One other week and extra disappointment for market members eyeing price cuts from the Federal Reserve. A sluggish begin to the week with plenty of rangebound value motion by means of to Thursday afternoons CPI launch.

The backend of the week nevertheless didn’t disappoint, US and European indices alike rallying larger on Friday particularly in an try to complete the week sturdy. On the time of writing all wall streets main indexes in addition to gold had been buying and selling within the inexperienced for the week.

Market pricing for a 25 bps price reduce from the Federal Reserve has modified from 97% likelihood on October 4, to 87% likelihood on the time of writing.

Supply: CME FedWatch Software

costs had been buying and selling simply over 1% larger this week following final week’s rally. The dearth of additional geopolitical escalation between Israel and Iran stored oil costs in examine, coupled with renewed considerations that the latest Chinese language stimulus is probably not sufficient to spur on progress.

The FX font noticed the dominate proceedings, with features throughout the majors. Rising market currencies nevertheless fared barely higher towards the buck, particularly towards the backend of the week.

Earnings season bought off to a optimistic begin as JPMorgan Chase & Co (NYSE:)revenue estimates. The shock got here from the upper curiosity earnings and stable efficiency from the funding banking division. The large tech names and main earnings releases are largely scheduled for later within the month, however subsequent week nonetheless brings some large names.

Among the many names reporting subsequent week are Netflix (NASDAQ:), Funding Banks like Blackrock (NYSE:), Financial institution of America Corp (NYSE:), Citigroup Inc (NYSE:) and naturally Taiwan Semiconductor Manufacturing (NYSE:), higher often called TSM.

Because the US election attracts nearer one wonders whether or not we could begin seeing some response as polls start coming by means of thick and quick. For now although, the week forward is stacked with key knowledge releases, whereas the cloud of tensions within the Center East continues to maintain market members in some sectors on edge.

The Week Forward: CPI Knowledge, US Earnings and ECB Curiosity Charges

The week forward sees a number of CPI releases from China, Canada, New Zealand and the UK. The largest occasion of the week nevertheless, is prone to be the which is a giant occasion for the Euro Space.

Progress has turn into a sticky level with regards to the Euro Space and therefore the anticipation for this week’s price assembly. Will a 25 bps reduce be sufficient to stimulate progress?

Asia Pacific Markets

In Asia, knowledge kicks off with Chinese language CPI over the weekend. China’s Ministry of Finance additionally introduced a briefing scheduled for 10:00 GMT+8 on Saturday. Markets are largely anticipating that Finance Minister Lan Fo’An will unveil an in depth stimulus plan. Nonetheless, with market expectations operating excessive, there’s potential for disappointment.

Australia will launch labor knowledge however eyes might be on the New Zealand CPI print following a 50 bps price reduce this previous week. Third-quarter CPI figures are set to be launched on Wednesday and will affect the dimensions of the upcoming price reduce by the Reserve Financial institution of New Zealand.

A sharper than anticipated drop off in inflation might result in a rise in price reduce expectations. There’s a large hole between the November and February conferences of the RBNZ, thus a softer than anticipated inflation print might see markets value in an aggressive price reduce for February which might weaken the New Zealand Greenback additional.

Europe + UK + US

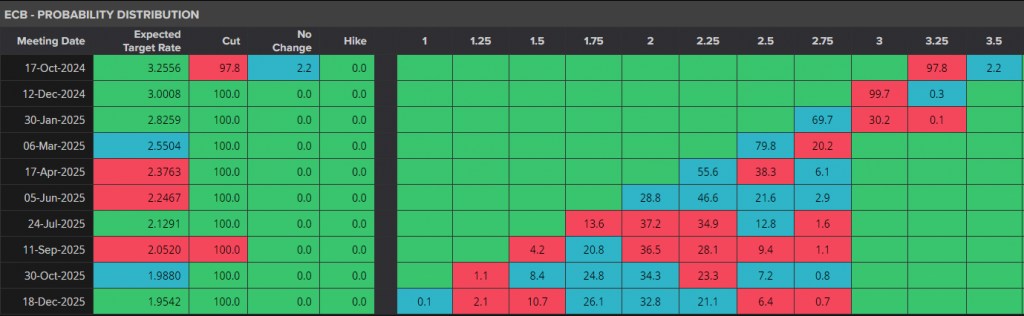

In developed markets, the European Central Financial institution rate of interest assembly will hold the eye of market members. There was a stark change over the previous month as price reduce bets have considerably elevated for the ECB. This has been largely attributed to a wider decelerate within the Euro Space whereas the struggles of Germany proceed. At current markets are pricing in round 98% likelihood that the ECB will reduce charges by 25 bps.

Supply: LSEG Refinitiv

Within the UK, Wednesday’s figures are essential as analysts assess the Financial institution of England’s subsequent steps. Based mostly on the UK In a single day Index Swaps (OIS), traders presently see a 75% probability of a 25-basis level reduce on November 7, with a 60% likelihood of an extra reduce in December.

The August employment report and September retail gross sales might be launched on Tuesday and Friday. Traders might be seeking to see if wage progress slowed down and whether or not shoppers continued to spend final month.

The US lastly will get a breather because the US Earnings season will take heart stage. A number of banks talked about above coupled with US retail gross sales would be the highlights.

Chart of the Week

This week’s focus is again to the (DXY) because it has run right into a key confluence space. The conflicting alerts between the technical and elementary image makes this much more intriguing to regulate.

The confluence space the place the 100-day MA rests round 103.20 ought to present a stern problem for the DXY bulls within the early a part of subsequent week. A break above this excessive will face one other confluence space the place the 200-day MA rests round 103.65.

Conversely, there’s potential for a pullback. The Friday day by day candle shut could give us extra perception into the potential of an early week pullback in value. A bearish or doji shut will enhance the likelihood of a pullback, nevertheless as i discussed any draw back could also be restricted relying on Geopolitical circumstances and different exterior dynamics.

Supply: TradingView.Com (click on to enlarge)

Key Ranges to Think about:

Help:

Resistance:

One other chart that could be of curiosity within the which hit recent highs this week. There’s a huge triangle technical sample which remains to be in play that could be of some curiosity.

Supply: TradingView.Com (click on to enlarge)

Authentic Put up