Up to date on Could thirtieth, 2025 by Bob Ciura

Grasp Restricted Partnerships, in any other case often called MLPs, have apparent attraction for revenue buyers. It’s because MLPs broadly supply yields of 5% and even greater in some instances.

With this in thoughts, we created a full downloadable checklist of almost 100 Grasp Restricted Partnerships.

You possibly can obtain the Excel spreadsheet (together with related monetary metrics like dividend yield and payout ratios) by clicking on the hyperlink beneath:

This text covers the 15 highest-yielding MLPs as we speak which might be coated within the Positive Evaluation Analysis Database.

The desk of contents beneath permits for straightforward navigation of the article:

Desk of Contents

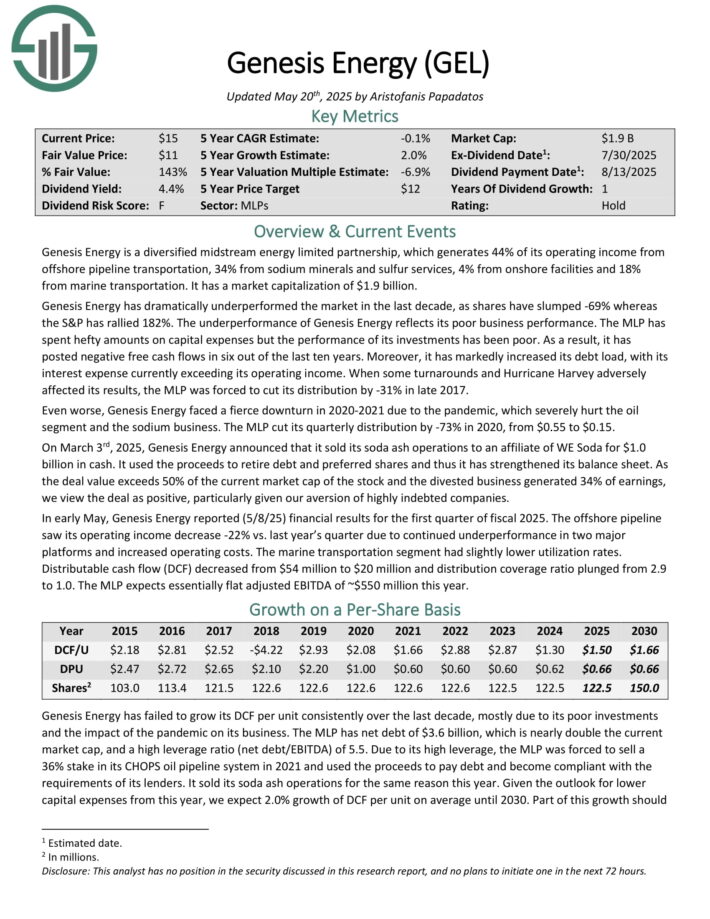

Excessive Yield MLP #15: Genesis Vitality LP (GEL)

Genesis Vitality is a diversified midstream vitality restricted partnership, which generates 44% of its working revenue from offshore pipeline transportation, 34% from sodium minerals and sulfur companies, 4% from onshore amenities and 18% from marine transportation.

On March third, 2025, Genesis Vitality introduced that it bought its soda ash operations to an affiliate of WE Soda for $1.0 billion in money. It used the proceeds to retire debt and most well-liked shares and thus it has strengthened its steadiness sheet.

Because the deal worth exceeds 50% of the present market cap of the inventory and the divested enterprise generated 34% of earnings, we view the deal as constructive, notably given our aversion of extremely indebted corporations.

In early Could, Genesis Vitality reported (5/8/25) monetary outcomes for the primary quarter of fiscal 2025. The offshore pipeline noticed its working revenue lower -22% vs. final yr’s quarter because of continued underperformance in two main platforms and elevated working prices. The marine transportation section had barely decrease utilization charges.

Distributable money movement (DCF) decreased from $54 million to $20 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on GEL (preview of web page 1 of three proven beneath):

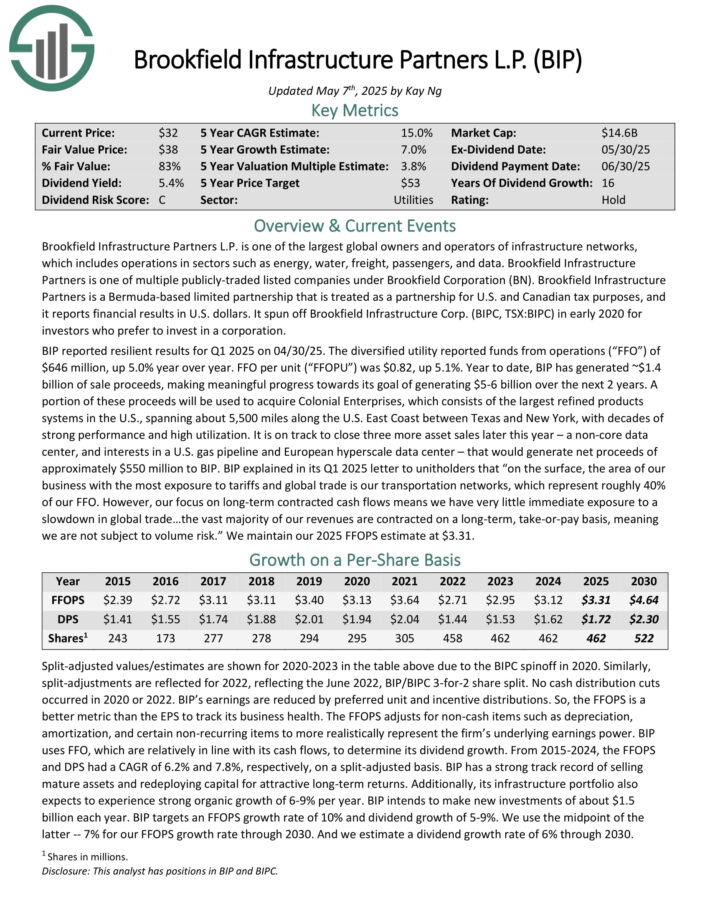

Excessive Yield MLP #14: Brookfield Infrastructure Companions LP (BIP)

Brookfield Infrastructure Companions L.P. is among the largest world homeowners and operators of infrastructure networks, which incorporates operations in sectors reminiscent of vitality, water, freight, passengers, and information.

Brookfield Infrastructure Companions is one among 4 publicly-traded listed partnerships that’s operated by Brookfield Asset Administration (BAM).

BIP has delivered 8% compound annual distribution development over the previous 10 years.

