Final yr, in September, we launched to our readers the idea of ratio charts. In that, we defined what ratio charts are, how they’re constructed and the way they can be utilized as a instrument in technical evaluation for forecasting.

On the time of doing that research (in September 2023), the Dow Jones Industrial Common was at 34,837 and the Nifty 50 was at 19,435. Primarily based on the ratio evaluation, we had mentioned that the Dow Jones can rise to 39,000 and the Nifty can go as much as 23,400. During the last yr, the indices haven’t solely risen to these ranges, however have raced previous too and at the moment are poised at 42,863 and 24,964.

Equally, we had recognized IT, PSU Banks and Pharma because the three sectors that may outperform the Nifty primarily based on ratio charts. Nifty has risen 28 per cent since then. The Nifty IT, Nifty PSU Banks and Nifty Pharma indices have surged 34 per cent, 46 per cent and 57 per cent respectively.

It’s now time to take a re-look on the ratio charts and see the place the markets are headed. For the good thing about new readers, we’re repeating the fundamentals of what ratio charts are, what do their strikes imply, find out how to interpret them and the use for forecasting right here.

Ratio charts

Take two variables and calculate the ratio by dividing them. Plotting this ratio calculated on a steady foundation provides us the ratio chart. For instance, dividing Nifty 50 by the Dow Jones Industrial Common will give us the Nifty50/Dow Jones ratio. Taking the historic day by day closing worth of each the indices and plotting the calculated ratio will give us the day by day ratio chart of Nifty50/Dow Jones. The identical, carried out by taking the weekly closing values of each the indices, will give us the weekly ratio chart.

Chart motion

The ratio chart motion can hint two eventualities – one, a rising pattern and the opposite, a falling one. We take the Nifty50/Dow Jones ratio talked about above to elucidate these two eventualities.

The ratio graph can rise when:

* Nifty strikes up; and the Dow Jones falls, or stays secure/vary certain or rises, however lower than the Nifty

* Nifty stays secure/vary certain and the Dow Jones falls

* Nifty falls and the Dow Jones falls greater than Nifty.

The ratio graph can fall when:

* Nifty falls; and the Dow Jones rises, or stays secure/vary certain or falls however lower than the Nifty

* Nifty stays secure/vary certain and the Dow Jones rises

* Nifty strikes up and the Dow Jones rises greater than Nifty.

Deciphering the chart

A rising ratio chart signifies that the Nifty is outperforming the Dow Jones. However, if the graph falls, then it signifies that the Nifty is underperforming, and the Dow Jones is outperforming.

In a ratio chart, the rise and fall in graph will at all times must be interpreted with respect to the numerator, Nifty in our case right here.

Additionally, the ratio chart will give us solely the relative efficiency of two parameters that’s getting used and never the course of absolutely the worth motion. That’s, a rising ratio chart doesn’t imply that Nifty will rise. As defined above, even when the Nifty stays secure or in a spread and the Dow Jones falls, the ratio chart can rise.

Forecasting

Technical evaluation could be utilized on the ratio charts for analysing and making forecasts, as is finished in every other worth chart. This is likely one of the main benefits of getting a ratio chart. Certainly, the indications equivalent to trendlines, shifting averages and so forth. that are utilized in technical evaluation could be utilized right here as effectively. This aids in forecasting the place the ratio chart is headed. Along with this, you probably have the forecast for any two of the ratio variables, then you possibly can calculate/forecast the third variable.

Say, that you just make a view that the Nifty/Dow ratio can go up to some extent X from present ranges primarily based in your technical evaluation. Moreover, you probably have the forecast for the Dow Jones as Y, then X multiplied by Y provides you with the forecast for the Nifty.

Limitations

Timeframe of the forecasts made is essential to think about right here. That’s, forecast for the ratio and the one variable must be carried out for a similar interval with the intention to get the third variable proper. Say, in case you are anticipating the ratio to go as much as the purpose X in three months, then you need to have a three-month forecast for the Dow Jones. Else, the logic of figuring out the third variable, that’s the Nifty right here, will go fallacious. Whereas one can, in fact, do a direct technical evaluation of the Nifty, this method is one other option to take a look at your evaluation and prediction.

Secondly, if the evaluation or the forecast made for the Dow Jones or the ratio goes fallacious, then the forecast for the Nifty calculated from the opposite two may also go fallacious.

Maintaining these in thoughts, right here is an evaluation on how the Nifty can carry out within the coming months, the place it’s headed from right here and what might be the attainable prime for the Nifty primarily based on the ratio charts.

