U.S. shares ended greater on Friday following the discharge of the newest PCE inflation information, however the three main indexes nonetheless posted losses for the week.

Supply: Investing.com

The S&P 500 and tech-heavy Nasdaq Composite snapped three-week streaks of weekly features, falling 0.3% and 0.7% respectively. The 30-stock ended 0.2% decrease for the interval, whereas the small-cap shed 0.6%.

Extra volatility may very well be in retailer within the week forward as buyers assess the outlook for the economic system, inflation, rates of interest and company earnings amid ongoing commerce tensions.

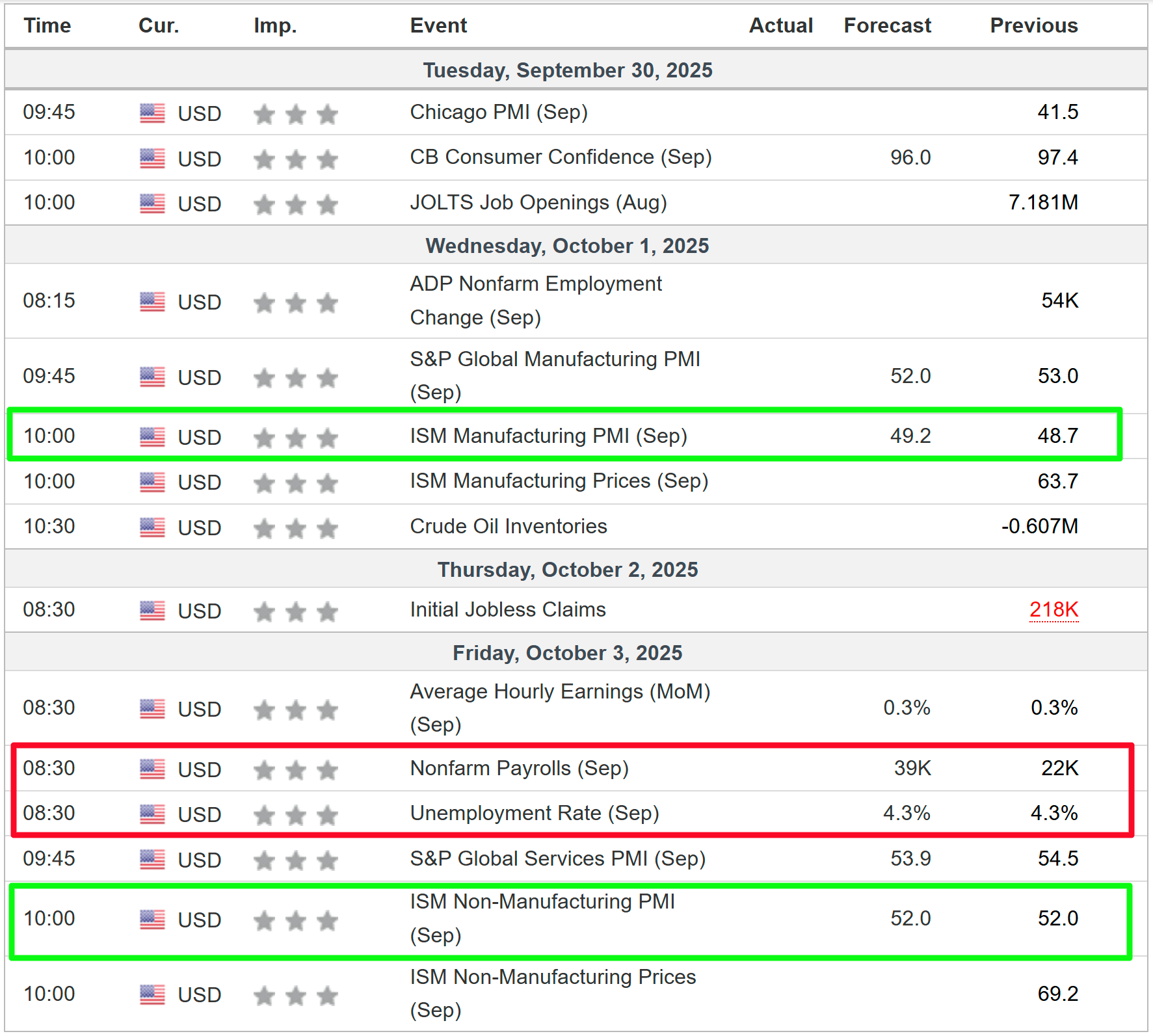

Most essential on the financial calendar shall be Friday’s U.S. employment report for September, which is forecast to indicate the economic system added 39,000 positions. The unemployment charge is seen holding regular at 4.3%. Along with the roles report, the ISM manufacturing and companies PMIs may even be intently watched.

Supply: Investing.com

