holds above 1.14 whereas the struggles as miners drop after weak Chinese language knowledge.

- EZ HICP is anticipated to fall to 2%

- The USD is rising however the outlook stays weak

- EUR/USD has recovered above 1.1400

EUR/USD is modestly decrease, giving again a few of yesterday’s features, however stays above the 114 degree because the USD recovers some floor on a technical correction and regardless of ongoing considerations over the outlook for the US economic system amid Trump’s erratic commerce insurance policies.

The is recovering barely after weak point in current periods as Trump ramped up rhetoric towards China, elevating considerations of escalating commerce tensions. In the meantime, knowledge from yesterday means that ISM manufacturing PMI declined for a 3rd straight month. The file saved 48.5 in Could, down from 48.7 in April, which was weaker than the 49.5 forecast.

Wanting forward, US are anticipated to fall 3% in April, whereas are additionally anticipated to point out that the labour market is slowing modestly, with 7.1 million openings down from 7.2 million in Could.

The row has been a key benefactor of USD weak point amid Trump’s commerce insurance policies, with the current rally within the euro reflecting the greenback’s vulnerabilities although the ECB is anticipated to chop once more this week.

EUR/USD Forecast Technical Evaluation

EUR/USD has prolonged its restoration from the 1.1065 Could low, rising above 1.14. The value is being guided greater by the 50 SMA because it seems to be in the direction of 1.1450. An increase above right here might open the door to 1.15 and recent YTD highs.

Ought to the worth weaken beneath 1.14, the subsequent assist is seen at 1.1285 forward o 1.12, final week’s low and the 50 SMA.

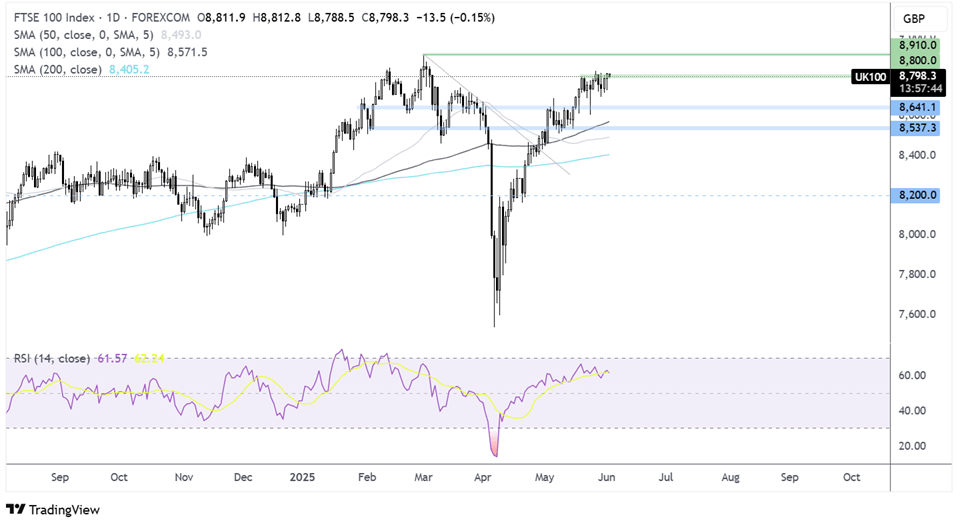

FTSE 100 Struggles as Miners Drop After Weak Chinese language Knowledge

- Chinese language manufacturing PMI falls into contraction

- Miners put stress on the index

- FTSE’s restoration runs into resistance at 8800

The FTSE 100 is below stress, pulled down by miners as Chinese language manufacturing exercise tumbles into contraction.

China’s manufacturing sector skilled its worst stoop since September 2020 in response to the , which fell to 48.3 in Could, down from 50.4 within the prior month. The determine 50 separates enlargement from contraction.

The outcomes had been far weaker than expectations of an increase to 50.7. They had been additionally considerably weaker than the official Nationwide Bureau of Statistics manufacturing PMI, which could possibly be attributed to the 2 surveys masking totally different pool sizes and enterprise varieties.

The weak knowledge comes as President Trump ramped up rhetorically towards China and because the influence of commerce tariffs is felt throughout industries in Asia, Vietnam, Indonesia, Thailand, Japan, and South Korea. All suffered building and manufacturing exercise final month.

The info raises considerations over the outlook for the Chinese language economic system, which is affecting steel costs and dragging miners decrease. Antofagasta trades 2 decrease.

The UK financial calendar is quiet as we speak. Consideration might be on US manufacturing facility orders, JOLTS jobs openings, and several other Fed audio system, for additional fears over the outlook of the US economic system, which might influence broader market sentiment.

FTSE 100 Forecast – Technical Evaluation

The FTSE 100’s restoration from the 7535 low has run into resistance at 8800. Consumers might want to rise above this degree to increase features in the direction of 8910 and recent file ranges.

Quick assist might be seen at 8725, and beneath right here, 8650 comes into play.

Unique Publish