Supply: Investor Presentation

BIP reported resilient outcomes for Q1 2025 on 04/30/25. The diversified utility reported funds from operations of $646 million, up 5.0% yr over yr. FFO per unit (“FFOPU”) was $0.82, up 5.1%.

Yr up to now, BIP has generated ~$1.4 billion of sale proceeds, making significant progress in the direction of its aim of producing $5-6 billion over the following 2 years.

A portion of those proceeds can be used to accumulate Colonial Enterprises, which consists of the most important refined merchandise methods within the U.S., spanning about 5,500 miles alongside the U.S. East Coast between Texas and New York.

Click on right here to obtain our most up-to-date Positive Evaluation report on Brookfield Infrastructure Companions (preview of web page 1 of three proven beneath):

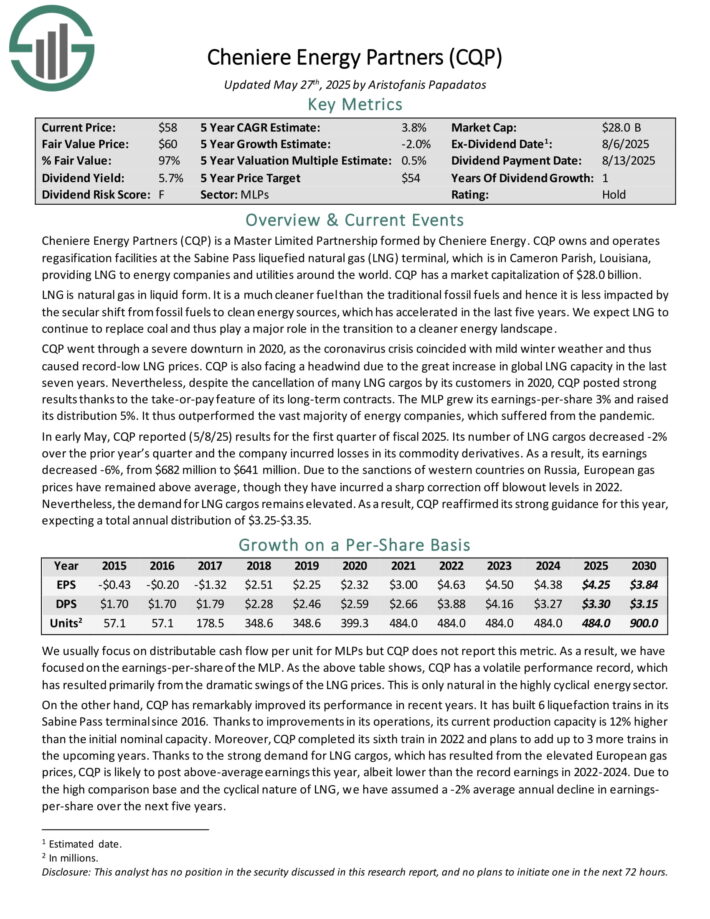

Excessive Yield MLP #13: Cheniere Vitality Companions LP (CQP)

Cheniere Vitality Companions owns and operates regasification amenities on the Sabine Go liquefied pure gasoline (LNG) terminal, which is in Cameron Parish, Louisiana, offering LNG to vitality corporations and utilities world wide.

LNG is pure gasoline in liquid kind. It’s a a lot cleaner gas than the standard fossil fuels and therefore it’s much less impacted by the secular shift from fossil fuels to scrub vitality sources, which has accelerated within the final 5 years. We count on LNG to proceed to exchange coal and thus play a serious function within the transition to a cleaner vitality panorama.

In early Could, CQP reported (5/8/25) outcomes for the primary quarter of fiscal 2025. Its variety of LNG cargos decreased -2% over the prior yr’s quarter and the corporate incurred losses in its commodity derivatives. Consequently, its earnings decreased -6%, from $682 million to $641 million.

Nonetheless, the demand for LNG cargos stays elevated. Consequently, CQP reaffirmed its robust steerage for this yr, anticipating a complete annual distribution of $3.25-$3.35.

Click on right here to obtain our most up-to-date Positive Evaluation report on CQP (preview of web page 1 of three proven beneath):

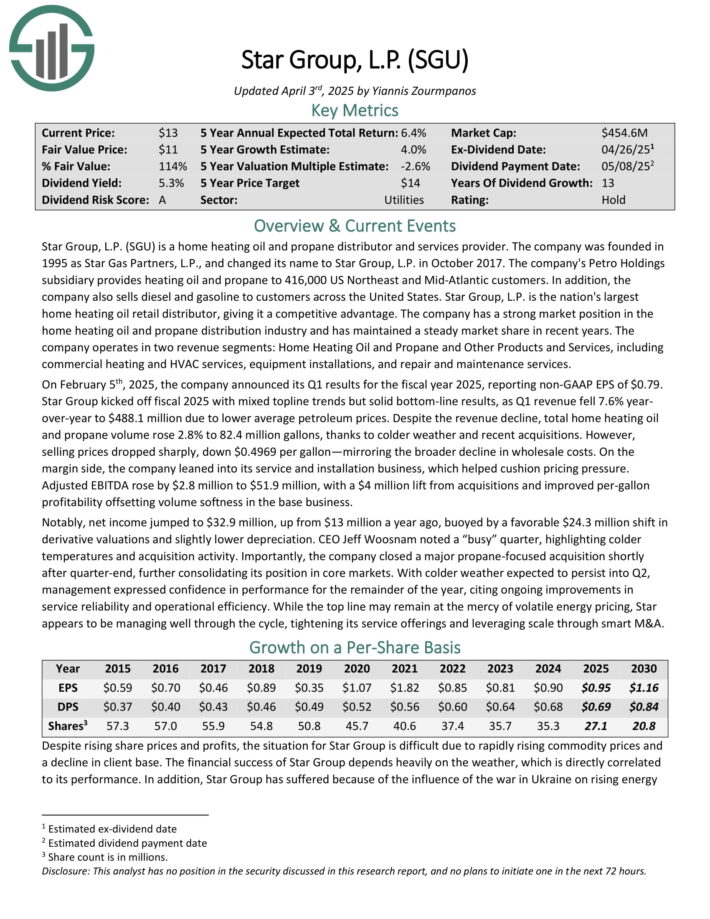

Excessive Yield MLP #12: Star Group LP (SGU)

Star Group, L.P. is a house heating oil and propane distributor and companies supplier. The corporate’s Petro Holdings subsidiary offers heating oil and propane to 416,000 US Northeast and Mid-Atlantic clients. As well as, the corporate additionally sells diesel and gasoline to clients throughout america.

