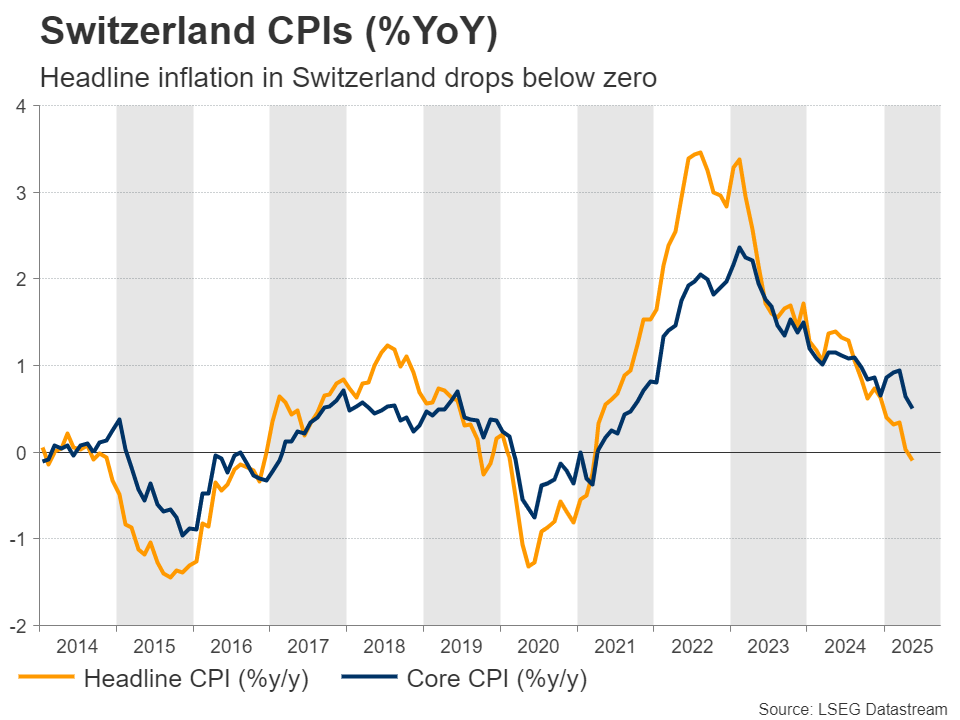

Switzerland’s information for June, due out on Thursday, may additionally assault particular consideration. With inflation in Switzerland falling in unfavorable territory, there was hypothesis that the would lower by 50bps at its prior assembly, taking rates of interest into unfavorable territory. This didn’t occur because the SNB lower by solely 25bps to zero.

Now, there’s a 30% likelihood of one other charge lower on the September gathering and will Thursday’s information counsel that the nation remained in deflation in June, that likelihood may go larger, thereby weighing on the , which stays very robust regardless of the most recent wave of threat urge for food.