Extra rise

The Nifty/Dow ratio is at present at 0.5824. On the charts, the pattern is down. The ratio can fall to 0.5740 from right here in a month or two. On this interval, the Dow Jones will outperform the Nifty. Thereafter, the ratio can rise to 0.60 by the top of this yr. As we head into 2025, the ratio chart can prolong its rise in the direction of 0.62 within the first quarter subsequent yr.

The Dow Jones is trying bullish. It may possibly rise to 43,000-43,500 in a month or two, after which goal 44,000-44,500 by this year-end. Thereafter, the index can run right into a correction. So, a reversal from 44,000-44,500 can drag the Dow Jones all the way down to 41,000 within the first quarter subsequent yr.

Translating this into Nifty, we get a spread of 25,000-25,500, because the ratio falls to 0.5740 from right here. Nifty can rise to 26,500-27,000 because the Nifty/Dow Jones ratio goes up in the direction of 0.60. From there, a corrective fall to 25,400 is a risk because the ratio goes as much as 0.62 and the Dow Jones falls to 41,000.

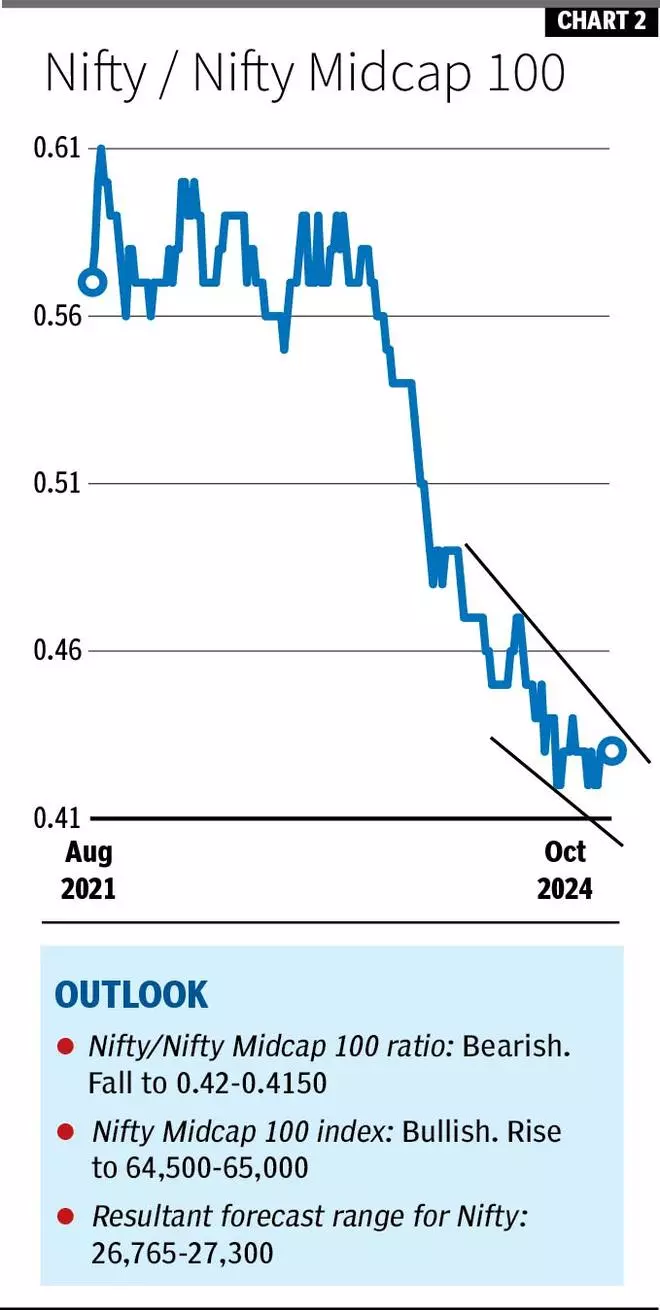

Nifty Vs Midcap

The Nifty Midcap100 index (59,213) has a powerful assist at 56,800, from the place it’s bouncing again now. The outlook is bullish. The index can rise to 64,500 and 65,000 by the top of this yr.

The Nifty/Nifty Midcap 100 ratio is at present at 0.43, . The bias is destructive to see a fall to 0.42-0.4150.

So, for a spread of 64,500-65,000 on the Nifty Midcap 100 and 0.42-0.4150 on the Nifty/Nifty Midcap 100 ratio, we get a forecast vary of 26,765-27,300 for the Nifty. That provides a median of 27,033.