It operates two segments: House Heating Oil and Propane and Different Merchandise and Providers, together with business heating and HVAC companies, tools installations, and restore and upkeep companies.

On February fifth, 2025, the corporate introduced its Q1 outcomes for the fiscal yr 2025, reporting non-GAAP EPS of $0.79. Star Group kicked off fiscal 2025 with blended top-line developments however strong bottom-line outcomes, as Q1 income fell 7.6% year-over-year to $488.1 million because of decrease common petroleum costs.

Regardless of the income decline, whole house heating oil and propane quantity rose 2.8% to 82.4 million gallons, due to colder climate and up to date acquisitions.

Nonetheless, promoting costs dropped sharply, down $0.4969 per gallon—mirroring the broader decline in wholesale prices. On the margin facet, the corporate leaned into its service and set up enterprise, which helped cushion pricing strain.

Click on right here to obtain our most up-to-date Positive Evaluation report on SGU (preview of web page 1 of three proven beneath):

Excessive Yield MLP #11: Brookfield Renewable Companions LP (BEP)

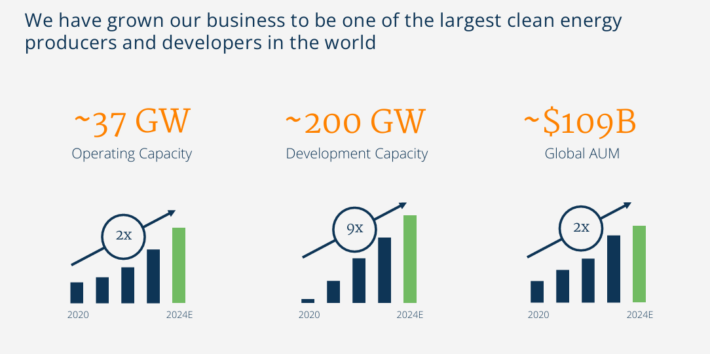

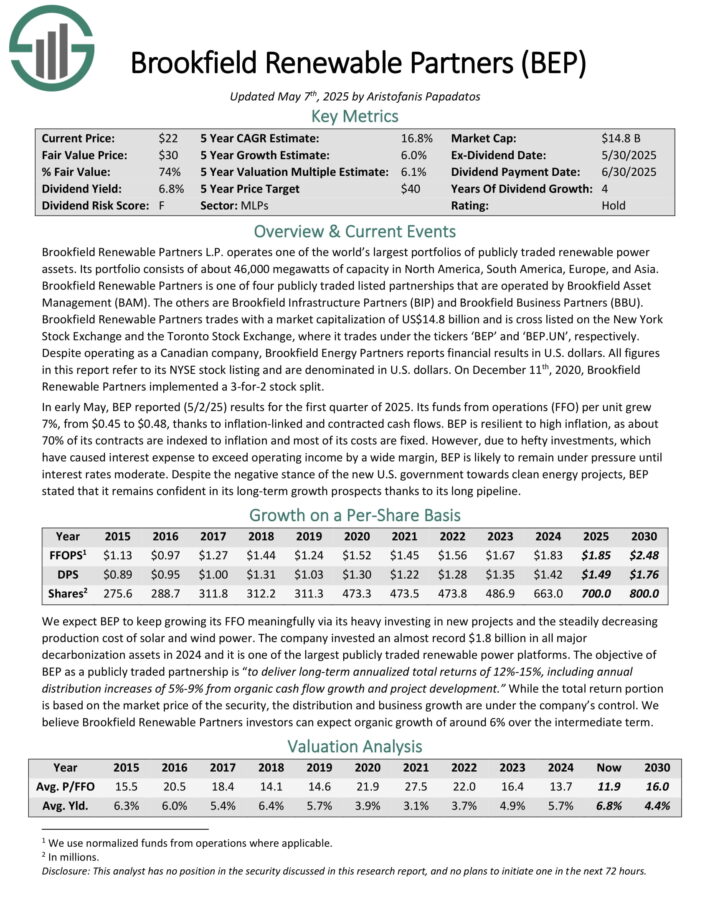

Brookfield Renewable Companions L.P. operates one of many world’s largest portfolios of publicly traded renewable energy property. Its portfolio consists of about 33,000 megawatts of capability in North America, South America, Europe, and Asia.

Brookfield Renewable Companions is one among 4 publicly traded listed partnerships which might be operated by Brookfield Asset Administration (BAM). The others are Brookfield Infrastructure Companions (BIP) and Brookfield Enterprise Companions (BBU).

Supply: Investor Presentation

In early Could, BEP reported (5/2/25) outcomes for the primary quarter of 2025. Its funds from operations (FFO) per unit grew 7%, from $0.45 to $0.48, due to inflation-linked and contracted money flows.

BEP is resilient to excessive inflation, as about 70% of its contracts are listed to inflation and most of its prices are mounted.

Nonetheless, because of hefty investments, which have prompted curiosity expense to exceed working revenue by a large margin, BEP is prone to stay underneath strain till rates of interest reasonable.

Click on right here to obtain our most up-to-date Positive Evaluation report on Brookfield Renewable Companions (preview of web page 1 of three proven beneath):

Excessive Yield MLP #10: Sunoco LP (SUN)

