It’s summertime and the meltdowns are straightforward.

The third quarter could be a harmful time for markets. Traditionally most of the largest crises have began in late summer season when liquidity is skinny and the VIX is vulnerable to spike.

Markets have been remarkably resilient this yr, however there isn’t a scarcity of catalysts ready within the wings, mentioned Henry Allen, macro strategist for Deutsche Financial institution Analysis.

Donald Trump’

s commerce struggle is about to climax on Aug. 1, the deadline for

reciprocal tariffs

to take impact on a bunch of nations. On high of that, the U.S. president has begun to announce plans for sectoral duties on such

merchandise as copper and prescription drugs.

“Markets presently aren’t pricing this in in any respect,” mentioned Allen.

Trump’s frequent shifts and the prospect that offers might be reached earlier than the deadline has made the market skeptical of this risk, he mentioned.

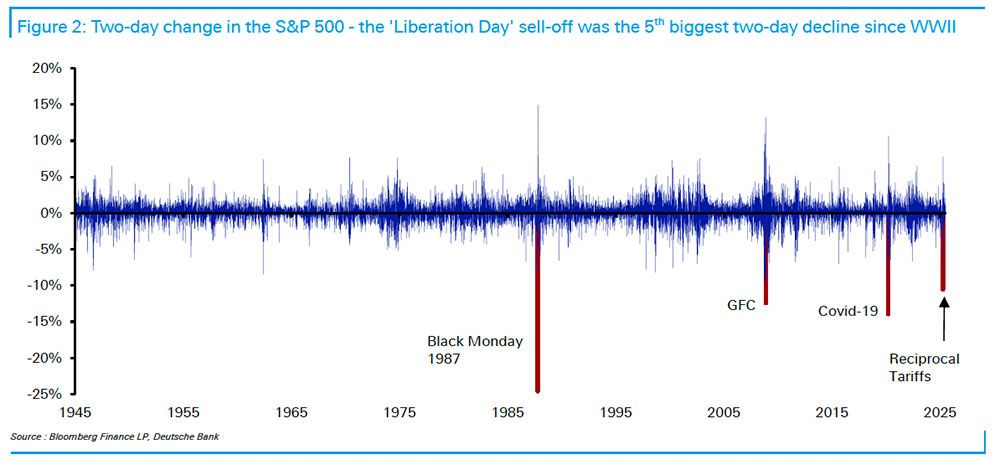

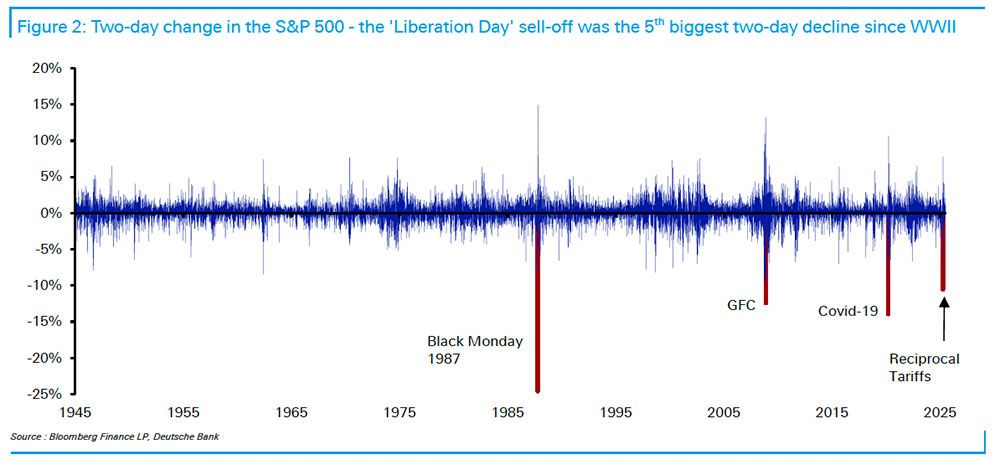

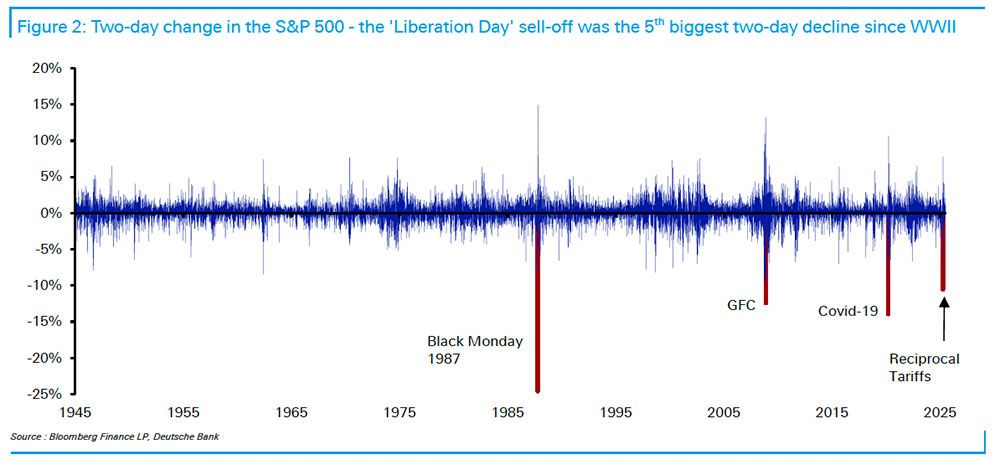

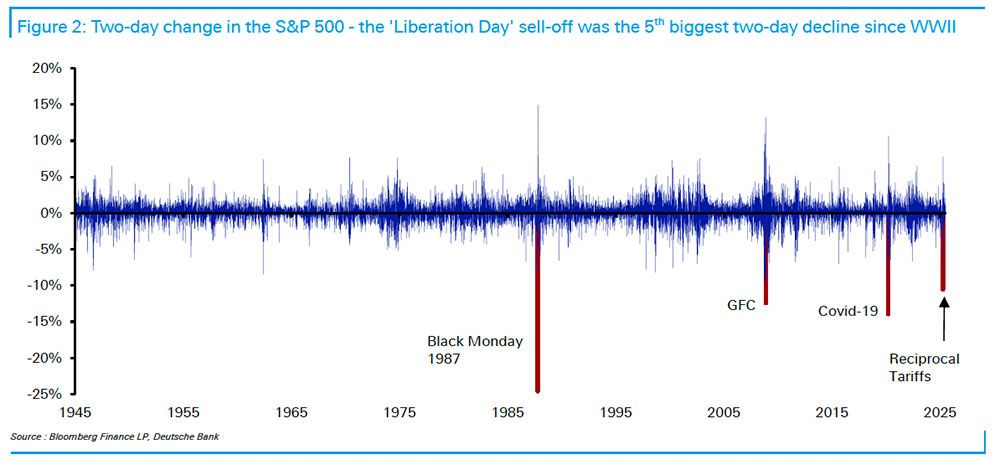

However we’ve got already seen the carnage that comes when traders are shocked by United States’ aggression. Shares tumbled after Liberation Day on April 2 and when

Trump slapped Canada and Mexico

with a 25 per cent tariff in March.

“So a sharper-than-expected tariff spike in August would definitely slot in that class and will spark a recent sell-off,” mentioned Allen.

Inflation is one other set off

. To this point the impact of tariffs has not proven up in the US, but it surely wasn’t anticipated to till June and July after corporations had time to regulate their costs. The primary of that knowledge comes out subsequent week.

Hotter inflation would maintain the

Federal Reserve

on the sidelines and markets, who’re anticipating two extra fee cuts this yr, would react, he mentioned.

