Nvidia Corp.

shares are buying and selling close to

their lowest valuation

of the

synthetic intelligence period

, however a

rising listing of perils

has traders cautious about benefiting from the dip.

The most recent shock for the chipmaker got here after saying final week United States authorities have

barred it from promoting the H20 chip line in China

, a transfer that may value it billions of {dollars}. The information added to issues that spending on AI may very well be poised to gradual, particularly because the escalating commerce struggle additional clouds general prospects for financial progress.

“The outlook isn’t as compelling because it was, and you actually should make plenty of assumptions right here, about tariffs, China, hyperscalers, the macro,” mentioned Krishna Chintalapalli, portfolio supervisor and tech sector head at Parnassus Investments. “As a result of all these issues are compounding, the extent of uncertainty is far increased than it has been.”

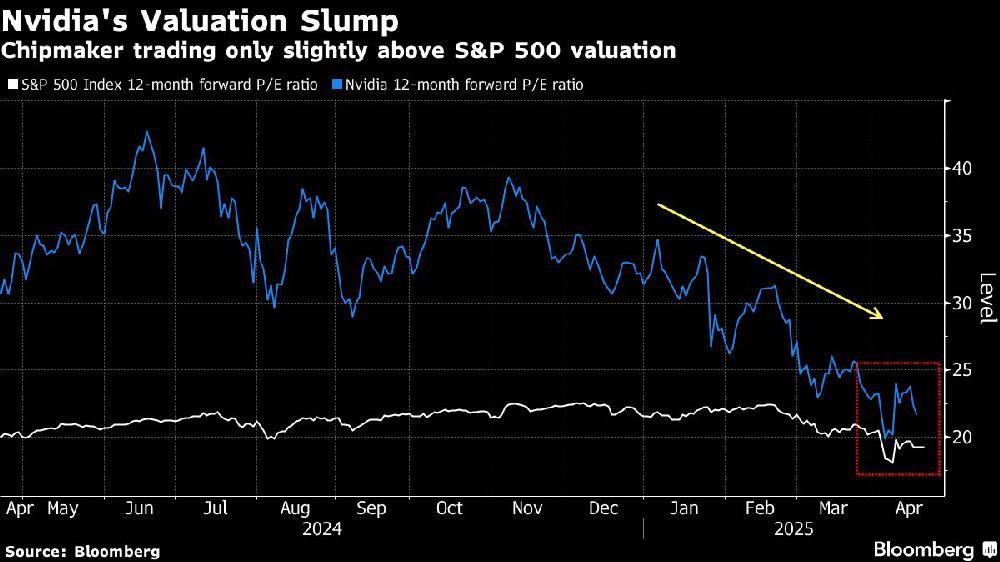

Shares of Nvidia

have dropped about 25 per cent this yr, roughly twice the decline of the

Nasdaq 100 Index

. Chintalapalli views the inventory as pretty valued, even with shares buying and selling at about 21 instances estimated earnings, and effectively beneath their long-term common. The valuation just isn’t removed from the S&P 500 Index’s a number of of 19. The inventory fell as a lot as 4 per cent in early buying and selling Monday.

That Nvidia solely trades at a slight premium to the market is notable given the corporate’s progress is anticipated to be dramatically sooner, with income seen rising 57 per cent within the present yr, in contrast with 4.7 per cent for the S&P. The expansion largely displays how

so-called hyperscalers

— Microsoft Corp., Alphabet Inc., Amazon.com Inc., and Meta Platforms Inc., that are amongst Nvidia’s largest prospects — have allotted tens of billions of {dollars} constructing out AI infrastructure.

“If you wish to purchase right here, you’re in all probability betting on hyperscaler demand for AI,” Chintalapalli mentioned. Whereas the intent to spend on AI is there, “they will at all times decelerate on the margins” and “you’ll be able to’t make a name on the tempo of funding, given the macro and tariff points.”

Nvidia’s share stoop and ensuing hit to valuation underline the perils the chipmaker faces from a possible slowdown in AI spending and the Trump administration’s makes an attempt to reset international commerce relations. Ought to the commerce tensions tip the financial system into recession, all bets about future earnings are off, undermining the valuation case.

Downward Revisions

The analyst consensus for Nvidia’s full-year earnings has dropped 1.5 per cent over the previous month, whereas the view for income is down about one per cent, in response to knowledge compiled by Bloomberg.

Microsoft has introduced plans to drag again on knowledge centre tasks, and whereas others similar to Alphabet have maintained capital spending plans for the present yr, the outlook for 2026 stays unsure.

Traders had already been debating the outlook for AI spending, ever since China’s DeepSeek emerged in January, claiming efficiency that’s corresponding to U.S. fashions regardless of costing much less and requiring fewer chips. Nonetheless, as tariff talks progress, traders are beginning to see that demand for AI gear leaves Nvidia much less uncovered to commerce dangers than a few of its mega cap friends.

Bloomberg Intelligence wrote earlier this month that “AI-focused gamers like Nvidia seem most insulated” from tariffs, whereas different chipmakers — particularly these uncovered to finish markets like PCs, handsets, autos, and industrials — “will face oblique strain through demand destruction.”

The tariff state of affairs has been extremely unstable. A current reprieve on smartphones, computer systems and different electronics appeared to have eliminated an overhang from the shares, although Trump maintained the measure is short-term.

Final week, ASML Holding NV bought off after it reported first-quarter orders that had been weaker than anticipated, and it warned it didn’t know find out how to quantify the influence of tariffs. Individually, Taiwan Semiconductor Manufacturing Co. affirmed its outlook, suggesting demand for AI-related chips stays robust, though analysts mentioned tariffs are a key query mark.

“Politics will stay a part of the funding panorama for the foreseeable future, and the panorama will proceed to evolve,” mentioned Daniel Flax, a senior analysis analyst at Neuberger Berman. “This may influence many corporations, together with Nvidia, however I feel it is going to proceed to execute and innovate, and that may proceed to drive progress. I feel shares look fairly enticing in case you have a 12- or 18-month time horizon.”

Lengthy-Time period Bulls

Analysts have stayed broadly constructive, as almost 90 per cent of the companies tracked by Bloomberg suggest shopping for the inventory. Moreover, with shares buying and selling greater than 60 per cent beneath the typical analyst worth goal, implied returns for the inventory are among the many highest over the previous few years.

Those that are nonetheless long-term bulls see the current weak spot as a shopping for alternative.

Within the short-term, “the information removes a significant overhang — the inventory H20 chipis extra enticing at the moment than yesterday,” Ivana Delevska, chief funding officer at SPEAR Make investments mentioned Wednesday, after Nvidia’s preliminary dip on the H20 chip information, including that within the long-run, Nvidia not getting access to the Chinese language market could be a destructive.

Shana Sissel agrees that the present valuation marks time to purchase, particularly forward of the corporate’s late Could earnings report, which she expects will present indicators of Chinese language prospects front-loading purchases in anticipation of tariffs.

“I feel it’s enticing,” she mentioned. “I’m clearly a bull on it. I’ve at all times favored Nvidia inventory.”

Bloomberg.com