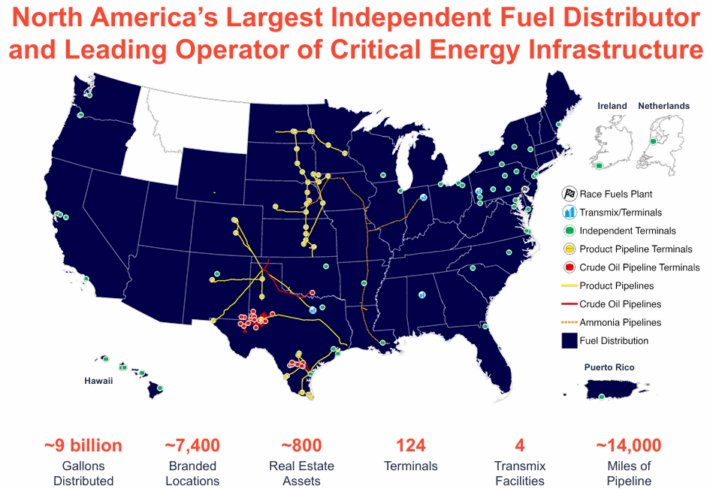

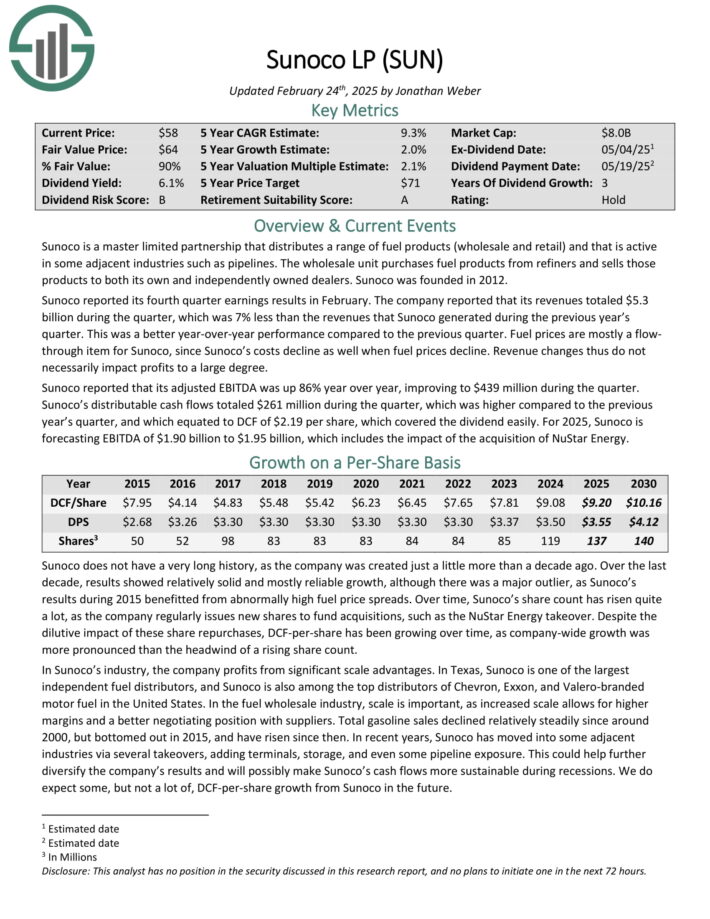

Sunoco is a grasp restricted partnership that distributes a spread of gas merchandise (wholesale and retail) and that’s energetic in some adjoining industries reminiscent of pipelines.

The wholesale unit purchases gas merchandise from refiners and sells these merchandise to each its personal and independently owned sellers.

Supply: Investor Presentation

Sunoco reported its fourth quarter earnings ends in February. The corporate reported that its revenues totaled $5.3 billion throughout the quarter, which was 7% lower than the revenues that Sunoco generated throughout the earlier yr’s quarter.

Gasoline costs are principally a movement by way of merchandise for Sunoco, since Sunoco’s prices decline as properly when gas costs decline. Income adjustments thus don’t essentially influence income to a big diploma.

Sunoco reported that its adjusted EBITDA was up 86% yr over yr, enhancing to $439 million throughout the quarter. Distributable money flows totaled $261 million throughout the quarter, which was greater in comparison with the earlier yr’s quarter, and which equated to DCF of $2.19 per share.

Click on right here to obtain our most up-to-date Positive Evaluation report on SUN (preview of web page 1 of three proven beneath):

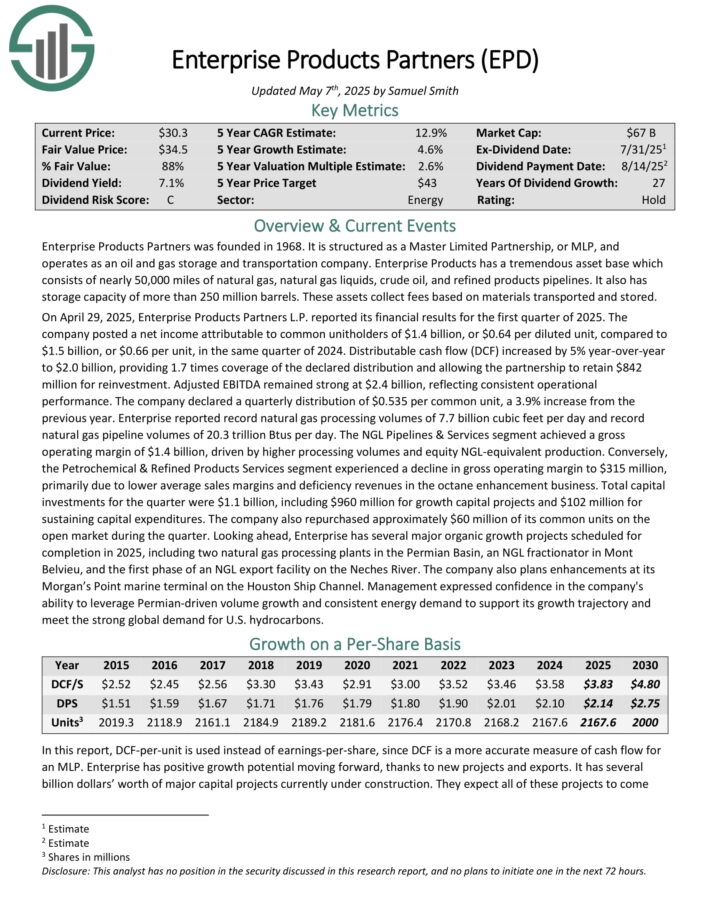

Excessive Yield MLP #9: Enterprise Merchandise Companions LP (EPD)

Enterprise Merchandise Companions was based in 1968. It’s structured as a Grasp Restricted Partnership, or MLP, and operates as an oil and gasoline storage and transportation firm.

Enterprise Merchandise has a big asset base which consists of almost 50,000 miles of pure gasoline, pure gasoline liquids, crude oil, and refined merchandise pipelines.

It additionally has storage capability of greater than 250 million barrels. These property acquire charges primarily based on volumes of supplies transported and saved.

Supply: Investor Presentation

On April 29, 2025, Enterprise Merchandise Companions L.P. reported its monetary outcomes for the primary quarter of 2025. The corporate posted a web revenue attributable to widespread unitholders of $1.4 billion, or $0.64 per diluted unit, in comparison with $1.5 billion, or $0.66 per unit, in the identical quarter of 2024.

Distributable money movement (DCF) elevated by 5% year-over-year to $2.0 billion, offering 1.7 instances protection of the declared distribution and permitting the partnership to retain $842 million for reinvestment.

