- Volatility could return in 2025, creating recent alternatives for savvy buyers.

- A concentrated rally raises questions—are there nonetheless undervalued gems out there?

- Utilizing a confirmed inventory screening technique, we have pinpointed three undervalued shares with 30%+ upside.

- Kick off the brand new 12 months with a portfolio constructed for volatility and undervalued gems – subscribe now throughout our New 12 months’s Sale and rise up to 50% off on InvestingPro!

Volatility might make a comeback in 2025, with forecasts predicting a shift in market dynamics after two years of practically uninterrupted positive aspects.

Many monetary consultants are anticipating a correction, and whereas which may sound unsettling, extra volatility usually interprets into recent alternatives—particularly in immediately’s hyper-concentrated market.

A Rally Pushed by Only a Few Shares

The surge within the since October 2022 has been exceptional, climbing practically 70%. Nevertheless, this rally has been largely fueled by a handful of powerhouse shares—notably these tied to the AI increase.

As Duncan Lamont, CFA, Head of Strategic Analysis at Schroders, identified, the six largest U.S. firms now maintain a mixed market share higher than the subsequent six largest nations—Japan, the UK, Canada, France, China, and Switzerland—mixed. The load of those six shares is the same as that of two,000 of the smallest world firms.

One standout is Nvidia (NASDAQ:), whose market capitalization has soared by over $2 trillion this 12 months alone, a determine greater than double the overall worth of Italy’s inventory market.

Are There Nonetheless Undervalued Gems within the Market?

With a couple of shares driving the market’s momentum, many marvel if there are different high-quality, undervalued firms nonetheless ripe for progress. The reply is sure—although discovering them is not any easy process. Screening for these alternatives takes time, and as seasoned buyers know, time is cash.

That’s the place inventory screeners come in useful. With instruments like InvestingPro’s inventory screener, you possibly can shortly sift via potential candidates, making use of filters primarily based on key monetary metrics. This lets you deal with shares which have sturdy fundamentals and important upside potential—with out getting misplaced within the noise.

Here is How I Discovered 3 Excessive-High quality Undervalued Shares With 30%+ Upside Potential

One highly effective methodology for figuring out high-quality shares is utilizing the Piotroski F-Rating, a system developed by Stanford professor Joseph Piotroski. This strategy evaluates firms on 9 key metrics, together with profitability, liquidity, and working effectivity. Traditionally, this filter has delivered spectacular outcomes, with a mean annualized return of 23% over twenty years.

Utilizing the Piotroski filter, you possibly can slender down your checklist to firms with excessive scores and strong fundamentals. Search for firms that meet no less than eight of the 9 standards, specializing in these with constructive returns, sturdy money circulation, low debt, and increasing margins.

