US CPI KEY TAKEAWAYS:

- US expectations: 2.9% y/y headline inflation, 3.1% y/y core inflation

- The Fed is more likely to stay on maintain for the following a number of months no matter this month’s CPI studying, with a hotter-than-expected print doubtlessly prompting merchants to cost out any fee cuts in 2025.

- The (DXY) is rallying off vary assist, opening the door for prolonged beneficial properties towards 109.00 if the CPI studying is available in hotter-than-expected.

When is the US CPI report?

The US CPI report for January shall be launched at 8:30ET (13:30 GMT) on Wednesday, February 12.

What are the US CPI Report Expectations?

Merchants and economists are projecting headline CPI to come back in at 2.9% y/y, with the core (ex-food and -energy) studying anticipated at 3.1% y/y.

US CPI Forecast

Financial knowledge is attention-grabbing for economists, however for merchants, it’s solely attention-grabbing insofar because it impacts markets. For that, we’ve got to think about the “transmission mechanism” between the information and market actions: central financial institution coverage.

The Fed, as at all times, is concentrated on each sustaining full employment (primarily based on Friday’s report, the labor market stays regular, if not fairly as sturdy as a pair years in the past) and inflation, which has stubbornly stalled within the 3% vary after a steep decline in 2022 and 2023.

With the labor market remaining sturdy and inflation nonetheless (barely) above the Fed’s goal, it’s not stunning that merchants are pushing out of one other rate of interest lower from the Fed towards the center of the yr; accordingly, the volatility round this week’s inflation studying could also be extra restricted than up to now, because the Fed will, in all chance, nonetheless get one other handful of inflation (and jobs) reviews earlier than making any further adjustments to rates of interest.

That stated, a pickup in worth pressures could lead on merchants to begin asking whether or not the Fed’s rate of interest chopping cycle could also be accomplished already, complicating the trail ahead for a central financial institution that has clearly been hinting that the easing cycle isn’t performed but.

As many readers know, the Fed technically focuses on a unique measure of inflation, , when setting its coverage, however for merchants, the CPI report is a minimum of as important as a result of it’s launched weeks earlier. Because the chart under exhibits, the year-over-year measure of US CPI has now risen for 3 straight months after ticking just under 2.5% again in September:

Supply: TradingView, StoneX

Because the chart above exhibits, the “Costs” element of the PMI reviews has risen in latest months and will proceed to rise if President-Elect Trump continues to emphasise protectionism and tariffs when he takes workplace, doubtlessly placing upward stress on the CPI report itself.

Crucially, the opposite key element to observe in relation to US CPI is the so-called “base results,” or the affect that the reference interval (on this case, 12 months) has on the general determine. Final January’s 0.3% m/m studying will drop out of the annual calculation after this week’s print, opening the door for an lower within the headline year-over-year CPI studying if the month-over-month studying is lower than 0.3%.

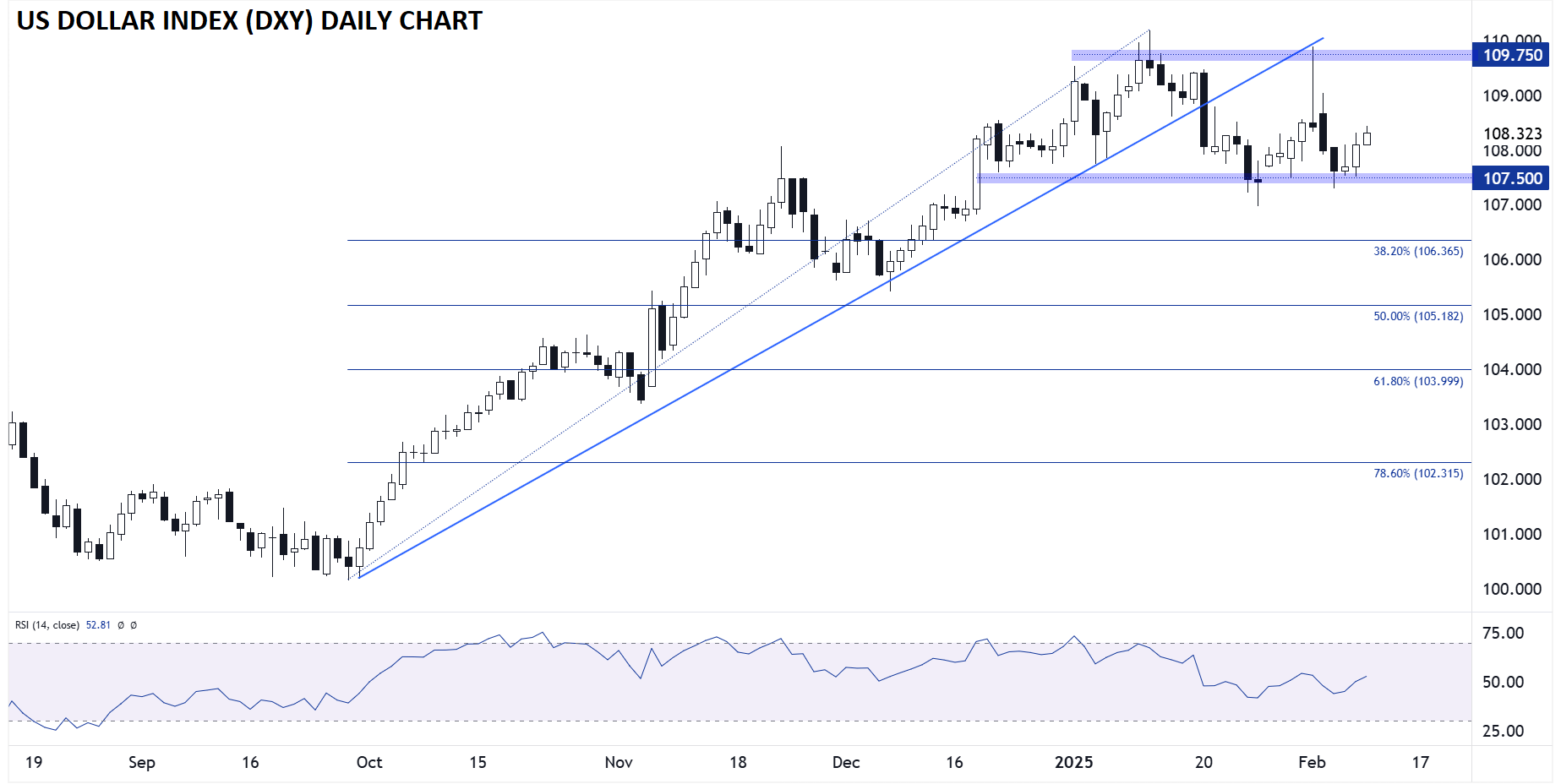

US Greenback Index Technical Evaluation – DXY Every day Chart

Pattern line breaks are one of many trickiest setups in technical evaluation. By definition, a pattern breaking implies that it’s essentially altering, however as any skilled dealer will inform you, a damaged uptrend doesn’t routinely transition instantly right into a downtrend; generally, a damaged uptrend merely leads right into a sideways vary or perhaps a shallower uptrend.

In terms of the US Greenback Index, the previous scenario seems to be at hand. Since breaking under This fall’s bullish pattern line in mid-January, the US Greenback Index has carved out a transparent vary between assist at 107.50 and resistance round 1.0975.

As of writing, the pair is bouncing off assist, maybe boosted by Friday’s strong NFP report and the potential for added tariff bulletins, so a hotter-than-expected CPI studying might push DXY again towards 109.00, whereas a cool studying might take the index again towards well-established assist close to 107.50.

Authentic Publish