- There are a number of shares which have scored sturdy triple-digit year-to-date positive aspects.

- This comes amid a spectacular bull marketplace for the inventory market this yr.

- With sturdy monetary well being and robust development trajectories, we’ll spotlight three shares to be actually grateful for as 2024 nears its shut.

- In search of extra actionable commerce concepts? Subscribe right here for 60% off InvestingPro as a part of our Black Friday sale!

As Thanksgiving approaches, there’s a lot to be glad about within the inventory market.

Three corporations stand out in 2024 for his or her extraordinary returns and vital upside potential: Applovin Corp (NASDAQ:), Palantir Applied sciences (NASDAQ:), and Vistra Power (NYSE:).

These corporations not solely delivered stellar year-to-date performances but in addition maintained sturdy monetary well being, with above-average InvestingPro Monetary Well being Scores.

For each seasoned buyers and newcomers, these shares symbolize innovation and resilience of their respective industries.

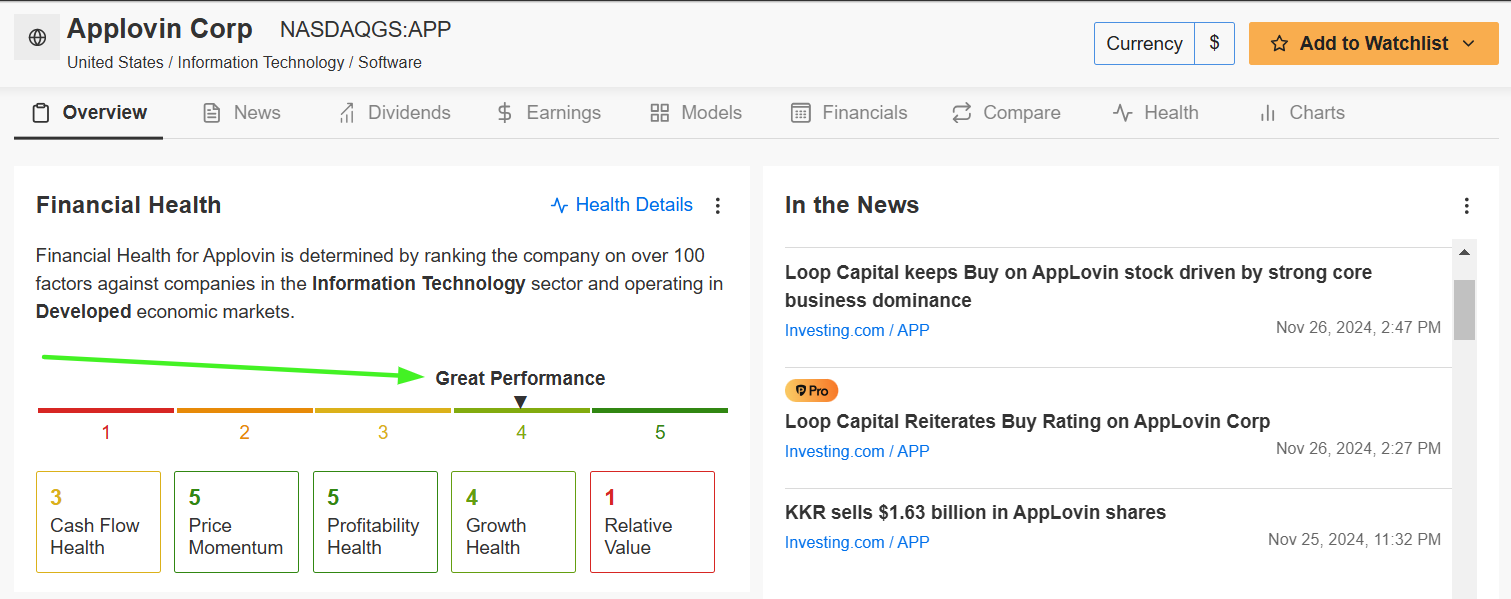

1. AppLovin

- 2024 Efficiency: +727.5% YTD

- Market Cap: $110.7 Billion

What They Do: AppLovin makes a speciality of cell app monetization and advertising and marketing options, providing AI-powered instruments that assist builders develop and optimize their apps.

Supply: Investing.com

Why It’s Thriving: AppLovin’s meteoric rise—from $39.41 initially of the yr to an all-time excessive of $344.77—has been fueled by surging demand for cell gaming and app analytics.

Traders stay bullish as AppLovin capitalizes on the rising demand for in-app promoting options, supported by its revolutionary AI-driven algorithms. With additional enlargement into international markets, its development trajectory stays compelling.

