Betting has quickly emerged as a major cultural and financial phenomenon throughout Africa, propelled by the continent’s youthful demographic, increasing web and smartphone entry, and the widespread enthusiasm for sports activities, significantly soccer. In alignment with our ongoing dedication to offer well timed, data-driven insights into social and client traits, GeoPoll has carried out a follow-up examine analyzing betting behaviors in key African markets.

This new survey builds upon our 2024 report, which investigated the betting habits of youth in Ghana, Kenya, Nigeria, South Africa, Tanzania, and Uganda. The 2025 version revisits these similar nations, using the identical methodology to facilitate direct comparability of findings, highlighting shifts in attitudes, participation charges, motivations, and spending patterns over the previous yr.

Along with monitoring year-on-year traits, the up to date examine incorporates new demographic insights, thereby providing a extra nuanced understanding of the continued evolution of betting throughout the area. As policymakers, trade stakeholders, and communities deal with the rising affect of playing, GeoPoll’s information serves as a dependable and real-time reflection of African views on this important challenge.

Employment standing of the respondents

The survey, carried out amongst a randomized pattern of respondents throughout six African nations, highlights a different employment panorama. 38% of members reported being formally employed, whereas 29% recognized as self-employed or entrepreneurs. Moreover, 18% of respondents said they had been presently unemployed, and 14% had been college students. A small proportion, 1%, indicated that they had been unable to work.

Traits in Betting Participation Throughout International locations

Over the previous three years, betting participation throughout African nations has proven dynamic shifts. In 2022, Kenya led the continent with 83.9% of respondents reporting they’d tried playing or betting, adopted by Nigeria at 78% and South Africa at 74%. The 2024 examine reaffirmed Kenya’s lead, with 82.8% of respondents indicating they’d positioned a wager, whereas South Africa (73.9%), Ghana (73%), Uganda (71.4%), Tanzania (71.1%), and Nigeria (65.3%) adopted carefully behind.

Nonetheless, the 2025 outcomes mark a notable shift in regional rankings. South Africa now tops the record with a hanging 90% of respondents having positioned bets, adopted by Uganda at 87%. Kenya, beforehand the constant frontrunner, has dropped to 3rd place with 79%. Nigeria follows at 71%, whereas Ghana and Tanzania each report considerably decrease betting participation at 56% every.

