Not too long ago, I used to be a visitor on the ChooseFI podcast, Episode 543, to speak in regards to the Center-Class Lure, a time period Scott Trench and I’ve coined on the BiggerPockets Cash Podcast, to explain a situation somebody on the trail to FIRE (Monetary Independence, Retire Early) would possibly discover themselves on in the event that they’re not cautious.

The crux of the Center-Class Lure is: You do all the things proper, max out your 401(ok), dutifully pay down (or off) your mortgage—maybe you go as far as to contribute to HSA and Roth IRA accounts. You end up at your FI quantity and make plans to retire early, however upon additional inspection, you’ll be able to’t really entry these funds with out paying charges and/or excessive rates of interest.

How Did I Get Right here?

The traditional FI knowledge is to contribute to your tax-advantaged accounts to get your organization match, then max out Roth IRA and HSA, then return and proceed with tax-advantaged accounts to the tip of your investing {dollars} or till it’s maxed, after which transfer to after-tax brokerage accounts.

The issue right here is that many individuals’s investing {dollars} run out earlier than they get to their after-tax brokerage accounts. Or, to cite one respondent, “My 401(ok) simply comes out of my paycheck tremendous straightforward; taxable takes extra work that I’m not pretty much as good about.”

Chatting about it with my husband, he had this to say:

“In my case, after I began working, I wasn’t incomes sufficient to max out my 401(ok). On the time, my wage as a software program developer was a wholesome $36,000 (hey, it was 25 years in the past!). 401(ok) limits have been $10,500.

In fact, the time in our life while you’re making the least quantity of cash is in the beginning of your profession. Additionally, I was saddled with faculty loans. It took a decade of labor earlier than I had sufficient left over after maxing out my 401(ok) to take into consideration vital contributions to a post-tax account.

Subsequently, my 401(ok) had an enormous head begin. And by the point I may contribute wholesome quantities to an after-tax account, I used to be making good cash ($95,000/yr), so the incentives have been a lot larger to max out my 401(ok) to chop my taxable revenue ($16,500).”

In fact, to be higher about after-tax investing, you can set it up with HR to ship a set quantity to your brokerage account each paycheck. You’d additionally must arrange computerized investing together with your brokerage; in any other case you’d end up in a similar-but-different place of getting the cash there, however not invested in something.

The Center-Class Lure ISN’T a Downside!?

As a response to this episode, Sean Mullaney, The FI Tax Man, and a CPA, wrote this text, sharing why he felt the Center-Class Lure doesn’t exist and isn’t an issue for folks on the trail to FI.

Now, Sean and I are buddies, so this text isn’t an assault on me—it’s a wholesome dialogue (within the type of a rebuttal) between people who find themselves actually simply attempting to deliver mild to conditions (and options) in order that in case you DO determine with the Center-Class Lure, you can begin engaged on a monetary change.

One very essential level to notice (and Brad introduced it up in Episode 543) is that whereas your private home fairness IS a part of your internet price, it ought to NOT be a part of your FI quantity. I feel a lot of FIRE Group peeps conflate these two numbers. I do know I continuously do. However in case you’re planning on retiring early, AND persevering with to dwell in your house, your FI calculation ought to NOT embrace that house fairness.

Additional, I’d argue that in case you are planning to maneuver out of your present house and downsize into one thing else, you need to take a take a look at the actual property market the place you hope to retire. With the run-up in house valuation over the previous few years, you can be promoting your present house solely to tackle an analogous—and even bigger—mortgage fee as a result of rising rates of interest. For those who’re paying money for the brand new house, this issues much less however can even take a great chunk of your fairness, so make certain to issue that in.

10% Penalty Isn’t a Barrier to Early Retirement

In one other level Sean makes, he says, “The ten% Early Withdrawal Penalty Is No Bar to Early Retirement.”

I feel Sean forgets who he’s speaking to. These are the identical people who find themselves vigorously debating 50 foundation factors on an funding account. They’re not going to drop 10% on charges to entry their cash.

Efficient Tax Price

Sean does deliver up a superb level in regards to the efficient tax charge, and that is one thing that I’m “conscious” of however all the time neglect. I additionally really feel like I signify the extra “common” FIRE adherent in that I’m not formally skilled on this like a monetary planner could be. The tax code is complicated on function, and I really feel the totally different tiers of taxation are NOT designed to clear issues up.

The Efficient Tax Price means the ACTUAL charge of tax you pay, when you have in mind the quantity of taxes paid in your revenue that falls into the ten% bracket, the taxes paid at 12%, and many others.

The federal tax brackets chart exhibits the tax charge you’ll pay on any set revenue vary, relying in your submitting standing.