Supply: InvestingPro

Its above-average Monetary Well being Rating of three.5 additional underscores its resilience in managing development and profitability, making it an investor favourite.

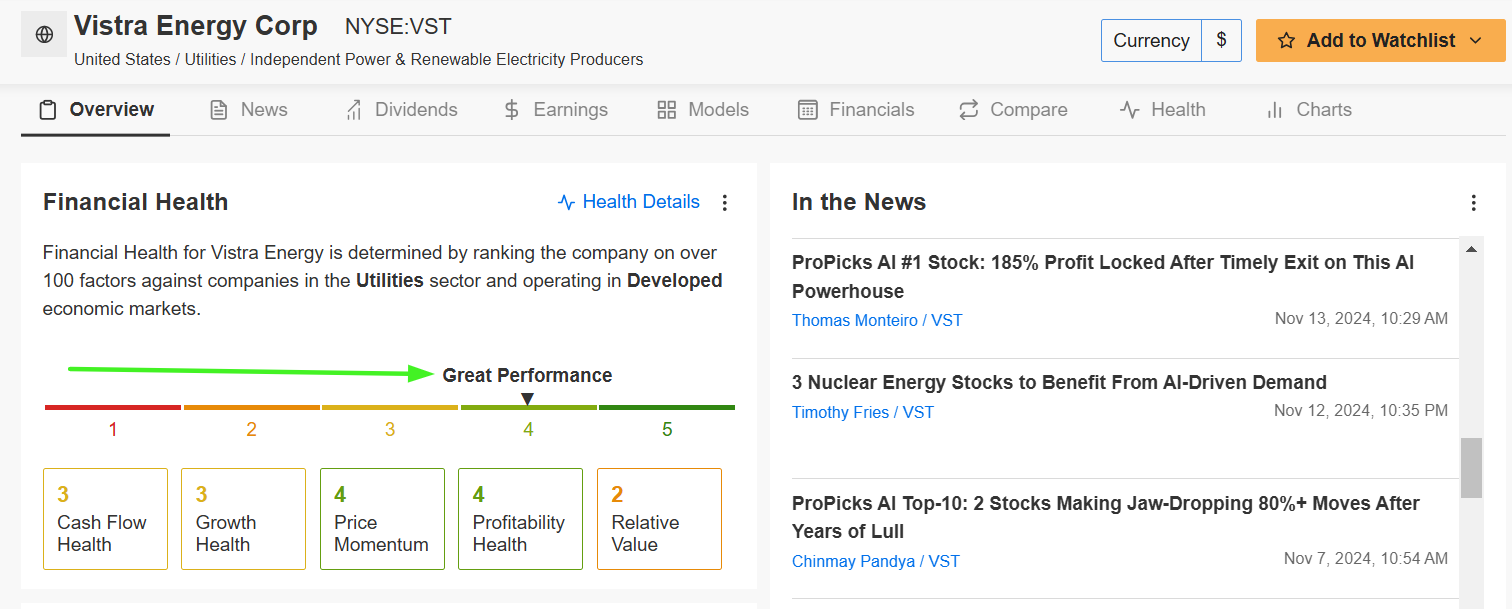

2. Vistra Power

- 2024 Efficiency: +322.3% YTD

- Market Cap: $55.3 Billion

What They Do: Vistra Power is a serious vitality supplier with operations in conventional energy technology and renewable vitality, together with battery storage initiatives.

Supply: Investing.com

Why It’s Thriving: From $38.29 initially of the yr to a file $168.67, Vistra’s success is rooted in its twin technique of embracing clear vitality whereas sustaining its conventional operations.

The corporate has capitalized on the shift towards clear vitality with strategic investments in renewable energy and battery storage applied sciences. As international demand for sustainable vitality options grows, Vistra’s investments in renewable vitality infrastructure have positioned it as a frontrunner within the sector.

Supply: InvestingPro

Its Monetary Well being Rating of three.2 highlights its skill to navigate the evolving vitality panorama whereas pursuing long-term development.

