For $20,000, you should purchase a worldwide airline go to see the world. Or, for the low value of free, you may take a fast journey with us worldwide. Sadly, our international journey just isn’t as thrilling as an around-the-world go. Nonetheless, it could enlighten you about some financial struggles overseas. Furthermore, why, in time, they could be problematic for the US.

China, Britain, Europe, and different international locations and areas are experiencing sluggish financial progress and, in some circumstances, contraction. On the similar time, the US continues its sturdy post-pandemic progress tempo. Has the US economic system diverged from the worldwide economic system, or are quite a lot of financial canaries in coalmines keeling over and warning the US is quickly to catch down?

Globalization

Earlier than summarizing financial circumstances in just a few main economies, it’s price appreciating that globalization has tightly bonded the financial exercise of the US and developed nation’s economies.

The graph under, courtesy of the IMF, reveals that the quantity of worldwide commerce as a share of worldwide is on the highest degree since at the very least 1870. We enterprise to say it’s the best ever. The current upward pattern beginning in 1944 is the results of the changing into the world’s reserve forex.

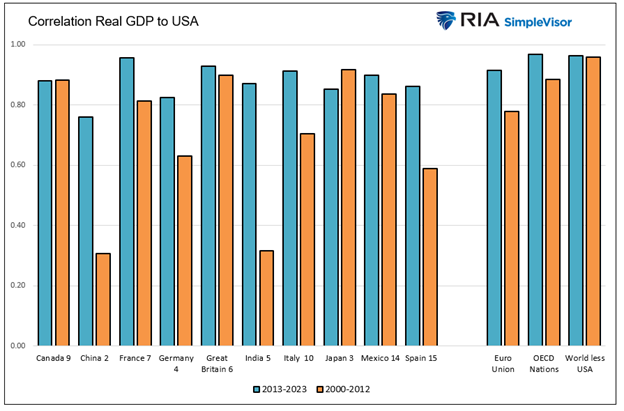

Primarily based on knowledge from the World Financial institution, the next graph reveals highly effective statistical financial relationships between the US and different nations and financial areas. The quantity beside every nation within the X-axis is their international GDP rank.

Aside from Japan, the correlation between the true GDP of the US and that of each nation and area proven has elevated over the past ten years in comparison with the prior twelve-year interval. Equally essential, the connection between the US economic system and the European Union, OECD nations, and the remainder of the world is extremely excessive. These three aggregates exclude the US of their computations.