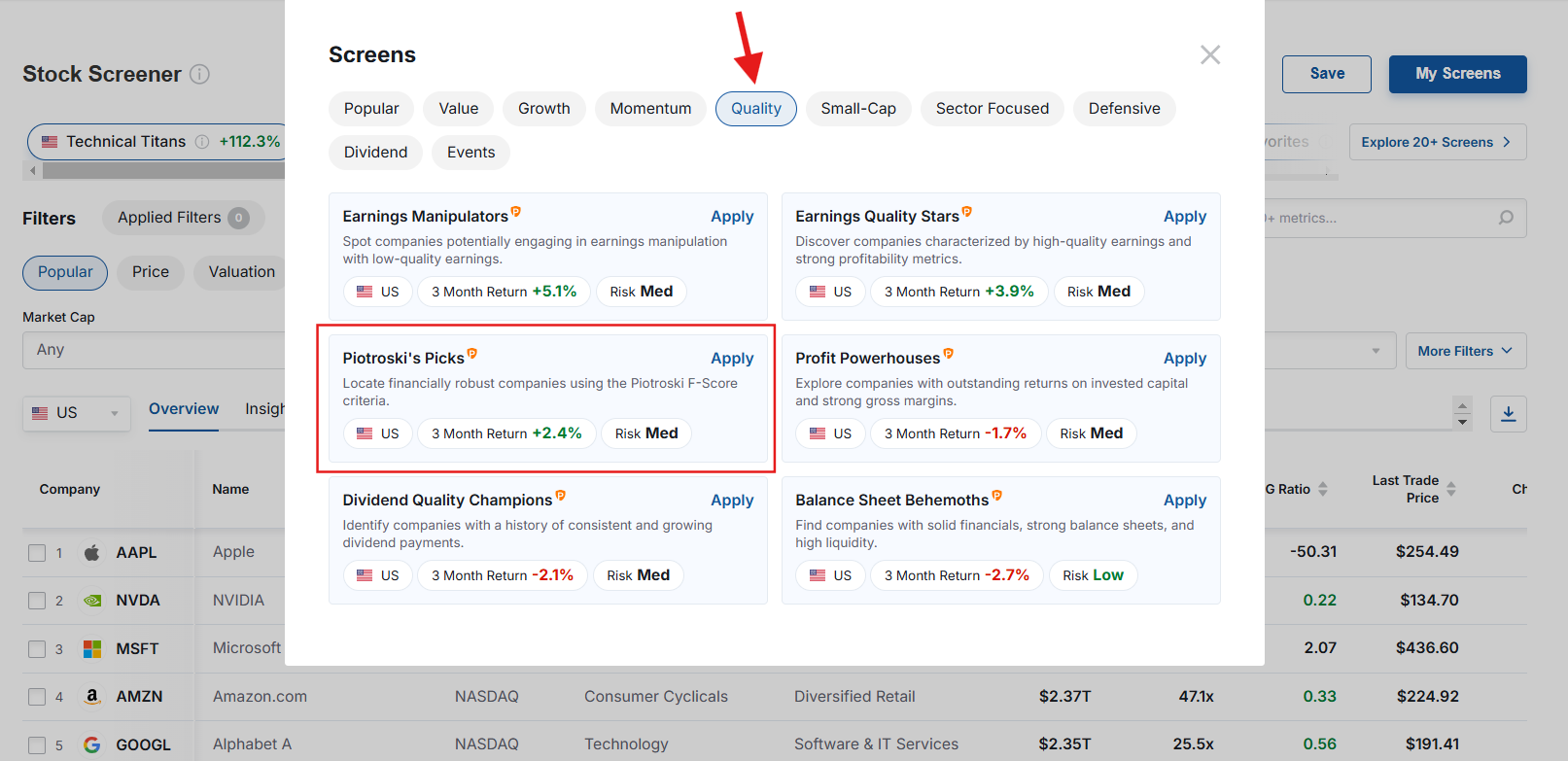

Supply: InvestingPro

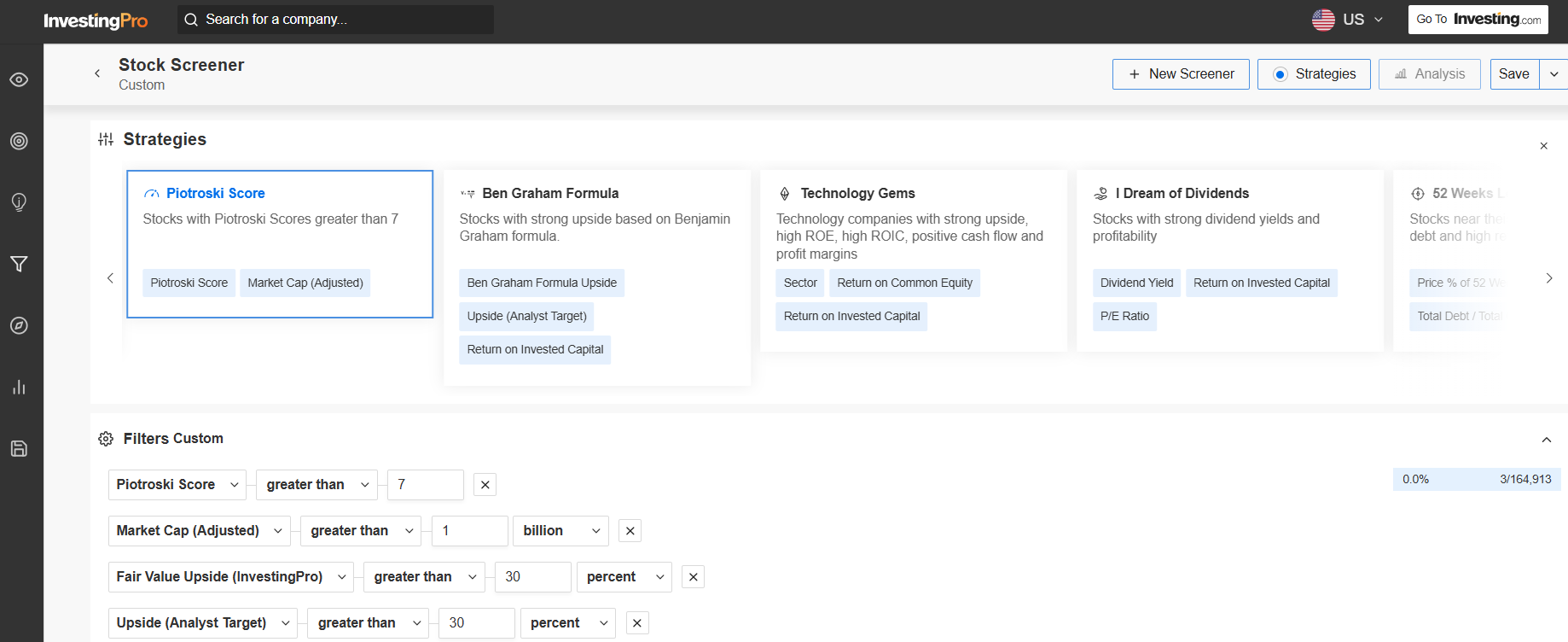

After filtering for high quality, the subsequent step is figuring out shares that additionally provide important upside potential. Utilizing predefined parameters—such at least market cap of $1 billion and analysts’ goal costs—you possibly can additional refine your search to focus on solely shares with no less than 30% upside potential.

Supply: InvestingPro

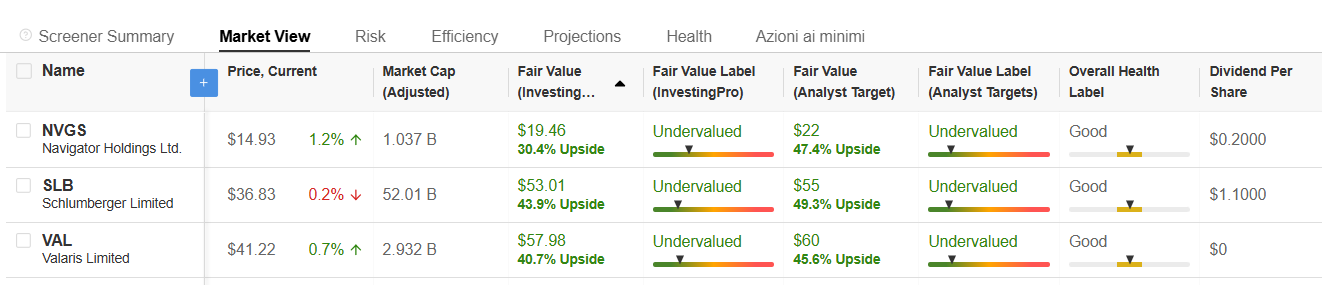

After making use of these filters, three standout shares emerge as sturdy candidates for 2025. These firms not solely rating extremely on Piotroski’s scale however are additionally undervalued in line with analysts’ honest worth estimates and goal costs:

- Navigator Holdings (NYSE:) – Piotroski Rating 8, Honest Worth +30.4%, Analyst TP +47.4%

- Schlumberger NV (NYSE:) – Piotroski Rating 9, Honest Worth +43.9%, Analyst TP +49.3%

- Valaris (NYSE:) – Piotroski Rating 8, Honest Worth +40.7%, Analyst TP +45.6%

Unlock the potential to focus on strong, undervalued shares poised for important progress in 2025 through the use of the technique we have outlined.

Curious how the world’s prime buyers are positioning their portfolios for subsequent 12 months utilizing methods identical to this one?

Don’t miss out on the New 12 months’s provide—your last probability to safe InvestingPro at 50% low cost.

Get unique entry to elite funding methods, over 100 AI-driven inventory suggestions month-to-month, and the highly effective Professional screener that helped establish these high-potential shares.

Able to take your portfolio to the subsequent stage? Click on the banner beneath to find extra.

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, counsel or advice to speculate as such it’s not supposed to incentivize the acquisition of belongings in any manner. I wish to remind you that any sort of asset, is evaluated from a number of views and is extremely dangerous and subsequently, any funding resolution and the related threat stays with the investor.