A 3rd is weak financial knowledge and this one is a hair-trigger. Final summer season the U.S. unemployment fee rose greater than anticipated, breaching what’s generally known as the Sahm rule. The market response was swift and brutal, with the S&P 500 shedding greater than 6 per cent in simply three buying and selling periods.

Allen mentioned what’s attention-grabbing about this sell-off was the information wasn’t even that dangerous, but it surely tapped into

recession fears

that had been brewing for awhile.

“For right this moment, what that reveals is it might simply take a number of days in a row of underwhelming knowledge releases to ramp up these recession fears, even when subsequent knowledge doesn’t justify it,” mentioned Allen.

“That’s notably so given the broad optimism that there isn’t going to be a recession in the meanwhile, in a state of affairs the place international equities are close to report highs and credit score spreads are tight by historic requirements.”

Rising fears about nations’s debt hundreds is one other vulnerability. We have now already seen bond yields spike this yr in the US after the Moody’s credit score downgrade and in the UK final week.

The issue with fiscal fears is they will change into self-fulfilling, mentioned Allen. An increase in bond yields raises doubt about debt sustainability, which then can push yields even increased.

That’s what occurred in the summertime of 2011, when the US was embroiled in a cliff-hanging debt ceiling dispute and confronted a S&P credit score downgrade. Issues about debt have been additionally rising in Europe.

The S&P 500 fell 5.7 per cent that August and one other 7.2 per cent in September.

The explanation markets have held up so effectively this yr is that coverage makers have proven a willingness to step in when issues go sideways and not one of the shocks have really affected the economic system, mentioned Allen.

Everyone was apprehensive about recession after Liberation Day, however when Trump prolonged the tariff deadline, partially due to bond market strain, these fears pale.

To get a long-lasting market sell-off there must be a shock that impacts macro fundamentals and that coverage makers can’t repair, he mentioned.

