It now takes solely 60% of your earnings to personal a house

Article content material

Lastly some excellent news on the house affordability entrance.

Based on the Royal Financial institution of Canada‘s measure, it took 59.5 per cent of the median family earnings to personal a house on this nation within the second quarter. And whereas that may sound like lots, it’s down from 63.7 per cent on the finish of 2023.

The housing growth fuelled by the rock-bottom lending charges of the pandemic pushed house costs to dizzying heights in Canada, after which when mortgage charges shot up, RBC’s housing affordability measure deteriorated to the worst in historical past.

Commercial 2

Article content material

The beginning of this yr marked a turning level, when house costs stalled or fell in some markets, mortgage charges eased and wages grew, stated Robert Hogue, RBC’s assistant chief economist.

“These developments lastly halted the historic run-up in homeownership prices that happened throughout the pandemic,” he stated.

Nationally, a family wanted an earnings of $155,000 within the second quarter to afford a mortgage on a $810,200 house (the common benchmark worth) — down from $161,000 on the finish of 2023.

However that’s nonetheless a lot increased than in 2019 earlier than the pandemic, when the earnings wanted was $96,000, or 38 per cent decrease, stated Hogue.

“Consumers proceed to battle to discover a house they’ll afford within the aftermath of large worth escalation and spike in rates of interest throughout the pandemic,” he stated.

“Latest declines barely moved RBC’s affordability measures off worst-ever ranges nationally and in lots of main markets.”

RBC estimates the median earnings in Canada at $87,000, about half of the paycheque wanted to afford a house lately.

That will clarify why even 75 foundation factors of rate of interest cuts have failed to awaken house gross sales from their slumber.

Article content material

Commercial 3

Article content material

Royal LePage in its home worth survey out right this moment stated listings on its web sites hit a historic excessive in September, up 19 per cent from a yr in the past, however consumers proceed to bide their time.

“Regardless of three cuts to the Financial institution of Canada’s in a single day lending price, purchaser demand nationally stays weak, notably amongst two key teams: first-time homebuyers and small buyers,” stated Royal LePage chief govt Phil Soper.

Royal LePage says the nationwide house worth fell 1.1 per cent to $815,500 within the third quarter from the quarter earlier than, and it has revised down its forecast for the fourth quarter to five.5 per cent development, “to replicate present market circumstances.”

The excellent news is that housing affordability ought to proceed to enhance.

RBC expects the Financial institution of Canada to chop its rate of interest by one other 125 bps to three per cent by spring. In its base-case situation, house costs rise barely, rates of interest drop and family earnings grows.

“This can result in the reversal of greater than a 3rd of the large deterioration in RBC’s mixture affordability measure that occurred throughout the pandemic,” stated Hogue.

Commercial 4

Article content material

Enroll right here to get Posthaste delivered straight to your inbox.

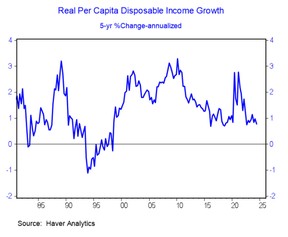

Inflation and better rates of interest have eaten into Canadians’ buying energy since 2022, a Parliamentary Finances Officer report stated this week, however there have been harder occasions, stated Priscilla Thiagamoorthy, senior economist at BMO Capital Markets.

Authorities help, increased wages and funding earnings have helped buffer Canadians from the rising value of dwelling, and for the previous yr and a half, buying energy development has been regular and roughly according to pre-pandemic developments, she stated.

“The large image is that though buying energy development is slower in comparison with the previous 20 years, it’s higher than the early Nineties,” she stated.

- The American Chamber of Commerce in Canada and the Enterprise Council of Canada host a dialog between U.S. ambassador David Cohen and Teck Sources CEO Jonathan Worth on important minerals in Ottawa

- In the present day’s Knowledge: United States shopper worth index for September

- Earnings: Aritzia Inc., Tilray Manufacturers Inc., Richelieu {Hardware} Ltd, Domino’s Pizza Inc., Delta Air Strains Inc.

Commercial 5

Article content material

Advisable from Editorial

-

Toronto lags the world in returning to the workplace

-

Immigrant entrepreneurs face hurdles

With rates of interest dropping, a brand new or refinanced mortgage would possibly make sense, however specialists say debtors must be careful for what could possibly be hefty charges. Discover out extra about the advantages and pitfalls right here

Construct your wealth

Are you a Canadian millennial (or youthful) with a long-term wealth constructing purpose? Do you want assist getting there? Drop us a line together with your contact data and your purpose and you can be featured anonymously in a brand new column on what it takes to construct wealth.

McLister on mortgages

Wish to study extra about mortgages? Mortgage strategist Robert McLister’s Monetary Put up column can assist navigate the complicated sector, from the newest developments to financing alternatives you gained’t need to miss. Plus examine his mortgage price web page for Canada’s lowest nationwide mortgage charges, up to date day by day.

In the present day’s Posthaste was written by Pamela Heaven, with extra reporting from Monetary Put up workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? E-mail us at [email protected].

Bookmark our web site and assist our journalism: Don’t miss the enterprise information it’s worthwhile to know — add financialpost.com to your bookmarks and join our newsletters right here.

Article content material