Canadian mining and manufacturing within the firing line, say Desjardins

Article content material

Article content material

Article content material

Canadian firms are bracing for a tariff tsunami when Donald Trump takes workplace immediately, however in response to a brand new report, some must be extra fearful than others.

Trump, whose group has reportedly ready greater than 100 govt orders prepared for signing after his inauguration, has mentioned he would impose 25 per cent tariffs on all imports from Canada and Mexico. For our nation, the place 70 per cent of exports go to america, it is a large risk.

Commercial 2

Article content material

To get a deal with on it, principal economist Florence Jean-Jacobs and her group at Desjardins Group analyzed the potential influence of tariffs on particular person sectors.

“Whereas it appears like Canadian exports ended 2024 on a robust be aware because the prospect of tariffs inspired U.S. firms to construct up their inventories, this pattern may reverse course in 2025 after Donald Trump takes workplace,” she wrote.

How weak a sector is boils all the way down to how dependent America is on the actual product and whether or not it could actually purchase it some place else.

About half the worth of Canada’s output in mining and oil and fuel is exported to the U.S. and a couple of third of producing, although the share is increased within the auto sector at about 50 per cent and in aerospace at 40 per cent.

Oil and fuel and the auto business have attracted essentially the most consideration on this commerce furor and are most depending on the U.S. for exports, however they’re additionally almost certainly to be exempted, mentioned Desjardins.

America doesn’t produce sufficient crude oil to satisfy its wants and will get 58 per cent of its imported oil from Canada. Slapping tariffs on this product would danger elevating costs which fits towards Trump’s promise to convey gasoline prices down.

Article content material

Commercial 3

Article content material

The auto business is extremely built-in, which means that exporter and importer are sometimes the identical mum or dad firm. Half of the Normal Motors Co. pickup vehicles bought within the U.S., for instance, are imported from Canada and Mexico, mentioned the report. If their prices go up, these multinational giants are more likely to foyer for exemptions.

The first metals sector, meals and beverage manufacturing, chemical substances, equipment and aerospace, nonetheless, usually are not so fortunate and Desjardins considers them most weak to tariff ache.

Canada exports about 41 per cent of its major metallic manufacturing to the U.S. and Quebec exports 54 per cent, representing in {dollars} about $44 billion and $16 billion, respectively, mentioned the report. Although American doesn’t produce sufficient of those merchandise to satisfy its wants, it could actually get them by way of different overseas suppliers. Desjardins calculates that if tariffs scale back demand on this sector by 10 per cent, business revenues would hunch 4.1 per cent in Canada and 5.4 per cent in Quebec.

Different sectors are weak as a result of America already makes sufficient of their merchandise by itself. That is true for lumber, transportation tools apart from autos, paper and cardboard, agricultural meals and petroleum-based merchandise.

Commercial 4

Article content material

Then there are the merchandise the U.S. can simply get from one other provider — prescribed drugs, fundamental chemical substances, equipment and processed petroleum merchandise. The petroleum and coal merchandise America now will get from Canada may simply be sourced from South Korea, India and Netherlands and prescribed drugs may come from Eire, Germany and Singapore, mentioned the report.

There are some Canadian merchandise, although, America would discover exhausting to do with out. Desjardins believes uranium ore will more likely to be exempted from tariffs as a result of the U.S. imports virtually all of its provide — 27 per cent from Canada, 25 per cent from Kazakhstan and 12 per cent from Russia.

Potash, used extensively on American farms in fertilizer, will not be mined in america and with Canada being the world’s largest producer, there are few different choices.

Cobalt and graphite, vital minerals utilized in batteries and electronics, are additionally more likely to be exempt as america has invested in Canadian manufacturing to cut back its dependence on Chinese language suppliers.

Nevertheless, the influence on sectors weak to tariffs gained’t cease there. Transportation and warehousing, wholesale commerce {and professional} providers would endure from spill-over results and even industries much less uncovered to commerce will really feel the pinch of the financial slowdown tariffs convey on, mentioned Desjardins.

Commercial 5

Article content material

“Clearly, companies have to plan forward as they navigate immediately’s shifting commerce winds and discover methods to mitigate their dangers, like boosting interprovincial commerce, diversifying exports away from the U.S. and investing in innovation and modernization,” wrote Jean-Jacobs.

It’s instances like these when a weak Canadian greenback is useful. A decrease loonie means Canadian merchandise will value much less in U.S. {dollars}, partially offsetting the hit from tariffs, she mentioned.

Enroll right here to get Posthaste delivered straight to your inbox.

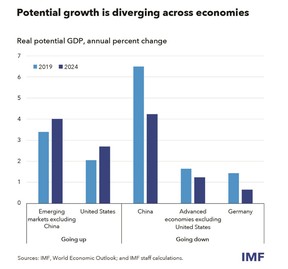

Take coronary heart Canada, our economic system is likely to be lagging america, however we’re not alone.

The divergence between the U.S. and different economies was the speaking level of the Worldwide Financial Fund’s world progress forecast Friday. Although the IMF’s outlook was broadly the identical as in October, divergences throughout nations are widening. Principally, the U.S. has rebounded again to its pre-pandemic progress potential, whereas different superior nations and China haven’t.

- U.S. president-elect Donald Trump shall be sworn into workplace on Monday. He has threatened to impose 25 per cent tariffs on items headed to the U.S. from Canada and Mexico on his first day as president except the 2 nations cease unlawful border crossings and forestall illicit medication from getting into america.

- U.S. markets closed for Martin Luther King Jr. Day

- The Financial institution of Canada releases its enterprise outlook survey and its Canadian survey of client expectations

Commercial 6

Article content material

With all of the uncertainty across the capital features tax hike, tax knowledgeable Jamie Golombek takes a deeper dive into who could also be affected, and the financial trade-off of selecting to not observe the Canada Income Company’s steerage. Discover out extra

Calling Canadian households with youthful youngsters or teenagers: Whether or not it’s budgeting, spending, investing, paying off debt, or simply paying the payments, does your loved ones have any monetary resolutions for the approaching 12 months? Tell us at [email protected].

McLister on mortgages

Wish to be taught extra about mortgages? Mortgage strategist Robert McLister’s Monetary Submit column can assist navigate the complicated sector, from the most recent traits to financing alternatives you gained’t need to miss. Plus examine his mortgage price web page for Canada’s lowest nationwide mortgage charges, up to date every day.

Monetary Submit on YouTube

Go to the Monetary Submit’s YouTube channel for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

In the present day’s Posthaste was written by Pamela Heaven, with extra reporting from Monetary Submit employees, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this article? Electronic mail us at [email protected].

Really helpful from Editorial

-

Canada’s personal commerce boundaries quantity to almost 25% tariff

-

The ‘outdated regular’ is again and meaning increased rates of interest

Bookmark our web site and assist our journalism: Don’t miss the enterprise information it’s essential know — add financialpost.com to your bookmarks and join our newsletters right here

Article content material