That occurred in a summer season not so way back.

In late August of 2022, inflation was sky excessive and Fed chair

Jerome Powell

delivered a hawkish speech at Jackson Gap, adopted by a 3rd outsized fee hike in a row.

The S&P 500 fell over 4 per cent in August and 9.3 per cent in September.

Enroll right here to get Posthaste delivered straight to your inbox.

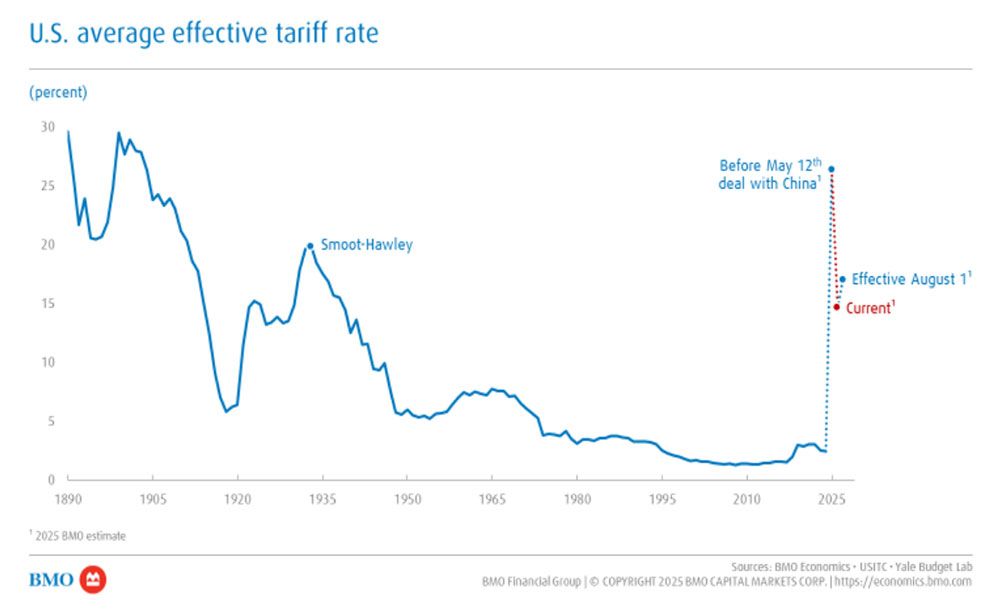

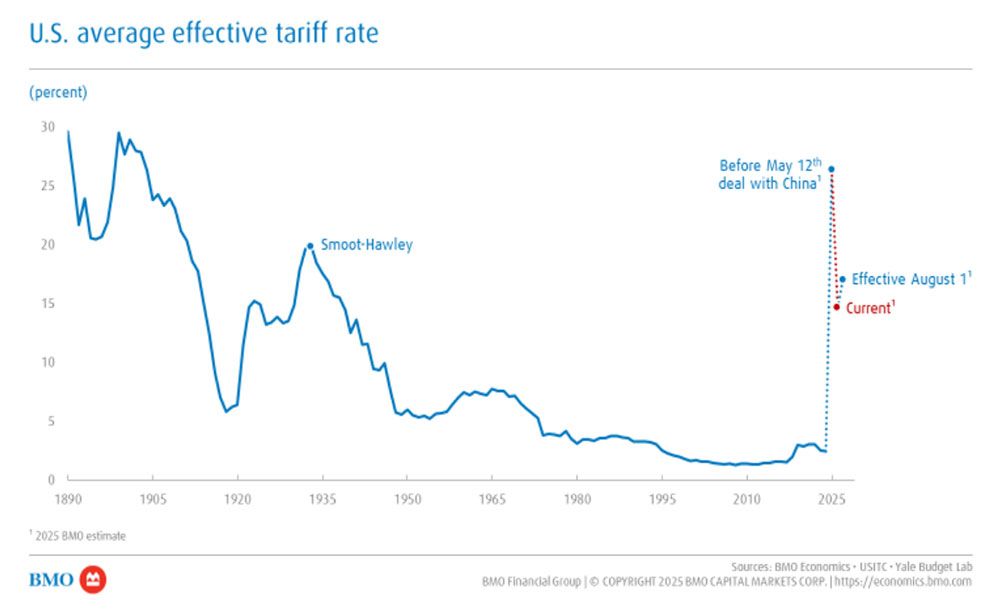

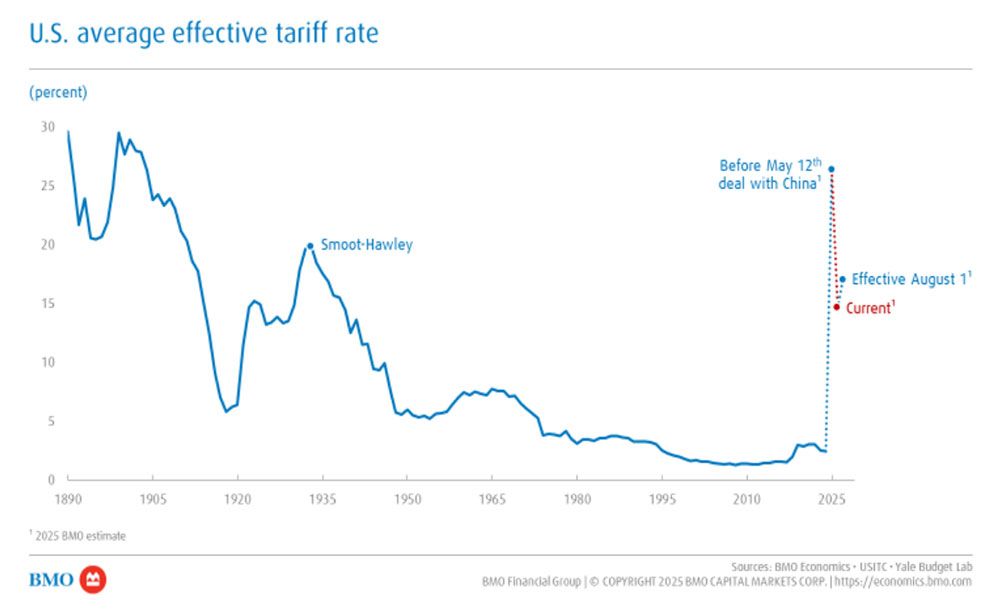

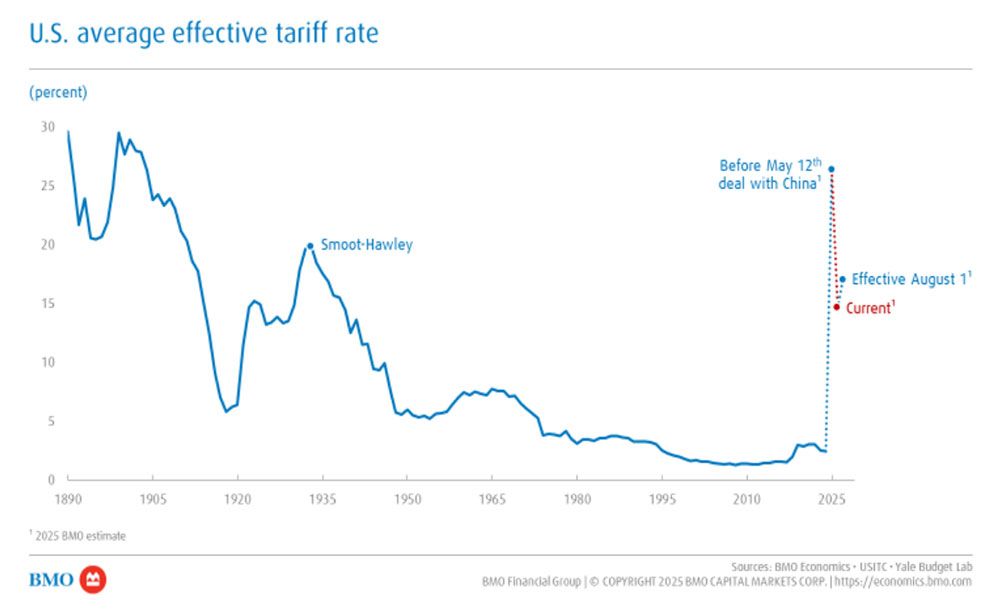

America’s efficient tariff fee is on its manner again up, after

President Donald Trump introduced reciprocal duties

starting from 25 to 40 per cent for 14 nations this week. While you issue within the Vietnam deal, the speed rises to 17 per cent, mentioned Sal Guatieri, senior economist with BMO Capital Markets.

Although that’s decrease than the 26 per cent peak in early Might earlier than the China settlement it is sufficient to do some harm to the U.S. economic system, mentioned the economist — within the vary of about half a per cent of annual progress.

- Right now Knowledge: United States preliminary jobless claims

- Earnings: Aritzia Inc., Conagra Manufacturers Inc., Delta Air Traces Inc., Richelieu {Hardware} Ltd.

- Mutual fund gross sales tradition at banks raises purple flags for market watchdogs

- Canada’s copper commerce with the U.S. beneath risk as Trump dangles tariff on the metallic

- For some fortunate Canadians, their pensions and retirement outlooks have by no means been higher

A B.C. couple of their 40s with three rental properties marvel if it’s time to begin investing within the inventory market to assist fund their retirement or if they need to buy a fourth earnings property.

