Michael Burry is a widely known determine in monetary markets, well-known for precisely predicting the 2008 actual property market collapse, a narrative prominently featured within the film The Massive Brief. Consequently, buyers carefully monitor the market actions of Scion Asset Administration by the obligatory F13 report.

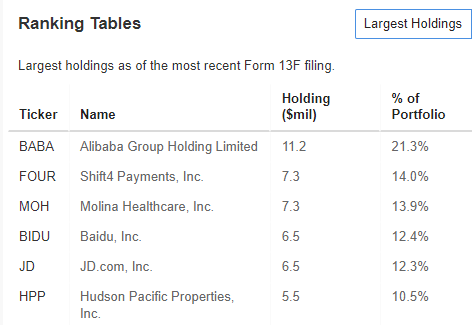

Presently, Burry is making a robust wager on China, committing almost 50% of his capital to corporations throughout the nation. The crown jewel of his investments is Alibaba (NYSE:), through which he holds a 21.3% stake, with the InvestingPro index suggesting an upside potential of over 60%.

In current weeks, the Chinese language inventory market has skilled sturdy progress, as evidenced by the iShares MSCI China ETF (NASDAQ:), which has gained greater than 27% over the previous month.

Supply: InvestingPro

Stimulus Packages and Market Corrections

All because of the introduced stimulus bundle geared toward addressing challenges in attaining the 5% y/y financial progress goal, with the World Financial institution forecasting a extra modest 4.8% y/y.

Nevertheless, the current market correction signifies that the present measures, primarily an rate of interest minimize anticipated to unencumber $142 billion in borrowing capability, might not suffice.

However, indications recommend that additional actions from Beijing are on the horizon, with extra packages anticipated from the Finance Minister on October 12.

Chinese language Corporations With Large Development Potential

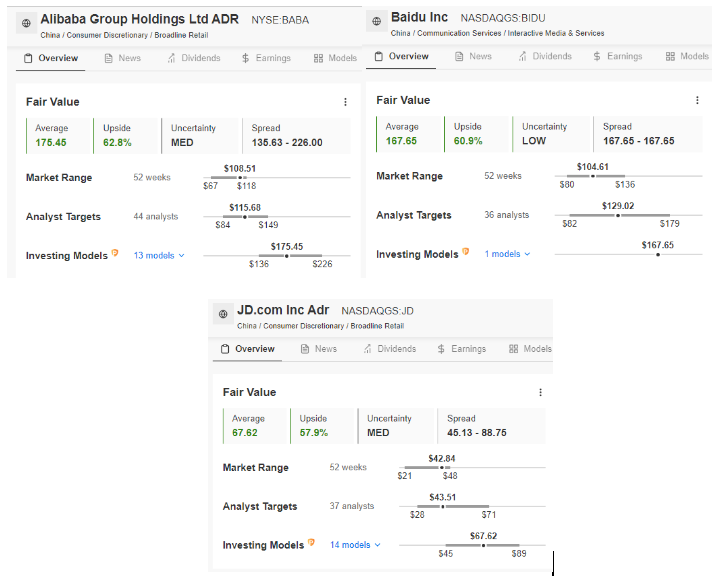

Among the many six largest corporations in Scion Asset Administration’s portfolio, three—Alibaba, Baidu (NASDAQ:), and JD.com (NASDAQ:)—are Chinese language corporations.

Supply: InvestingPro

Contemplating their progress potential and monetary well being, there’s appreciable optimism surrounding these corporations, with their honest worth index potential hovering round 60%.

Supply: InvestingPro

Elementary Energy and Authorities Motion

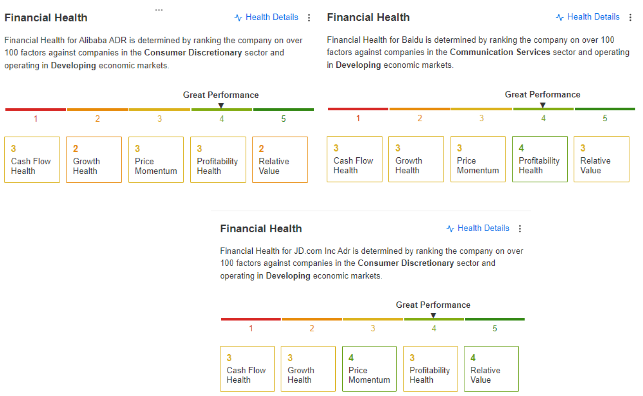

The basic outlook is equally sturdy, with the monetary well being index for these corporations scoring 4 out of 5.

Supply: InvestingPro

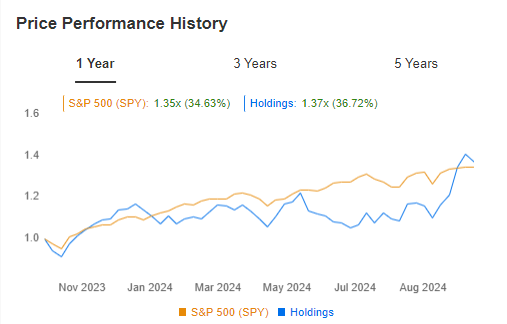

The underlying indicators replicate their energy, however the essential issue would be the Chinese language authorities’s subsequent strikes and the size of its stimulus measures. If authorities stay decided, they might maintain the demand momentum initiated within the latter half of September on the Shanghai Inventory Trade. The portfolio’s worth, regardless of the current correction, has outperformed the benchmark index for the primary time since January.

Supply: InvestingPro

Alibaba’s Inventory Efficiency

Given Alibaba’s important share in Burry’s portfolio, it is important to evaluate its present technical state of affairs and progress potential. Following a dynamic bullish rally, the inventory has slowed in a clearly marked provide zone close to $120 per share.

Source: InvestingPro

A rebound is approaching a key help stage round $102 per share; breaking this might push the value beneath the numerous psychological barrier of $100. These ranges are essential for sustaining upward momentum, and a breakout may negate the general bullish outlook. The first resistance stays at $120, and surpassing this stage would sign a continuation of demand-side dominance.

***

Disclaimer: This text is written for informational functions solely. It’s not supposed to encourage the acquisition of property in any method, nor does it represent a solicitation, supply, suggestion or suggestion to take a position. I wish to remind you that every one property are evaluated from a number of views and are extremely dangerous, so any funding resolution and the related threat is on the investor’s personal threat. We additionally don’t present any funding advisory providers.