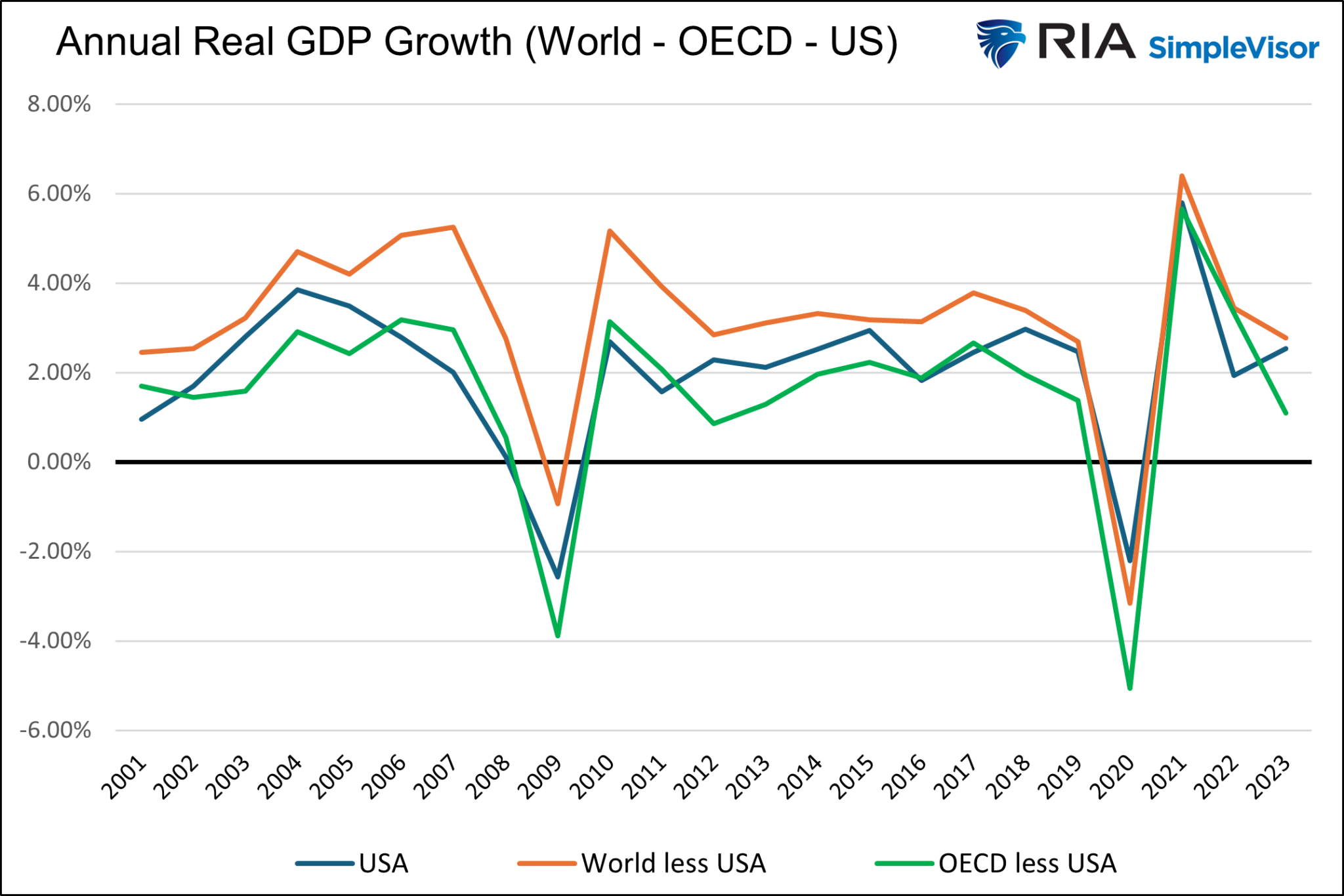

The graph under additional highlights the sturdy relationships that globalization has introduced upon US financial exercise.