Sectoral outlook

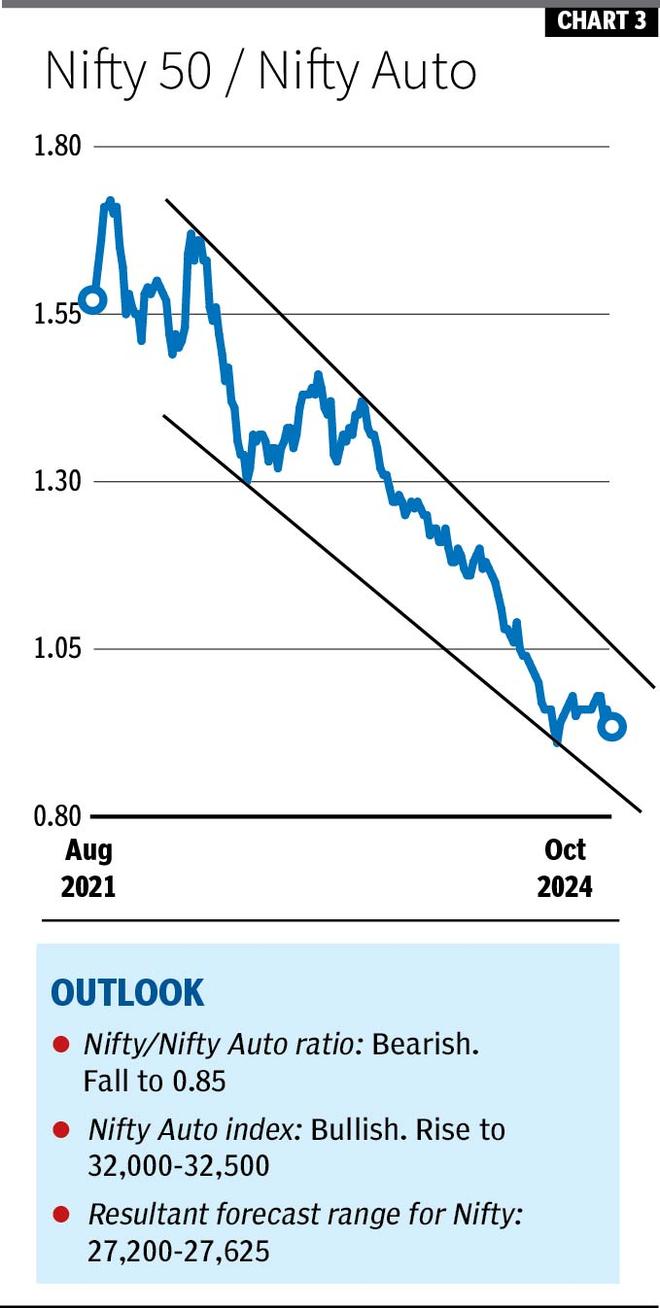

This time, we’ve got recognized two sectors that may outperform the Nifty for the remainder of the yr. Like final yr, Pharma finds a spot once more this time additionally. Together with that, we are able to anticipate the Auto sector to outperform the Nifty, going ahead. Right here is the ratio chart evaluation of the Nifty Pharma and Nifty Auto indices to see the place the Nifty is headed.

Nifty/Nifty Auto: The Nifty/Nifty Auto ratio has been in a powerful downtrend for nearly three years now. Nevertheless, there have been intermediate corrections inside that. The ratio is at present at 0.94. It may possibly fall to 0.90 from right here. Finally, the ratio can break 0.90 and prolong the autumn to 0.85.

The Nifty Auto index (26,437) has good assist at 25,150. The outlook is bullish. The index can rise to 32,000-32,500 within the subsequent three months.

Because the index goes as much as 32,000-32,500 and the ratio falls to 0.85, the Nifty can rise to 27,200-27,625 in that interval.

Nifty/Nifty Pharma: The ratio peaked in Might 2023 and has been declining since then. The ratio is at present at 1.06. It may possibly fall to 1.04-1.02 from there.

The Nifty Pharma index (23,582) is trying bullish for an increase to 27,500-28,000 from right here. Help for the index is at 22,600.

So, if the ratio falls to 1.02 and the Nifty Pharma goes as much as 27,500-28,000, Nifty can see 26,960-27,450.

Take Away

All of the ratio chart evaluation above signifies that there’s room for Nifty to go farther from right here for the remainder of the yr. They point out that Nifty can discover a prime wherever within the 27,000-27,500 area by this year-end. Thereafter, a corrective fall is probably going as we head into 2025 as indicated by the Nifty/Dow Jones ratio chart evaluation.

We have now restricted the above research to just one leg of transfer in Nifty — an increase to 27,000-27,500. It’s as a result of, aside from the Nifty/Dow Jones, different ratio charts don’t give a transparent image past one leg of transfer that we’ve got predicted above in every part. So, as soon as the Nifty makes a peak after which turns down, we are able to revisit the ratio charts to gauge the quantum of correction that may occur.