Household Finance crunches the numbers.

Ship us your summer season job search tales

Just lately, we revealed a characteristic on the

loss of life of the summer season job

as pupil unemployment reaches disaster ranges. We need to hear instantly from Canadians aged 15-24 about their summer season job search.

Ship us your story, in 50-100 phrases, and we’ll publish one of the best submissions in an upcoming version of the Monetary Put up.

You possibly can submit your story by electronic mail to

fp_economy@postmedia.com

beneath the topic heading “Summer season job tales.” Please embody your title, your age, the town and province the place you reside, and a cellphone quantity to achieve you.

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

will help navigate the complicated sector, from the newest developments to financing alternatives you gained’t need to miss. Plus verify his

mortgage fee web page

for Canada’s lowest nationwide mortgage charges, up to date every day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

YouTube channel

for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

Right now’s Posthaste was written by Pamela Heaven with further reporting from Monetary Put up workers, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this text? E-mail us at

posthaste@postmedia.com

.

Bookmark our web site and assist our journalism: Don’t miss the enterprise information it is advisable know — add financialpost.com to your bookmarks and join our newsletters right here

It’s summertime and the meltdowns are straightforward.

The third quarter could be a harmful time for markets. Traditionally most of the largest crises have began in late summer season when liquidity is skinny and the VIX is vulnerable to spike.

Markets have been remarkably resilient this yr, however there isn’t a scarcity of catalysts ready within the wings, mentioned Henry Allen, macro strategist for Deutsche Financial institution Analysis.

Donald Trump’

s commerce struggle is about to climax on Aug. 1, the deadline for

reciprocal tariffs

to take impact on a bunch of nations. On high of that, the U.S. president has begun to announce plans for sectoral duties on such

merchandise as copper and prescription drugs.

“Markets presently aren’t pricing this in in any respect,” mentioned Allen.

Trump’s frequent shifts and the prospect that offers might be reached earlier than the deadline has made the market skeptical of this risk, he mentioned.

However we’ve got already seen the carnage that comes when traders are shocked by United States’ aggression. Shares tumbled after Liberation Day on April 2 and when

Trump slapped Canada and Mexico

with a 25 per cent tariff in March.

“So a sharper-than-expected tariff spike in August would definitely slot in that class and will spark a recent sell-off,” mentioned Allen.

Inflation is one other set off

. To this point the impact of tariffs has not proven up in the US, but it surely wasn’t anticipated to till June and July after corporations had time to regulate their costs. The primary of that knowledge comes out subsequent week.

Hotter inflation would maintain the

Federal Reserve

on the sidelines and markets, who’re anticipating two extra fee cuts this yr, would react, he mentioned.

A 3rd is weak financial knowledge and this one is a hair-trigger. Final summer season the U.S. unemployment fee rose greater than anticipated, breaching what’s generally known as the Sahm rule. The market response was swift and brutal, with the S&P 500 shedding greater than 6 per cent in simply three buying and selling periods.

Allen mentioned what’s attention-grabbing about this sell-off was the information wasn’t even that dangerous, but it surely tapped into

recession fears

that had been brewing for awhile.

“For right this moment, what that reveals is it might simply take a number of days in a row of underwhelming knowledge releases to ramp up these recession fears, even when subsequent knowledge doesn’t justify it,” mentioned Allen.

“That’s notably so given the broad optimism that there isn’t going to be a recession in the meanwhile, in a state of affairs the place international equities are close to report highs and credit score spreads are tight by historic requirements.”

Rising fears about nations’s debt hundreds is one other vulnerability. We have now already seen bond yields spike this yr in the US after the Moody’s credit score downgrade and in the UK final week.

The issue with fiscal fears is they will change into self-fulfilling, mentioned Allen. An increase in bond yields raises doubt about debt sustainability, which then can push yields even increased.

That’s what occurred in the summertime of 2011, when the US was embroiled in a cliff-hanging debt ceiling dispute and confronted a S&P credit score downgrade. Issues about debt have been additionally rising in Europe.

The S&P 500 fell 5.7 per cent that August and one other 7.2 per cent in September.

The explanation markets have held up so effectively this yr is that coverage makers have proven a willingness to step in when issues go sideways and not one of the shocks have really affected the economic system, mentioned Allen.

Everyone was apprehensive about recession after Liberation Day, however when Trump prolonged the tariff deadline, partially due to bond market strain, these fears pale.

To get a long-lasting market sell-off there must be a shock that impacts macro fundamentals and that coverage makers can’t repair, he mentioned.

That occurred in a summer season not so way back.

In late August of 2022, inflation was sky excessive and Fed chair

Jerome Powell

delivered a hawkish speech at Jackson Gap, adopted by a 3rd outsized fee hike in a row.