That shall be accompanied by a heavy slate of Fed audio system, together with district governors Chris Waller, Raphael Bostic, John Williams, and Alberto Musalem all set to make public appearances. Markets proceed to cost in two quarter-point charge cuts on the Fed’s upcoming conferences, which is what the central financial institution has projected.

And whereas the earnings season is all however over, just a few notable corporations will report within the coming week, together with (NYSE:NKE), , , , and .

No matter which course the market goes, beneath I spotlight one inventory prone to be in demand and one other which may see recent draw back. Keep in mind although, my timeframe is simply for the week forward, Monday, September 29 – Friday, October 3.

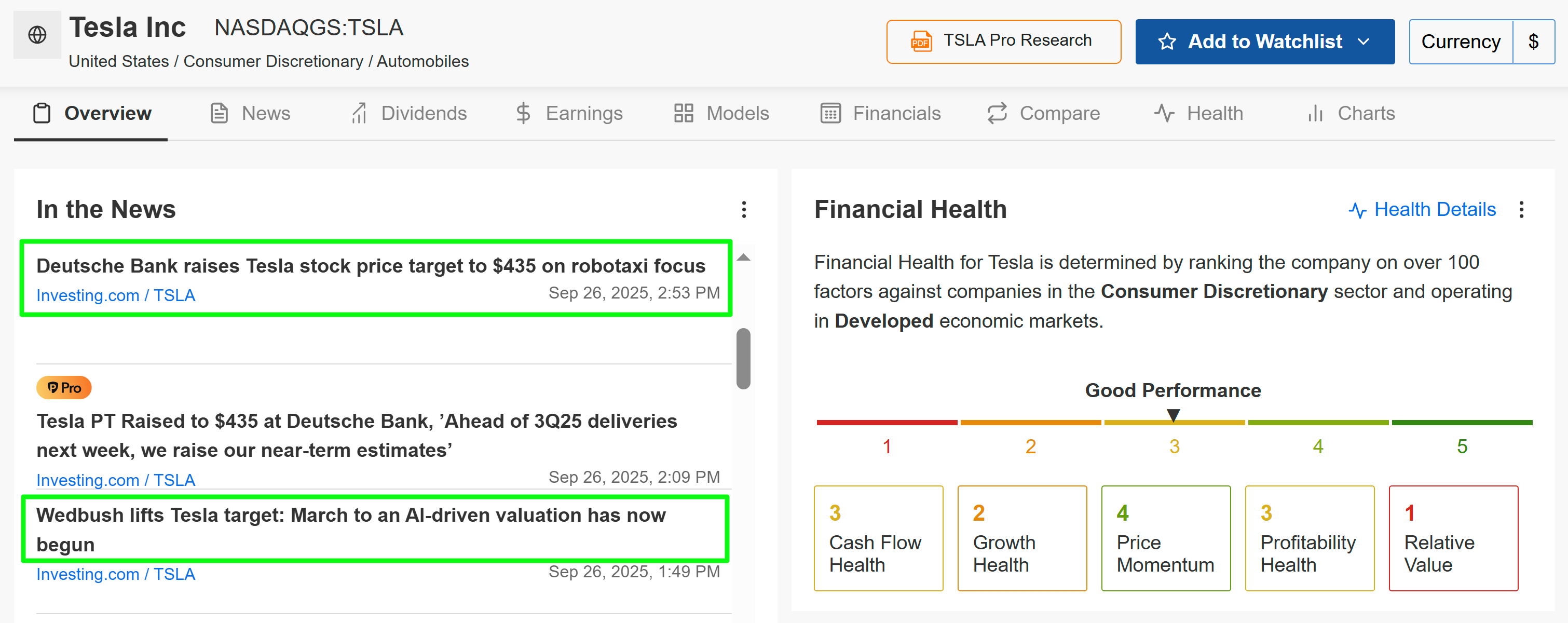

Inventory to Purchase: Tesla

(NASDAQ:TSLA) emerges because the compelling purchase alternative this week, with a number of catalysts converging that would drive important upside past present market expectations.