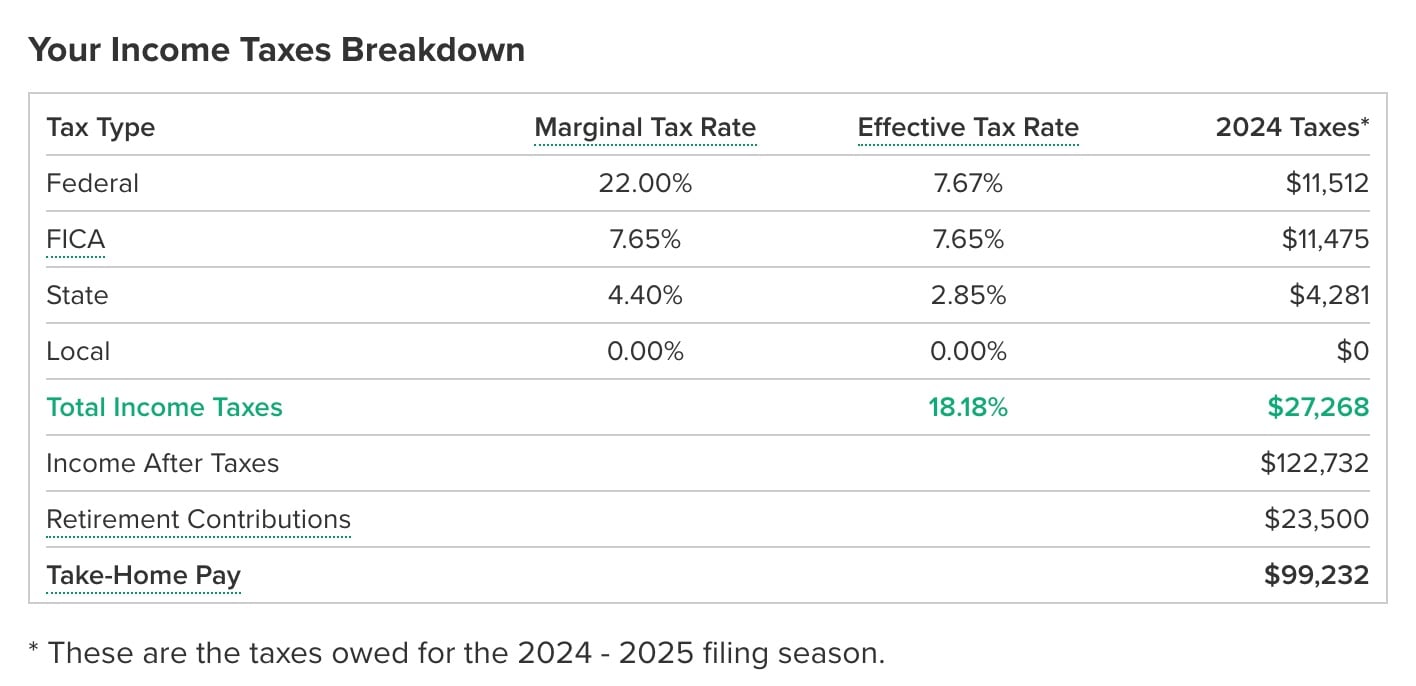

Sensible Asset has a superb Efficient Tax Price Calculator that can offer you a down-and-dirty estimate of your taxes owed. I ran a fast hypothetical, and on $150,000 in revenue, submitting in Colorado and maxing out your conventional 401(ok), your take-home revenue for the yr is simply over $99,000, and your efficient tax charge is eighteen%.

Right here is how the taxes shake out:

“I Don’t Have Sufficient Left Over”

I’ll argue the purpose made by one of many respondents within the ChooseFI group: After maxing out the 401(ok), paying payments, and doing all of the issues, there isn’t a complete lot left over to place into an after-tax brokerage. Bear in mind, these FI folks may also be maxing out an HSA ($8,550) and a Roth ($7,000). In that case, we’re now at $83,600, however we nonetheless haven’t paid for something for each day life but.

We’re at $6,900/month. Let’s begin paying some payments.

I tracked my spending in 2022 at www.biggerpockets.com/mindysbudget, and actuality exhibits my spending to be $6,500/month on common. (Which is completely NOT what I assumed my spending was, and I encourage everybody to trace their spending in actual time for a couple of months to find out your ACTUAL spending, not what you THINK you’re spending.)

That doesn’t depart a complete lot left over to place into an after-tax brokerage account if I have been this fictional individual within the instance above—about $400/month.

The Argument for Brokerage Accounts Anyway

And whereas Sean (and Brad and Chris) all espoused the tax advantages of the normal 401(ok), paying 10% penalties to get your cash is 10% PLUS paying revenue tax on the withdrawals—revenue tax brackets begin at $1 revenue. Evaluate that to the capital beneficial properties tax charges that apply to brokerage accounts however don’t begin till $96,701—AND needless to say’s simply the GAIN.