The S&P 500 fell over 4 per cent in August and 9.3 per cent in September.

Enroll right here to get Posthaste delivered straight to your inbox.

America’s efficient tariff fee is on its manner again up, after

President Donald Trump introduced reciprocal duties

starting from 25 to 40 per cent for 14 nations this week. While you issue within the Vietnam deal, the speed rises to 17 per cent, mentioned Sal Guatieri, senior economist with BMO Capital Markets.

Although that’s decrease than the 26 per cent peak in early Might earlier than the China settlement it is sufficient to do some harm to the U.S. economic system, mentioned the economist — within the vary of about half a per cent of annual progress.

- Right now Knowledge: United States preliminary jobless claims

- Earnings: Aritzia Inc., Conagra Manufacturers Inc., Delta Air Traces Inc., Richelieu {Hardware} Ltd.

- Mutual fund gross sales tradition at banks raises purple flags for market watchdogs

- Canada’s copper commerce with the U.S. beneath risk as Trump dangles tariff on the metallic

- For some fortunate Canadians, their pensions and retirement outlooks have by no means been higher

A B.C. couple of their 40s with three rental properties marvel if it’s time to begin investing within the inventory market to assist fund their retirement or if they need to buy a fourth earnings property.

Household Finance crunches the numbers.

Ship us your summer season job search tales

Just lately, we revealed a characteristic on the

loss of life of the summer season job

as pupil unemployment reaches disaster ranges. We need to hear instantly from Canadians aged 15-24 about their summer season job search.

Ship us your story, in 50-100 phrases, and we’ll publish one of the best submissions in an upcoming version of the Monetary Put up.

You possibly can submit your story by electronic mail to

fp_economy@postmedia.com

beneath the topic heading “Summer season job tales.” Please embody your title, your age, the town and province the place you reside, and a cellphone quantity to achieve you.

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

will help navigate the complicated sector, from the newest developments to financing alternatives you gained’t need to miss. Plus verify his

mortgage fee web page

for Canada’s lowest nationwide mortgage charges, up to date every day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

YouTube channel

for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

Right now’s Posthaste was written by Pamela Heaven with further reporting from Monetary Put up workers, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this text? E-mail us at

posthaste@postmedia.com

.

Bookmark our web site and assist our journalism: Don’t miss the enterprise information it is advisable know — add financialpost.com to your bookmarks and join our newsletters right here

It’s summertime and the meltdowns are straightforward.

The third quarter could be a harmful time for markets. Traditionally most of the largest crises have began in late summer season when liquidity is skinny and the VIX is vulnerable to spike.

Markets have been remarkably resilient this yr, however there isn’t a scarcity of catalysts ready within the wings, mentioned Henry Allen, macro strategist for Deutsche Financial institution Analysis.

Donald Trump’

s commerce struggle is about to climax on Aug. 1, the deadline for

reciprocal tariffs

to take impact on a bunch of nations. On high of that, the U.S. president has begun to announce plans for sectoral duties on such

merchandise as copper and prescription drugs.

“Markets presently aren’t pricing this in in any respect,” mentioned Allen.

Trump’s frequent shifts and the prospect that offers might be reached earlier than the deadline has made the market skeptical of this risk, he mentioned.

However we’ve got already seen the carnage that comes when traders are shocked by United States’ aggression. Shares tumbled after Liberation Day on April 2 and when

Trump slapped Canada and Mexico

with a 25 per cent tariff in March.

“So a sharper-than-expected tariff spike in August would definitely slot in that class and will spark a recent sell-off,” mentioned Allen.

Inflation is one other set off

. To this point the impact of tariffs has not proven up in the US, but it surely wasn’t anticipated to till June and July after corporations had time to regulate their costs. The primary of that knowledge comes out subsequent week.

Hotter inflation would maintain the

Federal Reserve

on the sidelines and markets, who’re anticipating two extra fee cuts this yr, would react, he mentioned.

A 3rd is weak financial knowledge and this one is a hair-trigger. Final summer season the U.S. unemployment fee rose greater than anticipated, breaching what’s generally known as the Sahm rule. The market response was swift and brutal, with the S&P 500 shedding greater than 6 per cent in simply three buying and selling periods.

Allen mentioned what’s attention-grabbing about this sell-off was the information wasn’t even that dangerous, but it surely tapped into

recession fears

that had been brewing for awhile.

“For right this moment, what that reveals is it might simply take a number of days in a row of underwhelming knowledge releases to ramp up these recession fears, even when subsequent knowledge doesn’t justify it,” mentioned Allen.

“That’s notably so given the broad optimism that there isn’t going to be a recession in the meanwhile, in a state of affairs the place international equities are close to report highs and credit score spreads are tight by historic requirements.”