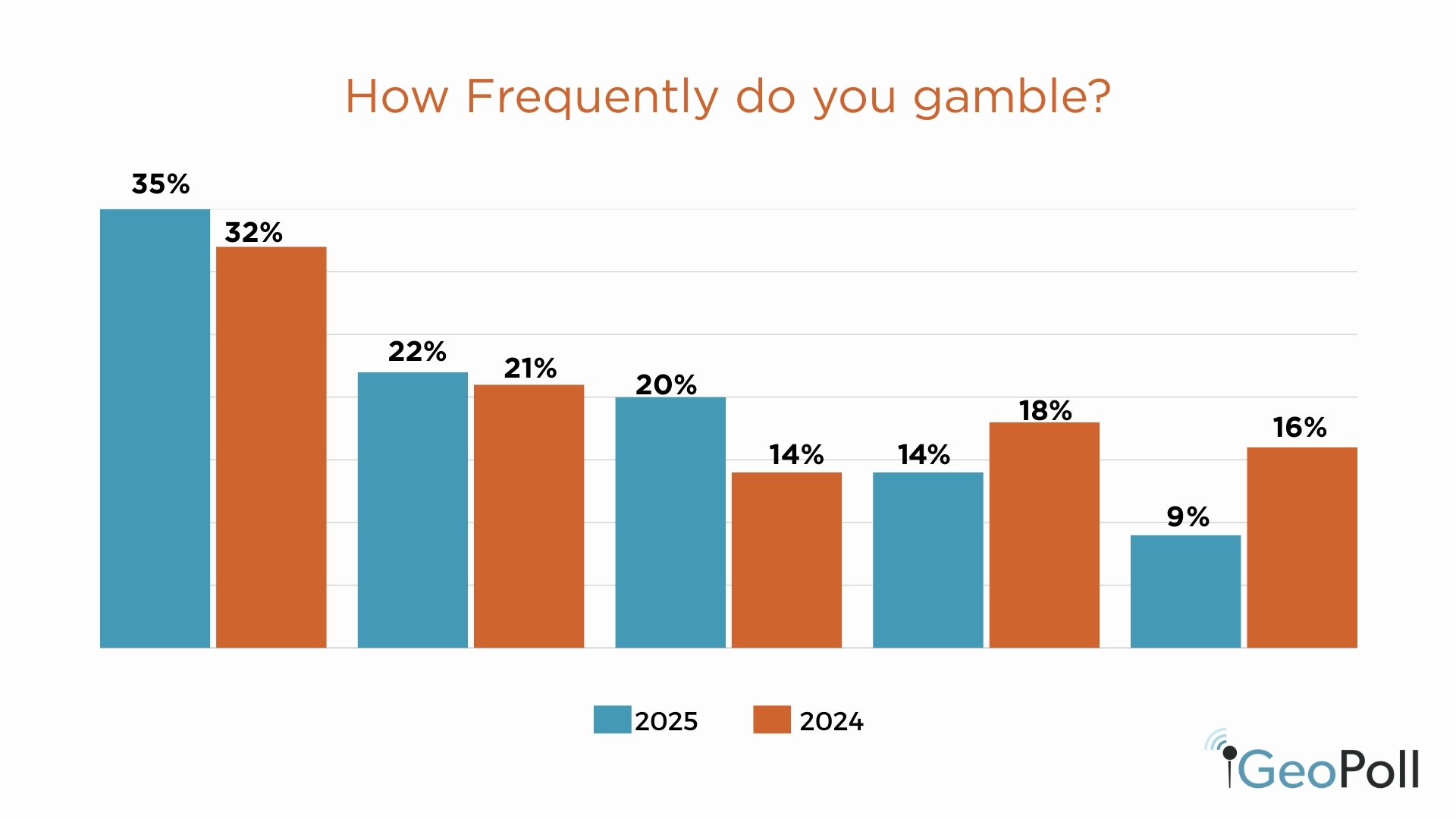

Playing frequency

Amongst those that reported having ever positioned a wager, we explored how regularly they have interaction in playing actions. Within the 2024 survey, 32% of respondents indicated they wager roughly as soon as every week. Moreover, 20.8% positioned bets as soon as a month, 17.8% wager no less than as soon as a day, and 15.6% reported betting greater than as soon as a day.

The 2025 findings present a slight enhance in weekly betting, with 35% of respondents now playing as soon as every week. 22% reported betting as soon as a month, whereas 20% accomplish that lower than as soon as a month. Day by day betting has seen a modest decline, with 14% betting as soon as a day and 9% putting bets greater than as soon as a day.

Cellular betting

Cell phones have firmly established themselves as the popular platform for betting throughout Africa. In line with the 2025 survey, an awesome 91% of respondents who take part in playing reported that they place their bets utilizing a cell phone. This highlights the important function that cell know-how continues to play in shaping betting behaviors on the continent.

The dominance of cell betting will be attributed to a number of components: the widespread penetration of smartphones, the affordability of cell information in lots of African nations, and the comfort of betting apps and mobile-optimized platforms. With cell units providing quick access to betting companies anytime and anyplace, they’ve successfully reworked playing into an on-the-go exercise—particularly interesting to the continent’s predominantly younger, tech-savvy inhabitants.

