RBC says these worrying indicators are value keeping track of

Article content material

Article content material

Article content material

Donald Trump has “large” plans for the U.S. economic system — a smaller public sector, overhauling international commerce in order that it advantages Individuals and new tax insurance policies that intention to spur development.

However because the president himself admitted lately, the problem is getting there. “There’ll be a little bit disturbance, however we’re OK with that,” Trump advised Congress final week.

What that disturbance develops into is the query, and over the previous month the economists at Royal Financial institution of Canada have seen a number of “yellow flags” popping up within the knowledge.

Commercial 2

Article content material

Listed here are “the cracks forming within the U.S. economic system,” RBC chief economist Frances Donald and senior economist Mike Reid say are value keeping track of.

Sentiment is slumping

Client and enterprise surveys are flashing rising indicators of “financial discomfort,” stated the economists. The College of Michigan shopper confidence survey fell in January after rising for 5 months in a row and the Convention Board’s examine dropped in December and January after hitting a close to document leap in October. The NFIB survey of small enterprise reported that solely 15 per cent of companies had been planning on creating new jobs.

Nevertheless, that is “comfortable knowledge” and doesn’t essentially translate right into a decline within the “arduous knowledge” of shopper spending, they stated. What RBC thinks is occurring is that lower- and middle-income Individuals are scuffling with larger rates of interest and inflation, whereas higher-income teams stay in higher form.

The wealthier Individuals, who account for a bigger share of spending, are those to look at so far as the economic system is anxious. “A pullback amongst high-income shoppers would benefit a shift in our U.S. shopper outlook,” stated Donald and Reid.

Article content material

Commercial 3

Article content material

What might set off such a pullback? A inventory market meltdown for one factor, and there have been loads of indicators for fear there as tariff threats hike volatility. A current survey by the American Affiliation of Particular person Traders confirmed that bullish sentiment had declined to ranges seen solely in main inventory market drawdowns.

A plunging market would create a “unfavorable wealth impact” for higher-income earners that results in company earnings being revised decrease, inventory portfolios dropping worth and wealthier shoppers slicing again on spending, they stated.

Inflation expectations are rising

Inflation was already a priority in america, however now expectations are rising, mirrored in each shopper and enterprise surveys.

The hazard is this might change behaviour each within the economic system and inventory market, they stated.

Authorities job cuts are displaying up in knowledge

The federal authorities reduce 10,000 jobs in February and people numbers are prone to get larger. Deliberate job cuts measured by Challenger jumped 103 per cent.

The priority is that authorities cuts will filter by way of to the broader economic system by cancelling contracts and future funding. Some universities, for instance, lately introduced they’re freezing hiring.

Commercial 4

Article content material

Client debt is swelling

American shoppers piled on US$56 billion in non-real-estate debt in December and January and most of it was on bank cards, stated the economists. Meaning they’re now spending 2.5 per cent of their month-to-month disposable revenue on non-mortgage curiosity funds, a share that might rise because the Federal Reserve retains rates of interest excessive and dear credit score debt mounts. The rising debt burden is already displaying up in “arduous knowledge” with actual private spending falling by greater than 5 per cent from the 12 months earlier than in January, stated the economists.

At this level RBC nonetheless expects the U.S. economic system to drag off a “comfortable touchdown” however will watch these “yellow flags” intently within the months to come back.

“We surmise it’s uncertainty itself weighing on a lot of those indicators — an uncertainty that might reverse or change — but in addition dangers bleeding into the true economic system in additional tangible methods if left unchecked,” stated Donald and Reid.

Enroll right here to get Posthaste delivered straight to your inbox.

The place the Financial institution of Canada rate of interest goes subsequent is unsure, as a result of nobody is aware of what Trump and his tariffs will do subsequent, however economists say it’s prone to be decrease than the market expects.

Commercial 5

Article content material

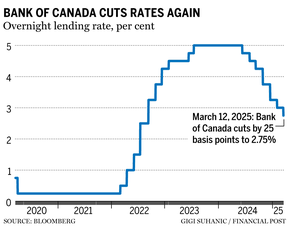

Canada’s central financial institution reduce its key price to 2.75 per cent Wednesday, warning the financial affect of a protracted commerce struggle with america may very well be extreme.

If tariffs take maintain, the financial institution could should steadiness rising inflation with a slowing economic system, and plenty of economists suppose it’s going to come down on the facet of weak development.

Financial institution of Montreal economists count on three extra cuts bringing the speed to 2 per cent.

“Our core assumption is that Canada will probably be dealing with some critical tariffs for an prolonged time period and that the expansion dampening features of the commerce struggle will finally outweigh the upside inflationary affect, protecting the Financial institution in easing mode,” wrote Douglas Porter, chief economist for BMO Capital Markets.

- At the moment’s Information: Canada constructing permits, U.S. producer worth index

- Earnings: Transat AT Inc., Empire Co. Ltd.

British Columbia-based couple Gloria, 49, and Rob, 51, are centered on an early retirement and a career-change for Gloria. However are the 2 objectives suitable? Household Finance walks them by way of the eventualities and the important thing questions they should handle. Learn extra

Commercial 6

Article content material

Calling Canadian households with youthful youngsters or teenagers: Whether or not it’s budgeting, spending, investing, paying off debt, or simply paying the payments, does your loved ones have any monetary resolutions for the approaching 12 months? Tell us at wealth@postmedia.com.

McLister on mortgages

Need to study extra about mortgages? Mortgage strategist Robert McLister’s Monetary Put up column may also help navigate the advanced sector, from the most recent traits to financing alternatives you gained’t need to miss. Plus test his mortgage price web page for Canada’s lowest nationwide mortgage charges, up to date each day.

Monetary Put up on YouTube

Go to the Monetary Put up’s YouTube channel for interviews with Canada’s main specialists in enterprise, economics, housing, the power sector and extra.

At the moment’s Posthaste was written by Pamela Heaven, with extra reporting from Monetary Put up employees, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this text? E-mail us at posthaste@postmedia.com.

Really useful from Editorial

Bookmark our web site and help our journalism: Don’t miss the enterprise information you want to know — add financialpost.com to your bookmarks and join our newsletters right here

Article content material