Rising fears about nations’s debt hundreds is one other vulnerability. We have now already seen bond yields spike this yr in the US after the Moody’s credit score downgrade and in the UK final week.

The issue with fiscal fears is they will change into self-fulfilling, mentioned Allen. An increase in bond yields raises doubt about debt sustainability, which then can push yields even increased.

That’s what occurred in the summertime of 2011, when the US was embroiled in a cliff-hanging debt ceiling dispute and confronted a S&P credit score downgrade. Issues about debt have been additionally rising in Europe.

The S&P 500 fell 5.7 per cent that August and one other 7.2 per cent in September.

The explanation markets have held up so effectively this yr is that coverage makers have proven a willingness to step in when issues go sideways and not one of the shocks have really affected the economic system, mentioned Allen.

Everyone was apprehensive about recession after Liberation Day, however when Trump prolonged the tariff deadline, partially due to bond market strain, these fears pale.

To get a long-lasting market sell-off there must be a shock that impacts macro fundamentals and that coverage makers can’t repair, he mentioned.

That occurred in a summer season not so way back.

In late August of 2022, inflation was sky excessive and Fed chair

Jerome Powell

delivered a hawkish speech at Jackson Gap, adopted by a 3rd outsized fee hike in a row.

The S&P 500 fell over 4 per cent in August and 9.3 per cent in September.

Enroll right here to get Posthaste delivered straight to your inbox.

America’s efficient tariff fee is on its manner again up, after

President Donald Trump introduced reciprocal duties

starting from 25 to 40 per cent for 14 nations this week. While you issue within the Vietnam deal, the speed rises to 17 per cent, mentioned Sal Guatieri, senior economist with BMO Capital Markets.

Although that’s decrease than the 26 per cent peak in early Might earlier than the China settlement it is sufficient to do some harm to the U.S. economic system, mentioned the economist — within the vary of about half a per cent of annual progress.

- Right now Knowledge: United States preliminary jobless claims

- Earnings: Aritzia Inc., Conagra Manufacturers Inc., Delta Air Traces Inc., Richelieu {Hardware} Ltd.

- Mutual fund gross sales tradition at banks raises purple flags for market watchdogs

- Canada’s copper commerce with the U.S. beneath risk as Trump dangles tariff on the metallic

- For some fortunate Canadians, their pensions and retirement outlooks have by no means been higher

A B.C. couple of their 40s with three rental properties marvel if it’s time to begin investing within the inventory market to assist fund their retirement or if they need to buy a fourth earnings property.

Household Finance crunches the numbers.

Ship us your summer season job search tales

Just lately, we revealed a characteristic on the

loss of life of the summer season job

as pupil unemployment reaches disaster ranges. We need to hear instantly from Canadians aged 15-24 about their summer season job search.

Ship us your story, in 50-100 phrases, and we’ll publish one of the best submissions in an upcoming version of the Monetary Put up.

You possibly can submit your story by electronic mail to

fp_economy@postmedia.com

beneath the topic heading “Summer season job tales.” Please embody your title, your age, the town and province the place you reside, and a cellphone quantity to achieve you.

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

will help navigate the complicated sector, from the newest developments to financing alternatives you gained’t need to miss. Plus verify his

mortgage fee web page

for Canada’s lowest nationwide mortgage charges, up to date every day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

YouTube channel

for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

Right now’s Posthaste was written by Pamela Heaven with further reporting from Monetary Put up workers, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this text? E-mail us at

posthaste@postmedia.com

.

Bookmark our web site and assist our journalism: Don’t miss the enterprise information it is advisable know — add financialpost.com to your bookmarks and join our newsletters right here

It’s summertime and the meltdowns are straightforward.

The third quarter could be a harmful time for markets. Traditionally most of the largest crises have began in late summer season when liquidity is skinny and the VIX is vulnerable to spike.

Markets have been remarkably resilient this yr, however there isn’t a scarcity of catalysts ready within the wings, mentioned Henry Allen, macro strategist for Deutsche Financial institution Analysis.

Donald Trump’

s commerce struggle is about to climax on Aug. 1, the deadline for

reciprocal tariffs

to take impact on a bunch of nations. On high of that, the U.S. president has begun to announce plans for sectoral duties on such

merchandise as copper and prescription drugs.

“Markets presently aren’t pricing this in in any respect,” mentioned Allen.

Trump’s frequent shifts and the prospect that offers might be reached earlier than the deadline has made the market skeptical of this risk, he mentioned.

However we’ve got already seen the carnage that comes when traders are shocked by United States’ aggression. Shares tumbled after Liberation Day on April 2 and when

Trump slapped Canada and Mexico

with a 25 per cent tariff in March.

“So a sharper-than-expected tariff spike in August would definitely slot in that class and will spark a recent sell-off,” mentioned Allen.