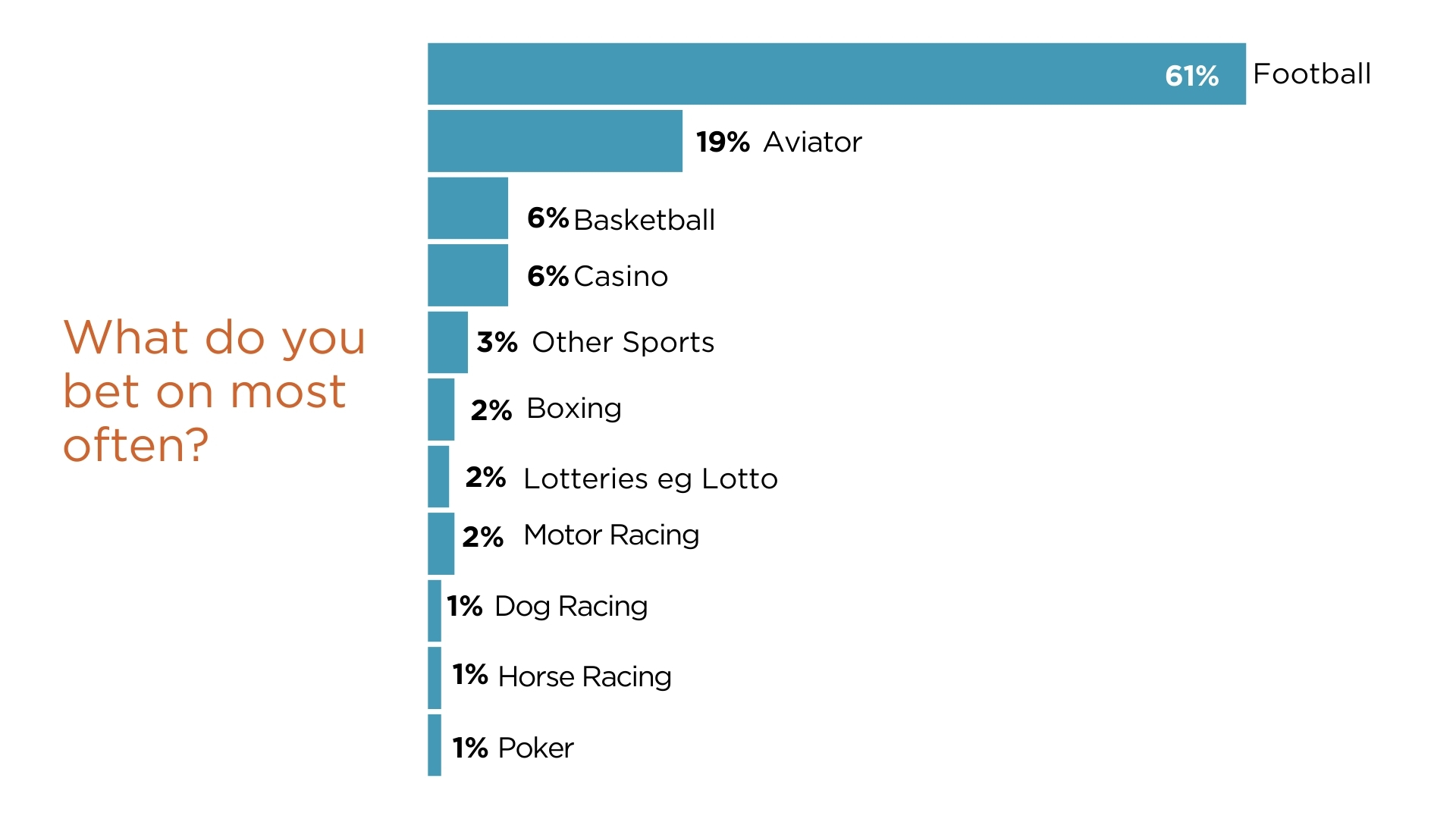

Soccer Betting Stays King, Aviator Rises

Soccer stays the preferred type of betting in Africa, with 61% of respondents within the 2025 survey stating they primarily wager on soccer matches—persevering with the development noticed in 2024. Aviator, a fast-paced digital recreation, has shortly risen in reputation, with 19% selecting it as their major betting choice. Basketball follows distantly, most popular by 6% of respondents. These findings spotlight soccer’s enduring enchantment, whereas additionally pointing to a rising curiosity in different, high-speed betting codecs like Aviator.