TSLA inventory closed Friday’s session at $440.40, properly above each its 50-day ($351.96) and 200-day ($334.47) transferring averages. Pivot factors present near-term resistance at $442.36, with help at $436.17–$433.90.

Supply: Investing.com

The first catalyst is its upcoming third-quarter EV supply and manufacturing report, scheduled for Thursday morning, which has the potential to handily beat a comparatively low bar set by Wall Road. Analyst consensus from FactSet tasks world Q3 deliveries at roughly 448,000 autos, a 17% improve from Q2 however a 3% decline year-over-year.

Nevertheless, the Kalshi prediction market is way extra optimistic, forecasting a record-breaking 505,000 items. This bullish outlook is pushed by shoppers possible dashing to capitalize on the $7,500 EV tax credit score, set to run out on September 30. Tesla produces the Mannequin 3, the Mannequin Y, Mannequin X and Mannequin S, in addition to the Semi and Cybertruck.

Past the supply numbers, what may additionally drive Tesla’s inventory greater are the continuing developments in its self-driving ambitions. CEO Elon Musk introduced that Full Self-Driving (FSD) Model 14 can have an “early vast” launch this week. Musk has additionally hinted that Tesla’s robotaxis may function with out security displays or drivers by the top of the 12 months.

Supply: InvestingPro

It’s value mentioning that Tesla’s monetary well being stands out as assessed by InvestingPro’s AI-backed quantitative fashions, with an general InvestingPro rating of two.67 (“GOOD”), supported by robust money circulate and profitability.

Make sure to try InvestingPro to remain in sync with the market development and what it means in your buying and selling. Subscribe now for $9/month and place your portfolio one step forward of everybody else!