Adjusted EBITDA remained robust at $2.4 billion, reflecting constant operational efficiency. The corporate declared a quarterly distribution of $0.535 per widespread unit, a 3.9% enhance from the earlier yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on EPD (preview of web page 1 of three proven beneath):

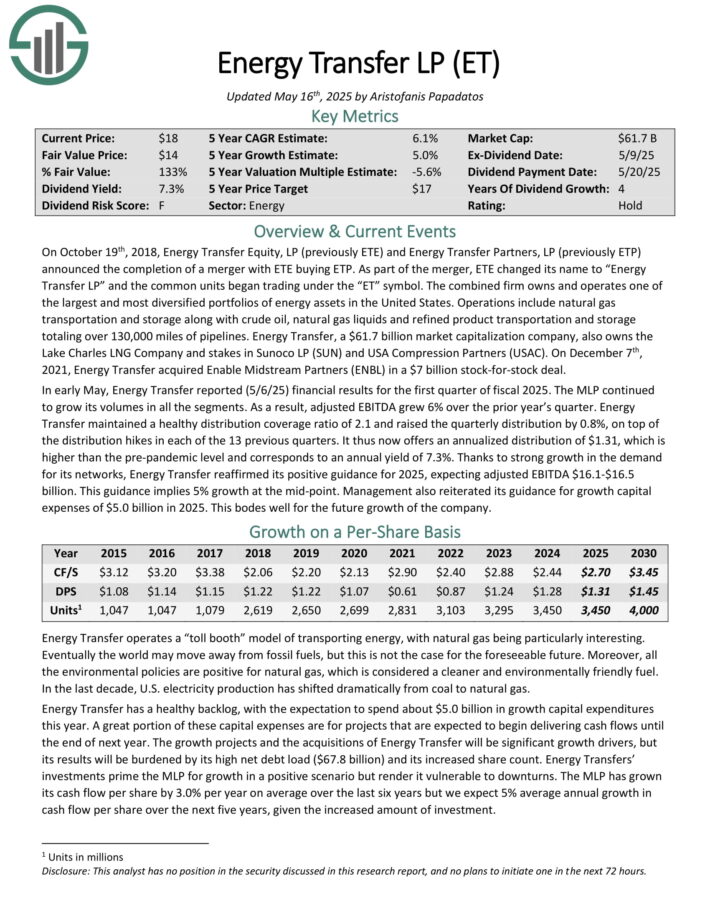

Excessive Yield MLP #8: Vitality Switch LP (ET)

Vitality Switch LP owns and operates one of many largest and most diversified portfolios of vitality property in america. Operations embody pure gasoline transportation and storage together with crude oil, pure gasoline liquids and refined product transportation and storage totaling over 130,000 miles of pipelines.

Vitality Switch additionally owns the Lake Charles LNG Firm and stakes in Sunoco LP (SUN) and USA Compression Companions (USAC).

In early Could, Vitality Switch reported (5/6/25) monetary outcomes for the primary quarter of fiscal 2025. Adjusted EBITDA grew 6% over the prior yr’s quarter. Vitality Switch maintained a wholesome distribution protection ratio of two.1 and raised the quarterly distribution by 0.8%, on high of the distribution hikes in every of the 13 earlier quarters.

Due to robust development within the demand for its networks, Vitality Switch reaffirmed its constructive steerage for 2025, anticipating adjusted EBITDA $16.1-$16.5 billion. This steerage implies 5% development on the mid-point.

Click on right here to obtain our most up-to-date Positive Evaluation report on ET (preview of web page 1 of three proven beneath):

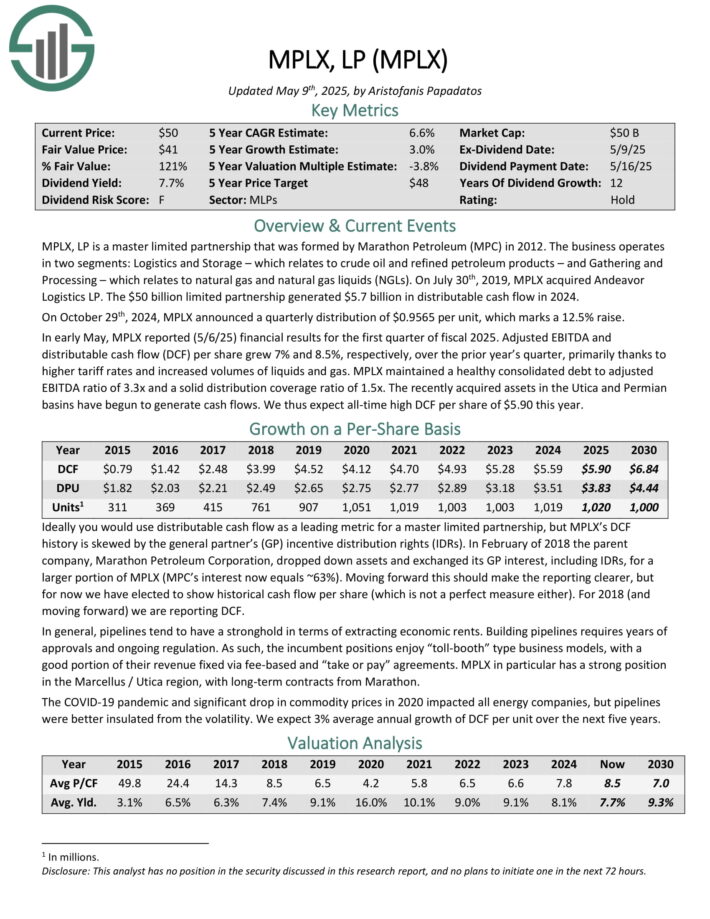

Excessive Yield MLP #7: MPLX LP (MPLX)

MPLX LP is a Grasp Restricted Partnership that was fashioned by the Marathon Petroleum Company (MPC) in 2012. In 2019, MPLX acquired Andeavor Logistics LP.

The enterprise operates in two segments:

- Logistics and Storage, which pertains to crude oil and refined petroleum merchandise

- Gathering and Processing, which pertains to pure gasoline and pure gasoline liquids (NGLs)

In early Could, MPLX reported (5/6/25) monetary outcomes for the primary quarter of fiscal 2025. Adjusted EBITDA and distributable money movement (DCF) per share grew 7% and eight.5%, respectively, over the prior yr’s quarter, primarily due to greater tariff charges and elevated volumes of liquids and gasoline.

MPLX maintained a wholesome consolidated debt to adjusted EBITDA ratio of three.3x and a strong distribution protection ratio of 1.5x.