Regression Evaluation Confirms Financial Globalization

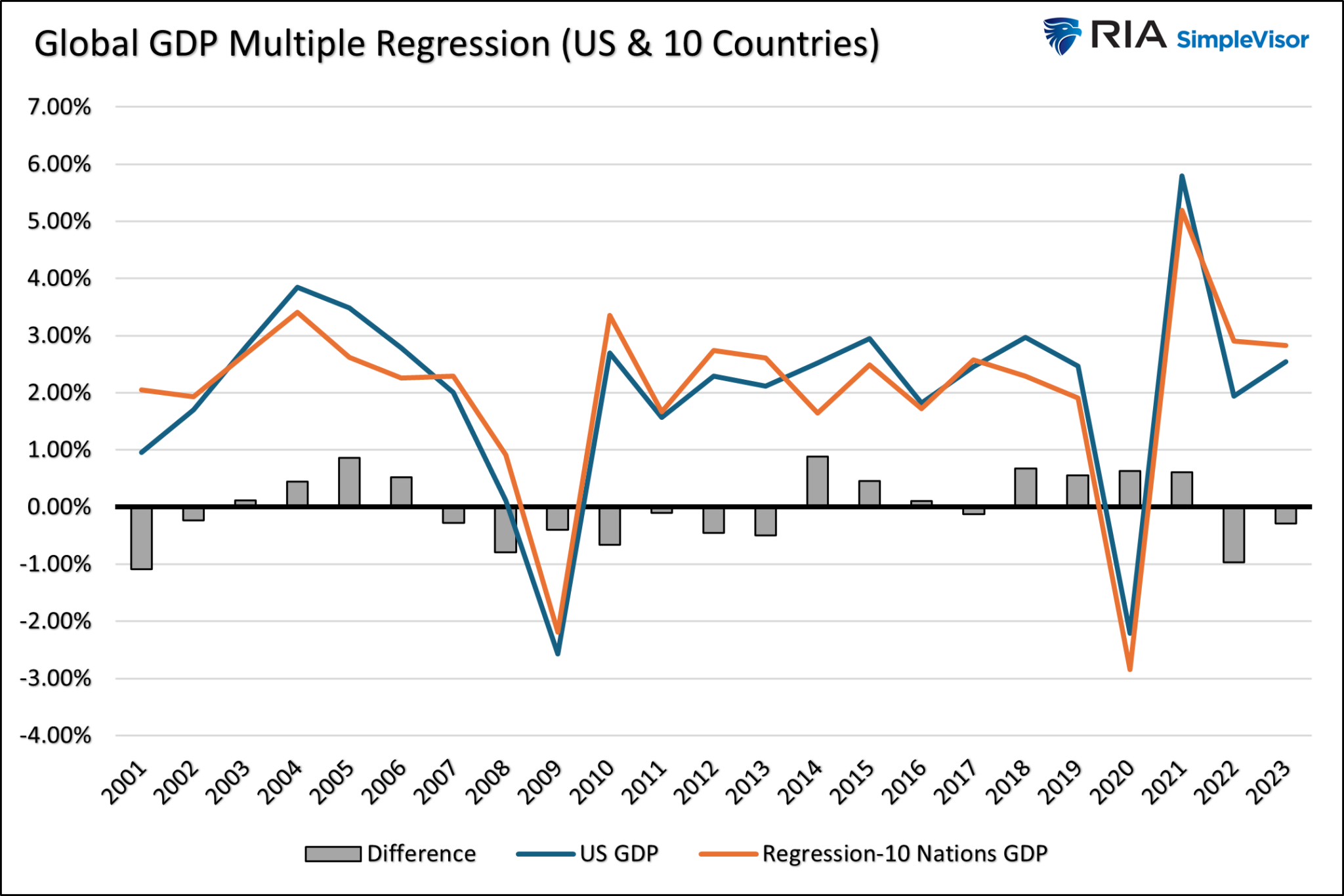

Lastly, we created a a number of regression mannequin to foretell US actual GDP primarily based on the true GDP of the ten nations we highlighted within the prior graphs. Our mannequin has an R-square of .886, denoting a big statistical relationship.

The graph under compares the US actual GDP versus the mannequin’s output. The distinction between the US GDP and the mannequin averages barely lower than half a % yearly and doesn’t range past +/- 1%.

The US economic system is tied on the hip to the worldwide economic system and economies of main developed economies. Very short-term divergences happen, however barring a change to the world commerce order or one other spherical of huge US stimulus, it’s inconceivable that current divergences will final.

Word: The info for the next graphs is thru 2023; thus, it doesn’t embrace 2024. Our dialogue of financial divergence between the US and different nations primarily pertains to newer knowledge.

Britain

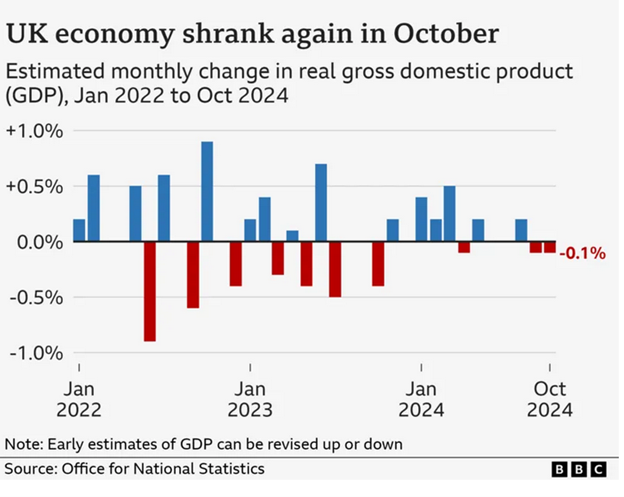

Britain’s actual GDP, as proven under, courtesy of the BBC, has contracted for 2 months in a row. Moreover, it has proven no progress since June.

Private consumption is a contributor to weak UK progress. Per Bloomberg:

An enormous drag on the economic system was consumer-facing companies, the place output tumbled 0.6%, together with a 2% decline in pubs and eating places. It means that households tightened their belts, probably fearing a squeeze from the funds.

Client sentiment in Britain is poor. Its residents are nervous about above-average inflation and excessive rates of interest. Extra lately, shoppers look like pulling again as a result of elevated proposed fiscal spending that might be funded with increased taxes and borrowing.

As with most nations, the worry of US tariffs weighs on UK client and enterprise sentiment.

Lastly, it’s price noting that Britain’s actual progress in 2023 was a mere 0.10%. The nation has barely grown in two years!

Europe

The European Union faces challenges much like these confronted by Britain. Europe’s financial powerhouse, Germany, noticed its actual decline final 12 months, and contraction will seemingly proceed this 12 months.

One giant differentiator between paltry European progress and progress within the US is within the fiscal response to the pandemic. The US flooded its economic system with stimulus throughout and nicely after the preliminary sting of the pandemic. Customers had been supplied with funds and lots of different monetary advantages, and the CHIPS Act fed infrastructure and manufacturing tasks, additional bolstering progress. Whereas the European Union and its nations additionally stimulated financial exercise, the quantities had been a lot much less. Per the Atlantic:

The UK and Germany spent greater than $500 billion. France spent $235 billion, Italy $216 billion. However america was in a league of its personal, spending an astonishing $5 trillion on pandemic reduction. That’s extra, even in at present’s {dollars}, than America spent on the New Deal and World Battle II mixed—and, crucially, it’s greater than double what most European international locations spent on pandemic reduction relative to the sizes of their respective economies.

Additional, take into account that Russia’s invasion of Ukraine and the impression it has on vitality costs can be responsible for sluggish progress together with a number of different political and social components.