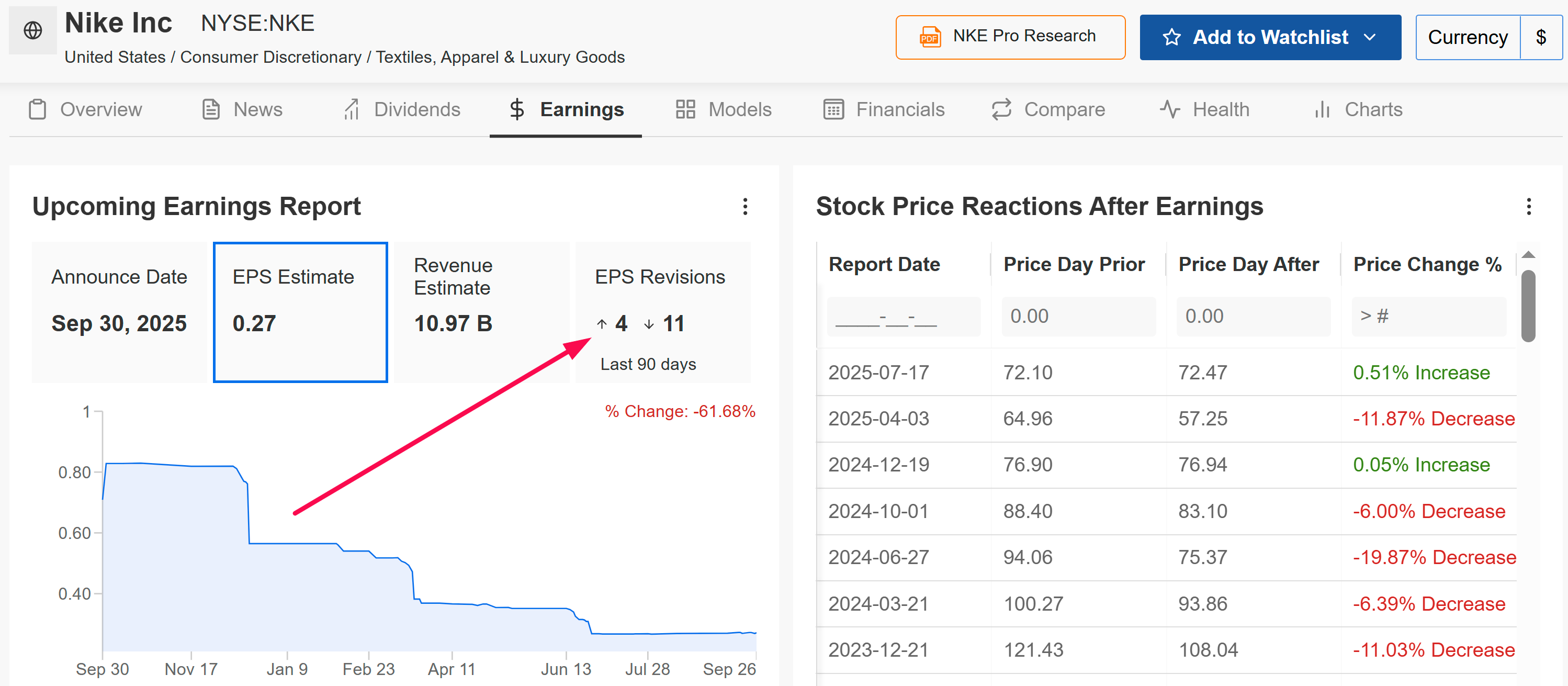

Inventory to Promote: Nike

Nike, then again, is a inventory to contemplate promoting this week because it faces a number of headwinds heading into its newest earnings report. The sports activities attire titan is slated to ship its fiscal Q1 outcomes after the closing bell on Tuesday at 4:15PM ET and the outlook is grim.

Regardless of its robust model recognition, the sneaker big has confronted mounting challenges in latest quarters, battling shifting client preferences, elevated competitors, and provide chain challenges.

Analyst sentiment is overwhelmingly bearish, with 11 downward revisions within the weeks previous the report in comparison with 4 upward changes. With implied volatility pointing to a +/-6.6% inventory transfer post-earnings, the danger of a miss looms massive.

Supply: InvestingPro

Nike is anticipated to put up a staggering 61% year-over-year drop in adjusted earnings per share to $0.27. Income is projected to fall by roughly 5% from the year-ago interval to about $11 billion, reflecting slowing progress in North America and China, two of Nike’s largest markets.

Ought to this forecast show correct, it will mark the sixth consecutive quarter of declining income for the Beaverton-based big, pushed by intense competitors from rising footwear manufacturers like Hoka (owned by ) and . Including to Nike’s challenges are macroeconomic headwinds, together with greater tariffs that would additional strain margins.

Amid this backdrop, promoting strain has been constructing as Wall Road awaits concrete proof of a profitable turnaround beneath its new Chief Government, Elliott Hill. With profitability plummeting and progress nowhere in sight, Nike’s earnings report is extra prone to affirm ongoing weak point than sign a return to type.

Supply: Investing.com

NKE inventory ended at $69.31 on Friday, nearly precisely on its 200-day transferring common and beneath its 50-day, reflecting the market’s uncertainty. Technical evaluation requires “robust promote” on day by day and weekly timeframes, reflecting a lack of momentum.

Moreover, it must be famous that Nike has an InvestingPro Monetary Well being rating of two.2 out of 5.0, labeled as “FAIR”, attributable to mounting fears over weakening gross revenue margins, spotty gross sales progress and a excessive debt-to-equity ratio.

