Bonds

flashing pink compelled

Donald Trump

to U-turn on reciprocal

tariffs

, however the sector isn’t out of the woods but, analysts say.

“Most monetary market individuals are satisfied that turmoil in authorities bond markets — which suffered neck-snapping volatility from (April 2) by way of (Wednesday) morning — and recession warnings from company executives — like JP Morgan’s

Jamie Dimon

— had been vital in convincing the administration to again off,” Karl Schamotta, chief market strategist at Corpay Foreign money Analysis, mentioned in a be aware.

Previous to Trump’s

stunning announcement

on Wednesday that he was pausing increased tariffs in opposition to many international locations,

rates of interest

on United States authorities bonds of all maturities had been on the rise, “

with the lengthy finish main the way in which increased and exhibiting unusually excessive volatility,” Royce Mendes, managing director and head of macro technique at Desjardins Group, mentioned in a be aware on Wednesday.

He mentioned the yield on the 10-year Treasury rose above 4.5 per cent, whereas the 30-year yield hit 5 per cent.

“Liquidity was skinny and there have been dangers that market functioning may start to deteriorate extra meaningfully, which may have confirmed catastrophic,” he mentioned.

The hazard to the monetary system was fairly actual.

Schamotta mentioned it appeared traders earlier within the week had been looking for to boost money by promoting bonds, probably to cowl their inventory market losses.

“That’s one thing fairly typical of a monetary disaster,” he mentioned, as “liquidity will get faraway from all world markets concurrently, then now we have a serious downturn and different issues begin to seize up.”

U.S. Treasuries are the worldwide lending market benchmark, so bother there can unfold round world bond markets.

“The danger right here was that if we had a speedy rise in yields, then that might set off misery for individuals throughout the worldwide economic system who’re reliant on that entry to U.S. funding,” Schamotta mentioned, including that the U.S.

Federal Reserve

was near stepping in so as to add liquidity to maintain the bond market functioning.

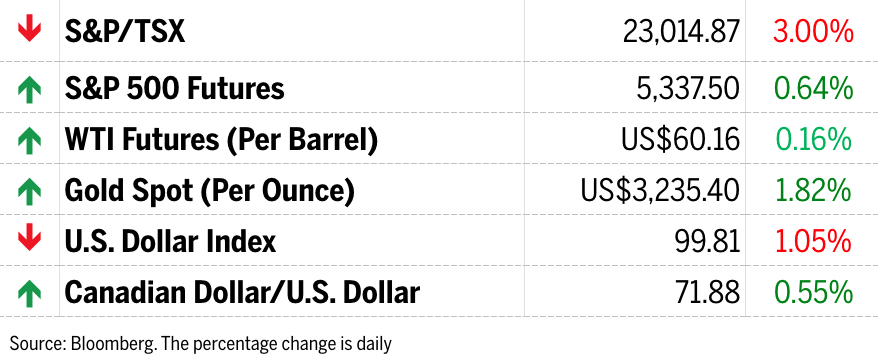

Inventory markets

soared Wednesday following Trump’s announcement, recouping trillions of {dollars} in losses, with the

S&P 500

closing up 9.5 per cent, whereas the

S&P/TSX composite index

rose 5.4 per cent.

However the euphoria didn’t final lengthy. Markets closed down once more on Thursday as traders got here to phrases with the ten per cent baseline world reciprocal tariffs and the potential affect on U.S. and world financial exercise.

On Thursday, long-term bond yields had been on the rise once more, although not as precipitously as earlier within the week, with the yield on 30-year Treasuries hitting 4.85 per cent after pulling again. Yields on shorter-term bonds got here down.

Economists at

Nationwide Financial institution of Canada

mentioned they’ve bond traders of their sights.

“As current occasions have emphasised, abroad bond investor attitudes bear shut scrutiny,” Taylor Schleich, Warren Beautiful and Ethan Currie mentioned in a be aware.

Schamotta agrees bonds aren’t out of the woods but.

“The dynamics that we’ve seen even at this time are worrisome once more; firstly, that U.S. yields are rising and the

greenback

is falling on the similar time, indicative of loads of stress within the monetary system,” he mentioned. “And it’s very clear … none of those monetary devices might be relied on to be secure within the coming months.”

Join right here to get Posthaste delivered straight to your inbox.