China

Earlier than the monetary disaster, China had grown its economic system by 10-15% yearly. Whereas exceptional, it was unsustainable. Since then, progress has slowed considerably, albeit it’s nonetheless excessive in comparison with most developed nations. From 2020 to 2023, its actual progress was a comparatively low 4.1%. It’s anticipated to stay under 5% for the rest of this 12 months and subsequent 12 months.

The nation is coping with a credit score hangover following many years of serious financial progress pushed partly by huge infrastructure funding. Vacant cities and properties throughout China are resulting in a decline in actual property exercise, which as soon as accounted for a good portion of GDP. Development and associated industries have been negatively impacted, as has client sentiment.

Concurrently, the nation has a shrinking workforce and an growing old inhabitants. Furthermore, it faces weaker international export demand amid ongoing geopolitical tensions, notably with the US. Commerce restrictions and the post-pandemic redirection of worldwide provide chains away from Chinese language manufacturing have negatively impacted key industrial sectors. Lastly, enterprise confidence is eroding as a result of current authorities insurance policies, together with regulatory crackdowns on tech companies and blended indicators on private-sector stimulus.

Excessive ranges of company debt and native authorities borrowing have additional restricted fiscal flexibility, making the federal government’s current spate of stimulus packages a lot much less efficient than prior stimulus. China’s bond buyers are taking discover. As proven under, its ten-year sovereign bond yield is now under 2%, the bottom in historical past.

China, as soon as the world’s marginal driver of financial progress, is exporting their financial slowdown throughout the globe.

Canada

We shared the next paragraph and graph from our current on Canada:

On Wednesday, the Financial institution of Canada lower its key benchmark charge by 50bps. They’ve now lower by 150 bps in 2024, in comparison with what’s going to seemingly be 100 bps for the Fed after subsequent week’s assembly. Not like the Fed, Canada’s central financial institution is combating off a recession. Canadian actual GDP for the final 4 quarters has been under 1%. Its unemployment charge troughed in January 2022 at a fifty-year low of 4.9%. Nevertheless, since then, it has risen steadily to six.8%. The Canadian greenback has been buying and selling at its lowest ranges in comparison with the US greenback since 2016 (excluding the pandemic).

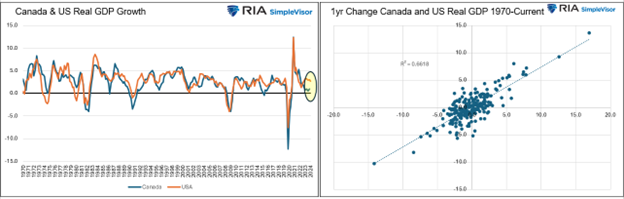

We must always concentrate as a result of the US economic system and Canada are extraordinarily carefully linked regardless of being totally different. The most important differentiator is that Canada’s economic system depends far more closely on commodities and manufacturing, whereas the US is extra service-sector-oriented. Regardless of the variations, there was a traditionally tight financial relationship between Canada and the US, as proven under.

Excessive rates of interest and sluggish oil costs weigh on Canada’s financial progress. Not like China, they’re experiencing inhabitants progress. Nevertheless, its progress masks financial weak point. Per The Fraser Institute:

Canada’s current progress file has obtained a lot consideration as a result of it’s, fairly merely, abysmal. One current evaluation famous that as a result of weak whole progress accompanied by a surging inhabitants, Canada has truly been in a “per capita” recession for a while. Per-person GDP has declined by 3.4 % in inflation-adjusted phrases between the second quarter of 2022 and the ultimate quarter of 2023.

Abstract

We might summarize financial circumstances in different developed international locations, and in virtually all circumstances, we might give you themes much like these we share above. The takeaway just isn’t essentially the particulars of every nation and area however the current uncommon financial progress divergence between the US and the world.

The large pandemic and post-pandemic stimulus by the US authorities is a key issue explaining the distinction. The US offered extra stimulus on a GDP foundation than all main developed economies. The stimulus was within the type of emergency funds, which had restricted period advantages. Nevertheless, it additionally got here in longer-lasting varieties just like the CHIPS Act and mortgage forgiveness packages, which continues to bolster progress.

Certainly, vital federal deficit spending has helped offset a lot increased rates of interest and cussed inflation. Client confidence stays weary, however shoppers proceed to spend because the labor markets are comparatively wholesome. Whereas all could appear nicely, we’re rising involved that headwinds to progress, together with the worldwide economic system and excessive rates of interest, will weigh on the US economic system.

As we wrote earlier, “Very short-term divergences happen, however barring a change to the world commerce order or one other spherical of huge US stimulus, it’s inconceivable that current divergences will final.”

It’s extra seemingly the US economic system will catch all the way down to the worldwide economic system!