Greater than three quarters say they’ll use the ‘gradual purchasing’ approach, survey finds

Article content material

Article content material

Article content material

Confronted with troubling financial situations, Canadians are considering strategically in the case of their vacation purchasing habits this yr.

Greater than three-quarters of customers are utilizing the “gradual purchasing” strategy of stopping to contemplate an merchandise as an alternative of creating a rash shopping for choice, in response to a brand new survey from the cost platform Affirm Canada Holdings Ltd.

Commercial 2

Article content material

Different methods are being employed this vacation season as nicely, with 71 per cent spending extra time to contemplate smarter selections and 60 per cent spreading their spending all through the season.

General, 46 per cent of Canadians plan to spend much less this yr, whereas simply eight per cent have elevated their budgets, a latest survey by the Angus Reid Institute mentioned.

Canadians have additionally embraced the purchase now, pay later (BNPL) possibility, which presents customers the prospect to pay for an merchandise over a number of months as an alternative of immediately.

BNPL spending is predicted to develop by 14 per cent and hit US$6.7 billion in Canada this yr, in response to a report in August by Analysis and Markets.

The Affirm survey mentioned 48 per cent of respondents pointed to their capacity to successfully finances as their cause for utilizing BNPL packages, whereas 42 per cent mentioned low rates of interest are a pretty a part of the BNPL technique.

“As Canadians take a extra aware, value-driven strategy to vacation purchasing, many are leaving bank cards behind,” Wayne Pommen, chief income officer at Affirm, mentioned in a launch. “As an alternative, they’re turning to versatile, clear cost choices that allow them store responsibly and benefit from the season.”

One other technique Canadians are already contemplating is ready till the federal authorities’s GST minimize takes impact on Dec. 14 earlier than making some purchases.

The GST minimize consists of a number of gadgets that could be on many vacation purchasing lists, together with many meals merchandise, youngsters’s toys and garments, and video-game consoles.

Dan Kelly, president of the Canadian Federation of Unbiased Enterprise, has been posting reactions on X from enterprise house owners who consider some customers will wait till the tax vacation kicks in, successfully making the purchasing season extra condensed.

He has additionally heard from retailers that customers could return some gadgets already purchased with the aim of shopping for them again as soon as the tax adjustments kick in.

Article content material

Commercial 3

Article content material

The CFIB is urging Canadians to spend extra with small companies.

“It’s been a troublesome yr for small companies throughout Canada, however we have now an opportunity for a robust end because the essential vacation purchasing season kicks off,” Ryan Mallough, CFIB’s vice-president of legislative affairs, mentioned in a launch.

“The place you store could make an actual distinction. For each greenback you spend at a small enterprise, 66 cents stays within the native financial system. It’s not only a win for the enterprise; it’s a win for the entire neighborhood.”

Join right here to get Posthaste delivered straight to your inbox.

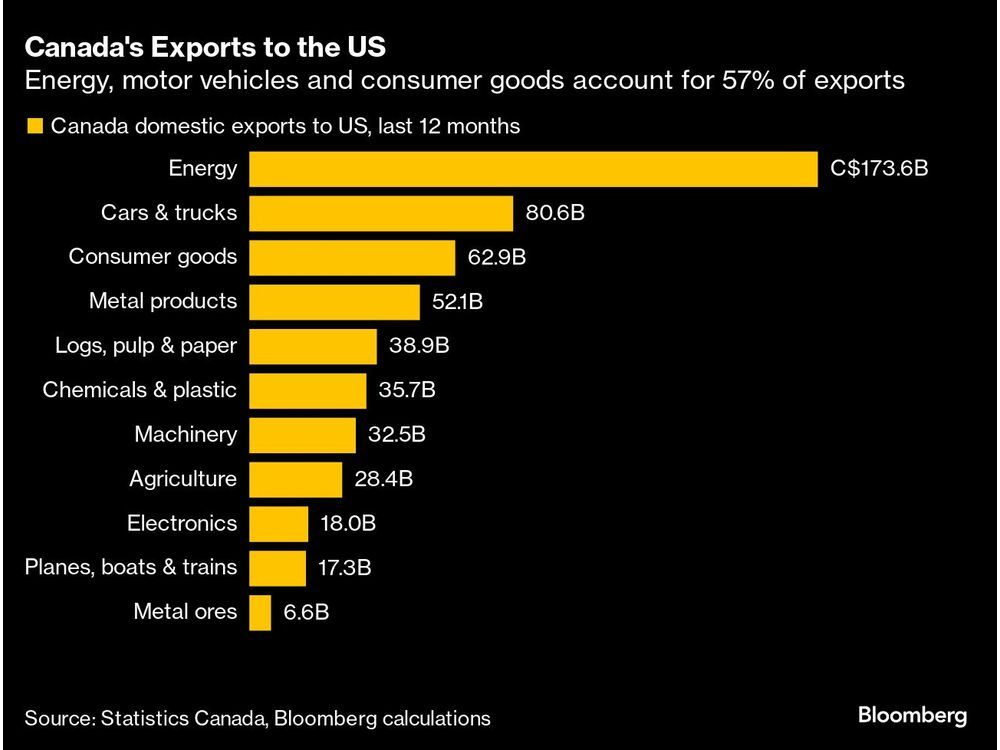

That said, Canada’s energy, automotive manufacturing and consumer goods sectors have the most at risk, having sent more than $320 billion worth of goods combined to our southern neighbour in the past 12 months. Overall, exports from the three sectors amounted to 57 per cent of all of Canadian exports to the U.S. in the last year.

Advertisement 4

Article content

Read more here.

- Today’s Data: U.S. real third quarter GDP

- Earnings: Macro Bank Inc., Frontline Plc, Spire Global Inc.

Recommended from Editorial

-

Trump’s 25% tariff would mean recession for Canadian economy

-

The sugar rush from ill-advised tax breaks is not healthy

A financial plan can help keeping track of financial goals, incorporating the key areas of personal finance: retirement, tax, investment, insurance, estate planning, and how much earn, spend, and borrow. But how often should such a plan be updated? Jason Heath, a fee-only, advice-only certified financial planner (CFP) at Objective Financial Partners Inc., says a financial plan should be updated whenever a big life event occurs, including buying a home, getting married or having kids. Read more here.

Advertisement 5

Article content

Build your wealth

Attention Canadian savers: You might live to 100. Do you have enough wealth to get there? Here’s how to take longevity risk into account in your financial planning.

Are you a millennial or younger, or know someone who is, who wants to build long-term wealth? E-mail [email protected].

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Financial Post on YouTube

Visit the Financial Post’s YouTube channel for interviews with Canada’s leading experts in business, economics, housing, the energy sector and more.

Today’s Posthaste was written by Ben Cousins, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at [email protected].

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here

Article content