Click on right here to obtain our most up-to-date Positive Evaluation report on MPLX (preview of web page 1 of three proven beneath):

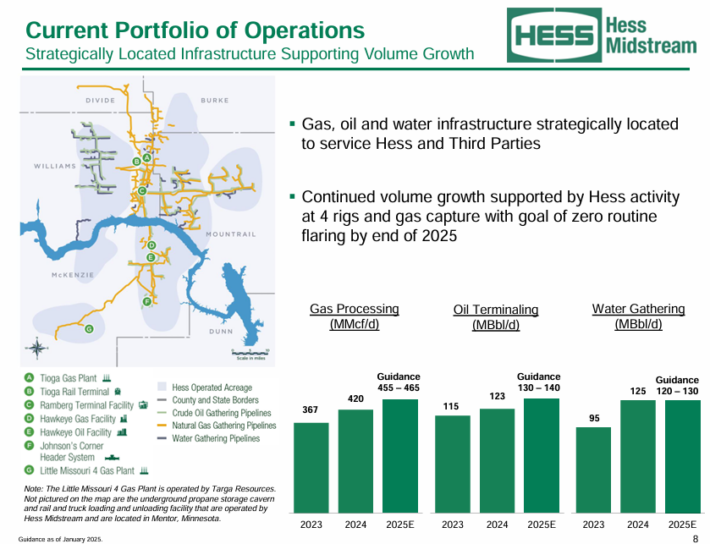

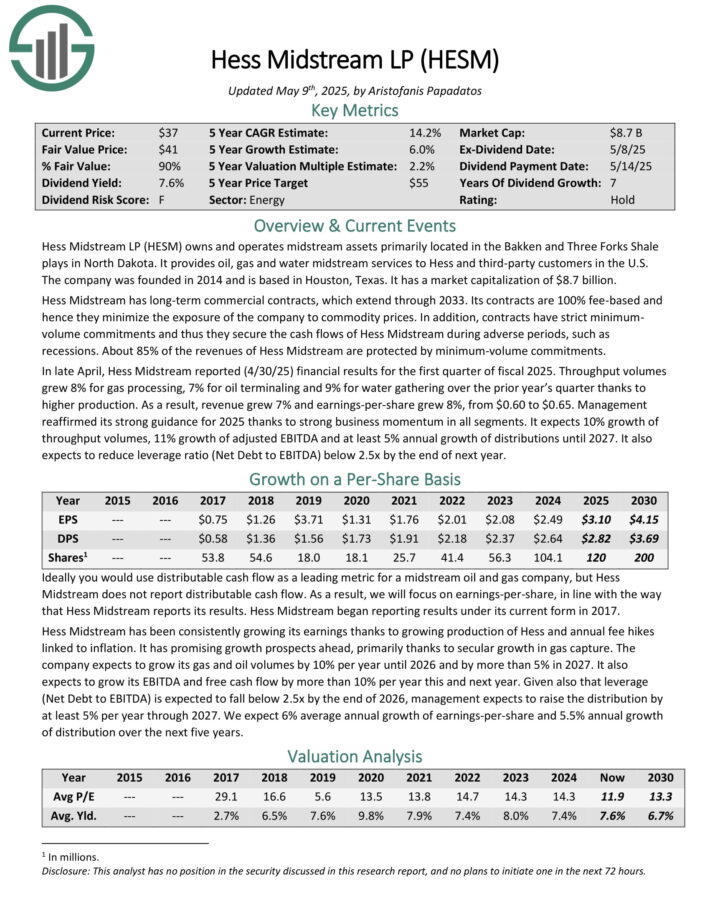

Excessive Yield MLP #6: Hess Midstream LP (HESM)

Hess Midstream LP owns and operates midstream property primarily situated within the Bakken and Three Forks Shale performs in North Dakota. It offers oil, gasoline and water midstream companies to Hess and third-party clients within the U.S.

Hess Midstream has long-term business contracts, which lengthen by way of 2033. Its contracts are 100% fee-based and reduce the publicity of the corporate to commodity costs.

Supply: Investor Presentation

In late April, Hess Midstream reported (4/30/25) monetary outcomes for the primary quarter of fiscal 2025. Throughput volumes grew 8% for gasoline processing, 7% for oil terminaling and 9% for water gathering over the prior yr’s quarter due to greater manufacturing.

Consequently, income grew 7% and earnings-per-share grew 8%, from $0.60 to $0.65. Administration reaffirmed its robust steerage for 2025 due to robust enterprise momentum in all segments.

It expects 10% development of throughput volumes, 11% development of adjusted EBITDA and a minimum of 5% annual development of distributions till 2027.

Click on right here to obtain our most up-to-date Positive Evaluation report on HESM (preview of web page 1 of three proven beneath):

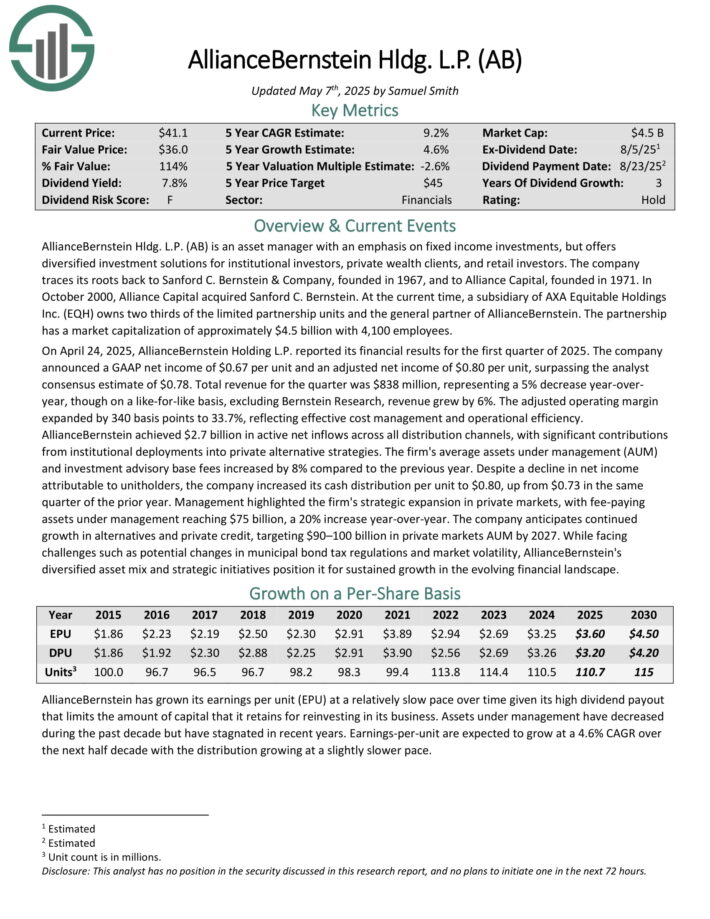

Excessive Yield MLP #5: Alliance Bernstein Holding LP (AB)

AllianceBernstein Hldg. L.P. is an asset supervisor with an emphasis on mounted revenue investments, however presents diversified funding options for institutional buyers, non-public wealth purchasers, and retail buyers.