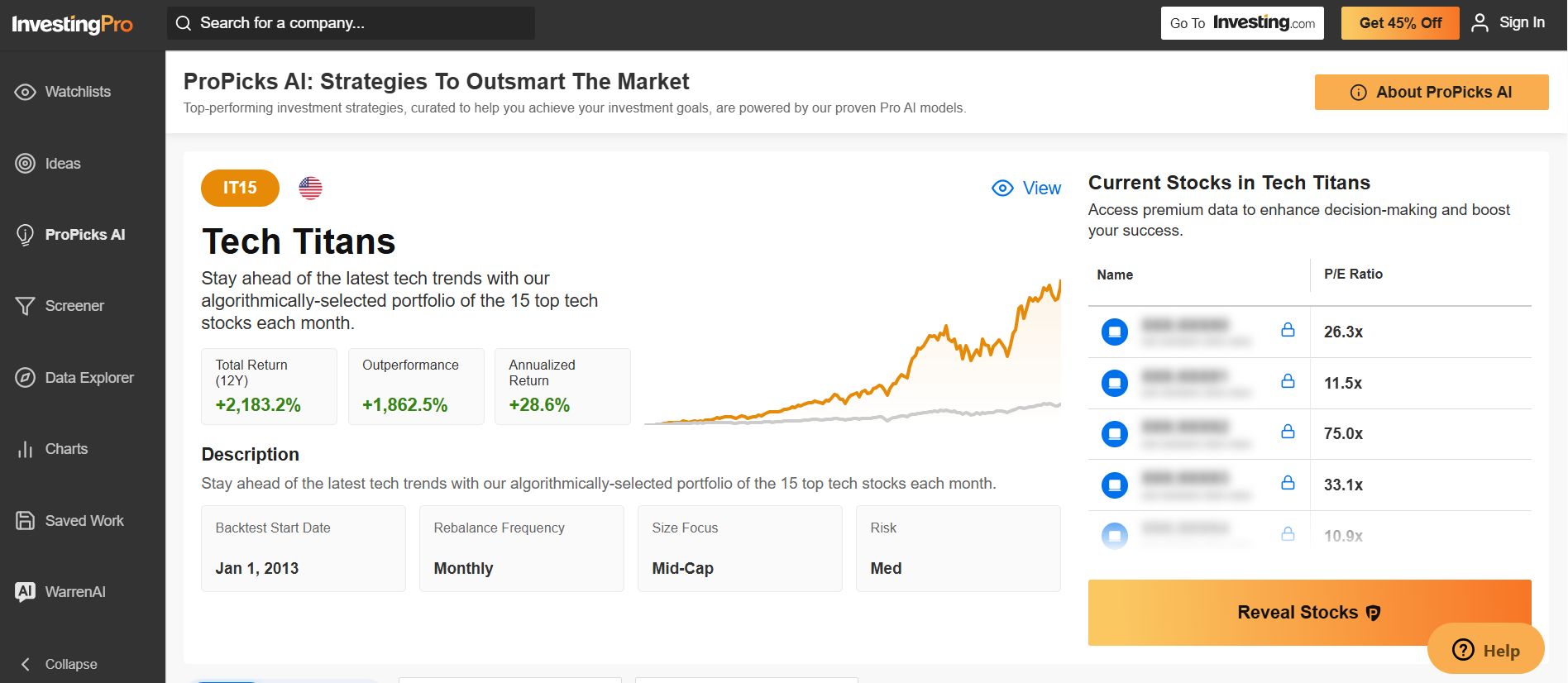

Whether or not you’re a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now and immediately unlock entry to a number of market-beating options, together with:

- ProPicks AI: AI-selected inventory winners with confirmed observe document.

- InvestingPro Truthful Worth: Immediately discover out if a inventory is underpriced or overvalued.

- Superior Inventory Screener: Seek for the perfect shares primarily based on a whole bunch of chosen filters, and standards.

- High Concepts: See what shares billionaire buyers resembling Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the Nasdaq 100 by way of the SPDR® S&P 500 ETF (SPY), and the . I’m additionally lengthy on the , and Invesco S&P 500 Equal Weight ETF (RSP).

I commonly rebalance my portfolio of particular person shares and ETFs primarily based on ongoing danger evaluation of each the macroeconomic setting and corporations’ financials.

The views mentioned on this article are solely the opinion of the writer and shouldn’t be taken as funding recommendation.

Comply with Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.