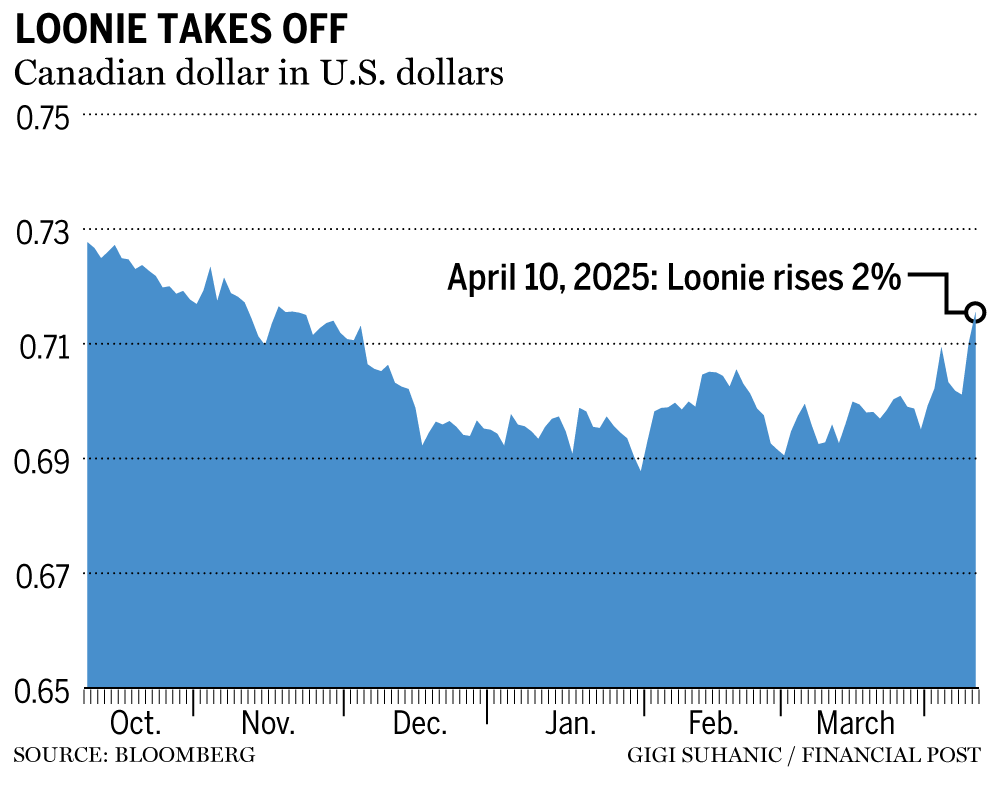

The

Canadian greenback

on Wednesday rose above 71 cents U.S. for the primary time since early December, whereas its

American counterpart

is being severely weakened by the uncertainty and chaos that Donald Trump’s

commerce warfare has unleashed

.

The loonie was up

1.4 per cent in early buying and selling Thursday as a part of a surge that began Wednesday after Trump introduced a 90-day pause on increased reciprocal tariffs, decreasing the levy on most international locations to a baseline of 10 per cent, however mountaineering duties on China to 125 per cent.

Learn the complete story right here.

- Financial institution of Montreal holds its annual normal assembly

- At present’s Knowledge: College of Michigan Shopper Sentiment Index

- Earnings: JPMorgan Chase & Co., Wells Fargo & Co., Morgan Stanley, Blackrock Inc., MTY Meals Group Inc., Corus Leisure Inc.

- The subsequent Canadian authorities must cope with an immigration system that has ‘misplaced its model’

- Canada may change into LNG world chief, however authorities wants new roadmap, says TC Vitality CEO

- Cash-laundering questions proceed to chase TD months after U.S. sanctions

- Many Canadians are delaying submitting their taxes over confusion with current adjustments

- Some taxpayers could discover CRA’s on-line portal is lacking tax slips

McLister on mortgages

Wish to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Publish column

will help navigate the advanced sector, from the most recent tendencies to financing alternatives you gained’t need to miss. Plus verify his

mortgage price web page

for Canada’s lowest nationwide mortgage charges, up to date each day.

Monetary Publish on YouTube

Go to the Monetary Publish’s

YouTube channel

for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

At present’s Posthaste was written by Gigi Suhanic with further reporting from Monetary Publish employees, The Canadian Press and Bloomberg.

Have a narrative concept, pitch, embargoed report, or a suggestion for this article? Electronic mail us at

.

Bookmark our web site and assist our journalism: Don’t miss the enterprise information you must know — add financialpost.com to your bookmarks and join our newsletters right here