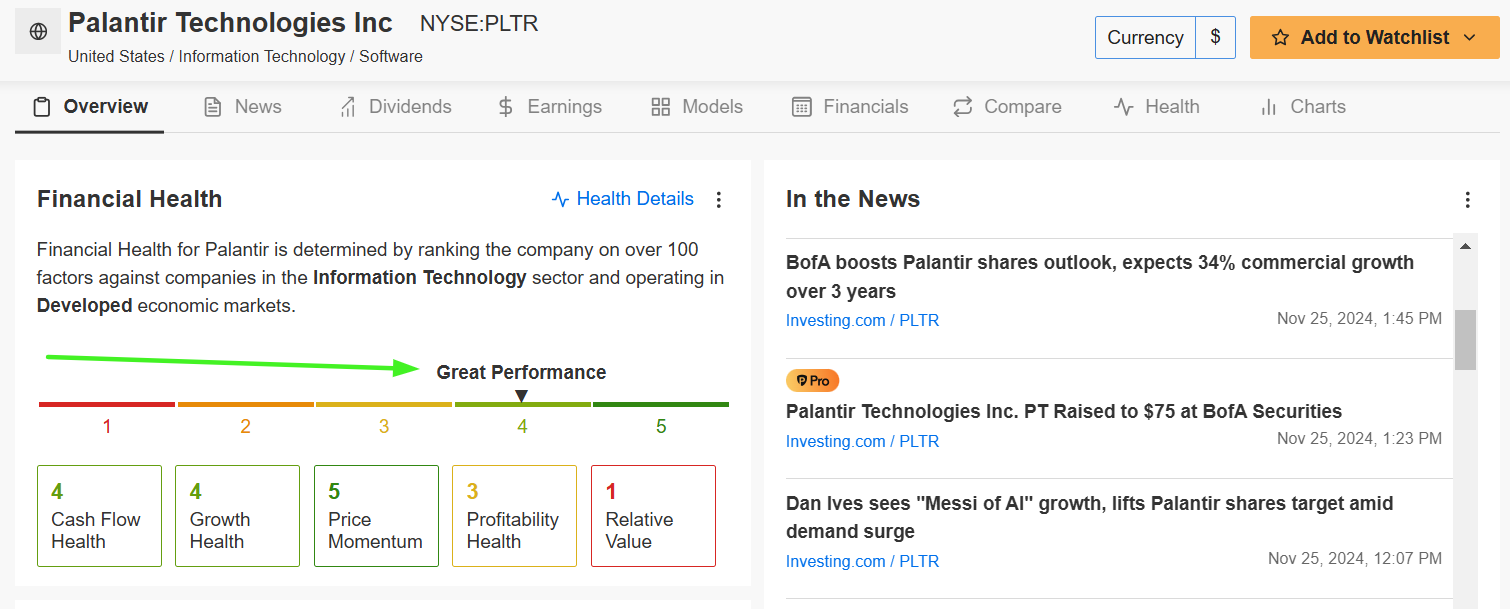

3. Palantir

- 2024 Efficiency: +282.9% YTD

- Market Cap: $149.8 Billion

What They Do: Palantir gives cutting-edge information analytics software program, primarily serving authorities and enterprise shoppers to assist them make sense of large datasets.

Supply: Investing.com

Why It’s Thriving: Beginning the yr at $16.95 and climbing to a file $67.88, Palantir has reaped the rewards of its deep investments in synthetic intelligence.

Its groundbreaking AI platform has turn out to be important for presidency and enterprise shoppers navigating digital transformation. Palantir’s skill to safe strategic contracts and innovate in data-driven decision-making has been instrumental in its ascent.

Supply: InvestingPro

With a Monetary Well being Rating of three.4, Palantir demonstrates a steadiness of development and operational effectivity, making it a sexy play within the tech sector.

Last Ideas

These three corporations exemplify innovation, adaptability, and resilience, and are well-positioned in high-growth sectors. AppLovin dominates the cell app area, Palantir is on the forefront of AI-powered analytics, and Vistra is redefining the vitality sector.

With sturdy monetary well being and robust development trajectories, these are shares to be actually grateful for as 2024 nears its shut.

Pleased Thanksgiving—and joyful investing!

Whether or not you are a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now to get 60% off all Professional plans and immediately unlock entry to a number of market-beating options, together with:

- ProPicks AI: AI-selected inventory winners with confirmed observe file.

- InvestingPro Honest Worth: Immediately discover out if a inventory is underpriced or overvalued.

- Superior Inventory Screener: Seek for the most effective shares primarily based on lots of of chosen filters, and standards.

- High Concepts: See what shares billionaire buyers similar to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the through the SPDR® S&P 500 ETF, and the Invesco QQQ Belief ETF. I’m additionally lengthy on the Expertise Choose Sector SPDR ETF (NYSE:).

I frequently rebalance my portfolio of particular person shares and ETFs primarily based on ongoing danger evaluation of each the macroeconomic surroundings and corporations’ financials.

The views mentioned on this article are solely the opinion of the creator and shouldn’t be taken as funding recommendation.

Comply with Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.