Weaker financial outlook suggests at present’s supersized minimize will not be a one-off

Article content material

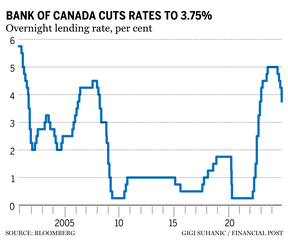

The Financial institution of Canada supersized its fourth consecutive rate of interest minimize to 50 foundation factors from the usual 25 foundation factors, bringing its benchmark lending fee beneath 4 per cent for the primary time in two years.

Policymakers began slicing in June, when the speed stood at a greater than two-decade excessive of 5 per cent.

Right here’s what economists are saying about the place the Financial institution of Canada goes from right here.

Commercial 2

Article content material

‘One other 50 bps in December’: Capital Economics

“The weak financial backdrop means there’s a sturdy case for the Financial institution of Canada to observe its bigger 50-basis-point minimize at present … with one other 50 foundation level transfer on the subsequent assembly in December,” Stephen Brown, assistant chief North America economist at Capital Economics Ltd., mentioned in a be aware.

The central financial institution, in its assertion accompanying the speed choice, mentioned the financial system is struggling on a number of fronts, from extra provide, as increased charges proceed to tamp down client spending, to a softening labour market.

Brown thinks it’s “unlikely” Wednesday’s larger-than-usual minimize is a “one-off” on condition that the Financial institution of Canada downgraded its forecast for third-quarter gross home product (GDP) to 1.5 per cent annualized in its up to date Financial Coverage Report (MPR) from 2.8 per cent within the earlier MPR.

For the fourth quarter, the Financial institution of Canada expects GDP of two per cent — “a modest pickup.”

Brown mentioned policymakers need to bolster development, however “nonetheless, the (central) financial institution doesn’t appear assured that development is on the cusp of accelerating strongly.”

Article content material

Commercial 3

Article content material

He expects the coverage fee will likely be minimize to three.25 per cent after the financial institution meets on Dec. 11, with a number of extra cuts in 2025 to reach at a terminal fee of two.25 per cent, “though the dangers to that terminal fee forecast now appear to deceive the draw back.”

Be careful for the loonie: RSM Canada

The Financial institution of Canada has shifted its focus from inflation to making an attempt to gas some development in Canada’s slowing financial system, Tu Nguyen, an economist at tax consultancy RSM Canada LLP, mentioned in a be aware.

Canada has posted 5 straight quarters of falling GDP per capita, so she thinks that may spur policymakers to get the lending fee to impartial — the place it neither stimulates nor suppresses development — as quick as potential, particularly on condition that “disinflation is spreading. Headline inflation has fallen beneath two per cent and the financial institution’s most popular measure of core inflation has fallen beneath 2.5 two per cent.”

Nguyen mentioned inflation excluding mortgage curiosity prices stands at one per cent, which is on the backside of the Financial institution of Canada goal vary of 1 per cent to a few per cent.

“Since curiosity funds play a nontrivial function in driving inflation, fee cuts will additional convey down curiosity funds and thus inflation,” she mentioned.

Commercial 4

Article content material

The place policymakers go from right here will rely on upcoming jobs and inflation knowledge, but in addition what america Federal Reserve does at its subsequent fee assembly Nov. 7, she mentioned.

Markets consider one other 50-basis-point minimize by the Fed is off the books, given the energy of the U.S. financial system.

“As a lot because the (Financial institution of Canada) is unbiased from the Fed, deviating too removed from the Fed dangers inflicting the loonie to lose much more worth,” Nguyen mentioned.

Because it stands, she expects charges to fall to three.5 per cent because the financial institution reverts to a normal 25-basis-point minimize in December, and the slicing cycle to finish at 2.75 per cent in early 2025.

‘No-brainer’: CIBC

The Financial institution of Canada’s 50-basis-point minimize was a “no-brainer,” Avery Shenfeld, chief economist at CIBC Capital Markets, mentioned in a be aware, including “it could take a big flip of occasions to face in the best way of one other minimize of that magnitude in December.”

Policymakers declared victory of their combat in opposition to inflation of their assertion, Shenfeld mentioned, whereas nonetheless maintaining their playing cards near their chests with regards to the dimensions of any future fee cuts.

Commercial 5

Article content material

The central financial institution is in search of development to choose up over the following two years and common 2.2 per cent, however he mentioned that doesn’t imply it’s “by any means ruling out additional rate of interest aid, as softer financial circumstances are cited as the motive force for the advance.”

5 25 bps cuts coming: BMO

The Financial institution of Canada has now trimmed charges by 125 foundation factors this 12 months, which is the “most aggressive set of cuts among the many main central banks globally,” Douglas Porter, chief economist on the Financial institution of Montreal, mentioned in a be aware.

Porter mentioned whereas the final tone of the statements and Financial Coverage report was dovish, the underlying message gave the impression to be that there’s little urgency to observe up with one other giant transfer and knowledge would decide the following transfer.

He mentioned that whereas the central financial institution missed on its third-quarter GDP estimates, it hasn’t altered its development forecasts for 2024 and 2025 and solely “shaved” its outlook for headline inflation.

“However the two-year view on core has not budged,” he mentioned.

Really helpful from Editorial

Commercial 6

Article content material

Porter mentioned Wednesday’s jumbo minimize got here “principally” as a result of vital slowdown in inflation over the previous few months, however he thinks the central financial institution’s total outlook for inflation and the financial system “counsel default strikes will likely be 25-bps steps,” until development or inflation dictate in any other case.

BMO is looking for 5 extra 25-basis-point cuts to convey the terminal fee to 2.5 per cent by June 2025, “on the low finish of the (central) financial institution’s 2.25 per cent 3.25 per cent vary for impartial.”

• E mail: gmvsuhanic@postmedia.com

Bookmark our web site and help our journalism: Don’t miss the enterprise information it is advisable know — add financialpost.com to your bookmarks and join our newsletters right here.

Article content material

![[Podcast]How to build a successful startup community ー Interview with Tim Rowe at Cambridge Innovation Center (Part4) [Podcast]How to build a successful startup community ー Interview with Tim Rowe at Cambridge Innovation Center (Part4)](https://i3.wp.com/storage.googleapis.com/jstories-cms.appspot.com/images/1750995302055image2_bigthumbnail.jpg?w=120&resize=120,86&ssl=1)