On April 24, 2025, AllianceBernstein Holding L.P. reported its monetary outcomes for the primary quarter of 2025. The corporate introduced a GAAP web revenue of $0.67 per unit and an adjusted web revenue of $0.80 per unit, surpassing the analyst consensus estimate of $0.78.

Complete income for the quarter was $838 million, representing a 5% lower year-over-year, although on a like-for-like foundation, excluding Bernstein Analysis, income grew by 6%. The adjusted working margin expanded by 340 foundation factors to 33.7%, reflecting efficient price administration and operational effectivity.

AllianceBernstein achieved $2.7 billion in energetic web inflows throughout all distribution channels, with important contributions from institutional deployments into non-public various methods. The agency’s common property underneath administration (AUM) and funding advisory base charges elevated by 8% in comparison with the earlier yr.

Regardless of a decline in web revenue attributable to unitholders, the corporate elevated its money distribution per unit to $0.80, up from $0.73 in the identical quarter of the prior yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on AB (preview of web page 1 of three proven beneath):

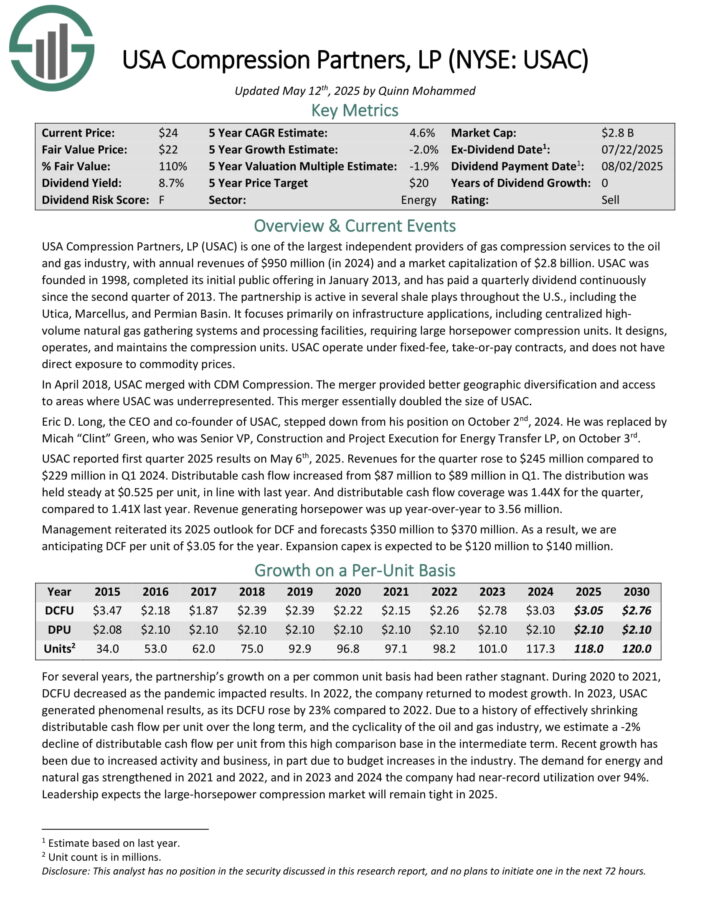

Excessive Yield MLP #4: USA Compression Companions LP (USAC)

USA Compression Companions, LP is among the largest impartial suppliers of gasoline compression companies to the oil and gasoline trade, with annual revenues of $950 million in 2024.

The partnership is energetic in a number of shale performs all through the U.S., together with the Utica, Marcellus, and Permian Basin. It focuses totally on infrastructure functions, together with centralized high-volume pure gasoline gathering methods and processing amenities, requiring massive horsepower compression models.

It designs, operates, and maintains the compression models. USAC function underneath fixed-fee, take-or-pay contracts, and doesn’t have direct publicity to commodity costs.

USAC reported first quarter 2025 outcomes on Could sixth, 2025. Revenues for the quarter rose to $245 million in comparison with $229 million in Q1 2024. Distributable money movement elevated from $87 million to $89 million in Q1. The distribution was held regular at $0.525 per unit, according to final yr.

Distributable money movement protection was 1.44X for the quarter, in comparison with 1.41X final yr. Income producing horsepower was up year-over-year to three.56 million. Administration reiterated its 2025 outlook for DCF and forecasts $350 million to $370 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on USAC (preview of web page 1 of three proven beneath):

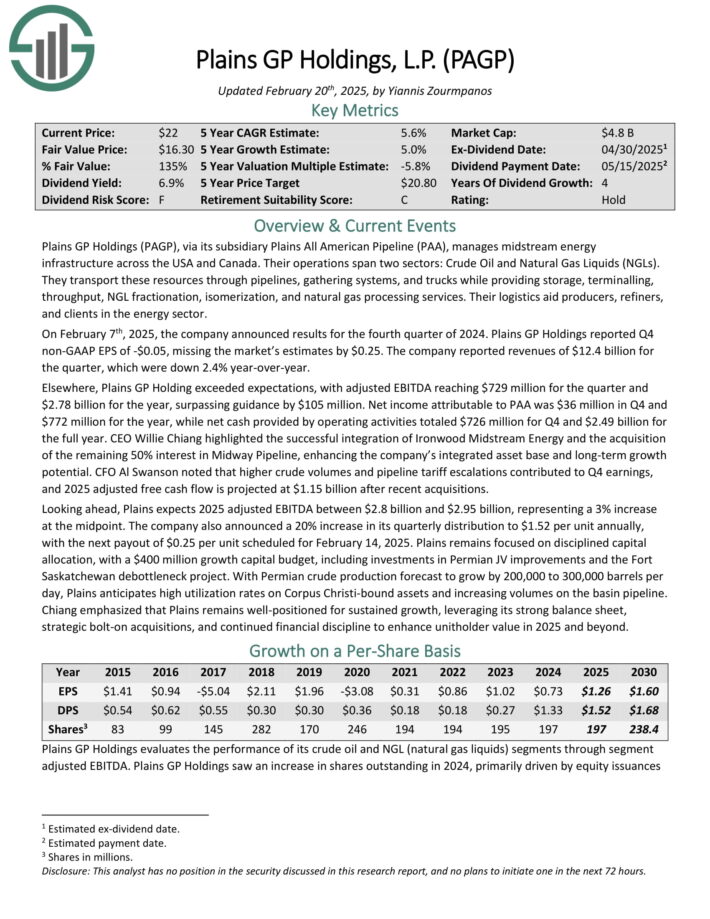

Excessive Yield MLP #3: Plains GP Holdings LP (PAGP)

Plains GP Holdings by way of its subsidiary Plains All American Pipeline (PAA), manages midstream vitality infrastructure throughout the USA and Canada. Their operations span two sectors: Crude Oil and Pure Fuel Liquids (NGLs).

