Nvidia (NASDAQ:) crushed expectations on Wednesday, but its inventory wobbled for a short interval in after-hours buying and selling, earlier than recovering in pre-market motion. The blended response indicators uncertainty as traders brace for at the moment’s session.

At first look, the AI chip big delivered a stellar efficiency. This autumn 2024 income soared to $39.33 billion, simply surpassing the $38.05 billion estimate. Earnings per share landed at $0.89, edging previous forecasts of $0.85. However regardless of the sturdy numbers, the market’s hesitation suggests traders could also be wanting past the headline beat.

Nevertheless, more and more demanding traders appear to have centered on different, much less optimistic particulars.

Why is the market response blended to Nvidia’s glorious outcomes?

To begin with, the corporate introduced that it expects gross sales of $43 billion for the primary quarter of 2025, barely above the common forecast ($42.3 billion), however beneath the excessive estimate of $48 billion.

The corporate additionally warned that its non-GAAP gross margin ought to attain 71% for the present quarter, 1 level beneath consensus.

It also needs to be famous that Q1 gross sales of $43 billion would correspond to annual gross sales progress of simply over 65%, which would definitely be spectacular, however would affirm the slowdown in progress.

Certainly, This autumn 2024 revenues revealed final evening corresponded to annual progress of 77.8%, itself decrease than Q3 (+94.4%) and Q2 (+130%).

Particulars of gross sales by division additionally prompted traders to train warning. Revenues from the networks division missed expectations, at $3.02 billion versus $3.51 billion anticipated, and down 9.2% year-on-year.

The identical was true of online game gross sales, down 14% year-on-year to $2.5 billion, in opposition to expectations of $3.02 billion.

Outcomes had been due to this fact not good throughout the board, and the slowdown in progress means that maturity is approaching for Nvidia, suggesting that we should not count on the inventory to repeat its stellar efficiency of 2024 (+194%) this 12 months.

Nvidia shares overvalued based on fashions

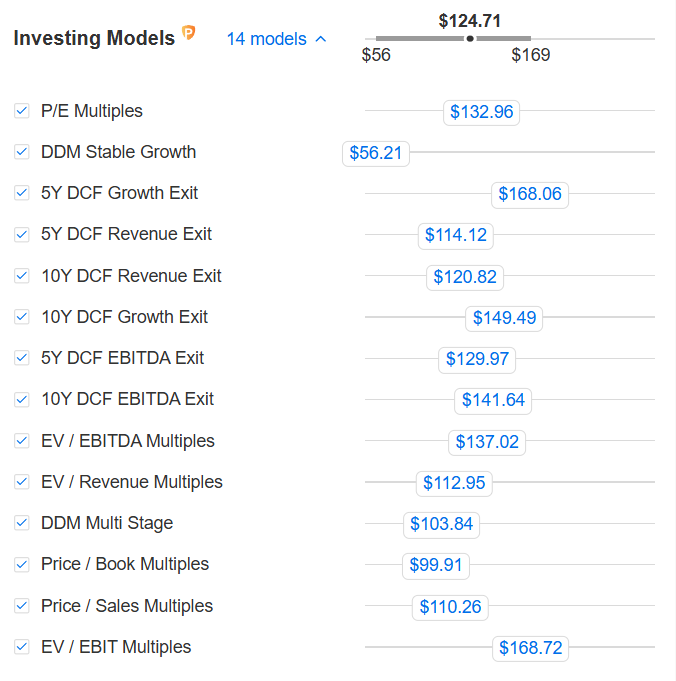

Then again, valuation fashions think about the share to be overvalued on the present value, with an InvestingPro Truthful Worth (which synthesizes a number of acknowledged fashions) at $124.71, 5% beneath Wednesday’s closing value.

This does not imply we must always essentially count on a plunge both, but it surely does indicate that there at the moment are extra fascinating alternatives to guess on this 12 months.

ProPicks AI sends a warning

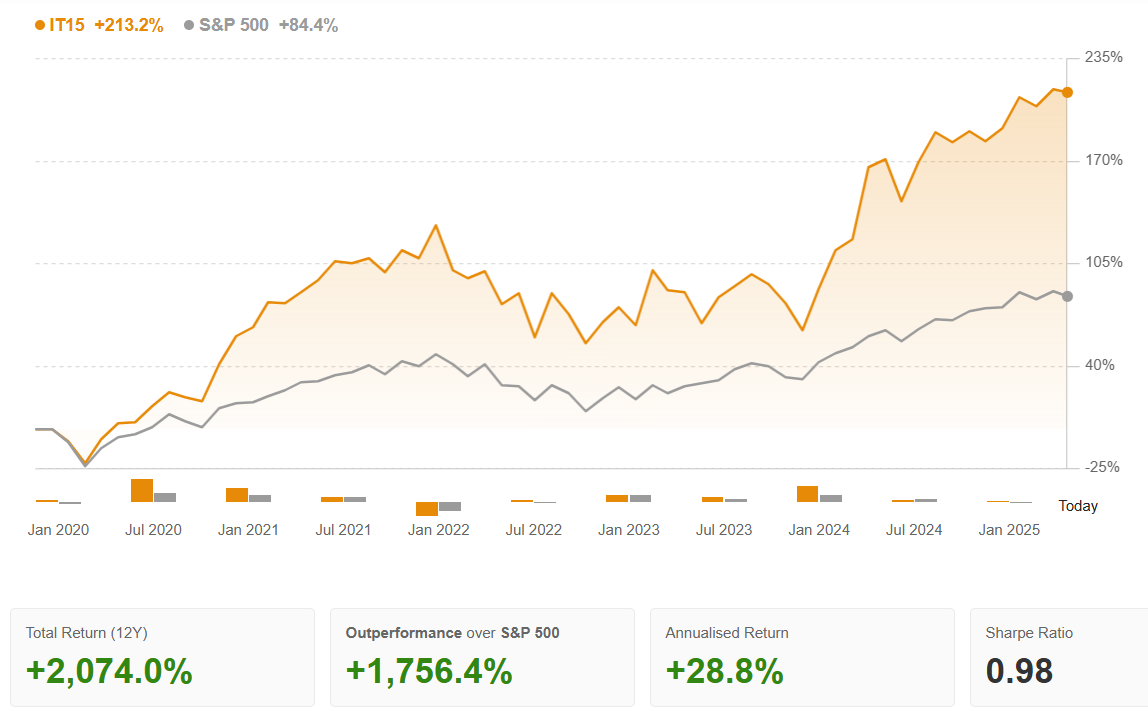

It is also value noting that Nvidia shares had been faraway from ProPicks AI’s Tech Titans technique earlier this month.

InvestingPro’s AI-managed technique added Nvidia shares as early as November 2023 and later closed the place with a staggering 229% acquire in simply 14 months.

Since its real-world launch in November 2023, the Tech Titans technique has delivered a formidable 95.08% general return—far outpacing the ’s 38.79% acquire by way of its February 2025 replace.

Up to date month-to-month—identical to all 30+ ProPicks AI methods on InvestingPro—the Tech Titans technique will get its subsequent refresh on Monday. That makes now the proper time to get in at a steep low cost by way of this hyperlink and begin profiting.

***

DISCLAIMER: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counsel or advice to take a position as such it isn’t meant to incentivize the acquisition of belongings in any method. As a reminder, any kind of asset, is evaluated from a number of factors of view and is very dangerous and due to this fact, any funding determination and the related threat stays with the investor