My good friend Jeremy Schneider over at Private Finance Membership made this EXCELLENT graphic to point out simply how highly effective the brokerage account could be—and how one can entry as much as $253,400 TAX-FREE!

I reached out to Jeremy to ask him to interrupt this down additional, and he didn’t disappoint. He stated:

“There are particular tax brackets set by the federal authorities for capital beneficial properties. Capital beneficial properties are while you promote stuff for a revenue, just like the investments you maintain in a daily brokerage account. In 2025, the bottom capital beneficial properties tax bracket is 0% for single filers with as much as $48,350 in revenue and married filers with as much as $96,700 revenue. Meaning if you retire early and end up with no different revenue, you’ll be able to ‘notice’ as much as that a lot in capital beneficial properties every year and pay ZERO federal tax.

Moreover, the married submitting collectively customary tax deduction for 2025 is $30,000. So you get to subtract that quantity from any revenue earlier than you apply the tax bracket. Meaning you’ll be able to really notice as much as $126,700 in beneficial properties and nonetheless pay ZERO federal tax. ($126,700 – $30,000 customary deduction = $96,700, which all falls within the 0% capital beneficial properties bracket.)

Moreover, you don’t pay tax on any PRINCIPAL of your investments. For instance, in case you invested $10,000 and it grows to $15,000, and then you definitely promote and spend the cash, you’d solely be on the hook to pay tax on the achieve of $5,000, not the complete quantity of $15,000. The instance on this submit assumes Will and Whitney’s investments have doubled after they promote, which means they wouldn’t owe capital beneficial properties tax on the $126,700 of principal, giving them a complete of $253,400 they will spend in a yr and pay zero tax.

In fact, that is for long-term capital beneficial properties—which means investments you’ve held for MORE than one yr. Common revenue tax applies to short-term capital beneficial properties—investments held for lower than one yr.”

It’s Necessary When It Occurs to YOU

One level I introduced up in Episode 543, and need to restate right here, is that I’ve 100+ emails in my inbox from listeners of the BiggerPockets Cash Podcast who determine with the Center-Class Lure and are in search of a means out of it.

When it’s occurring to you, it sort of doesn’t matter that you simply’re “within the minority” of individuals with this problem. You’re 100% of your personal private expertise.

Scott and I didn’t begin speaking about the Center-Class Lure to trigger an inter-podcast warfare. We introduced it as much as get our listeners to start out serious about the place their cash goes. To begin directing it on function to allow them to attain early retirement and really retire, as a result of they’ve acquired cash within the right buckets.

Sean talked about the 72T choice, which Scott and I additionally introduced up in our episode, The best way to Keep away from the Center-Class Lure. This selection, as soon as initiated, requires you to take basically the identical distribution for no less than 5 years, or till you attain age 59½, whichever comes first, however these distributions are penalty-free.

Not tax-free—you continue to pay revenue tax on the distribution. And whereas 72T could be began at any age, the youthful you might be while you begin, the longer you must take this cash. Uncle Sam desires his cash!

An alternative choice—however solely out there to folks age 55 or older—is the Rule of 55, which permits for penalty-free withdrawals as long as you’ve separated from the corporate you’ve your 401(ok)/IRA with, and have reached age 55. You may get one other job, however in case you roll over your 401(ok)/IRA to the brand new firm, your withdrawals should cease.

There ARE choices out there to you, however provided that to ask about them.

Verbal Numbers Are Arduous to Observe

Throughout Episode 543, I used to be spouting out numbers from precise Finance Friday visitors to attempt to illustrate my level, and Sean helpfully put all of them right into a chart in his article so you’ll be able to comply with alongside. I feel Sean’s abstract of those 4 eventualities is spot on: “Individuals A, B, and D should not within the Center-Class Lure. Reasonably, they’re in a state of affairs the place they should work longer…”

In the end, that is the place our Finance Friday visitors continuously discover themselves: not as FI as they thought they have been.

Which I feel goes again to the highest: Your property fairness is a part of your internet price, however shouldn’t be included in your calculations when figuring out how a lot you’ve for retirement.

I’m so completely satisfied this dialogue that Scott and I began sparked a lot dialog in our neighborhood. All these totally different factors of view solely assist us all be taught.

Due to Brad Barrett and Chris Mamula for the dialog and to Sean Mullaney, The FI Tax Man, for this considerate response.

The Cash Podcast

Kickstart your private finance journey with Scott and Mindy as they break down the great, dangerous, and ugly of individuals’s private cash tales. From interviews with entrepreneurs and enterprise house owners to breakdowns of listener funds, you’ll get actionable recommendation on easy methods to get out of debt and develop your cash.