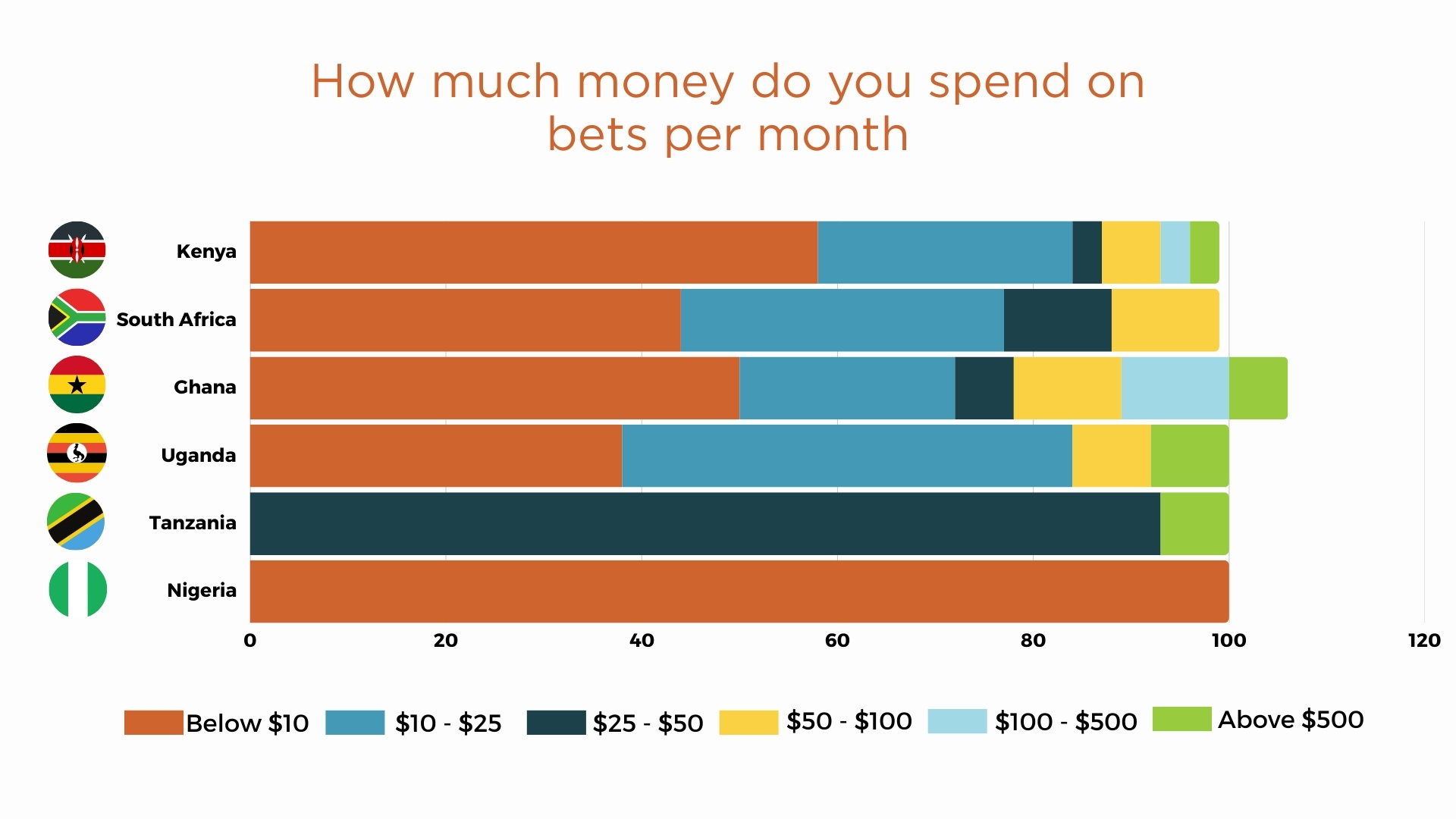

Common month-to-month spend

- Ghana: Spending patterns present selection. 50% reported spending lower than $10 month-to-month. 22% spend between $10 and $25. Smaller teams spend extra: 5% between $25 and $50, 11% between $50 and $100, 11% between $100 and $500, and 5% reported spending over $500. This means frequent small-stake betting alongside a phase of high-stakes bettors.

- Kenya: The bulk (57%) reported spending lower than $10 monthly. Larger spending brackets included: 28% between $10 and $25, 3% between $25 and $50, 6% between $50 and $100, 3% between $100 and $500, and three% spending over $500 month-to-month. This displays predominant low-stake playing but in addition a small group of high-stakes bettors.

- Nigeria: In 2025, the overwhelming majority of respondents reported spending lower than $10 monthly on playing, indicating a pronounced choice for low-stakes participation. In contrast, the 2024 information revealed a extra different spending sample: 58% spent below $10, 28% spent between $10 and $25, and 13% exceeded $25, suggesting solely restricted engagement in larger spending classes.

- South Africa: 45% reported spending lower than $10 monthly. 33% spend between $10 and $25. Larger spending contains 11% between $25 and $50, and one other 11% between $50 and $100. This exhibits most bettors are in low-to-mid spending ranges, with a smaller phase betting larger stakes.

- Tanzania: The overwhelming majority (93%) reported spending lower than $50 monthly. In stark distinction, a notable 7% spend over $500 million month-to-month, highlighting a high-spending minority.

- Uganda: Spending is distributed: 38% spend lower than $10 monthly, 46% spend between $10 and $25. Smaller teams spend extra: 8% between $50 and $100, and eight% spend above $500. This factors to frequent decrease stakes alongside a small group of higher-stake bettors.

About this survey

This GeoPoll fast survey was carried out in April 2025 amongst 4,191 youth in Ghana, Nigeria, Kenya, South Africa, Tanzania, and Uganda utilizing the GeoPoll cell app. The pattern was not absolutely demographically consultant and naturally skewed in direction of youthful folks in city areas. The pattern comprised 65% males and 35% females. Age teams had been distributed as follows: 18-24 (20%), 25-34 (63%), and over 35 (18%).

To conduct a scientific examine on playing or different matters in Africa, Asia, and Latin America, please contact GeoPoll.