As Dalal Road benchmarks progress in direction of their all-time highs of late September, with the Nifty50 nonetheless greater than 1,600 factors, or 6.2 per cent, under the mark, broader indices together with Nifty Midcap 100 and Nifty Smallcap 100 indices have registered smaller falls than the headline index throughout a market correction part. Traditionally, in case of a correction—a slide of 10 per cent or extra from its current peak—within the Nifty50 index, the broader indices have registered corrections to the tune of 2-4 occasions, apart from 2024, in response to brokerage Motilal Oswal Monetary Providers Ltd (MOFSL).

In response to the brokerage, as of November-end, whereas Nifty stood 8.0 per cent under its all-time excessive on a closing foundation, the midcap and smallcap indices had been 7 per cent and 5 per cent under their highs. In different phrases, it’s for the primary time in 10 years that midcap and smallcap gauges have fallen lower than their largecap counterparts throughout a correction within the Nifty index. Technically, a correction is outlined as a fall of at the least 10 per cent from the current peak.

What has helped midcap and smallcap indices stage relative outperformance to Nifty50?

A relentless web promoting by international institutional buyers (FIIs) has led to a big decline in largecaps, whereas sturdy retail and home institutional investor (DII) flows have led to midcaps and smallcaps outperforming by a large margin throughout the current market correction, in response to Motilal Oswal Monetary Providers.

This is a comparability of strikes within the Nifty 100, the Nifty Midcap 100 and the Nifty Smallcap 100 compared to technical corrections within the Nifty50 previously 10 years, as highlighted by MOFSL:

DII vs FII divergence hits multi-year low

Up to now 10 years, there was a big divergence in international institutional buyers’ and home institutional buyers’ web flows.

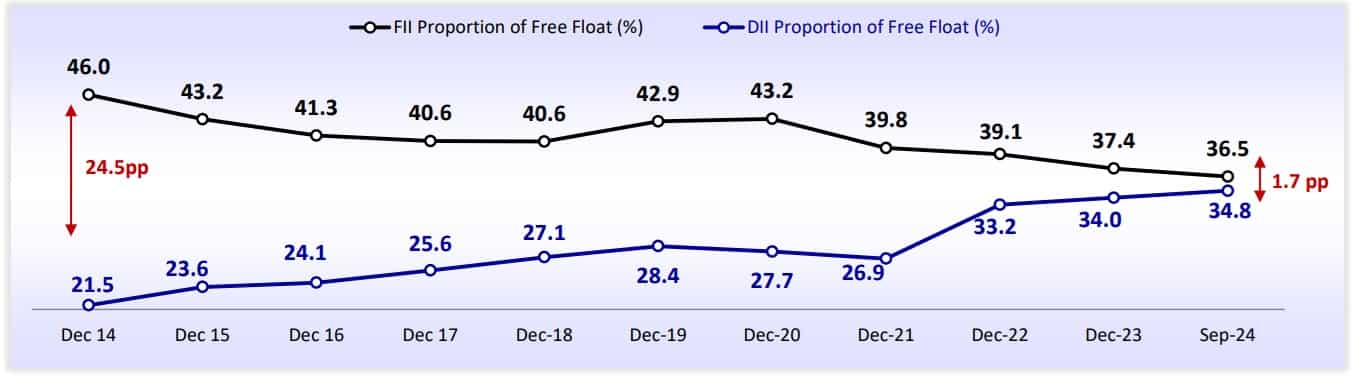

“Relentless FII promoting and DII shopping for have led to a big shift in possession within the Indian fairness market… FII/DII possession, as a proportion of free float, is down 950b/up 1,330bp since Dec’14 to 36.5 per cent/34.8 per cent,” in response to the brokerage.

Check out a gradual convergence of FII vs DII possession

Largecap contribution to market capitalisation hits all-time low

The sharp rise in midcap and smallcap valuations previously 10 years has led to a big decline out there capitalisation contribution of the largecap phase, in response to the brokerage.

The market cap contribution of largecaps is down 1,500 foundation factors from March 2020 highs to 60.4 per cent in November 2024, whereas that for midcaps and smallcaps shares has risen to all-time highs of 19.1 per cent and 20.5 per cent, respectively, in response to Motilal Oswal Monetary Providers.

Rupee extra steady than extra rising market friends over the previous decade

Up to now decade, the rupee has remained extra steady than extra of its rising market friends. It stays “one of the crucial steady currencies in rising markets”, in response to MOFSL.

Moreover, the rupee has continued to be much less risky than different main currencies in 2024 to date.

Nifty valuation

In response to the brokerage, the headline Nifty50 index’s 12-month trailing price-to-earnings ratio, at 23.2 occasions, stands at a premium of about 3.0 per cent to its long-period common (LPA). At 3.7 occasions, the 12-month trailing price-to-book-value ratio is available in 18 per cent above its historic common of three.1 occasions, in response to MOFSL.

However, the headline index’s 12-month ahead price-to-earnings ratio stands at 20.5 occasions, close to its long-period common, and its 12-month ahead price-to-book worth ratio at 3.3 per cent, marking a 16 per cent premium to the its historic common of two.8 occasions.

In the meantime, India’s mcap-to-GDP ratio has moderated to 138 per cent from an all-time excessive of 146 per cent recorded in September 2024, although above its long-term common of round 85 per cent, in response to the brokerage.

“In midcaps and smallcaps, the market cap-to-GDP ratios proceed to commerce at historic highs, with all smallcaps now surpassing midcaps,” MOFSL added.