They transport these sources by way of pipelines, gathering methods, and vehicles whereas offering storage, terminalling, throughput, NGL fractionation, isomerization, and pure gasoline processing companies. Their logistics support producers, refiners, and purchasers within the vitality sector.

On February seventh, 2025, the corporate introduced outcomes for the fourth quarter of 2024. Plains GP Holdings reported This autumn non-GAAP EPS of -$0.05, lacking the market’s estimates by $0.25. The corporate reported revenues of $12.4 billion for the quarter, which have been down 2.4% year-over-year.

Wanting forward, Plains expects 2025 adjusted EBITDA between $2.8 billion and $2.95 billion, representing a 3% enhance on the midpoint. The corporate additionally introduced a 20% enhance in its quarterly distribution to $1.52 per unit yearly, with the following payout of $0.25 per unit scheduled for February 14, 2025.

With Permian crude manufacturing forecast to develop by 200,000 to 300,000 barrels per day, Plains anticipates excessive utilization charges on Corpus Christi-bound property and growing volumes on the basin pipeline.

Click on right here to obtain our most up-to-date Positive Evaluation report on PAGP (preview of web page 1 of three proven beneath):

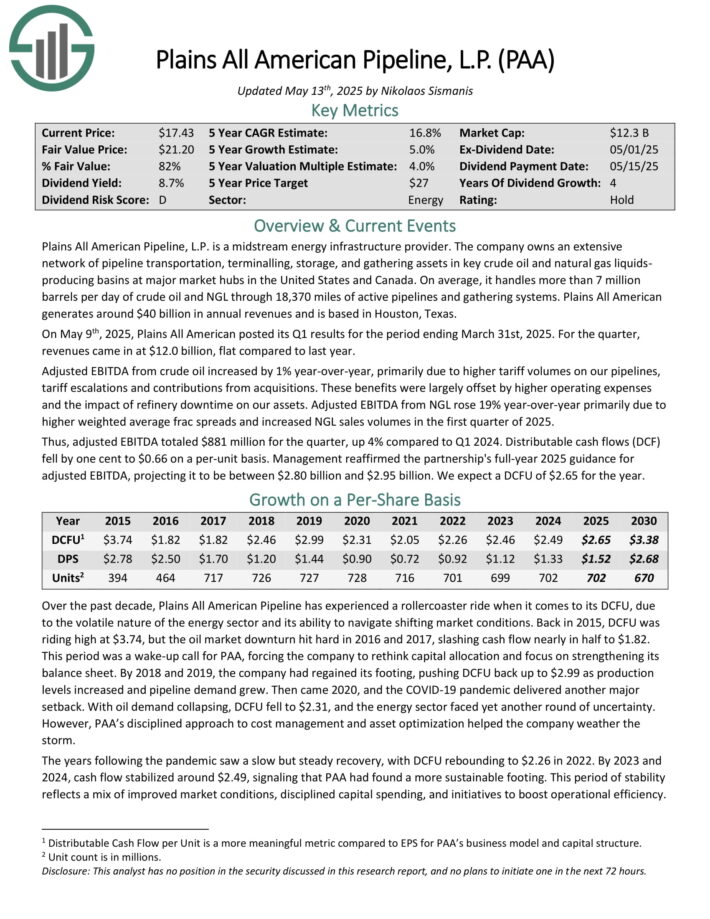

Excessive Yield MLP #2: Plains All American Pipeline LP (PAA)

Plains All American Pipeline, L.P. is a midstream vitality infrastructure supplier. The corporate owns an in depth community of pipeline transportation, terminalling, storage, and gathering property in key crude oil and pure gasoline liquids producing basins at main market hubs in america and Canada.

On common, it handles greater than 7 million barrels per day of crude oil and NGL by way of 18,370 miles of energetic pipelines and gathering methods. Plains All American generates round $40 billion in annual revenues and is predicated in Houston, Texas.

On Could ninth, 2025, Plains All American posted its Q1 outcomes for the interval ending March thirty first, 2025. For the quarter, revenues got here in at $12.0 billion, flat in comparison with final yr. Adjusted EBITDA from crude oil elevated by 1% year-over-year, primarily because of greater tariff volumes on our pipelines, tariff escalations and contributions from acquisitions.

These advantages have been largely offset by greater working bills and the influence of refinery downtime on our property. Adjusted EBITDA from NGL rose 19% year-over-year primarily because of greater weighted common frac spreads and elevated NGL gross sales volumes within the first quarter of 2025.

Click on right here to obtain our most up-to-date Positive Evaluation report on PAA (preview of web page 1 of three proven beneath):

Excessive Yield MLP #1: Delek Logistics Companions LP (DKL)

- Distribution yield: 10.7%

Delek Logistics Companions, LP is a publicly traded grasp restricted partnership (MLP) headquartered in Brentwood, Tennessee. Established in 2012 by Delek US Holdings, Inc. (NYSE: DK), Delek Logistics owns and operates a community of midstream vitality infrastructure property.

These property embody roughly 850 miles of crude oil and refined product transportation pipelines and a 700-mile crude oil gathering system, primarily situated within the southeastern United States and west Texas.

The corporate’s operations are integral to Delek US’s refining actions, notably supporting refineries in Tyler, Texas, and El Dorado, Arkansas.

Delek Logistics offers companies reminiscent of gathering, transporting, and storing crude oil, in addition to advertising and marketing, distributing, and storing refined merchandise for each Delek US and third-party clients.

DLK has elevated its distribution for 10 consecutive years and at the moment yields over 10%, making it a high-yield blue chip.

Click on right here to obtain our most up-to-date Positive Evaluation report on DKL (preview of web page 1 of three proven beneath):

Ultimate Ideas

Earnings buyers will discover loads to love about Grasp Restricted Partnerships. Particularly, MLPs are inclined to have very excessive yields.

In fact, buyers ought to at all times do their very own analysis to know the distinctive tax implications and danger components of MLPs.

However for revenue buyers primarily searching for excessive yields, these 20 MLPs could also be engaging.

If you’re focused on discovering high-quality dividend development shares and/or different high-yield securities and revenue securities, the next Positive Dividend sources

sources can be helpful:

Excessive-Yield Particular person Safety Analysis:

Different Positive Dividend Assets:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].