Inflation is one other set off

. To this point the impact of tariffs has not proven up in the US, but it surely wasn’t anticipated to till June and July after corporations had time to regulate their costs. The primary of that knowledge comes out subsequent week.

Hotter inflation would maintain the

Federal Reserve

on the sidelines and markets, who’re anticipating two extra fee cuts this yr, would react, he mentioned.

A 3rd is weak financial knowledge and this one is a hair-trigger. Final summer season the U.S. unemployment fee rose greater than anticipated, breaching what’s generally known as the Sahm rule. The market response was swift and brutal, with the S&P 500 shedding greater than 6 per cent in simply three buying and selling periods.

Allen mentioned what’s attention-grabbing about this sell-off was the information wasn’t even that dangerous, but it surely tapped into

recession fears

that had been brewing for awhile.

“For right this moment, what that reveals is it might simply take a number of days in a row of underwhelming knowledge releases to ramp up these recession fears, even when subsequent knowledge doesn’t justify it,” mentioned Allen.

“That’s notably so given the broad optimism that there isn’t going to be a recession in the meanwhile, in a state of affairs the place international equities are close to report highs and credit score spreads are tight by historic requirements.”

Rising fears about nations’s debt hundreds is one other vulnerability. We have now already seen bond yields spike this yr in the US after the Moody’s credit score downgrade and in the UK final week.

The issue with fiscal fears is they will change into self-fulfilling, mentioned Allen. An increase in bond yields raises doubt about debt sustainability, which then can push yields even increased.

That’s what occurred in the summertime of 2011, when the US was embroiled in a cliff-hanging debt ceiling dispute and confronted a S&P credit score downgrade. Issues about debt have been additionally rising in Europe.

The S&P 500 fell 5.7 per cent that August and one other 7.2 per cent in September.

The explanation markets have held up so effectively this yr is that coverage makers have proven a willingness to step in when issues go sideways and not one of the shocks have really affected the economic system, mentioned Allen.

Everyone was apprehensive about recession after Liberation Day, however when Trump prolonged the tariff deadline, partially due to bond market strain, these fears pale.

To get a long-lasting market sell-off there must be a shock that impacts macro fundamentals and that coverage makers can’t repair, he mentioned.

That occurred in a summer season not so way back.

In late August of 2022, inflation was sky excessive and Fed chair

Jerome Powell

delivered a hawkish speech at Jackson Gap, adopted by a 3rd outsized fee hike in a row.

The S&P 500 fell over 4 per cent in August and 9.3 per cent in September.

Enroll right here to get Posthaste delivered straight to your inbox.

America’s efficient tariff fee is on its manner again up, after

President Donald Trump introduced reciprocal duties

starting from 25 to 40 per cent for 14 nations this week. While you issue within the Vietnam deal, the speed rises to 17 per cent, mentioned Sal Guatieri, senior economist with BMO Capital Markets.

Although that’s decrease than the 26 per cent peak in early Might earlier than the China settlement it is sufficient to do some harm to the U.S. economic system, mentioned the economist — within the vary of about half a per cent of annual progress.

- Right now Knowledge: United States preliminary jobless claims

- Earnings: Aritzia Inc., Conagra Manufacturers Inc., Delta Air Traces Inc., Richelieu {Hardware} Ltd.

- Mutual fund gross sales tradition at banks raises purple flags for market watchdogs

- Canada’s copper commerce with the U.S. beneath risk as Trump dangles tariff on the metallic

- For some fortunate Canadians, their pensions and retirement outlooks have by no means been higher

A B.C. couple of their 40s with three rental properties marvel if it’s time to begin investing within the inventory market to assist fund their retirement or if they need to buy a fourth earnings property.

Household Finance crunches the numbers.

Ship us your summer season job search tales

Just lately, we revealed a characteristic on the

loss of life of the summer season job

as pupil unemployment reaches disaster ranges. We need to hear instantly from Canadians aged 15-24 about their summer season job search.

Ship us your story, in 50-100 phrases, and we’ll publish one of the best submissions in an upcoming version of the Monetary Put up.

You possibly can submit your story by electronic mail to

fp_economy@postmedia.com

beneath the topic heading “Summer season job tales.” Please embody your title, your age, the town and province the place you reside, and a cellphone quantity to achieve you.

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

will help navigate the complicated sector, from the newest developments to financing alternatives you gained’t need to miss. Plus verify his

mortgage fee web page

for Canada’s lowest nationwide mortgage charges, up to date every day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

YouTube channel

for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

Right now’s Posthaste was written by Pamela Heaven with further reporting from Monetary Put up workers, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this text? E-mail us at

posthaste@postmedia.com

.

Bookmark our web site and assist our journalism: Don’t miss the enterprise information it is advisable know — add financialpost.com to your bookmarks and join our newsletters right here